Keeping it in the family

Family businesses have long been a cornerstone of the global economy. By their very nature, family businesses possess unique strengths, with knowledge, insights and values passed down from generation to generation. To ensure long term success, however, there are some key areas family businesses must get right.

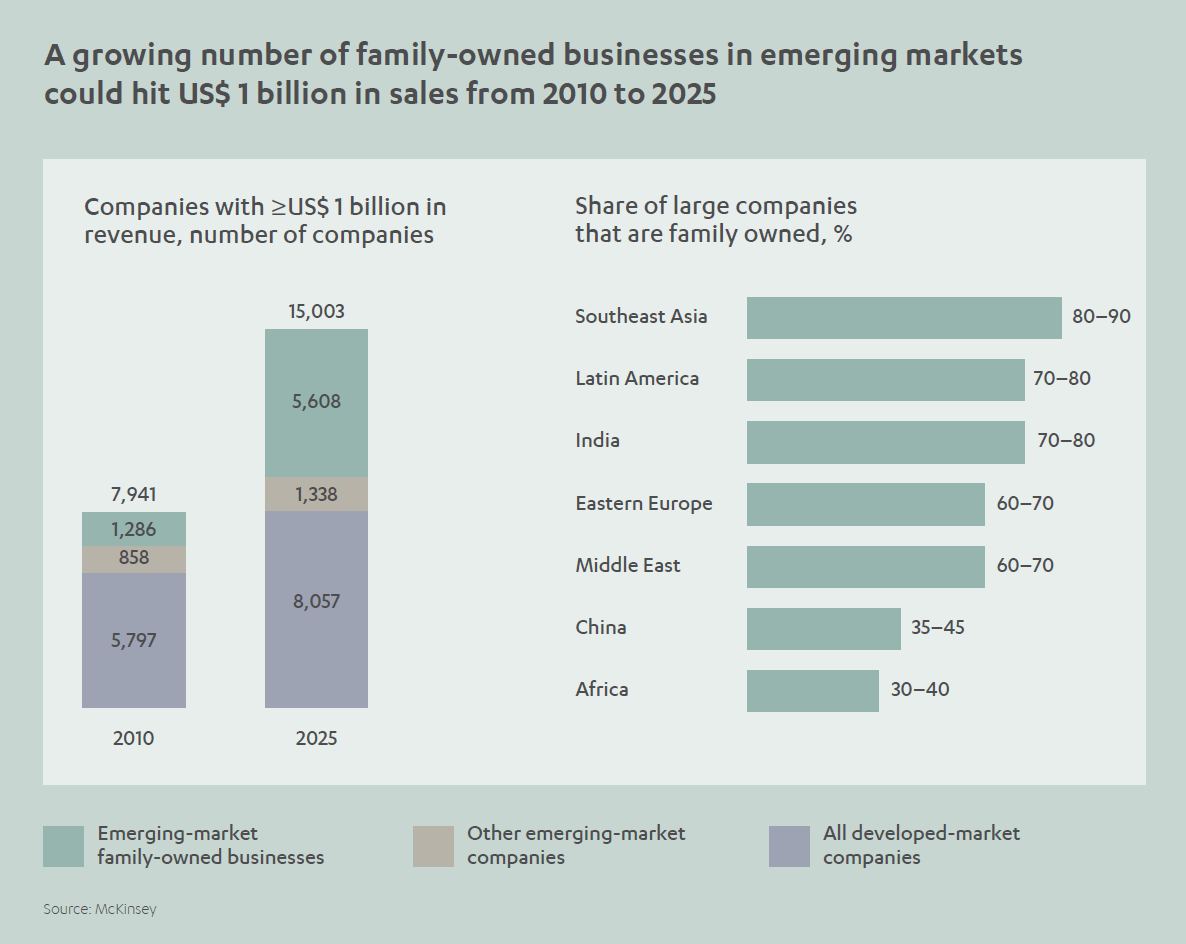

According to Boston Consulting Group (BCG), family businesses represent more than 30% of large companies globally.[1] They tend to be particularly strong in countries with large manufacturing economies. A 2010 study estimated the average life span of a family-owned business is circa 24 years and about 40% of (US) family-owned businesses turn into second-generation businesses, and of those, around 13% are passed down successfully to a third generation, but only 3% to a fourth or beyond. Today, around 35% of Fortune 500 companies are categorized as ‘family companies.’[2]

In India, for example, family businesses generate almost US$ 670 billion in revenue, or 25% of total GDP. In Germany, they contribute a huge US$ 1.8 trillion in revenue – around 49% of total GDP[3], while in the Middle East, they account for three-quarters of the private sector workforce[4].

While many of the largest corporations we know today are still family owned, most have divested their shares and decision control to a greater or lesser extent. The Walton family still owns around 50% of the shares in Walmart but has little control in managing the business. In contrast, the Ford family owns less than 2% of the shares in the eponymous automotive giant, but still retains 40% voting power.[5]

Cultural building blocks

Today, families like Swire, Tata, Cargill, Koḉ and Mars are still household names across the globe. For centuries, family corporations have always been at the ‘heart of business’, from the Rothschilds and Rockefellers in banking to the Benz, Toyota and Ford in the auto industry.

Abdul Latif Jameel started off as a small trading business in Jeddah, Saudi Arabia.

In 2020, some 75 years later, the company has grown to become a significant global investor, a worldwide distributor and has diversified into multiple sectors including energy, water, real estate, the future of mobility and financial services amongst others, with over 15,000 employees of more than 40 nationalities operating in some 30 countries around the World.

In a recent article for the World Economic Forum (WEF), Hassan Jameel, explores how family business are the life blood of the Middle East, “many of the largest businesses in the region remain family run, having grown over the course of several generations from small enterprises into conglomerates,” he notes and continues to acknowledge that “for governments in the region and beyond, family businesses are key to meeting ambitious goals for private sector growth.”

As the global economic center shifts towards Asia, where family businesses dominate, their role as a cornerstone of economic development is likely to be even greater.[6]

Due to their powerful internal culture, iconic brand names and long legacy of success, family firms are often perceived as more distinctive and trustworthy than their public company counterparts. They also tend to be more careful with their expenditure.[7]

A BCG report suggests that the debt of family businesses in developed markets is 27% lower on average than other companies, although in emerging markets debt levels between family and non-family businesses are comparable. The report also highlights the unique advantages of family businesses, which include credibility and trust, a deep knowledge of the business, agility in the way they can govern the business, and a long-term perspective in decision-making.[8]

Aspects such as shared vision and strategic clarity also make family businesses attractive to investors[9]. In India, for example, around 70% of private investment goes into family businesses.[10]

Governance, governance, governance

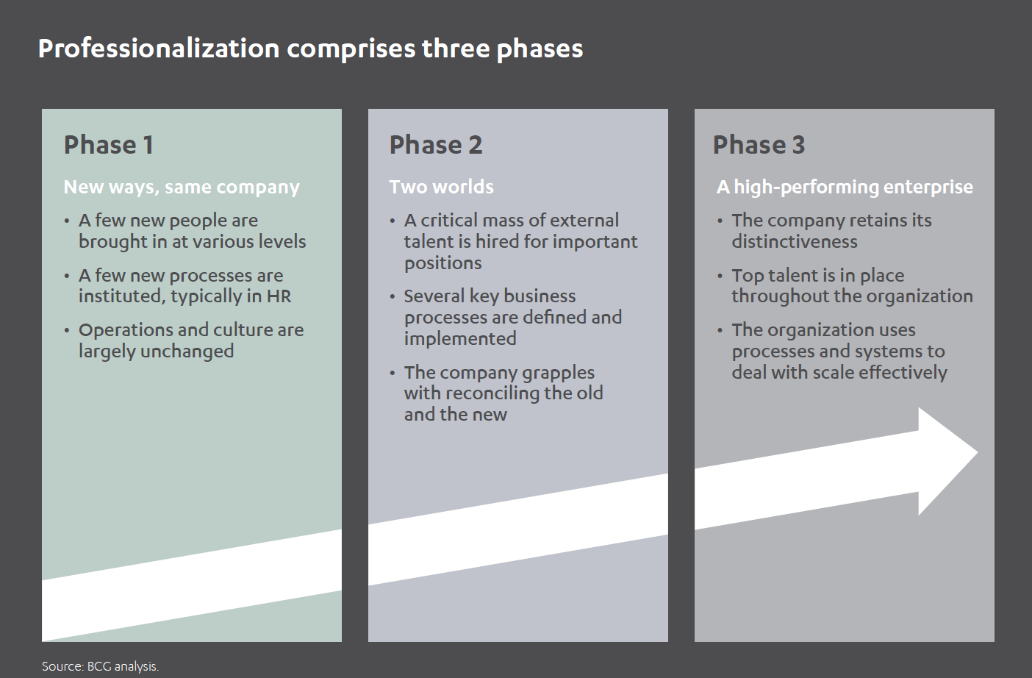

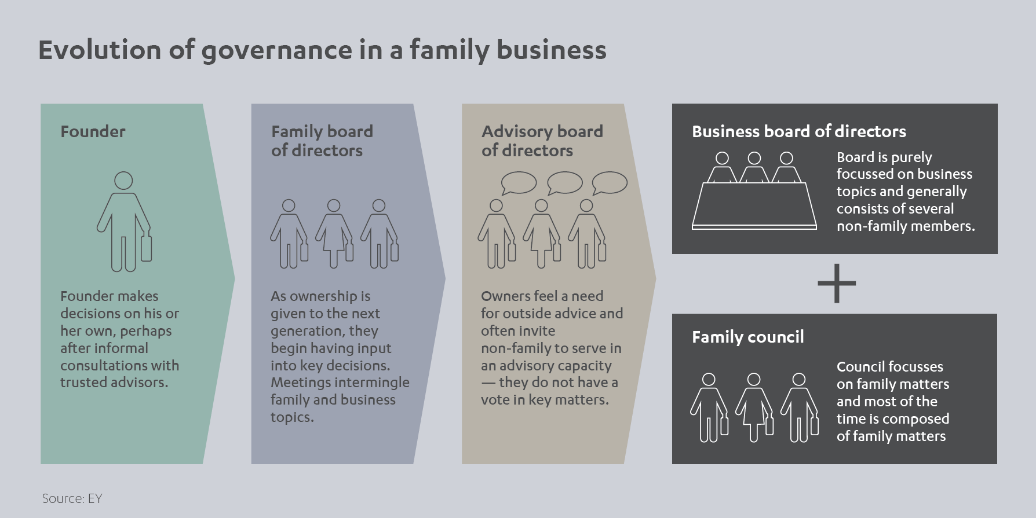

Strong, transparent governance is critical for family businesses. In their early years, family businesses are often characterized by quite a loose operating structure, with the founder and their family firmly in the center. As they grow, new people are brought in from outside the family and governance procedures become more formal[11] to bring order to the more complex structure.

Yet there are pitfalls. The nature of family businesses is built on entrepreneurship – a senior family member with a vision that has built the company over a number of years. But equally there is the danger of stifling future growth potential, should the founder not want to loosen the reigns and give future generations the room to take the business forward as market dynamics change.[12]

The rules that applied when the business was founded are destined to change organically over time. The key is in formulating a sound governance structure. Yet because of the inherent informal nature family businesses are first established, the issue of governance can often be neglected.

Nevertheless, the benefits of developing good governance outweigh the challenges – particularly as the business grows and employs more people from both within and outside the family circle.

Education is essential to ensure everybody, from directors to shareholders, managers and staff, understands essential aspects such as the processes and procedures they should follow, how things are managed and how decisions are taken.

Founders need to recognize that following generations will not run the business in the same way they have – and nor should they. As the business environment changes and organizations grow, successful businesses need to adapt or fail, and that includes family businesses. Governance structures can help ensure there are clear rules around the different ways family can participate and be recognized as members of the family and the business.

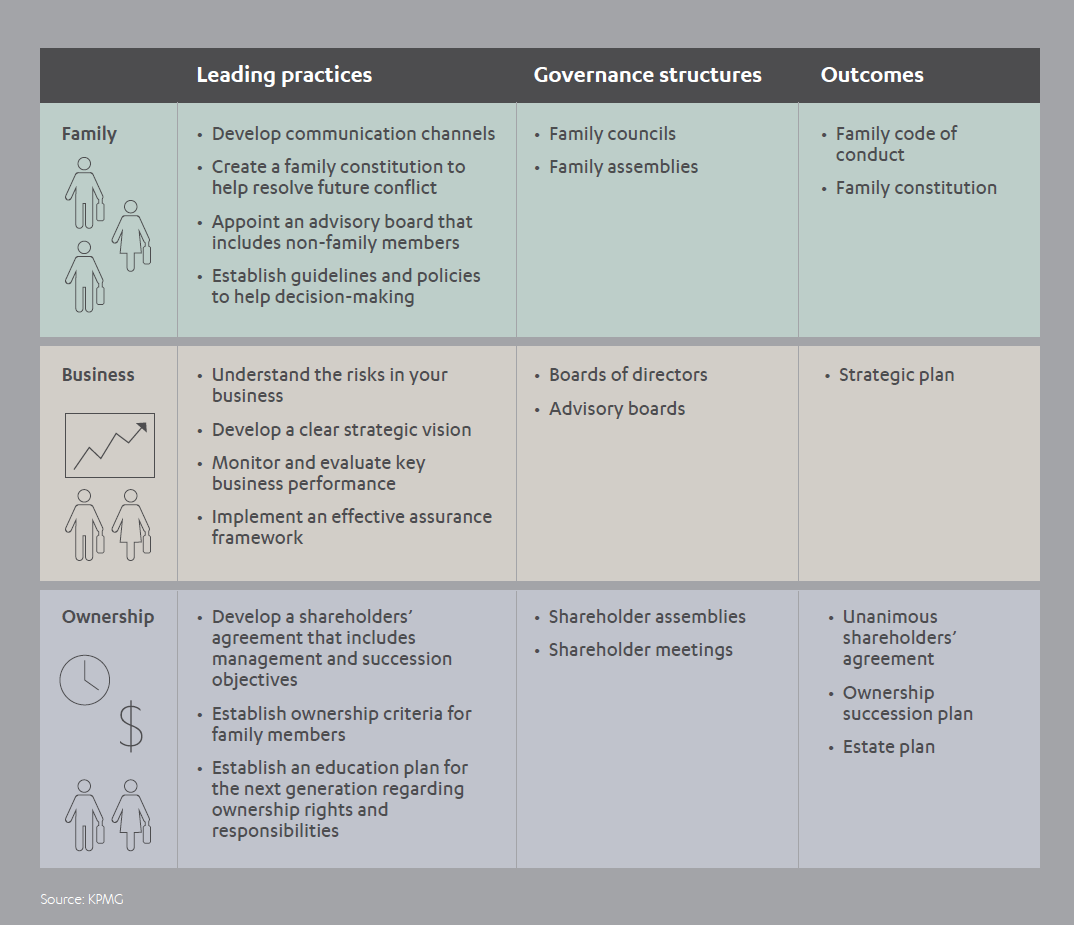

One key strategy cited in a family business report from KPMG[13] is to bring in an independent party to navigate the process, with pre-agreed rules regarding how family members can join the business, and the required experience, involvement, development and output – as with any other employee. Included within the governance structure, family members should ideally report to someone outside of the family, says the report, and there should be defined rules about family remuneration, decision-making and clear definitions in the separation of power.

Learning from other successful family business models is another. Hassan Jameel is a founding member of the Family Business Council -Gulf (FBCG) (itself a member of the Family Business Network International started in1989, and Today, with over 16,000 individual members from over 4,000 family businesses across 65 countries).

“Family-owned businesses account for about 90 percent of the GCC private sector economy and as such a global hub for business, trade and commerce, trust, transparency and governance are key” says Hassan, “Indeed, good governance maybe even more critical than in a more familiar corporate context in taking businesses from the kitchen table to the board room table. Companies that have been through this transition can play a valuable role in transferring knowledge to others, through organizations such as the FBCG, which launched guidelines for governance in 2016.”

Family versus business governance

The importance of governance becomes more crucial when considering the issues uniquely faced by family businesses. Are there processes in place for resolving family conflict? Is there a defined process for hiring, evaluating and remunerating family members? Are there processes to separate family and business issues? Is there a formulated family code of conduct? Do business objectives reflect family values?

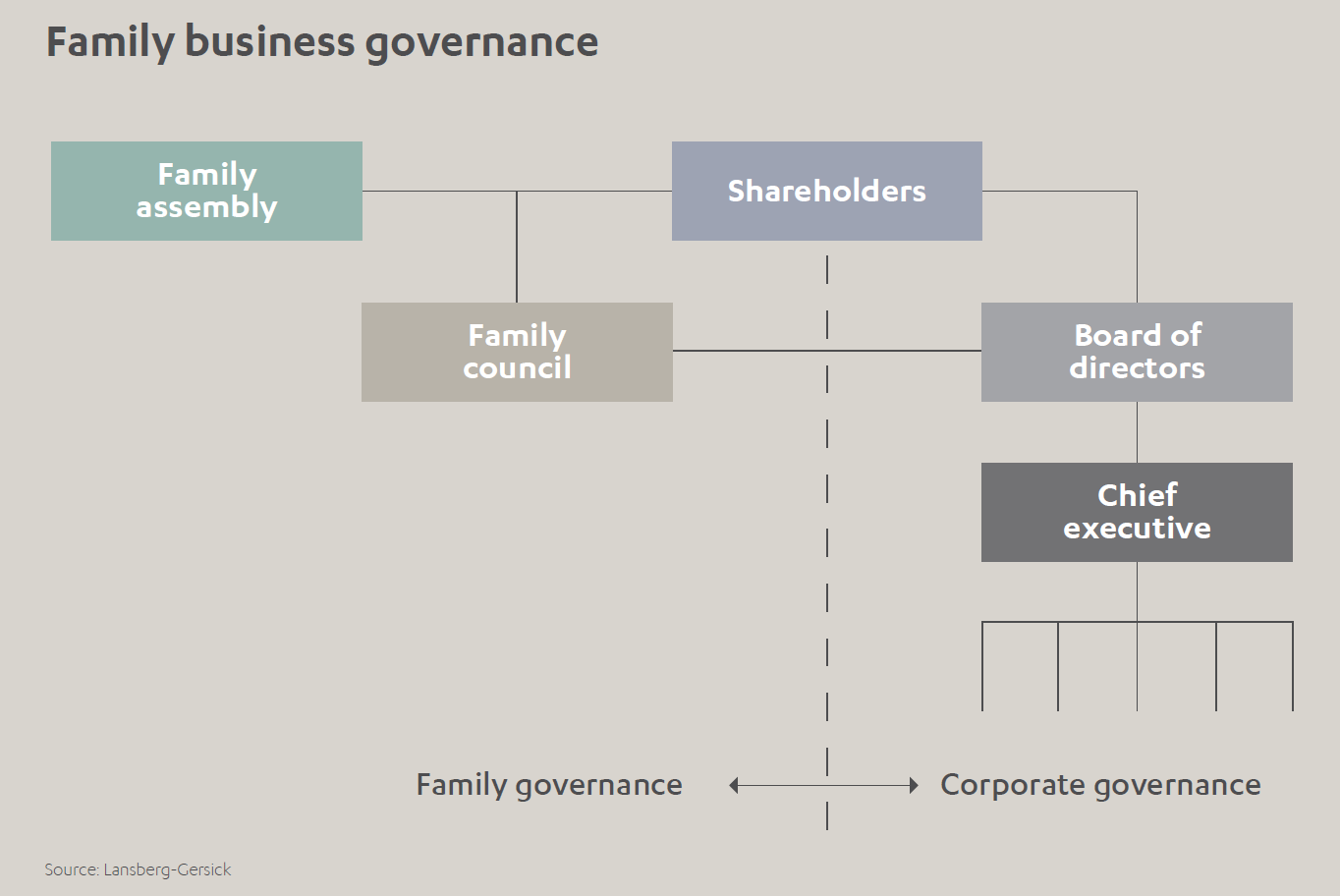

Resolving family issues can be tricky enough in private. Trying to do it in the glare of the corporate spotlight takes it to another level of sensitivity. Hence formulating governance structures for family alongside those of the business is paramount, in order to identify any potential areas of both agreement and disharmony. The degree of formality may vary depending on family dynamics. The diagram below illustrates the dividing lines and outcomes between family, business and ownership:[14]

The growth of the business will also inevitably mean bringing non-family executives onboard. As the BCG report baldly states: “even the most talented leaders of family businesses eventually find it hard to manage a rapidly growing company solely on the basis of willpower, charisma, and hard work.”[15]

The Institute for Family Business (IFB) is the UK’s largest family business organization. In its publication, ‘Understanding Family Business: A Practical Guide for the Next Generation’, it states that the governance requirements of a first-or-second generation family business may be vastly different from those of a more mature, multi-generational family business. It goes on to say that non-executive directors can be a very important tool in safeguarding against some of the inherent weaknesses associated with family businesses, particularly where the non-executive is not a family member and is independent.

Advantages that non-executive directors from outside the family can bring to the table include a valuable, impartial view on family member management and ownership succession suitability. They can help to ensure family member employees are not unfairly favored and introduce outside expertise and experience in the form of directors, managers and professional advisors.[16]

Effective governance means implementing a clear distinction between family and corporate governance, as shown in the diagram below. The family assembly comprises all family members. They are represented by the family council which make decisions on succession, long-term business goals, defines family values and resolves internal conflict. The Board of Directors includes non-family members, dictates strategy and appoints management. The Shareholders’ Council protects the interests of both family and non-family shareholders.

By bringing in non-family members to join its board of directors, a family business can gain access to highly experienced executives and specialists who can provide valuable insights that facilitate and support decision making.

According to Deloitte’s family business survey 2019, which polled 791 executives from family-owned businesses across 58 countries, around one third of board members of family businesses comprise non-family executives.[17]

Planning succession

Succession planning can be a minefield in any business, but even more so in family businesses, which have to deal with both biological and corporate challenges. PwC’s Family Business Survey 2019 observes that:

“Leadership succession is best handled through long-term strategy, not tactically at the time when the successor is needed. When planned over five to 15 years, the family can find a variety of candidates – family and non-family – and give them training and opportunities to grow.”[18]

Research suggests that for many family businesses, succession planning is a sensitive area and one that many often do not address early enough. A BCG report, for example, showed that while family business leaders ranked achieving alignment among family members as their number one concern, succession planning came in as a firm second.[19]

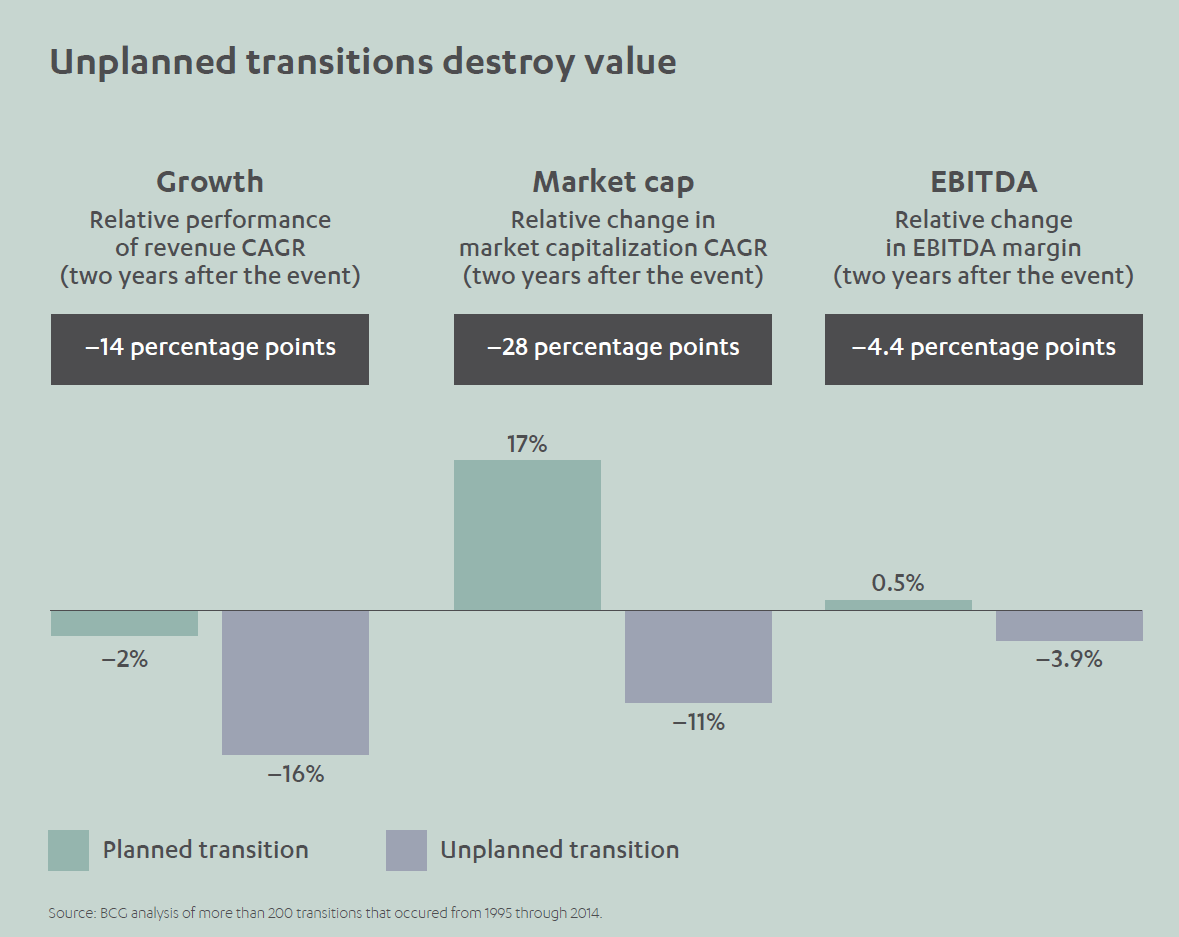

The survey, which looked at 200 family business successions conducted over a nine-year period, found a 14-percentage point difference in revenue over two years for companies that had planned succession transitions, a 28-percentage point difference in market capitalization growth, and a 4.4-percentage point EBITDA (earnings before interest, tax, depreciation and amortization) margin[20].

BCG makes some suggestions towards succession planning:

- Decide whether to choose successors from inside or outside the family – it may involve both within defined roles and strengths.

- Plan how successors will prepare for the role and gain acceptance.

- Start early to turn the wheels on the process for future generations.

- Set expectations but also understand aspirations.

- Be clear on the business priorities throughout. For example, whether the company wants to retain ownership and operation, or relinquish either or both of these aspects moving forward.[21]

Family succession planning can also be a way to promote female leadership, when a woman takes the helm after the death of a husband or father.[22]

Digitization and disruption

Attracting the right talent in the era of digitization is a major challenge for both family and non-family businesses. The digitization agenda demands not only a high degree of skill specialization, but also continuous learning and development in order to keep up with rapid progress. Indeed, “collaboration with academic institutions and upskilling of the existing talent pool are becoming a priority for family businesses,” says BCG in its family business report.[23]

A PwC report states that within the digital revolution, younger generation family members should be ‘reverse-mentoring’ older family members and employees. At the same time, it adds, “don’t assume that by adopting digital strategies you somehow need to change your family or business values.”[24]

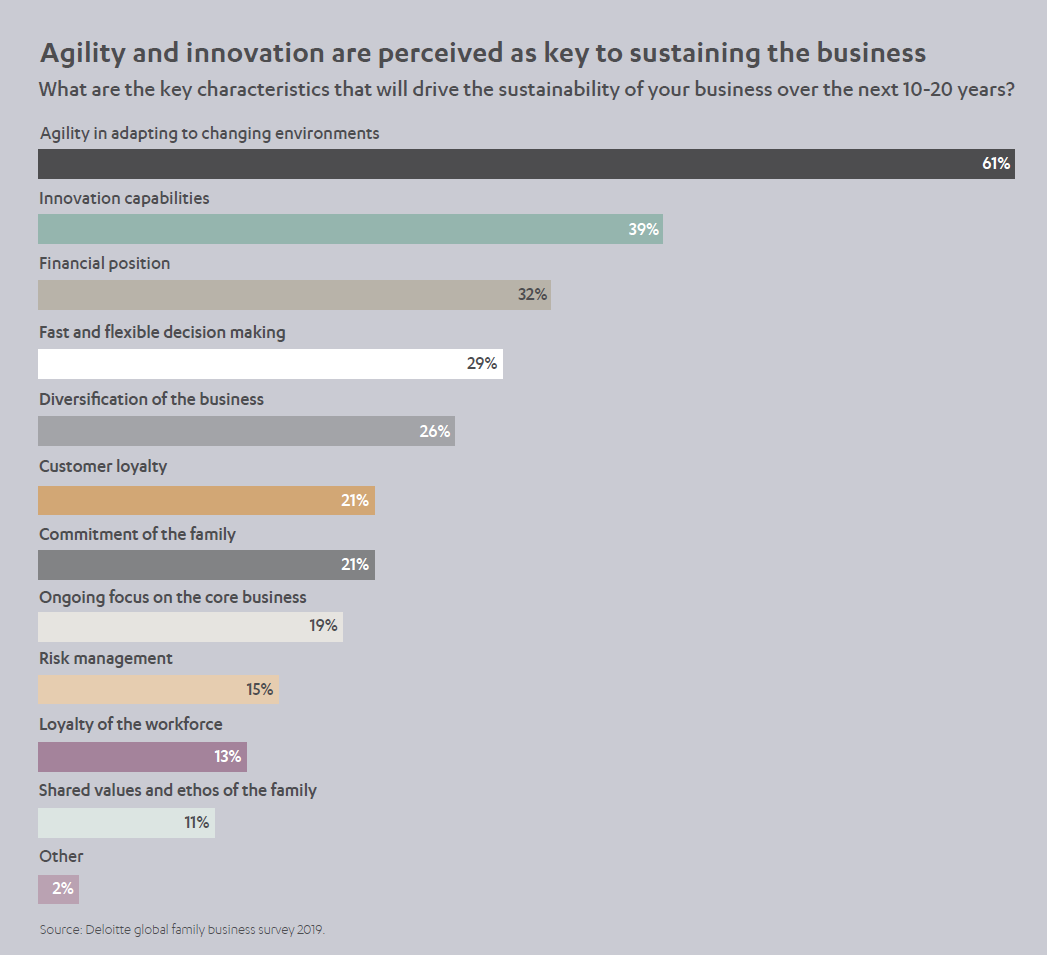

There are some distinct advantages family businesses can harness from disruption. Deloitte’s Family Business Survey 2019 suggests that family businesses are able to adapt within a growing business climate of unstable market conditions, changing consumer behaviors and evolving business structures. When asked about which key characteristics will drive the company’s sustainability over the next 20 years, 61% rated their agility in adapting to changing environments as their highest priority. Second at 39% was the capability to innovate:[25]

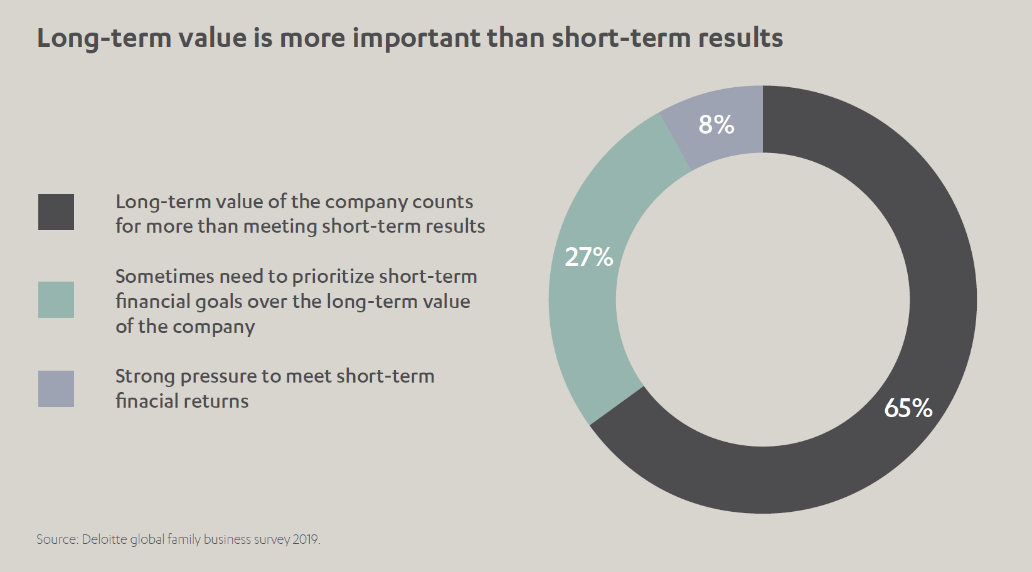

Another business sustainability indicator from the Deloitte survey was the importance of long-term value over short-term results, at 65%. Although 27% said they sometimes needed to prioritize short-term value over long-term goals, only 8% were pressured by short-term financial returns, reflecting the perception that by their very nature, family businesses are better able to take a long-term view.

Sustaining the future

All family businesses started with a purpose. John Cadbury started his chocolate business in 1824, to steer people away from alcohol.[26] ,When Henry Ford introduced his Model T in 1908, he realized his dream to produce an automobile that was reasonably priced, reliable, and efficient.[27] Sam Walton opened his first ‘dime store’ in 1950 with the goal of great value and great customer service. In 1962, he opened the first Walmart.[28]

Each purpose may change over time. Many family businesses now have wider philanthropy or environmental goals, too. Mohammed Jameel, for example, formalized the family’s varied and wide ranging philanthropy – which began in the 1940s with its late Founder – in 2003, and today Community Jameel supports a wide range of initiatives that promote positive societal change and economic sustainability. Its aim is to help communities transform themselves by delivering sustainable solutions in livelihoods, innovation, creativity, entrepreneurship and youth.

In some family businesses, the purpose transcends the generations. Ford still aims to produce high quality, reasonably priced vehicles. Walmart still aims to provide great value and great service. But for others, the purpose may change. Abdul Latif Jameel began trading business in 1945, and soon became a local automotive distributor for Toyota in 1955. Today, while this is still a core part of the business, it has diversified into multiple geographies and industries, from renewable energy and environmental solutions to financial services; mobility solutions to real estate. What doesn’t change, though, is the simple fact that there is a purpose that is clearly defined and communicated; a coherent vision to guide the business and its leadership through its continued growth.

“Few could have envisaged how the Abdul Latif Jameel family business would grow from a small trading business in a single filling station to a global investor in the infrastructure of life.

“Few could have envisaged how the Abdul Latif Jameel family business would grow from a small trading business in a single filling station to a global investor in the infrastructure of life.

While our purpose has grown and evolved, we are still guided by the same values and vision, which we endeavor to pass on through our family and employees today,” explains Fady Jameel, Deputy President and Vice Chairman, Abdul Latif Jameel.

In its Global Family Business Survey 2019[29], PwC identifies four main pillars of growth for family businesses.

- The first is ‘looking inwards’ – developing good corporate governance, attracting and retaining top talent, and empowering both management and next generation leaders.

- Second is ‘looking long-term’ – defining a long-term strategy, optimizing the business portfolio, and addressing both top-line growth and bottom-line profitability.

- Third is ‘looking forward’ – embracing digitization, new ways of thinking and business models.

- The last pillar is ‘looking outwards’ – being part of socio-economic development, encouraging public-private collaboration and being responsible for the benefit of all.

With these four pillars at their heart and the right fundamentals in place, family businesses like Abdul Latif Jameel can remain a driving force within the global economy for generations to come.

[1] https://www.bcg.com/capabilities/strategy/family-business.aspx

[2] familybusinesscenter.com, 2010

[3] https://www.bcg.com/publications/2020/great-family-businesses-need-good-governance.aspx

[4] https://www.pwc.com/m1/en/publications/documents/family-business-survey-2019.pdf

[5] https://www.cnbc.com/video/2017/05/22/ford-family-owns-less-than-2-of-shares-but-40-voting-power.html

[6] https://www.economist.com/special-report/2015/04/16/to-have-and-to-hold

[7] https://www.economist.com/special-report/2015/04/16/old-fashioned-virtues

[8] https://www.bcg.com/publications/2016/what-makes-family-businesses-in-emerging-markets-so-different.aspx

[9] mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/Joining%20the%20family%20business%20An%20emerging%20opportunity%20for%20investors/Joining_the_family_business_MoVest.ashx

[10] mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/Joining%20the%20family%20business%20An%20emerging%20opportunity%20for%20investors/Joining_the_family_business_MoVest.ashx

[11] bcg.com/publications/2017/family-business-people-organization-founders-guide-professionalizing-family-business.aspx

[12] weforum.org/agenda/2019/08/family-businesses-lifeblood-of-the-middle-east/

[13] home.kpmg/xx/en/home/insights/2017/01/power-of-governance-in-family-business.html

[14] https://assets.kpmg/content/dam/kpmg/cn/pdf/en/2015/06/Family-Business-Advisory-From-concept-to-road-map-201506.pdf

[15] https://www.bcg.com/publications/2016/what-makes-family-businesses-in-emerging-markets-so-different.aspx

[16] https://www.ifb.org.uk/media/1351/nxg_ufb_final.pdf

[17] deloitte.com/hr/en/pages/press/articles/global-family-business-survey-2019.html

[18] pwc.com/m1/en/publications/documents/family-business-survey-2019.pdf

[19] bcg.com/publications/2015/leadership_talent_growth_succeeding_with_succession_planning_family_businesses.aspx

[20] bcg.com/publications/2015/leadership_talent_growth_succeeding_with_succession_planning_family_businesses.aspx

[21] bcg.com/publications/2015/leadership_talent_growth_succeeding_with_succession_planning_family_businesses.aspx

[22] economist.com/special-report/2015/04/16/old-fashioned-virtues

[23] pwc.com/m1/en/publications/documents/family-business-survey-2019.pdf

[24] pwc.com/gx/en/family-business-services/assets/pwc-global-family-business-survey-2018.pdf

[25] deloitte.com/hr/en/pages/press/articles/global-family-business-survey-2019.html

[26] cadbury.co.uk/our-story?timeline=1824

[27] ford.co.uk/experience-ford/history-and-heritage

[28] corporate.walmart.com/our-story/our-history

[29] https://www.pwc.com/m1/en/publications/documents/family-business-survey-2019.pdf

1x

1x

Added to press kit

Added to press kit