Insuring the future

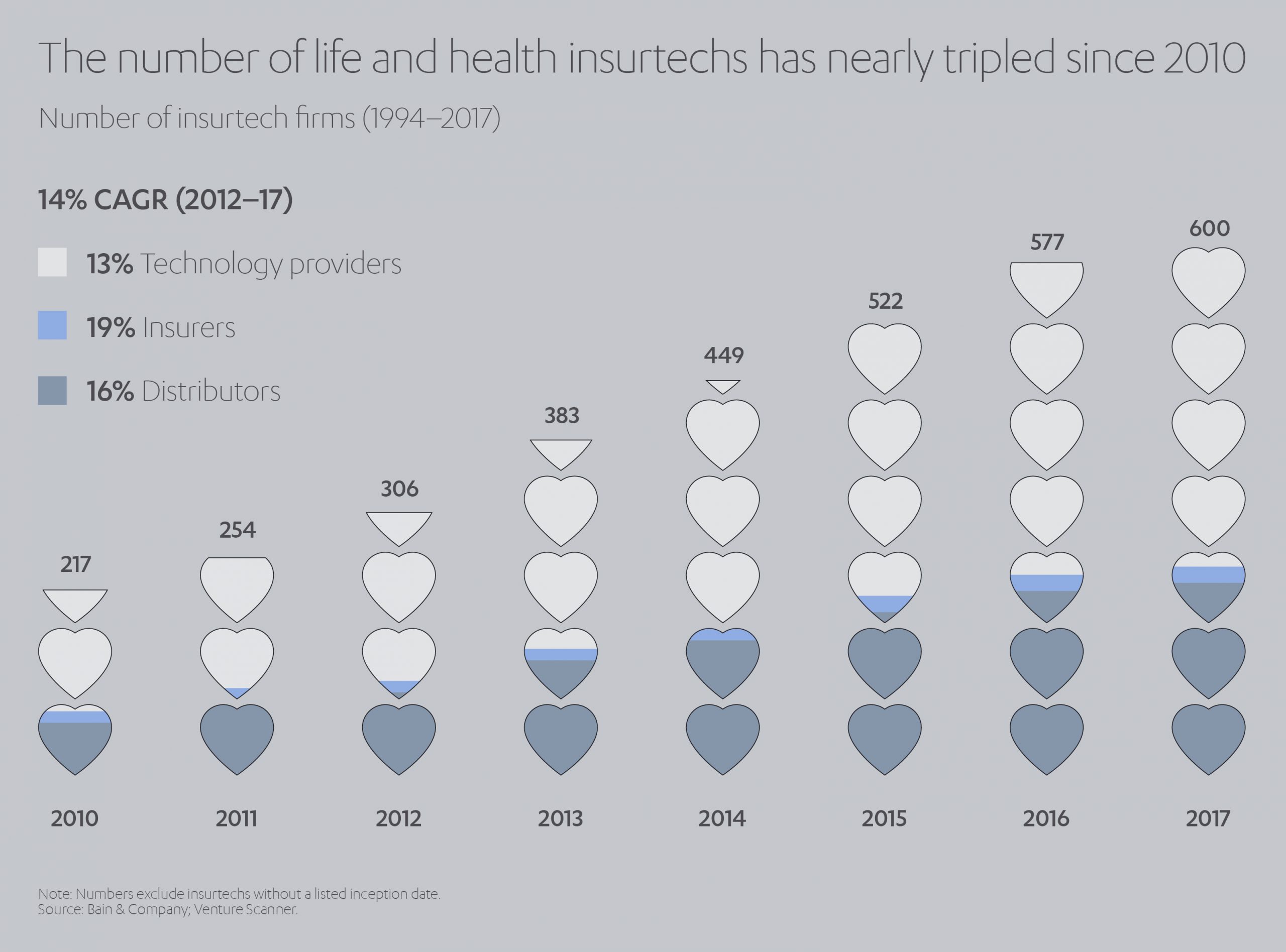

Insurance technology – or ‘insurtech’ – has already transformed the global insurance industry. And it is still evolving, with billions being invested in 2020, by insurers, start-ups, venture capitalists, development banks and government-backed innovation funds. So, what exactly is insurtech and what are the challenges and opportunities it presents for the insurance industry?

The insurance sector has been transformed and empowered over the past decade by the democracy of data, and its truly global reach. The proliferation of affordable smartphones and a reliable 4G/5G signal has created a customer base numbering in the billions. For the first time in history, a tenant farmer in Kenya or a truck driver in Kansas can obtain bespoke insurance cover, often on a pay-as-you-go basis (PAYG), that is exactly matched to their lifestyle and needs.

The old systems of paper-based policy documents, admin charges for mid-term adjustments, local brokers selling annual policies on commission and so on, are being rapidly replaced by a digital market – and ecosystem – where brand power, trust and consumer rewards are just as important as price.

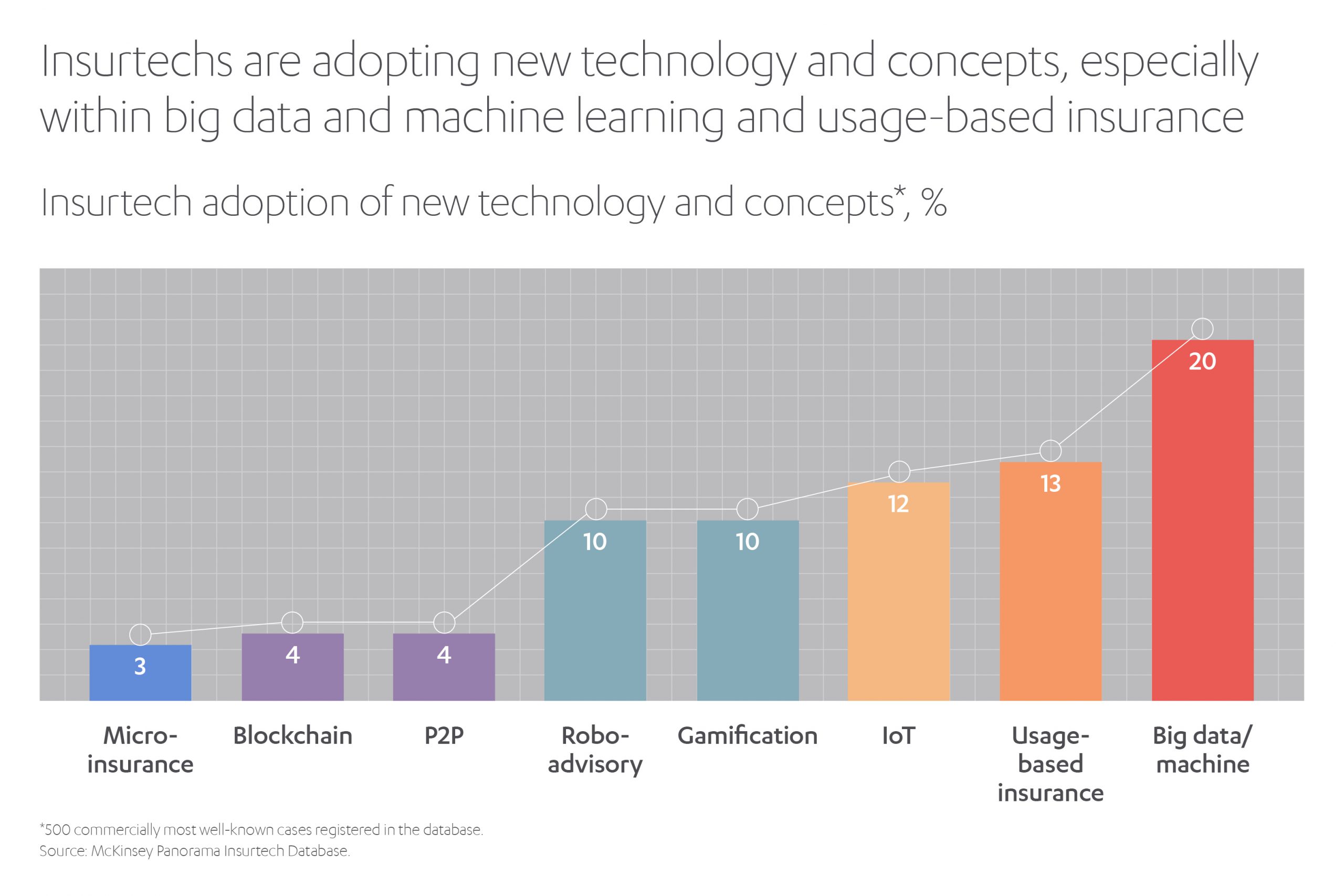

These changes are largely being driven by insurtech innovations facilitated by rapidly evolving advanced technologies, in particular AI and big data, blockchain, APIs (Application Programming Interface) and ever expanding 5G networks.

AI and big data are powerful tools when it comes to defining risk, which in turn leads to pricing insurance correctly in different markets. They facilitate a faster claims processes, thereby reducing costs and speeding up payments. They can also help to eliminate gender or racial bias from the insurance process, so the price of cover is not inadvertently influenced by gender, age, income, ethnic make-up of geo-locations, or other historical biases common in legacy systems. Blockchain is proving useful for compliance, among other things, as time-stamped records of payments, or policy incept dates are crucial, while APIs enable insurtechs to connect consumers with every link in the policy chain, like a digital central nervous system. 5G provides the infrastructure for new models of interaction between providers and consumers.

In short, smarter, more personalized use of data, as well as an ever-increasing dataflow from multiple devices and sources, is enabling insurtech to completely transform the insurance industry. With no legacy products, processes, or IT systems to constrain them, they are able to design new digital processes, products, and systems from the ground up. They can use the latest technology to target particular specific market segments, rather than trying to provide end-to-end solutions, using their digital expertise to maximize value by leveraging characteristics such as:

- Increased connectivity: Using artificial intelligence and bots to provide robo-advice through a digital customer interface with digital distribution.

- Targeted product concepts: Offering personalized ‘small-ticket’ products based on usage or value-added services.

- Full automation: By applying an automated-only approach, insurtechs cut costs and accelerate processes to meet customer expectations.

- Data-driven decision making and insights: With access to diverse sources of data, including telematics from installed boxes and smartphone apps, insurtechs are applying machine-learning techniques to offer innovative, personalized products and services.

“Insurtechs are redefining customer experience through innovations such as risk-free underwriting, on-the-spot purchasing, and AI-driven claims processing, making the customer journey ever faster, easier and more efficient.”

“While in the automotive sector, OEMs are forging new partnerships to develop in-car payment systems, enabling drivers to pay for things like fuel, snacks or even hotel bookings directly from their vehicles,” explains Nilüfer Günhan, Chief Financial Services Officer, Abdul Latif Jameel.

Improvement vs disruption

There are two main strands to insurtech: improvement vs. disruption.

The first is about technology that improves, speeds up and streamlines existing processes. This covers perhaps 80% of all insurtech. Insurers across the globe have been gradually applying technology since the invention of the silicon chip. In an industry that is structured around documents and admin, many insurtechs are concerned with resolving everyday problems for insurers, brokers and carriers, at a lower cost than existing systems.

In its 2019 report, The Rise of Insurtech[1], consultancy firm Accenture surveyed some 450 Insurtech companies to gain a deeper understanding of the sector. One important point that emerged is that many insurers still rely on legacy IT systems that essentially store data securely in ‘walled’ silos. Arguably the greatest step forward in improving every aspect of insurance admin is the adoption of a ‘data eco-system’, rather than the siloed legacy system.

As the Accenture report notes, “Decentralized, old technology surrounded by traditional corporate and IT governance structures can be difficult walls to break down. Insurtechs should consider working with other technology firms to create digital ecosystem-based offerings.”

Simply by removing the virtual walls between data records, insurers and brokers can work with third party companies, such as legal expenses or vehicle recovery firms, much faster, as well as improving their own internal admin processes.

There are hundreds of companies concerned with turbo-charging every type of admin function within the insurance world, including major players like Amazon Web Services, Oracle, DXC Technology, Accenture, CapGemini and more.

In turn, the big players have partnered up with medium sized SaaS (Software as a Service) specialists like Pegasystems, Duck Creek, Guidewire Software, OutSystems and many others. This creates an eco-system of knowledge and resources which can be accessed by insurers and agents, to better manage the transformation of a legacy system into something more flexible, bespoke and at heart, customer driven.

So instead of having insurer data in silos like a typical legacy system, every partner company in the chain can choose to dip into each stream of data as and when they need it. It could be actuarial risk tables for potential earthquake catastrophe loss in Japan, or Mercedes owner claims data from the EU zone. The point is that through this partnership, each element can be added as a layer by any insurtech, broker, or insurer, within their own company eco-system. It offers big insurers the opportunity to take a new idea and scale it up rapidly, by tapping into the data resources and expertise that insurtech partners provide.

This is another important point: thanks to insurtech innovations, the insurance customer is now carrying out many of the admin tasks that were previously done by brokers, agents and insurers, just a decade ago. Mid-Term Adjustments (MTAs) like change of address, marital status, job moves etc., are all being uploaded by policyholders via smartphone apps. This is why every insurer needs a network of multi-channel data management, that is compliant and secure, yet has the ability to automate as many admin functions as possible, from quote to claims payout.

Indeed, claims offers the greatest scope for developing insurtech products that shave precious time off the admin process. When an insurer is handling, say 500, ‘fender-bender’ auto insurance claims per month, any software that can take a few minutes off the time from FNOL (First Notification Of Loss) to claims settlement could save perhaps US$ 10 to US$ 25 per claim. Each SaaS tech advance may seem like a micro-step forwards, but in cash terms, it can impact the bottom line in a very positive way over a financial year.

Insurtech disruptors

Insurtech disruption is where it gets interesting. When you are talking about building the future, you often see a huge inflow of investment funds and venture capital. Partly, this is because the admin improvement sector of insurtech is already dominated by major global and Fortune 500 companies – they have the cash to do the job. But it’s also true that many insurance markets across the globe are ripe for disruption and that has prompted an ever-increasing wave of investors to look at buying into insurtech start-ups.

According to Willis Towers Watson’s quarterly insurtech report[2], the COVID-19 crisis failed to affect insurtech investment overall in 2020. On the contrary, it was a record year: “Global insurtech investment continued to grow amid a tumultuous year. In 2020, total annual Insurtech funding reached an all-time high of US$ 7.1 billion, with 377 deals.”

A new kind of auto insurance

As KPMG noted in an insurtech report in 2019[3], the shift from owning cars to leasing them, or simply buying subscriptions to urban mobility services, is one of the most disruptive forces shaking up the auto insurance market. This process has been accelerated by the pandemic, especially in Western economies, where the so-called ‘digital nomad’ section of the workforce has now been released from commuting to offices in major cities.

Pay-per-mile products from companies like Metromile in the US, By Miles in the UK, or PolicyBazaar in India all do the same basic thing: assess the ongoing risk based on driver behavior, routes traveled, plus other data gathered from the DAS systems built into the vehicle.

Abdul Latif Jameel Finance

This is a quantum shift in terms of underwriting risk compared to the existing actuarial table method of overlaying postcodes, local crime stats, driver claims history, jobs, gender, marital status and so on. Because the car journey data is cascading into insurtechs – and insurers – in real-time, via smartphones or telematics devices, it also allows AI to calculate future renewal premiums based on the data being gathered. No longer is insurance pricing based upon raw no-claims discounts or policyholder address and job information.

Truly disruptive, it allows insurers to make each policy very personalized based on the risk profile of an individual driver. Moreover, it fully automates the process, so there can be no accusations of bias by gender, racial identity or social class.

“As the number of insurance providers increases, the one with the best digital experience, data analytics and predictive capabilities will win the consumer’s business by making sure their solutions are the most relevant, timely and intuitive. These new technologies will open doors to more and more integrated experiences,” says Nilüfer Günhan.

Changing markets are empowering insurtechs

Although the Covid-19 pandemic has prompted a spike in interest in new healthcare insurance solutions and travel insurance products, many of the biggest social factors affecting the growth of insurtech go much deeper. These longer term demographic and social trends are creating opportunities for insurtechs to fill gaps in the market and challenge traditional offers from established insurers.

Generation ‘Z’- those born around 1990–2005 – is now reaching adulthood and seeking financial independence from their parents. These younger consumers need insurance products like car, bicycle, travel, or renters’ policies. And having grown up using smartphones as the go-to information resource, they expect to be able to do it all from their phones. This means app-based, PAYG subscription models are going to have more appeal to a Netflix demographic than old fashioned desktop websites and 18-page quote engines, found on typical price comparison sites.

At the other end of the spectrum, you have an ageing population across North America, Europe and East Asia, who may require pre-existing medical travel insurance, a range of healthcare and wellbeing policy products, or things like pet insurance.

The EU’s Eurostat department reported that single person households increased by 18% between 2010-2020[4]. In Sweden, Germany and Finland children lived in just 25% of all households. This means single people, or couples, have more money to spend on leisure, travel, buying gadgets or indeed insurance premiums. As the percentage of single person households increases, insurtechs are capitalizing on the solo lifestyle with products, services and business models specifically targeting this market.

The rapid adoption of the smartphone globally, even in developing nations, and the roll-out of 4G/5G services is another crucial factor. It is one thing having a brilliant insurtech product, but you need a mass market. That situation is changing as smartphones and 5G become ubiquitous, with insurtechs offering things like crop or motorcycle insurance via micropayment/smartphone systems.

For example, in India crop insurance was traditionally sold via local agents, bought with a one-off payment. Now small-scale farmers across rural India can obtain a quote on their smartphone, insure a crop in seconds and pay using a variety of micro-payment/debit services. In one sense, this is just an adaptation of an existing system, with the insurtech underpinned by streamlining admin. In fact, after the USA and the UK, India is the recipient of the third largest amount of Fintech investment, according to Accenture’s study[5] published in early 2020.

Regional centers, compliance support

Many government agencies, banks and investment funds have backed the idea of regional insurtech hubs to support this booming sector. In London, Insurtech UK acts an ideas factory and a conduit for investors and partnerships. The same approach can be seen in cities across the world, from Madrid and Berlin, to Dubai, Santiago, Istanbul and many more, where like-minded innovators are trying to disrupt local insurance markets, and eventually take their product global, often by forming partnerships with bigger insurance distributors and carriers.

Many regional hubs also offer prizes, venture capital and grants via annual pitch competitions or awards. Seedstars World in Switzerland, Lloyd’s Lab incubator in London and the NAMIC Fastpitch event in the US, are just three examples of this regional showcase approach to developing innovative start-ups and helping them make useful connections.

In terms of compliance this regional hub approach also offers regulators the chance to establish standards, and for innovators to effectively auto-comply as they build products.

Zego, which offers pay-as-you-go cover for delivery riders in Europe, automatically builds in local market rules on engine capacity, rider licence requirements and more. Plus, it has an auto-translation feature on policy wordings. This is important when you are offering cover on a pay-per-shift basis to expat Uber Eats or Deliveroo riders whose first language may not be English.

In Europe, there are many EU and individual government incubators and grants available for insurtechs. Not only does offer an important range of contacts and knowledge as regards compliance, these associations can open the door to increased funding, too. The real power gained by joining associations, or entering government-backed pitch competitions, is that insurtechs can access compliant, structured advice, right from the start of their journey.

There is another compliance benefit for insurtechs in the EU, Israel, India and many other markets, which is the matter of capital ratios, or solvency. While insurance companies must meet high standards as regards capital liquidity and cash reserves, in case of catastrophe claims, the same levels of capital generally do not apply to insurtechs. This is to allow the start-ups to make best use of their available funding, even though they are working in the same highly regulated market as bigger insurers.

Distribution is the key

As exciting as it is to see disruptive insurtechs bringing new ideas and products forward, it isn’t all about challenging the status quo. Big insurers often take a twin-track approach, establishing their own innovation hubs or centers and investing hard cash in new insurtechs. They essentially buy knowledge – what they then do with it depends on their distribution network globally, and their strategy.

Insurance giant Zurich, for example, opened its Innovation Foundry in 2018, along with an Ideas Centre and an insurtech award scheme. Within two years they had over 700 product concepts to review[6]. Unsurprisingly, having such a huge volume of innovations to consider proved impossible to manage, even for an insurance giant.

What has emerged as a global trend in the last few years are partnerships between insurtechs and bigger players, so that ‘proof of concept’ can be benchmarked as an idea develops. In other words: it might sound like a winner, but will people actually buy the product?

AXA partnered with UAE based Democrance in May 2020[7], testing its digital insurance product first in Thailand, before rolling it out to other developing markets. In Poland, the largest local insurer, PZU, recently partnered with Tractable AI[8] to streamline motor claims, before applying the same automated body repair claims tech in their other markets. Constant benchmarked testing of insurtech products is part of the process, and as insurers gather more claims data over time, they can find more problems that need resolving.

The other factor at play here is product journey to market, via distribution channels. There are huge market variations to consider. From an insurtech point of view, it can be better to develop a fledgling idea under the wing of a big name insurer and piggy-back on their sales channels. One example is Mapfre’s Insure-Space program, which offers funding and six months R&D time to start-ups. Similarly, Lloyd’s Lab in London and MetLife in the USA have established a global Innovation scheme[9], with US$ 100,000 worth of funding available for insurtechs based in EMEA and North America.

Insuring the future

As insurtech continues to advance and innovate around new technologies and services, certain sections of the market are expected to present significant opportunities. In a post-pandemic world, for example, healthcare insurance is likely to see huge changes. Not just to traditional life insurance policies, underpinned by things like big data, AI and wearable tech, but also new products that compensate the policyholder for lost income or being locked down in a particular location, plus rapid screening and diagnosis for non-COVID conditions. Many national health services struggled to maintain regular screenings or health checks during the pandemic, so this offers a huge opportunity for digital health and medical insurers, plus new start-ups.

The trend towards home-working in North America and Europe could also see a big increase in app-based PAYG auto insurance products, with many also acting as real-time data gatherers by default. Although telematics devices are improving, consumers are likely to reject buying these if their smartphone provides enough data to obtain a pay-per-mile insurance policy.

The Deloitte survey[10] noted that the pandemic had caused a profound shift in the commercial property market, with many companies giving up on renting commercial office space, or drastically scaling back operations. This will provide new opportunities in cities where office space is gradually re-purposed into apartments, leisure or set aside by local government for other uses. When this trend is underpinned by climate change and sustainability initiatives, it may well lead to demand for insurance cover on eco-parks, e-scooter ridesharing schemes, low carbon urban delivery projects and much more.

Abdul Latif Jameel, through Abdul Latif Jameel Finance, is already firmly embedded in this exciting market, finding new ways of bringing insurance solutions and financial services direct to customers.

We began over 40 years ago in Saudi Arabia, pioneering the provision of automotive finance to enable people to buy a car who perhaps could not find finance elsewhere.

Since then, we’ve grown into one of the largest auto-leasing and finance providers in the Middle East. And we’ve expanded our finance offering to cover not only vehicles, but also consumer products, commercial equipment, and real estate, as well as vehicle insurance products.

We are expanding the range of insurance advice and products we provide and plan to establish more insurance brokerages, including in Egypt, to complement our existing ones in Saudi Arabia and Turkey.

In 2020, we also launched a Lloyds-affiliated reinsurance broker in London called JENOA, which will bridge reinsurance business across MENAT and Lloyds of London, while also helping us develop and deliver insurance products to meet the evolving needs of our customers.

JENOA combines history and heritage with innovation, future-thinking capabilities and the latest technological advances in the reinsurance market. It aims to be an end-to-end digital broker, offering a comprehensive suite of reinsurance brokerage capabilities tailored to the specific needs of its clients.

As an appointed representative of Lloyds broker HW Wood Ltd, JENOA has access to the world’s largest reinsurance market, and backed by Abdul Latif Jameel Finance, its unique offering enables it to deliver traditional London market solutions, design innovative insurtech and offer Sharia-compliant solutions, expanding its reach into further exciting markets in the Middle East, North Africa and around the world.

Chief Executive Officer, JENOA,

Managing Director, Insurance & Risk Mitigation, Abdul Latif Jameel

“JENOA offers something new and different to the market. We are approaching reinsurance with a new perspective, while understanding the fundamentals of how the industry has developed over the last century.

“As the world embraces technology and digitization at an ever-accelerating rate, we are harnessing its power to deliver cutting edge solutions to our clients.

“This strength and commitment to innovation enables us to push boundaries and lead by example, encouraging our clients to establish the right insurance and risk solutions to allow their own businesses to flourish,” says Mahboob Khan, CEO at JENOA.

Insurance began centuries ago because merchants could see that the loss of one cargo through catastrophe could wipe out their business. The same balance of risk vs. upfront cost will underpin the insurtech products of the future too, although the methods of distributing and selling those policies will continue to evolve as technology develops. With Abdul Latif Jameel Finance, we look forward to participating in that journey.

[1] https://www.accenture.com/ae-en/insights/insurance/rise-insurtech

[2] https://www.willistowerswatson.com/en-GB/Insights/2021/01/quarterly-insurtech-briefing-q4-2020

[3] https://home.kpmg/xx/en/home/insights/2019/02/insurtech-10-auto-insurance-disruption-coming-but-director-not-clear-fs.html

[4] https://ec.europa.eu/eurostat/statistics-explained/index.php/Household_composition_statistics

[5] https://www.accenture.com/ae-en/insights/insurance/rise-insurtech

[6] Zurich: Innovation in insurance requires ‘the right mindset’ | Insurance Business (insurancebusinessmag.com)

[7] AXA and Democrance expand inclusive insurance to customers globally, 18 May 2020

[8] Poland’s PZU Uses Tractable AI to Analyze Auto Damage | Insurance Innovation Reporter (iireporter.com)

[9] https://www.metlife.com/about-us/newsroom/2020/september/metlife-digital-accelerator-partners-with-10-startups/

1x

1x

Added to press kit

Added to press kit