Electric vehicles primed to give auto market major jolt

The road to success for electric vehicles (EVs) has been long and bumpy, with years of exaggerated claims, false starts, and missed targets. However, the home straight appears to be in sight at last, as the economic case for EVs becomes as compelling as the environmental one.

All evidence suggests the automotive market – and society in general – is on the cusp of a major inflexion point. More than a hundred million new EVs are expected to join the World’s roads over the next decade, forever changing the concept of personal transport.

Professional advisory network Deloitte identifies 2022 as a banner year, the point at which the price of owning and running EVs will achieve parity with internal combustion engine counterparts: “With the cost of ownership no longer a barrier to purchase, EVs will become a realistic, viable option for any new car buyer.”[1]

The signs are already unmistakably positive. In 2017, approximately one million EVs left global forecourts, hailed then as a milestone moment for the industry. Already in 2019, data from EV volumes, the electric vehicles world sales database, reveals that over 1.1 million plug-in electric vehicles were sold during the first six months of 2019 alone. This includes all battery-powered and plug-in hybrids (PHEV) passenger cars sales, light trucks in the Americas and light commercial vehicle in Europe and Asia.[2]

For many, the shift to EVs cannot come soon enough, not least for the public health implications. According to the UN Environment Program, the transport sector is the fastest growing contributor to climate emissions. Particles from cars and other vehicles – including black carbon and nitrogen dioxide – also contribute to a range of illnesses including respiratory conditions, strokes, heart attacks, dementia and diabetes[3].

For many, the shift to EVs cannot come soon enough, not least for the public health implications. According to the UN Environment Program, the transport sector is the fastest growing contributor to climate emissions. Particles from cars and other vehicles – including black carbon and nitrogen dioxide – also contribute to a range of illnesses including respiratory conditions, strokes, heart attacks, dementia and diabetes[3].

In the United States, cars and trucks account for nearly one-fifth of all US emissions, while the transportation sector as a whole – which includes cars, trucks, planes, trains, ships, and freight, produces nearly 30 per cent of all US global warming emissions – more than almost any other sector.[4] In the UK, meanwhile, it is estimated that air pollution causes an estimated 40,000 early deaths every year. [5]

While data varies, many scientists believe that if we keep polluting the atmosphere at current levels we can expect a rise in global temperatures of several degrees by the end of the century – with predictably devastating consequences. Dwindling fossil fuel supplies, with oil and gas running out in as little as 50 years, makes the EV argument even more urgent.[6]

As globally significant as these issues are, however, it is not only environmental concerns that are propelling sales of EVs. For consumers, acquisition, price running costs and resale value – the ‘micro-economic argument in my pocket’ together with convenience are also decisive factors – and it’s here where EVs have experienced some of the most dramatic changes.

Price and ease-of-use represent vital gear change

Battery prices, so long the major drawback of EVS, are dropping – and fast. As recently as 2015, the battery of a typical EV car in the USA comprised 57 per cent of its total cost. Currently it’s 33 per cent, and by 2025 will have fallen further to 20 per cent.[7]

Aside from the battery, as economies of scale continue to improve efficiency, the costs of motors, inverters and electronics for EVs could by 2030 be 25 to 30 per cent lower than today.[8]

Nowhere is the explosion in EVs more visible than in China. Global investment giant JP Morgan estimates that by next year the country will represent an overwhelming 59 per cent of all global EV sales, with ever-smaller battery packs designed for 100-150 km journeys spurring the boom. With hundreds of EV makers operating in China alone, the country was responsible for almost 700,000 new EVs rolling off production lines in 2017 – more than the rest of the world combined. Understandable, considering prices for mini EVs in China start as low as US$ 6,250 each.[9]

When purchasers can act with both their wallets and their ethics, it’s a potent mix. But on its own, it is not enough to guarantee that EVs will become a truly long-term mainstream mobility solution. Until recently, one vital piece of the jigsaw – perhaps the most important piece – was still missing: the infrastructure to support EVs. After all, what use is an electric car if the battery is flat and there’s nowhere to plug it in for a recharge?

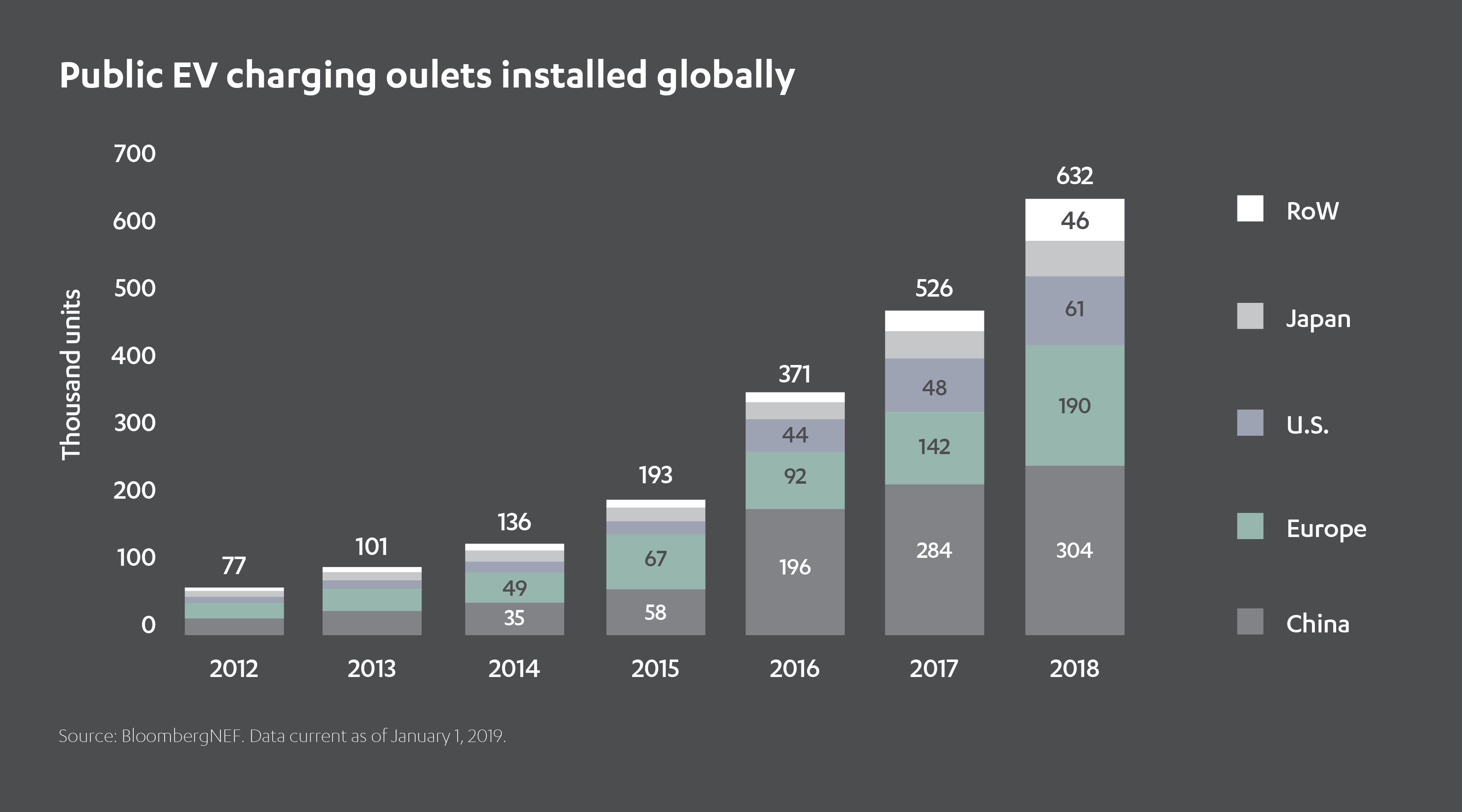

Such worries are rapidly receding. By the end of last year, approximately 600,000 charge points were installed worldwide – indeed now even Google Maps can tell you if there is a near EV charging point and if it is in use or free.

China again leads the way, accounting for half of those installations and targeting some 4 million new charge points by 2020.[10]

Other countries are swiftly taking note. In California, the state has earmarked US$ 1 billion for expanding its charging network; in the UK, meanwhile, the government is investing US$ 50 million in transforming its network of electric charge points, with wireless charging and ‘pop-up’ pavement technologies both winning new funding.[11]

The notion of ‘convenience’ also extends to driving distances – and sure enough, EVs are gradually acquiring the technology to undertake longer journeys between charges. EVs currently in development will boast ranges comparable to conventional engines, thanks to improvements in lithium-ion formulations, materials becoming denser, and advances in battery management systems. In real terms, current pace-setters such as the Polestar 2, Porsche Taycan and Mercedez-Benz EQC, can record several hundred kilometers on a single charge. Soon these will be eclipsed by Tesla’s next-generation 2020 Roadster, which promises a potential travel distance of a thousand kilometers.[12]

EVs will soon be about more than short-haul hops in city traffic – they’ll be able to tackle trips of country-spanning distances.

Governments throw legislative weight behind EV ambitions

Most major automotive markets have introduced game-changing fuel economy and emissions targets to boost the popularity of EVs and other clean vehicles. To meet EU emission rules, for example, it is estimated that the combined BEV (battery electric vehicle) and PHEV (plug-in hybrid electric vehicle) market share will need to hit at least 22 per cent by 2030 – with BEVs accounting for more than half of that.[13]

At the same time, many governments have been persuaded to introduce financial incentives for prospective EV purchasers. Price subsidy schemes and vehicle tax exemptions are the dominant incentives for both individual consumers and businesses. The proliferation of priority lanes for EVs will make them even more attractive, as roads everywhere groan under the strain of greater vehicle numbers.

Some measures will be more draconian, with restricted access for traditional cars in certain geographical markets, or even outright bans. In 2016, for instance, the mayors of Athens, Madrid, Mexico City and Paris said they intended outlawing diesel cars and vans entirely from their streets within a decade. Madrid has in addition been trialing a two-tier parking payment scheme, with higher fees for non-EVs. Paris, meanwhile, has already banned dirtier pre-2000 diesel vehicles.

Aiming for a world-first, Norway will end new sales of diesel and petrol cars entirely by 2025. India, France, Germany and China are all considering following in Norway’s footsteps; India’s intention to ban conventional engines by 2030 is particularly significant, considering the country’s millions of auto-rickshaws are notorious pollutants.

“The private sector is responding proactively to policy signals and technology developments,” says the International Energy Agency (IEA) in its Global EV Outlook 2019 report. “An increasing number of original equipment manufacturers (OEM) have declared intentions to electrify the models they offer, not only for cars, but also for other modes of road transport.”[14]

Brands going full-throttle for an electric revolution

With their ever-increasing range of hybrid vehicles, traditional motoring marques such as Toyota – the global market leader in hybrids – VW, BMW and Nissan are providing big-name backing for the electric revolution. Some of this due to consumer environmental sentiment, increasing demand and growing infrastructure, but more importantly due to the need to reach legislative fleet CO2 emissions or risk heavy fines from the EU. Indeed manufacturers may face a difficult decision and some small – and cheaper – combustion engine models might be taken out of production as no longer economically viable, to be replaced by more pricey EV models.

Innovative, pure-play electric vehicle brand are also helping to lead the charge towards green mobility.

Tesla is arguably the most high-profile name in EV vehicles. Founded in 2003, Tesla released its first EV, the Model S, in 2012, and went on to sell more than 250,000 units. It followed up with the Model X in 2015 and Model 3 in 2017, and will soon unveil its roomier Model Y, containing three rows of seat for up to seven people. The company is now looking beyond cars to SUVs, pickup trucks, minibuses and unmanned taxis.

Another US-based brand at the forefront of the next generation of EVs is RIVIAN, in which Abdul Latif Jameel was an early investor. Its US$ 700m funding round in February 2019 was led by online retail giant Amazon followed by US carmaker Ford Motor Co. (with US$ 500m) and most recently Cox Automotive (US$ 350m). RIVIAN’s fundraising in the past year has been phenomenal and totals at least US$ 2 billion with Cox’s latest investment. Its CEO, RJ Scaringe – a Clark Kent look-alike with a PhD in mechanical engineering from MIT – has spent over a decade refining his ideas for electric vehicles and may prove to be a meaningful rival to Tesla’s Elon Musk.

Another US-based brand at the forefront of the next generation of EVs is RIVIAN, in which Abdul Latif Jameel was an early investor. Its US$ 700m funding round in February 2019 was led by online retail giant Amazon followed by US carmaker Ford Motor Co. (with US$ 500m) and most recently Cox Automotive (US$ 350m). RIVIAN’s fundraising in the past year has been phenomenal and totals at least US$ 2 billion with Cox’s latest investment. Its CEO, RJ Scaringe – a Clark Kent look-alike with a PhD in mechanical engineering from MIT – has spent over a decade refining his ideas for electric vehicles and may prove to be a meaningful rival to Tesla’s Elon Musk.

Aiming to place the focus firmly on ‘performance’ in the EV field, RIVIAN unveiled its first two models, an electric pickup truck and an electric SUV, at the LA Auto Show in November 2018. The vehicles (called the R1T and R1S respectively) are classed as ‘Level 3 Autonomous’, meaning drivers’ eyes can safely be taken off the road. As an indication of its long-term commitment, Rivian in 2016 purchased the former Mitsubishi plant in Illinois for US$ 16 million. Today employing around 1,300 people, Rivian’s headcount has since increased fivefold, its staff now spread across California, Michigan and Illinois.

The United States is not the only market driving the EV market forward. Chinese manufacturer NIO, founded in 2014, specializes in autonomous EVs, and in 2016 was granted an Autonomous Vehicle Testing Permit in California to begin trialing its cars on public roads. Demonstrating huge appetite for its driverless technology, NIO last year filed for a US$ 1.8 billion IPO on the New York Stock Exchange. Its current models include the 2-door coupé EP9, and two SUVs, the ES6 and ES8.

Chinese-Swedish joint venture Lynk & Co, founded in 2016, targets younger buyers by emphasizing its internet connectivity and wide-ranging customization options. In 2018 it logged sales of more than 120,000 in China. Sweden-based Polestar, meanwhile, caught the eye of automotive giant Volvo, who snapped up its Polestar Performance division in 2015 to oversee the more experimental wing of its development slate.

Chinese-Swedish joint venture Lynk & Co, founded in 2016, targets younger buyers by emphasizing its internet connectivity and wide-ranging customization options. In 2018 it logged sales of more than 120,000 in China. Sweden-based Polestar, meanwhile, caught the eye of automotive giant Volvo, who snapped up its Polestar Performance division in 2015 to oversee the more experimental wing of its development slate.

Nor can the influence of a myriad smaller Chinese EV disruptors be ignored. These include BYD, a one-time rechargeable battery maker, now 25 per cent owned by investor Warren Buffett and luring former Ferrari and Mercedez-Benz designers to its EV team; the State-owned BAIC, whose EC-Series city car was the world’s top-selling EV in 2017; and Xpeng Motors, whose Tesla-inspired G3 has a sales price of just US$ 33,000 – substantially cheaper than many of its rivals, and more recent newcomers like Byton.

Any of these currently lesser-known brands could join the global goliaths as the EV market flourishes in the coming years. That’s not to say that EV producers have a golden ticket to success. The market has also seen its fair share of high profile failures. Notably US manufacturer Fisker Automotive, which was predicted to make a major impact with its Fisker Karma plug-in hybrid after debuting at the 2008 North American International Auto Show. However, production was halted with just 2,450 Karmas built after its Chinese battery supplier filed for bankruptcy. Likewise, US start-up Faraday Future was established in 2014 and announced its first production vehicle, the electric SUV FF 91, three years later. However, despite earmarking hundreds of millions of dollars for manufacturing facilities, financial problems led to the business cancelling a planned US$ 1 billion plant in Nevada, and an investor dispute later forced a restructuring and staff layoffs.

Failed EV Start-ups

EVs bright future

While these warning shots should be heeded by the industry, context is paramount, and the marketplace for EVs is evolving rapidly. The conditions which allowed the above setbacks have already been superseded.

The level of global engagement with the looming environmental crisis was unimaginable even a few years ago; experts and consumers alike are now united in the idea that tackling climate change is fundamental to safeguarding our world, and that EVs will play the dominant role in the future of personal mobility.

Green issues are now mainstream.

This powerful buyer impulse (combined with the brisk expansion of charge points, increased driving ranges, preferential tax inducements, and lower vehicle and battery prices) will eventually see EVs become the default option for new car buyers, rather than the quirky leftfield choice. As the market expands and consolidates, investments will be regarded as safer bets. Component supply will become more reliable. And as current cutting-edge technology becomes better understood and more widely dispersed, some of the technical challenges which beset the industry’s early prospectors will become inconsequential.

While the push toward EVs is a truly global initiative, one key to success will be anticipating future adoption patterns. Already, the International Energy Agency has detected the emergence of local inclinations and preferences. OEM targets for EV sales to 2020 are aligned with the IEA’s 2DS (2°C) scenario.

China, for instance, is driving growth in electric buses and two-wheelers, its fleet comprising 99 per cent of the global stock. While China, France and the Netherlands registered the strongest swings toward pure battery vehicles, Japan, Sweden and the UK buyers are instead gravitating to hybrids.[15]

Whatever the composition, the worldwide picture portrays unprecedented momentum behind EVs. Indeed, Deloitte is anticipating that EVs will account for a record 10 per cent of all new vehicle sales by 2024. Sales of 4 million units in 2020 will mushroom to 21 million units by 2030.[16]

Photo Credit: AP /Pablo Martinez Monsivais

Elsewhere, away from the manufacturers, big business is already in on the act to make this a reality. Amazon CEO Jeff Bezos announced this month to make the giant carbon neutral by 2040, and kicked this off with an order of 100,000 electric delivery vehicles from RIVIAN with 10,000 to be on the road by 2022 and all 100,000 by 2030, “saving 4 million metric tons of carbon per year by 2030”.

“We are on the cusp of one of the fastest, deepest, most consequential disruptions of transportation in history,” wrote Tony Seba, a professor of economics at Stanford University, in 2017.[17]

The future for the automotive market is electrifying. And Abdul Latif Jameel is proud to be part of it.

[1] https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/manufacturing/deloitte-uk-battery-electric-vehicles.pdf

[2] http://www.ev-volumes.com/news/81958/

[3] Gearing up for change: transport sector feels the heat over emissions

[4] https://www.ucsusa.org/clean-vehicles/car-emissions-and-global-warming

[5] Gearing up for change: transport sector feels the heat over emissions

[6] https://ourworldindata.org/how-long-before-we-run-out-of-fossil-fuels#note-6

[7] https://www.bloomberg.com/opinion/articles/2019-04-12/electric-vehicle-battery-shrinks-and-so-does-the-total-cost

[8] https://www.bloomberg.com/opinion/articles/2019-04-12/electric-vehicle-battery-shrinks-and-so-does-the-total-cost

[9] https://www.jpmorgan.com/global/research/electric-vehicles

[10] https://www.jpmorgan.com/global/research/electric-vehicles

[11] https://www.bbc.co.uk/news/business-48913028

[12] https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/manufacturing/deloitte-uk-battery-electric-vehicles.pdf

[13] https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/manufacturing/deloitte-uk-battery-electric-vehicles.pdf

[14] https://www.iea.org/publications/reports/globalevoutlook2019/

[15] https://www.iea.org/publications/reports/globalevoutlook2019/

[16] https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/manufacturing/deloitte-uk-battery-electric-vehicles.pdf

[17] https://www.dw.com/en/move-is-on-to-ban-diesel-cars-from-cities/a-42747043

1x

1x

Added to press kit

Added to press kit