Building back better: rethinking business for the post-pandemic recovery

In the last year, global business has been turned on its head in a way that previously seemed unimaginable. But 12 months on from the official declaration of the pandemic, there are positives to be drawn as businesses and their employees adapt and innovate moving forward.

It almost seems surreal. On December 31, 2019, Wuhan Municipal Health Commission in China released a media statement from its website about cases of ‘viral pneumonia’[1]. By January 9, 2020, it had been identified as a novel coronavirus – Coronaviridae being a family of viruses that cause respiratory and intestinal illnesses. These include SARS and MERS. It was named SARS-CoV-2 (Severe Acute Respiratory Corona Virus 2) and led to the disease we now know only too well as COVID-19[2] (COrona VIrus Disease-2019).

It almost seems surreal. On December 31, 2019, Wuhan Municipal Health Commission in China released a media statement from its website about cases of ‘viral pneumonia’[1]. By January 9, 2020, it had been identified as a novel coronavirus – Coronaviridae being a family of viruses that cause respiratory and intestinal illnesses. These include SARS and MERS. It was named SARS-CoV-2 (Severe Acute Respiratory Corona Virus 2) and led to the disease we now know only too well as COVID-19[2] (COrona VIrus Disease-2019).

On January 11, 2021, China reported its first death from the disease and just a few days later on January 30, with the virus now spreading internationally, the World Health Organization (WHO) declared an international public health emergency. By March 11, the disease had been officially classified as a global pandemic. Within a little over two months, our world – as we’d previously knew it – had been transformed.

Phrases such as ‘furlough’ and ‘social distancing’ that were barely in our vocabulary have become commonplace. Industries based around socialization such as hospitality, travel, leisure and, to a lesser extent, retail, have largely been out of operation for the best part of a year. Sports fixtures, if they’ve gone ahead at all, have played out in empty or socially distanced stadiums.

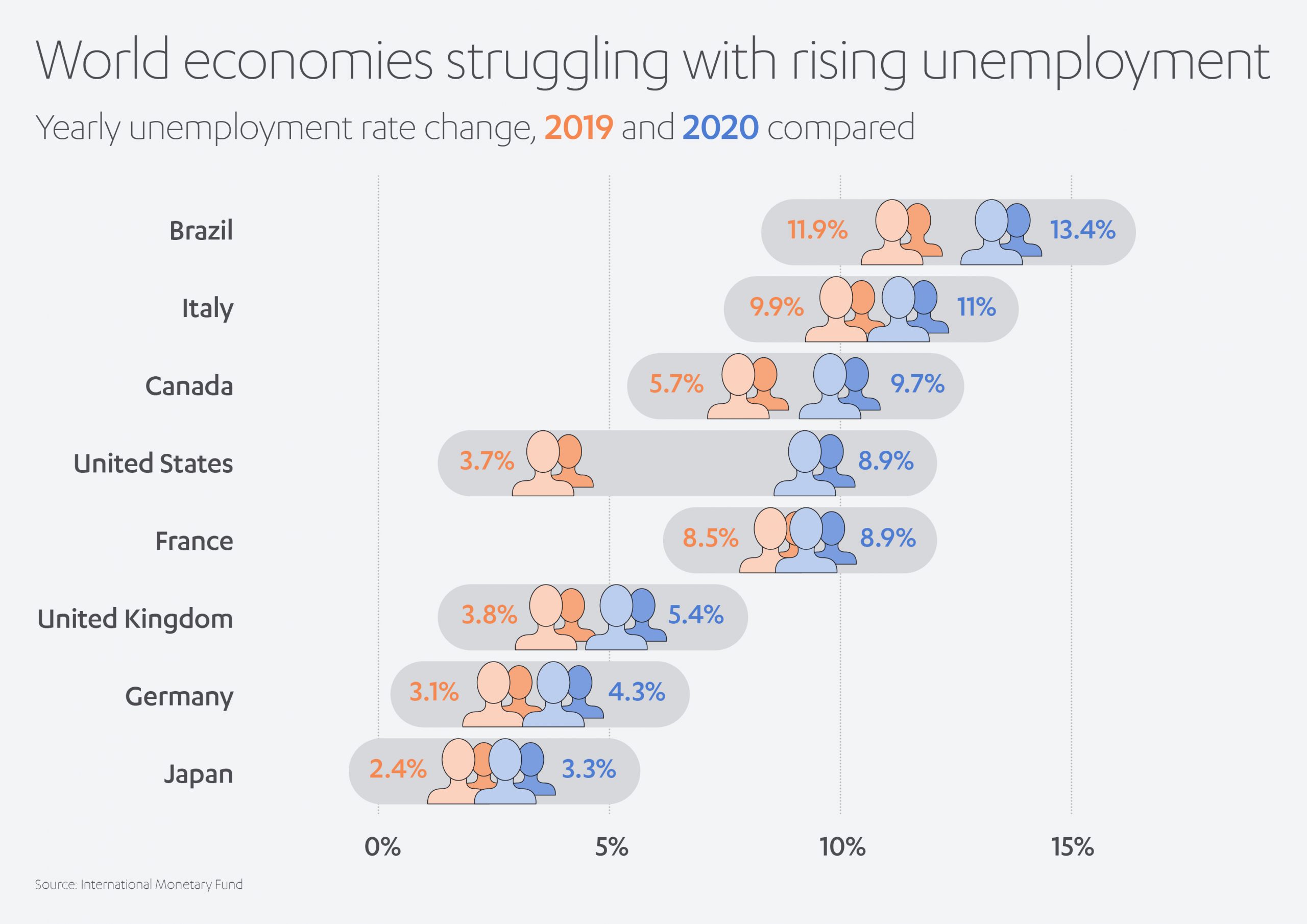

The corresponding human tragedy of COVID-19 is simply unfathomable. In the US alone, it has killed tens of thousands more people than in the country’s World War II military service[3]. Globally, the figures change daily but are devasting – around 2.5m deaths by the end of February 2021. For some of the world’s leading economies, unemployment levels from 2019 to 2020 have seen an unprecedented rise – particularly in the US which saw its economy shrink by 3.5% in 2020, the worst contraction since 1946[4]. The International Labor Organization (ILO) reports Q4 2020 working hour losses at 4.6% relative to pre-crisis – equivalent to 130 million full-time jobs. Employees currently on furlough schemes worldwide are not technically classed as being unemployed, so it is likely these figures will climb even higher once furlough schemes are wound down.

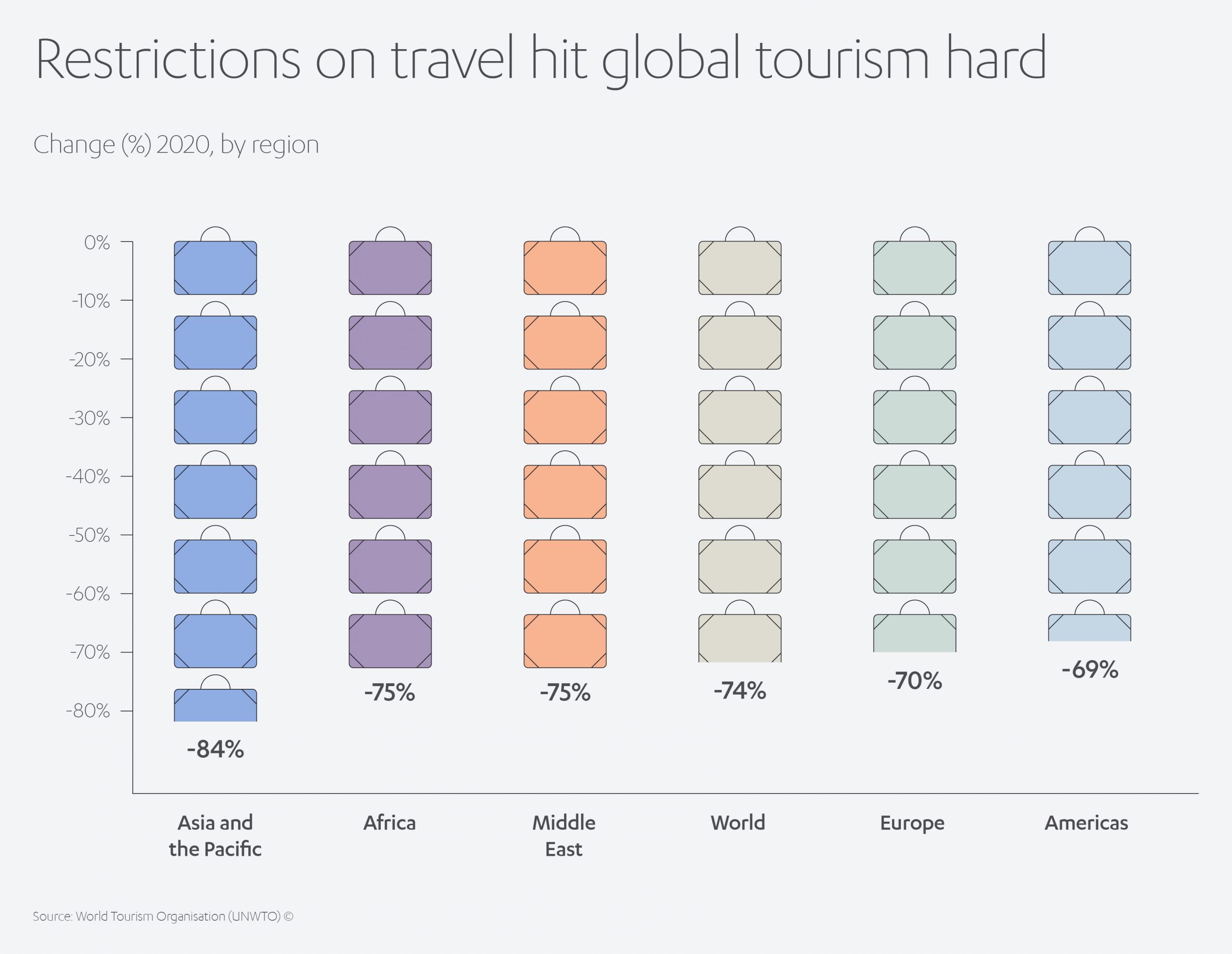

For some industries, their operating models became virtually obsolete overnight, such as the international travel and hospitality sectors. In the early stages of the pandemic, for example, air travel was down by 96%[5]. According to the UNWTO World Tourism Barometer, international tourist arrivals (overnight visitors) fell by 74% in 2020 compared to the previous year, curbed by slow virus containment, low traveler confidence and important restrictions on travel still in place[6]. The collapse in international travel represents an estimated loss of US$ 1.3 trillion in export revenues – more than 11 times the loss recorded during the 2009 global economic crisis.

COVID-19 has major implications for the commercial property sector, too. Remote working (discussed later in more detail) may fundamentally change the way businesses operate moving forward and a reduced need for physical space. In the US, office vacancy rates are already expected to rise to 20.2% by end-2022 compared to 16.8% at end-2019[7].

Assessing the full extent of the damage in the real estate sector is difficult because the market itself is opaque. Real estate investment trusts, or REITs, however, provide a useful guide. The Bank for International Settlements calculates that in the US, UK, continental Europe and Japan, the pandemic wiped out REITs’ cumulative valuation gains of the past five years. In comparison, stock market indices at the depth of the crisis in early March lost only the gains they had made in 2019. REITs have also lagged behind the subsequent stock market recovery[8].

Digitize or bust?

As the world starts to plan for recovery, however, it is increasingly clear that, rather than introducing a raft of new changes for businesses to deal with, in many ways the pandemic has merely accelerated existing trends that were already changing the face of business; trends that have not only been essential survival strategies over the past 12 months, but which can also provide a foundation for longer term business performance.

Chief among these is the move towards digitization as a crucial factor in strategic viability. With people stuck at home, high streets deserted, leisure and hospitality venues closed, huge swathes of our lives have moved over to the digital arena. An example is the entertainment industry. Museums, theaters and cinemas were largely closed to the public for almost a year, destroying livelihoods for a whole industry of performers, creatives, technicians, promoters and managers[9]. At the same time, online streaming platforms have thrived, as people have been locked down at home – in the first three months of the crisis, for example, Netflix received 16 million new sign-ups[10].

According to a McKinsey Global Survey of executives[11], companies have accelerated the digitization of their customer and supply-chain interactions and of their internal operations by three to four years. And the share of digital or digitally enabled products in their portfolios has accelerated by seven years. Nearly all respondents said their companies have adopted digital technologies to meet many of the new demands on them, and much more quickly than they had thought possible before the crisis.

What’s more, most of these changes are expected to be long lasting. Organizations are already making the kinds of investments that all but ensure they will stick. In fact, the McKinsey survey found that when asked about the impact of the crisis on a range of measures, an increase in funding for digital initiatives was deemed to be the number one impact – more than increases in costs, the number of people in technology roles, and the number of customers.

The detail of retail

The power of digital is perhaps most painfully visible on the high street. Stores without a strong online sales platform to run alongside their physical presence had been under growing pressure for a decade or more. For some, COVID-19 – which gave rise to the expression ‘non-essential retail’ – was the last straw. Take the flagship UK fashion retail chain, Arcadia Group. With a largely traditional high street model, shutdowns pushed Arcadia over the edge. In early 2021 it went into administration. Around the same time, Debenhams, a much-loved UK department store giant operating since 1778 with over 12,000 employees, also went out of business[12], while in the US, high street stalwarts like Brooks Brothers and Neiman Marcus fell into bankruptcy.

The power of digital is perhaps most painfully visible on the high street. Stores without a strong online sales platform to run alongside their physical presence had been under growing pressure for a decade or more. For some, COVID-19 – which gave rise to the expression ‘non-essential retail’ – was the last straw. Take the flagship UK fashion retail chain, Arcadia Group. With a largely traditional high street model, shutdowns pushed Arcadia over the edge. In early 2021 it went into administration. Around the same time, Debenhams, a much-loved UK department store giant operating since 1778 with over 12,000 employees, also went out of business[12], while in the US, high street stalwarts like Brooks Brothers and Neiman Marcus fell into bankruptcy.

Conversely, the pandemic has seen a boom in global e-commerce sales which grew 27.6% over 2020, valued at US$ 4.28 trillion[13]. Again, this was already a developing trend, only exacerbated by lockdown. Online UK fashion retailer, Boohoo, has since bought Debenhams and some of Arcadia’s premium brands[14]. In both cases, the deal extends to their online brand potential only. Their huge network of physical stores is not part of the deal – another nail in the coffin of the traditional high street.

Technology in good health

The healthcare sector was on the cusp of a technology-driven revolution of its own prior to the pandemic. With COVID-19 putting a huge strain on healthcare systems, these changes have been supercharged, especially as the pandemic and ensuing lockdowns have driven many people to pay closer attention to their physical and mental health.

As explored in the Abdul Latif Jameel Perspectives article on healthcare technology, healthcare innovations leveraging AI and machine learning can turn vast amounts of patient health data into refined insights for treating, preventing and even predicting diseases, and all at a speed that was previously impossible. Through the results that emerge, clinicians can come to understand recurring patterns and develop treatment models based on specific patient attributes.

Virtual medical appointments for minor illnesses and ailments – or ‘telemedicine’ – a niche offering 12 months ago, are now many people’s first consultation with a medical professional. In the US, nearly half of all patients now use telemedicine in some form, versus only about 10% pre-pandemic. Moreover, 83% of patients say they expect to continue using telemedicine post-pandemic, resulting in the potential for US$ 250 billion of US healthcare spending to shift to virtual care[15]. Another area of growth is expected be self-diagnostics. Using wearable devices to measure our temperature, blood pressure, heart rhythms and respiratory rate, then send the data to our doctor ahead of a virtual consultation, are increasingly common.

Healthcare technology extends to clinical trials with participants never needing to leave their home. Examples include the Apple Heart and Stanford University study of 400,000 people on using wearables to detect atrial fibrillation[16], and the Apple and Johnson & Johnson partnership Heartline study for stroke prevention which involved 150,000 participants[17]. Scientists widely concede that COVID-19 will become a carefully managed aspect of life for the foreseeable future – much like influenza. This being the case, the concept of remote healthcare will only develop and grow.

For over 25 years, Abdul Latif Jameel has been proud to make its own contribution to improving access to healthcare.

As far back as 1995, it established the Abdul Latif Jameel Hospital, the first non-profit rehabilitation hospital in Saudi Arabia. More recently, it has established partnerships with medical device innovators and innovation facilitators such as Cyberdyne, Cellspect and JOMMD.

The latest step in its commitment to encouraging and supporting innovation in healthcare is Abdul Latif Jameel Health, established in 2020, which aims to ensure the benefits of advances in healthcare are made available to communities across the emerging nations of the developing world. Abdul Latif Jameel Health is working with the global investment arm of the Jameel family, JIMCO (the Abdul Latif Jameel Investment Management Company) and their dedicated JIMCO Life Sciences Fund to further accelerate access to modern medical care with a series of targeted investments including in companies such as Evelo Biosciences, Cellarity, AVNeo, and more.

New perspectives on energy

COVID-19 has also shone a sharper spotlight on the environment and how we consume energy. When the world entered lockdown in early 2020, as cars were parked and airlines grounded, global carbon emissions fell, a topic we looked at in more detail in Fady Jameel’s Spotlight article on the relationship between the pandemic and the environment.

In China, emissions fell by 25% and coal use by 40%, and in New York, pollution levels halved[18]. Oil and gas, an industry known for its volatility, saw oil prices drop to US$ 20 per barrel in the early stages of the pandemic when lockdowns took hold and fuel demand plummeted[19].

This gives further incentive for the energy sector to step up its investment and innovation in renewable technologies, and governments internationally are making all the right noises, as discussed in Fady Jameel’s Spotlight article on the need for a ‘green recovery’.

For its part, Abdul Latif Jameel is expanding its own investments in this area, particularly in the renewable energy and water development industries. Fotowatio Renewable Ventures (FRV), part of Abdul Latif Jameel Energy and Environmental Services, continues to develop large scale photovoltaic solar projects and wind power solutions across the globe. In partnership with UK sustainable energy specialist Harmony Energy, it is also pioneering the development of utility-scale battery storage to provide renewable energy 24/7, building on its first plant at Holes Bay Dorset, with a second project in development at Contego, West Sussex, in the UK.

Meanwhile, Almar Water Solutions, also part of Abdul Latif Jameel Energy, continues to tackle water and environmental management challenges in some of the world’s most water-scarce regions, including at Saudi Arabia’s second largest desalination plant, Shuqaiq 3.

The European Union aims to direct 30% of its US$ 880 billion COVID-19 crisis plan towards climate change. China has pledged to reduce its carbon emissions to zero by 2026, and US president Joe Biden has committed to investing US$ 2 trillion in clean technologies. Other countries, including Japan, South Korea, Canada, Nigeria and Columbia have set their own ambitious targets[20].

There are global moves, too, to ensure that lower- and middle-income countries do not get left behind in the post-pandemic recovery, with support for developing the right policies, building local capacities and fostering innovation.

One such program is the COVID-19 Technical Assistance Response Initiative for Green and Climate Resilient Recovery, launched in December 2020 by the US$ 8.3 billion Climate Investment Funds (CIF).

The initiatives will be funded by over US$ 25 million from the governments of the UK, Netherlands and Switzerland. The aim is to offer technical assistance and capacity building to support low and middle-income countries to integrate green, low carbon and climate-resilient policies and investments into their recovery plans.

Climate Investment Funds

Mafalda Duarte, Head of the CIF, said: “After the 2008 financial crash, many countries made the climate crisis worse by investing heavily in fossil fuels. Our new program aims to ensure that the large stimulus packages agreed to rebuild from COVID-19 go towards a green and climate-resilient recovery The world must not waste this once-in-a-generation opportunity to build back cleaner, greener and better.”

Adapt and prosper through disruption

Throughout all the uncertainty, one of the biggest positives of the pandemic has been the ability of individual businesses to innovate and adapt – lessons that will be crucial going forward.

Take remote working (or telework) – something which many organizations had to roll out almost overnight. The remote working concept was an embryonic trend before COVID-19 but was proving slow to catch on. In one stroke, the crisis obliterated the cultural and technological barriers that had previously hindered the take-up of remote work, setting in motion a structural shift in where and when work takes place.

Estimates from the European Foundation for the Improvement of Living and Working Conditions (Eurofound)[21], suggest that close to 40% of those currently working in the EU began to work remotely full-time as a result of the pandemic. Considering that before the outbreak just 15% of people employed in the EU had ever teleworked, large numbers of workers and employers are facing a sudden change to working models. Indeed, a World Economic Forum survey across 15 European countries found that 76% now have flexible work policies, compared to just 15% before the crisis[22].

McKinsey estimates that more than 20% of the workforce could work remotely three to five days a week as effectively as they could if working from an office[23]. If remote work took hold at that level, it would mean three to four times as many people working from home than before the pandemic and would have a profound impact on urban economies, transportation, and consumer spending, among other things.

However, remote working will not work for every sector or every role. Some may thrive on remote working. Others will not adjust well to life in front of a screen versus the social interaction of the ‘office’. Many jobs require face-to-face collaboration or specialized machinery; other jobs must be done on location, such as builders or some medical care; and some, such as making deliveries or horticulture, can only be performed while out and about.

Even for those roles that can move to a remote working model, existing employees used to a traditional working environment will need support and guidance on how to be most effective both functionally and mentally within the new way of working. For new employees, remote working training will need to be embedded into induction at the time of onboarding. That’s why, according to industry experts, the most likely scenario for future working patterns is a hybrid model that combines some remote work with more limited time spend in the office[24]. On the surface, this should be a positive change, decreasing pressure on transport systems, reducing congestion and pollution, giving staff a better work-life balance, but it also poses significant challenges for city centers built around the daily needs of hundreds of thousands of commuters and office workers.

Positive learning

Perhaps above all, COVID-19 has shown businesses themselves that they are more adaptable, more innovative and more resilient than they thought. The pandemic presented the biggest business challenges in living memory, but there is every indication that companies can emerge stronger in their preparedness for unforeseen events and in their agility.

In many instances, businesses have proved to themselves the speed at which they can adapt and innovate, and this will serve as a welcome confidence booster. One study found that companies moved 40 times faster to remote working than they imagined possible prior to the pandemic. Rather than a year or more as they had previously thought, they had implemented a workable solution within an average of 11 days[25]. Craig Rowley, a senior partner at consulting firm Korn Ferry, tells the story of one client who had planned to implement a curbside pickup program over the course of 18 months. After the pandemic hit, they accelerated that time frame to implement it in just 18 days.

Sectors such as professional and financial services, healthcare and pharmaceuticals have been able to accelerate the digitization of internal operations such as production, research and development (R&D) and back office operations 20 to 25 times faster than they previously thought pre-crisis[26]. This doesn’t only extend to gaining maximum productivity from key back office functions such as HR, admin or finance, but also to governance – how board members communicate virtually, both internally and with key stakeholders during annual general meetings[27], as well as implementing the appropriate measures to ensure data integrity and security.

The pandemic has also made companies examine how they manage their supply chains. In the early days of the crisis, supply chains showed one of the first signs of business fragility under the strains of booming e-commerce orders, and as people and goods stopped crossing borders.

At least for the short-term, businesses have started to look locally in their sourcing policies, find ways to simplify their supply chains, proof them against possible disruptions and move away from single-source dependencies[28]. A case in point is the European pharmaceutical industry, which imports an estimated 80% of its drug components[29]. In a study conducted by IBM Institute of Business Value, 40% of executives have highlighted the need for more spare capacity within their supply chains[30].

A more resilient future

Over the past few weeks, businesses and communities have seen much light at the end of the tunnel, with the incredibly encouraging vaccine roll-out. However, there are still many unknowns on how long before a return to a manageable everyday life.

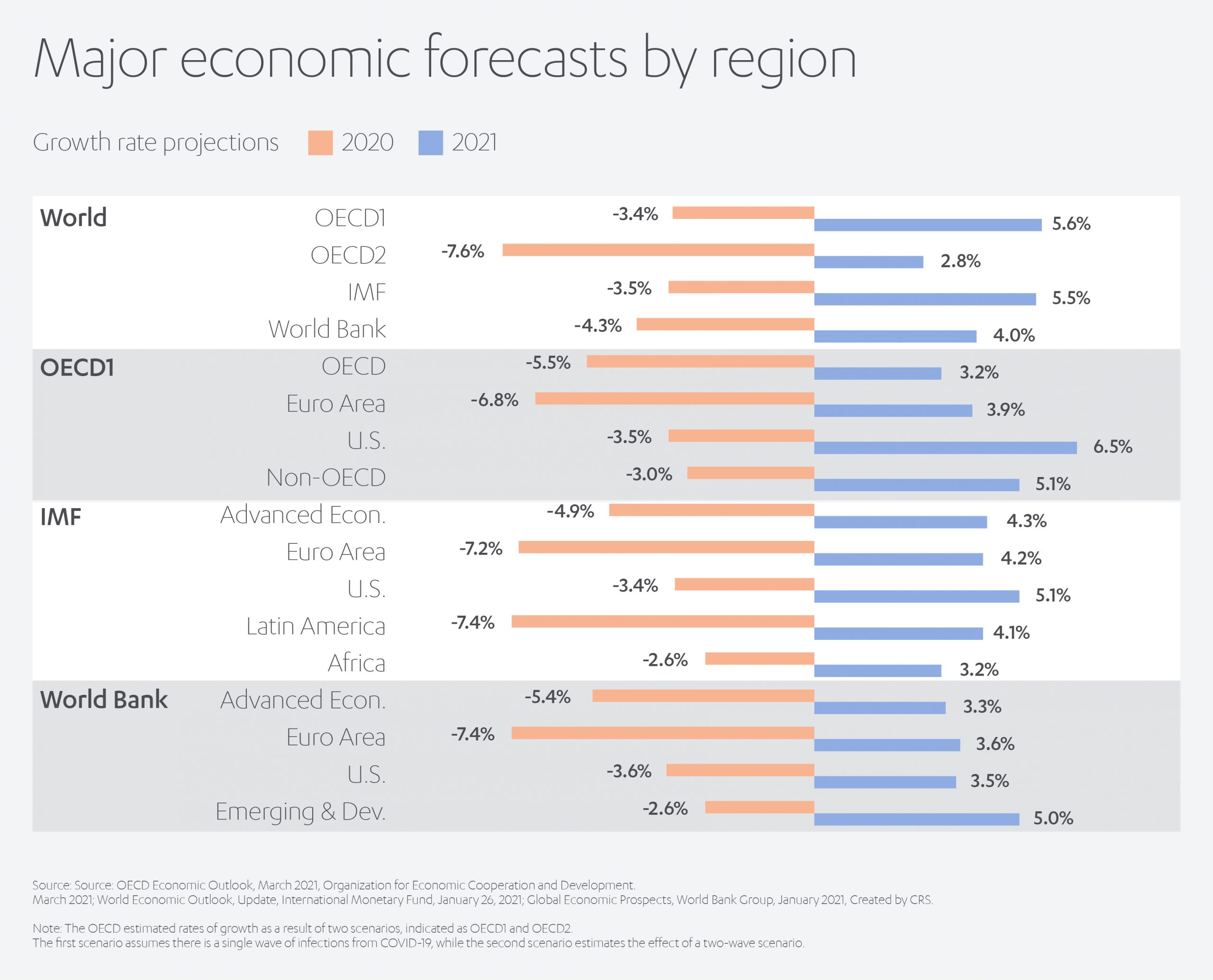

In the wake of COVID-19, the most forward-looking businesses are not getting ‘back to business’, they are looking outward to ‘different and better business’. The crisis has created the opportunity to shape the future rather than react to the present, ensure safety for all, and bolster the resilience of both business and society in the face of the greatest adversity. On a global level, businesses will be encouraged to see that most predictions for 2021 show a sharp recovery – the challenge is to turn those predictions into reality.

[1] https://www.who.int/emergencies/diseases/novel-coronavirus-2019/interactive-timeline#!

[2] https://coronavirusexplained.ukri.org/en/article/cad0003/

[3] https://www.mckinsey.com/industries/public-and-social-sector/our-insights/america-2021-rebuilding-lives-and-livelihoods-after-covid-19?cid=other-eml-alt-mip-mck&hdpid=1490c636-7d83-4dee-a154-cb3eafa05961&hctky=11595533&hlkid=60be643b18ed49678ace0eb50546b7d3

[4] https://www.theguardian.com/business/2021/jan/28/us-economy-shrank-2020-worst-year-since-second-world-war

[5] https://www.insider.com/new-rules-changes-flying-coronavirus-air-travel-2020-12

[6] UNWTO World Tourism Barometer | Global Tourism Statistics

[7]https://www.mckinsey.com/~/media/McKinsey/Featured%20Insights/Leadership/The%20next%20normal%20arrives%20Trends%20that%20will%20define%202021%20and%20beyond/The-next-normal-arrives-Trends-that-will-define-2021-and-beyond-Final.pdf?shouldIndex=false

[8] https://www.ft.com/content/aaf192ac-dc94-4509-8f24-5831a32e7aa2

[9] https://www.europeanbusinessreview.com/how-covid-19-has-affected-business/

[10] https://www.europeanbusinessreview.com/how-covid-19-has-affected-business/

[11] COVID-19 digital transformation & technology | McKinsey

[12] https://www.bbc.co.uk/news/business-55793411

[13] https://www.emarketer.com/content/global-ecommerce-update-2021

[14] https://www.businessoffashion.com/news/retail/boohoo-buys-remaining-apparel-brands-from-failed-arcadia-group

[15] One Year Later: The Harsh Business Lessons (kornferry.com)

[16] Apple Heart Study | Stanford Medicine

[17] Introducing the Heartline Study by Johnson & Johnson and Apple

[18] https://www.bbc.com/future/article/20200326-covid-19-the-impact-of-coronavirus-on-the-environment

[19] https://www.europeanbusinessreview.com/how-covid-19-has-affected-business/

[20]https://www.mckinsey.com/~/media/McKinsey/Featured%20Insights/Leadership/The%20next%20normal%20arrives%20Trends%20that%20will%20define%202021%20and%20beyond/The-next-normal-arrives-Trends-that-will-define-2021-and-beyond-Final.pdf?shouldIndex=false

[21] Living, working and COVID-19 | Eurofound (europa.eu)

[22] https://www.weforum.org/agenda/2020/11/pandemic-productivity-innovation-remote-working/

[23] Whats_next_for_remote_work_F.pdf (mckinsey.com)

[24]https://www.mckinsey.com/~/media/McKinsey/Industries/Public%20and%20Social%20Sector/Our%20Insights/Future%20of%20Organizations/Whats%20next%20for%20remote%20work%20An%20analysis%20of%202000%20tasks%20800%20jobs%20and%20nine%20countries/Whats_next_for_remote_work_F.pdf?shouldIndex=false

[25] https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/how-covid-19-has-pushed-companies-over-the-technology-tipping-point-and-transformed-business-forever

[26] https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/how-covid-19-has-pushed-companies-over-the-technology-tipping-point-and-transformed-business-forever

[28] https://www.imd.org/research-knowledge/articles/A-post-COVID-19-outlook-The-future-of-the-supply-chain/

[29] https://www.imd.org/research-knowledge/articles/A-post-COVID-19-outlook-The-future-of-the-supply-chain/

[30] https://www.bloomberg.com/news/articles/2020-09-30/most-executives-think-covid-19-changed-their-companies-forever

1x

1x

Added to press kit

Added to press kit