Wind power at full force in landmark year

Global energy consumption is predicted to double by 2050 as urban development and electric vehicles combine to further deplete existing energy sources[1].

Simultaneously, the International Renewable Energy Agency (IRENA) warns CO2 emissions will need a 70% reduction by that same mid-century date to meet existing climate targets[2].

Simultaneously, the International Renewable Energy Agency (IRENA) warns CO2 emissions will need a 70% reduction by that same mid-century date to meet existing climate targets[2].

More energy, yet fewer emissions. How to square that critical circle?

The latest global trends in green energy production suggest that the answer isn’t so much staring, but blowing in our face: wind power.

As the last 12 months have confirmed, the rise of wind is both unstoppable and global.

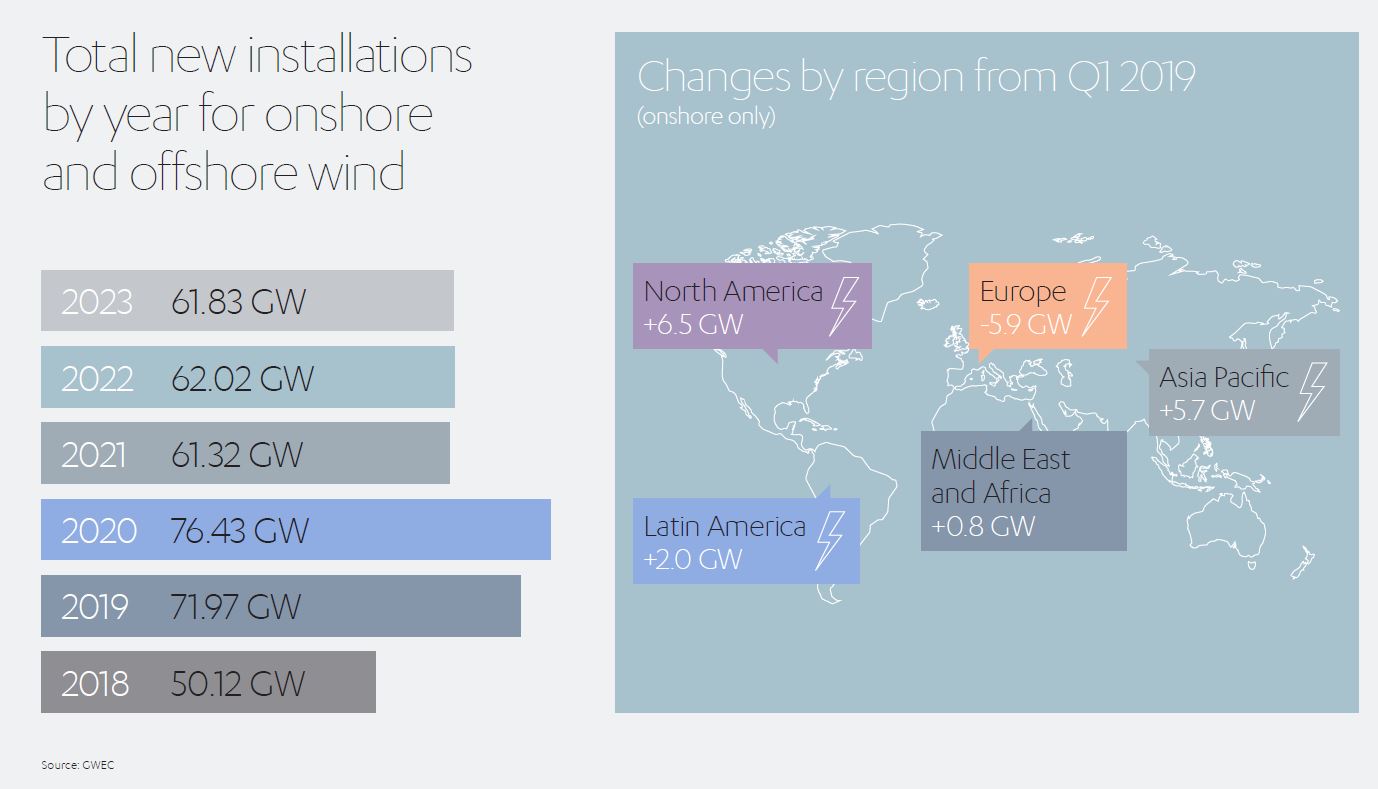

In its newest market outlook report, the Global Wind Energy Council (GWEC) foresees an additional 330 GW of wind energy capacity installed from now until 2023, bringing total global capacity to over 900 GW[3]. The main markets driving this boom are the USA and China, where onshore wind markets will add 6.5 GW and 10 GW capacity respectively over the next two years.

And this is only a light breeze, in terms of what is to come.

Peering further into the future, the European Wind Energy Association (EWEA) believes that by 2030 the EU alone will host 320 GW of wind capacity, meeting almost a quarter of the region’s power demand[4].

In financial and human terms, this means a € 239 billion (US$ 261 billion) investment in wind over the next decade and 569,000 new jobs across the continent[5].

Such enticing figures help explain why the wind industry has grown so rapidly in 2019 – and why this acceleration is likely to continue.

Americas lead milestone moments

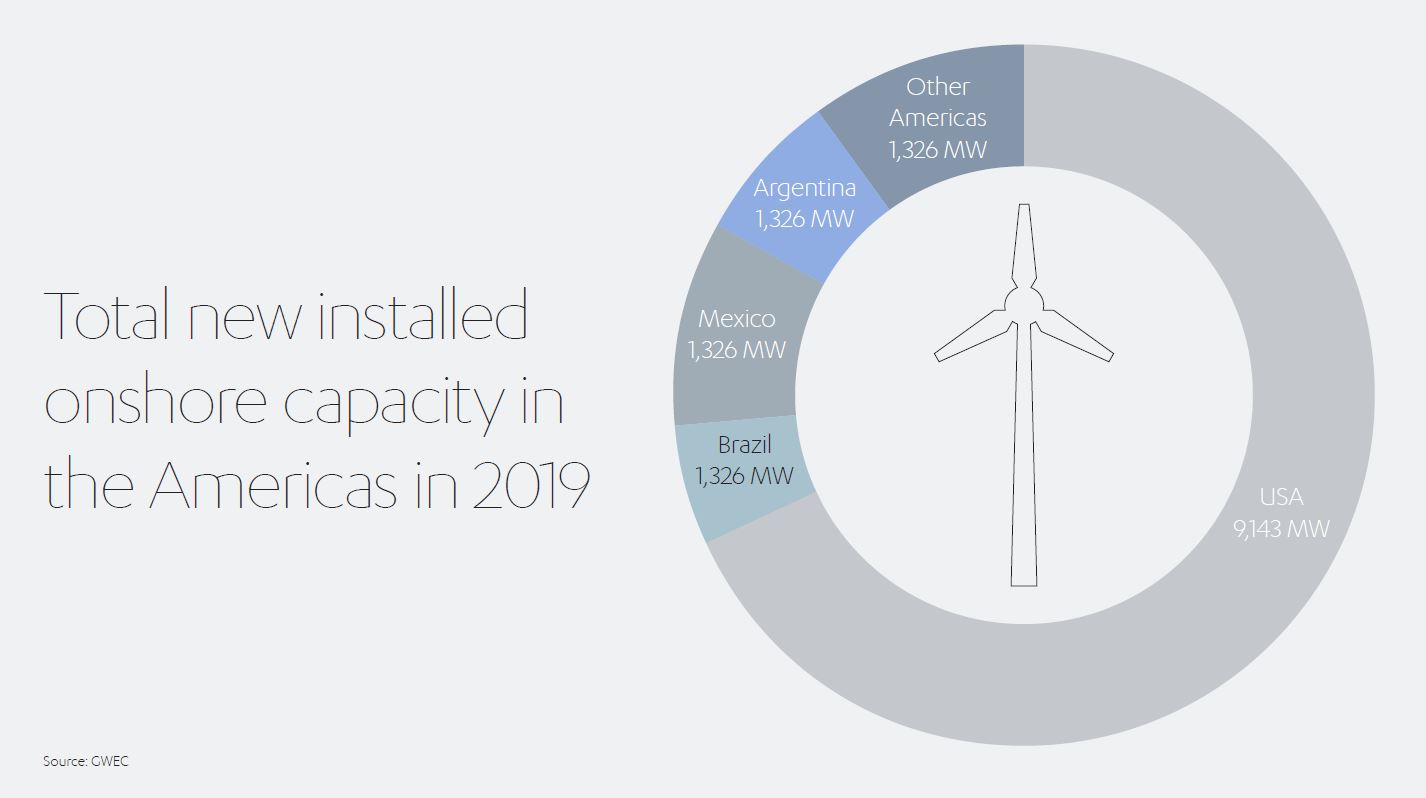

In its report of February 2020, the GWEC highlights a record 13.4 GW of new wind capacity installed across North, Central and South America (the Americas) in 2019[6]. This marks a significant 12% increase from 2018’s new installations and brings the region’s total capacity to 148 GW.

Looking ahead, the Americas surge is expected to continue, with GWEC forecasting some more than 220 GW new capacity between now and 2024.

Ramón Fiestas, Chair of GWEC’s Latin America Committee, notes Latin America’s massive potential for wind energy. He envisages many countries in the region forging reputations as renewable energy leaders via auctions delivering wind energy at globally competitive prices.

“New markets such as Colombia, which successfully executed its first renewable energy auction in 2019 [with US$ 1.8 billion of investment over the next three years[7]], and existing ones like Chile, which saw a record year installing 526 MW, show that there is still great untapped potential in the region,” he explains[8].

Abdul Latif Jameel Energy is one of the key players driving renewables expansion in Chile and Latin America, though renewable energy specialists Fotowatio Renewable Ventures (FRV).

Manuel Pavon, FRV Managing Director for South America, believes Chile’s early adoption of renewables, and its renewables-friendly regulatory framework, mean that, alongside Brazil, it has the potential to become one of the continent’s renewables success stories.

Manuel Pavon, FRV Managing Director for South America, believes Chile’s early adoption of renewables, and its renewables-friendly regulatory framework, mean that, alongside Brazil, it has the potential to become one of the continent’s renewables success stories.

“Within the Latin American region, most countries are at a similar stage, and FRV is exploring projects in Uruguay, Brazil, Peru and Colombia.

But Chile has gone one step further, in terms of things like the regulatory frameworks, for example. It can sometimes take a long time to get projects started, but it is very stable and secure. That’s why also most banks in Latin America are based in Chile,” he says.

Similarly, at a major wind energy conference in Buenos Aires in September, it was revealed that more than 70 projects for 4 GW of power have been greenlit across Argentina, with major suppliers including Nordex-Acciona and Vestas expanding their foothold in the country[9]. Accordingly, Argentina is in the process of establishing five new tower factories to accommodate the burgeoning industry. GWEC CEO Ben Backwell, GWEC CEO, predicts billions of dollars in investments and thousands of jobs as the country powers its growing economy.

Further North, FRV is also making a significant impact through the development of its major solar photovoltaic developments in Mexico. Its Potosi solar plant, in San Luis de Potosi, began operations in 2019. It will generate 815,000 MWh annually and provide enough energy to supply more than 76,000 homes, reducing Mexico’s CO2 emissions by almost 98 million tons per year. FRV’s second plant, the Potrero PV plant in Jalisco, will generate 750,000 MWh per year when it is completed in 2020. It will supply 128,000 homes and reduce CO2 emissions by some 437,000 tons.

“Energy demand in Mexico is growing 3% each year and some regions already have difficulty meeting the demand for energy,” says Fernando Salinas Loring, Managing Director of FRV (Mexico and Central America). “The country will need to combine renewable energy and conventional energy in order to avoid potential problems in future. But Mexico is a huge country – there are 130 million people here – and if you look at the big picture, it’s clear there will certainly be lots of opportunities. We are looking forward to staying here, taking advantage of those opportunities and helping to deliver a cleaner energy mix for Mexico’s future.”

The USA, however, remains a dominant force. In a huge signal of industry confidence, in January this year Dominion Energy unveiled expansion plans for its proposed 12 MW Coastal Virginia Offshore Wind (CVOW) pilot project, which at 2.64 GW will become the world’s largest ever offshore wind project[10]. The development will use Siemens Gamesa’s 6-MW SWT-6.0-154 wind turbines and should be operational later in 2020, with the expansion up and running by 2026.

It’s projects like this one that are responsible for much of the buzz currently surrounding wind energy.

Emerging markets ready to embrace offshore revolution

GWEC identifies offshore growth as a major factor in the gradual worldwide transition to wind energy. Indeed, it estimates that offshore energy will account for some 18% of total wind energy capacity by 2023, up from 9% in 2018[11].

Karen Ohlenforst, GWEC’s Director of Market Intelligence, stresses the importance of offshore wind for driving growth, adding: “It is set to take off globally over the next few years with a compound annual growth rate of 8% between 2019 and 2023 – double that of onshore wind”.

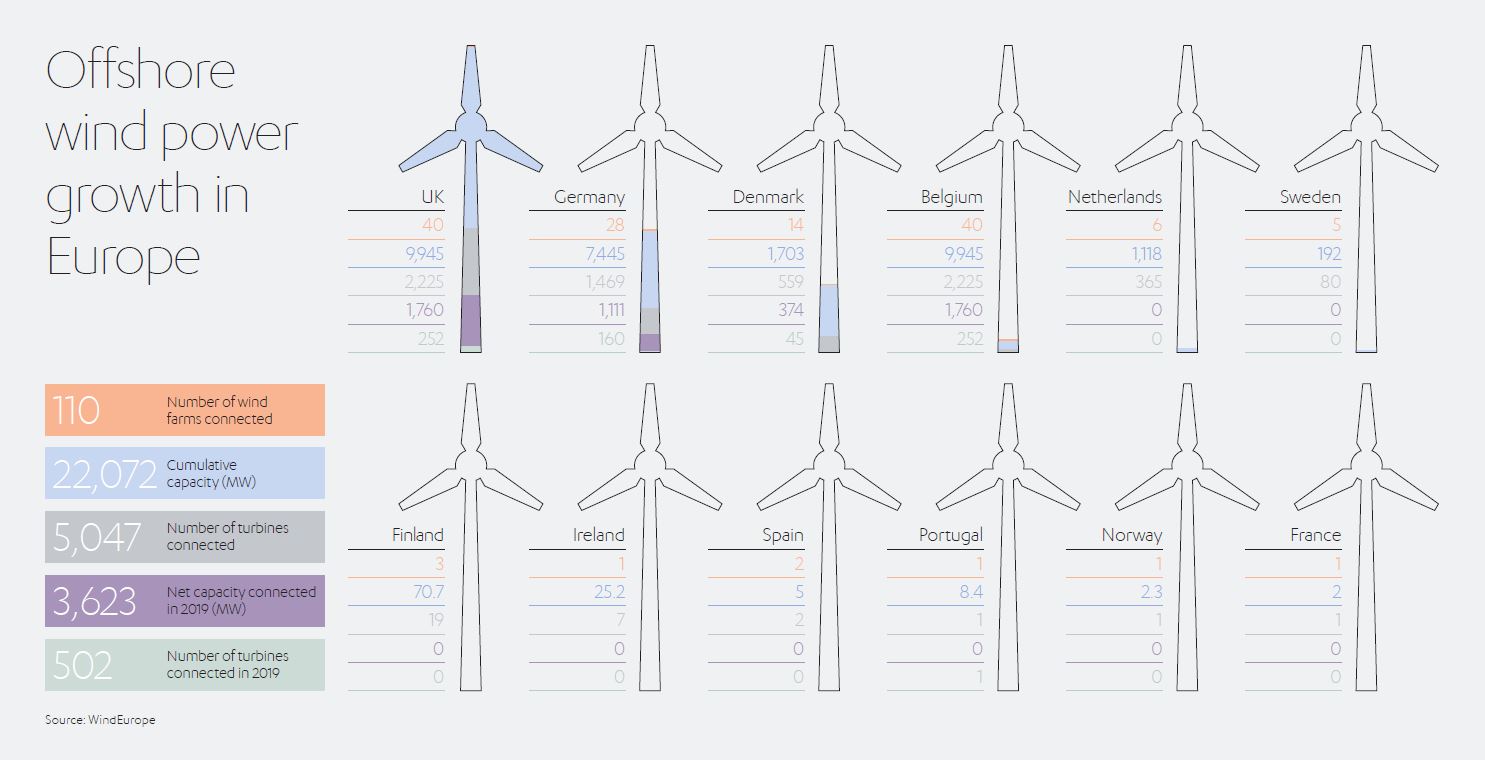

Europe saw a record 3.6 GW of offshore wind installed in 2019, with ten new farms coming online across five countries, bringing the continent’s total offshore capacity to 22 GW[12]. The UK led the way with 1.7 GW followed by Germany at 1.1 GW. The average size of Europe’s offshore farms has doubled since 2010 from 300 MW to 600 MW, with the largest currently being the UK’s Hornsea 1 at 1.2 GW, scheduled for completion in 2020.

Fady Jameel, Deputy President and Vice Chairman of Abdul Latif Jameel says:

“Wind power is already making a huge contribution to power generation globally, and there is the potential for it to contribute even more as part of the decarbonization agenda outlined in the UN-led 2016 Paris agreement.

At Abdul Latif Jameel, we’re acutely aware of wind’s potential to be a key component of a zero-emissions energy system, which is why we’re investing heavily in research to make it increasingly efficient and economic. It is clear that making the right choices now will help to drive the economy, protect the environment and safeguard our societies.”

Although offshore generation currently remains a more expensive prospect than onshore, due to higher installation and maintenance costs, that gap is narrowing. IRENA figures show that in 2018 offshore wind cost US$ 0.127 per KWH, compared to US$ 0.056 for onshore. That might sound a considerable difference, but whereas the cost of onshore generation fell just 1% in the 12 months leading up to 2018, offshore costs fell by 13%[13].

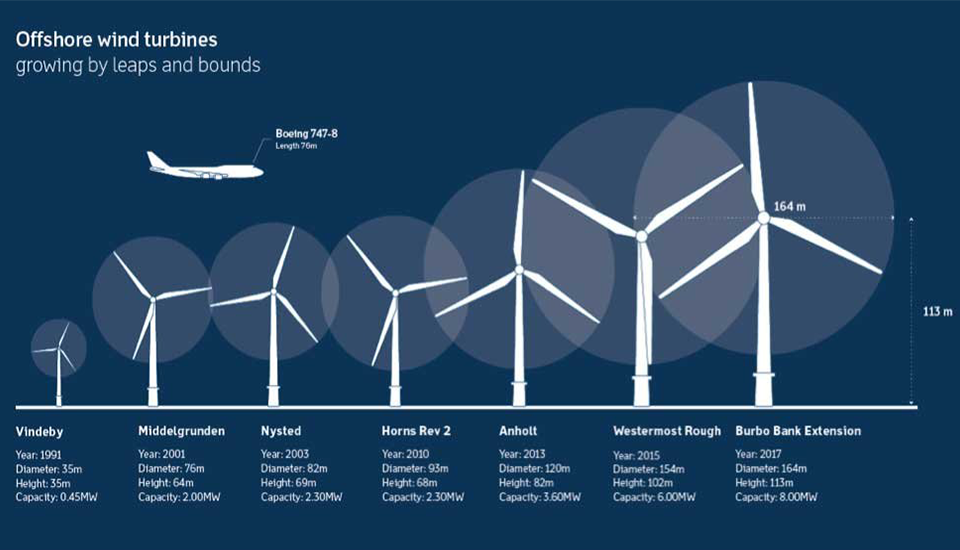

Investment research firm Nanalyze believes this is just part of a longer-term trend. It says the industry expects further cost reductions of 30%-50% over the medium term, thanks to increased competition, larger turbines, and economies of scale, all of which should serve to accelerate adoption.[14]

Economies of scale – golden words in any business. For illustration, one need only examine Danish wind giant Ørsted (formerly DONG). Its first project, in 1991, the Vindeby Offshore Wind Farm, comprised 11 small turbines producing 0.45 MW power – just half the amount produced by a single one of its largest wind turbines today. By 2015 it had installed wind farms totaling 3 GW capacity – its new offshore wind farms currently in development in the UK and Germany will see that rise to 6.7 GW.[15]

Ongoing revolutions in construction techniques and materials will soon usher in an era of even taller, more productive turbines.

Currently the tallest turbine in the world is Max Bögl Wind’s 178m construction near Stuttgart, Germany. Even this will be dwarfed by the turbines at the planned Dogger Bank development off the coast of Yorkshire, UK. Each turbine in the Dogger Bank wind farm will reach 220m high and generate enough electricity for 16,000 homes. That site is set to be up and running by the early 2020s.[16]

Energy consultancy K2 Management has the figures to demonstrate the ‘taller is better’ wisdom. Its calculations suggest that increasing a turbine’s height from 70m to 170m increases energy yield by an average of 35%.[17]

No wonder the industry is reaching for the sky…

It’s not just developed markets fueling the offshore enthusiasm. Ankit Mathur, of data analytics consultancy GlobalData, notes that several ‘budding countries’ such as Taiwan and South Korea are also set to make their mark in the coming decade: “We are witnessing the start of the offshore wind industry becoming truly global and stretching beyond European markets,” Mathur states.[18]

GlobalData suggests the worldwide offshore wind market is set to grow at a compound annual rate of 16.2% between 2019 and 2030, reaching a cumulative capacity of 142 GW by 2030. This compares to 23.2 GW at the end of 2018.

Created by Creative Nurds

ESMAP![]() (the Energy Sector Management Assistance Program – a collaboration between the World Bank and 21 international development partners) believes that as technological improvements and economies of scale encourage offshore generation prices to fall further, offshore wind will find even more traction in emerging markets[19].

(the Energy Sector Management Assistance Program – a collaboration between the World Bank and 21 international development partners) believes that as technological improvements and economies of scale encourage offshore generation prices to fall further, offshore wind will find even more traction in emerging markets[19].

In calculating the ‘technical potential’ (wind speed and water depth) of a series of developing economies, ESMAP identifies eight countries – Brazil, India, Morocco, the Philippines, South Africa, Sri Lanka, Turkey, and Vietnam – as having a combined potential output of almost 3.1 terawatts (TW), comprising 1,016 GW of fixed capacity versus 2,066 GW of floating capacity.

Given that offshore wind generation in many of these emerging markets is in its nascent stages, ESMAP believes that exploiting this natural resource can play a transformational role in meeting national goals – from expanding electricity access, to increasing the proportion of renewable resources in the energy mix.

Mirroring the global picture, little of this potential can be unlocked without supportive policies from governments – and the signs for this are so far encouraging.

Policies help put wind in industry’s sails

As public perception of the climate crisis grows, the eyes of legislators around the worlds are increasingly turning to green solutions.

In April 2019, Washington became the fifth US state (after California, Hawaii, Nevada and New Mexico) to set a 100% clean energy target by 2045[20]. Along the way, Washington will cut coal from the mix entirely by 2025 and aim for an interim goal of 80% renewable energy by 2030. Similar laws are pending in Minnesota, Illinois, New York and Maine.

“With China going subsidy free by 2021 for onshore wind and the Production Tax Credit phasing out in the US, there will be an installation rush over the next two years in these two leading onshore markets,” says Karin Ohlenforst, Director of Market Intelligence at GWEC[21].

On a more cautionary note, the bubbling trade war between China and the US threatens to increase the costs of wind projects by up to one-tenth due to tariffs on steel and aluminum, which together account for 90% of turbine raw materials[22].

Nor can Latin America’s recent surge be taken for granted. Uncertainty hovers over future auctions in Mexico after the cancellation of planned auctions and changes to the clean energy credits scheme, and likewise in Argentina following political and economic turbulence[23].

Fortunately, where political will exists, wind energy has almost limitless potential.

At the inaugural Thailand Wind Energy Roundtable in December, industry experts demonstrated that the Asian nation could in the foreseeable future increase tenfold its current 1.5 GW of onshore wind capacity, to 13-17 GW[24]. What is needed to make this Thai vision a reality? Clear targets, supportive policies such as optimized feed-in-tariffs, and improved transmission infrastructure – all quite achievable if endorsed by Thailand’s Power Development Plan (PDP).

If Thailand can foster this wind-friendly framework and achieve these generation figures, the rest of the world will be watching closely.

Technology can help counter headwinds

The growth of wind energy has until now been constrained by the problem of inconsistent supply: what to do when the breeze isn’t blowing but homes and businesses still need power?

In 2019, innovations continued in battery storage and grid management services that could soon make utility-scale batteries a common sight at renewables projects across the globe.

FRV, for example, announced its first utility-scale battery project as a part of the company’s long-term plan to develop energy storage projects globally.

The strategic development plan includes investments in energy storage technology projects, including commercial-scale battery technology, one that plays a central market role to consolidate a higher penetration of renewables into the global energy mix.

This first project will be delivered in the UK at Holes Bay, Poole, Dorset, in collaboration with the British developer Harmony Energy, which builds, owns and operates renewable energy assets across the UK.

The Holes Bay scheme will comprise a lithium-ion battery array, with a total capacity of 15 MWh, and it will be connected to the Southern Electric Power distribution network, providing the capability to store energy from renewable sources and afford peak-time flexibility to the UK National Grid.

The project will be a first-of-a-kind development in the UK and Europe, utilizing cutting-edge control and storage technologies. Construction began in January 2020, with commissioning expected by April 2020.

“FRV is already collaborating with governments, regulators, and partners around the world to lay the foundations for a new energy model. Energy storage plays a central and critical role to fully realize the power of renewable energy, and FRV acknowledges the value of this technology as a key element to achieve a decarbonized society,” says Felipe Hernández, Managing Director Engineering and Asset Management of FRV.

FRV’s pioneering project in Chile also demonstrates the progress being made in this area. Its revolutionary 540 GW/h hybrid wind-solar plant currently in development could become the first to use battery storage to provide renewable power 24/7 power. That’s enough for 224,000 homes, saving some 221,000 of CO2 emissions[25].

“This hybrid combination of solar and wind allows us to provide renewable energy 24/7,” says Manuel Pavon, FRV Managing Director for South America. “The ‘big four’ incumbents are losing market share every year, but the market itself is growing. We expect it will continue increasing up to 1.5 gigawatts per year for the following five years. So, it is a very interesting market for us.”

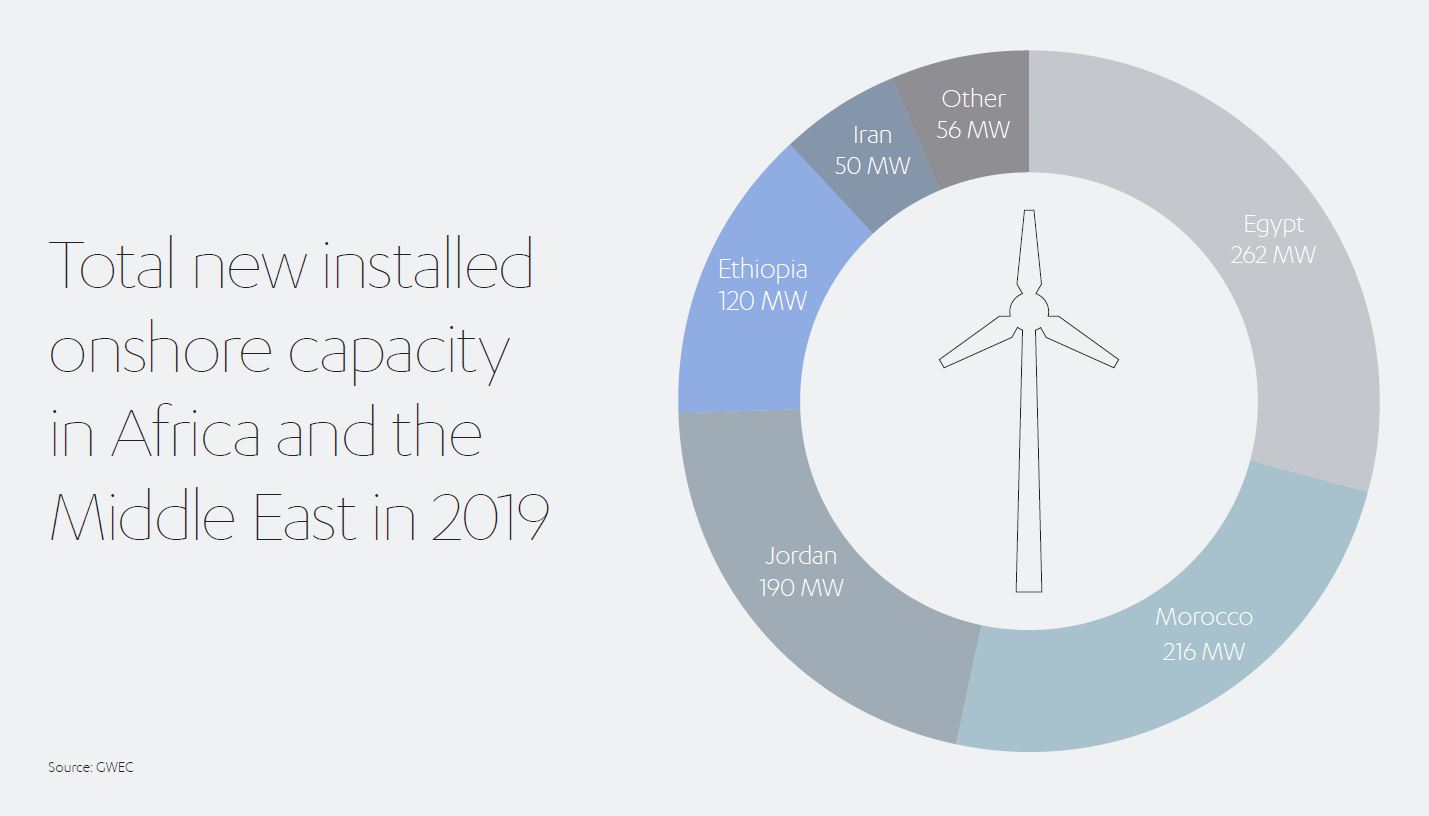

In traditionally arid regions, where solar power might seem the more logical option, the potential contribution of wind still cannot be overlooked. In 2019, Africa and the Middle East installed some 894 MW of new wind energy, bringing the region’s total installed capacity to 6 GW[26]. Planned projects over the next five years (led by South Africa – 3.3 GW, Egypt – 1.8 GW, Morocco – 1.2 GW, and Saudi Arabia – 1.2 GW) should see that number surge by another 10.7 GW. And new markets continue to open such as Tunisia.

In Saudi Arabia, one major contributor to this growth will be the US$ 500 million Dumat Al Jandal project. Awarded by the Renewable Energy Project Development Office at an LCOE (levelized cost of energy) of US$ 2.13 per kWh, Dumat Al Jandal is expected to create almost 1,000 jobs and power 70,000 homes[27].

That is merely the beginning. As part of the Saudi Vision 2030 ambitions, more than 6 GW of wind projects are set to be installed across Saudi Arabia over the next decade – accounting for almost half of all Middle Eastern wind projects by 2028[28].

Further afield, Abdul Latif Jameel continues to be a global trailblazer in the wind market. In 2019, Abdul Latif Jameel General Trading Japan entered the Japanese energy market for the first time, launching two micro wind turbines at Cape Erimo (Japan’s Wind Town) in south-east Hokkaido.

With a capacity of 20 KW each, these new installations will bring the total micro-turbines to be delivered through this project to 20: six units in Hokkaido, 12 in Aomori and two in Akita. Their combined power will generate a total of 400 KW into the national grid: enough to supply energy to around 400 typical homes and saving around 1,000 tons of CO2 annually through 20 year agreements with regional power companies Hokkaido Electric Power Company and Tohoku Electric Power Co., Inc. respectively. Cape Erimo was chosen for the turbines, as the wind blows at over 10 meters/minute for more than 260 days a year, making it one of the strongest wind potential areas in Japan.

“In the future, we will build 50 or more units of similar small-scale wind turbines, and from 2019 some much larger capacity units. This will be in partnership with Abdul Latif Jameel Energy’s renewables business ‘FRV’, and contribute positively to extending the clean energy business across Japan” stated Shigeki Enami, President and CEO, Abdul Latif Jameel General Trading.

Just the latest chapter in its exciting global renewable energy strategy.

Wind is blowing in the right direction

If the dramatic developments within the wind market in 2019 are any indicator, the next 12 months should see the industry scale even greater heights.

Capitalizing on the positivity behind wind power around the world, hundreds of speakers and sponsors will present the ever-more convincing case for wind to an audience of thousands at the Wind Show MENA 2020 in Egypt this April.

Over the next five years, industry experts at GWEC anticipate further global wind power growth thanks to bilateral Power Purchase Agreements (PPA: agreements defining the revenue and credit quality of generating projects – key enablers of financing). It’s just one of the mechanisms they believe will make wind energy more cost-competitive and increase confidence in large-scale project developments[29].

So, it’s not just hot air. Wind is universally recognized as a central solution to the entwined energy and environmental crisis. By unleashing its potential with the sort of joined-up thinking witnessed in 2019, wind power is fast making not just ecological but also economic sense.

Momentum is massing behind wind, as game-changing progress over the past 12 months has proven. Now, 2020 will confirm that where there’s a wind, there’s a way.

[1]https://www.mckinsey.com/~/media/McKinsey/Industries/Oil%20and%20Gas/Our%20Insights/Global%20Energy%20Perspective%202019/McKinsey-Energy-Insights-Global-Energy-Perspective-2019_Reference-Case-Summary.ashx

[2] https://www.irena.org/publications/2019/Apr/Global-energy-transformation-A-roadmap-to-2050-2019Edition

[3] https://gwec.net/press-release-q3-market-intelligence-update-2019/

[4] https://www.ewea.org/fileadmin/files/library/publications/reports/EWEA-Wind-energy-scenarios-2030.pdf

[5] https://windeurope.org/wp-content/uploads/files/about-wind/reports/Wind-energy-in-Europe-Scenarios-for-2030.pdf

[6] https://gwec.net/americas-wind-installations-rise-12-in-2019-to-13-4gw/

[7] https://gwec.net/wind-industry-to-invest-1-8bn-in-colombia-in-next-three-years-following-successful-tender/

[8] https://gwec.net/americas-wind-installations-rise-12-in-2019-to-13-4gw/

[9] https://gwec.net/industry-and-government-remain-confident-in-a-bright-future-for-wind-energy-in-argentina/

[10] https://www.renewableenergyworld.com/2020/01/07/dominions-planned-us-offshore-wind-project-could-be-worlds-largest-at-2-64-gw/

[11] https://gwec.net/press-release-q3-market-intelligence-update-2019/

[12] https://windeurope.org/newsroom/press-releases/europe-installs-a-record-3-6-gw-of-offshore-wind-in-2019/

[13] https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2019/May/IRENA_Renewable-Power-Generations-Costs-in-2018.pdf

[14] https://www.nanalyze.com/2019/05/wind-energy-stock-wind-power/

[15] https://www.offshorewindindustry.com/news/dong-energy-rounds-1000-wind-turbines-sea

[16] https://www.theguardian.com/environment/2019/oct/01/worlds-largest-wind-turbines-to-be-built-off-yorkshire-coast

[17] https://buildingspecifier.com/wind-turbines-set-to-reach-mega-heights-with-new-techniques/#

[18] https://www.globaldata.com/uk-owns-seven-of-top-ten-mega-capacity-offshore-wind-projects-globally/

[19] http://documents.worldbank.org/curated/en/716891572457609829/pdf/Going-Global-Expanding-Offshore-Wind-To-Emerging-Markets.pdf

[20] https://www.renewableenergyworld.com/2019/05/08/washington-becomes-fifth-state-in-the-us-to-aim-for-100-percent-clean-energy/

[21] https://gwec.net/press-release-q3-market-intelligence-update-2019/

[22] https://gwec.net/americas-wind-installations-rise-12-in-2019-to-13-4gw/

[23] https://gwec.net/americas-wind-installations-rise-12-in-2019-to-13-4gw/

[24] https://gwec.net/wind-industry-calls-for-additional-7-gw-of-wind-energy-to-be-installed-in-thailand-by-2037/

[25] https://www.alj.com/en/news/abdul-latif-jameel-energy-power-nearly-quarter-million-homes-chile-solar-wind-energy/

[26] https://mailchi.mp/gwec.net/americas-install-119gw-wind-capacity-in-2018-increase-by-2377971?e=8e8a5c5ea4

[27] https://www.arabianbusiness.com/energy/411144-saudi-arabia-awards-contract-for-first-wind-power-project

[28] https://www.arabianbusiness.com/energy/411144-saudi-arabia-awards-contract-for-first-wind-power-project

[29] https://gwec.net/press-release-q3-market-intelligence-update-2019/

1x

1x

Added to press kit

Added to press kit