So, how do small businesses make a big difference?

When you consider the economic forces that have enabled the Middle East to develop so rapidly over the past few decades, you might assume it was all down to scale. You might look at the giant Saudi Aramco, Saudi Arabia’s state-owned oil company, for example, with a net income in 2024 of more than US$ 100 billion[1]; or across the border the Abu Dhabi National Oil Company, with reported revenues of US$ 50 billion across its logistics, gas, drilling and distribution businesses.[2] In the private sphere, you could even include successful family-owned businesses like Abdul Latif Jameel, which have achieved sustainable success over successive generations in multiple markets.

There is no denying businesses like these have played a key role in the growth of the Middle East. Relying solely on these grand examples, however, risks missing the larger truth: the continued dominance of so-called ‘Small and Medium Enterprises’ (SMEs) within the region.

SMEs (typically those with fewer than 250 employees and revenues of less than US$ 50 million) account for more than 90% of all businesses in the MENA region[3] and, beyond the farming sector, provide around seven in ten jobs.[4]

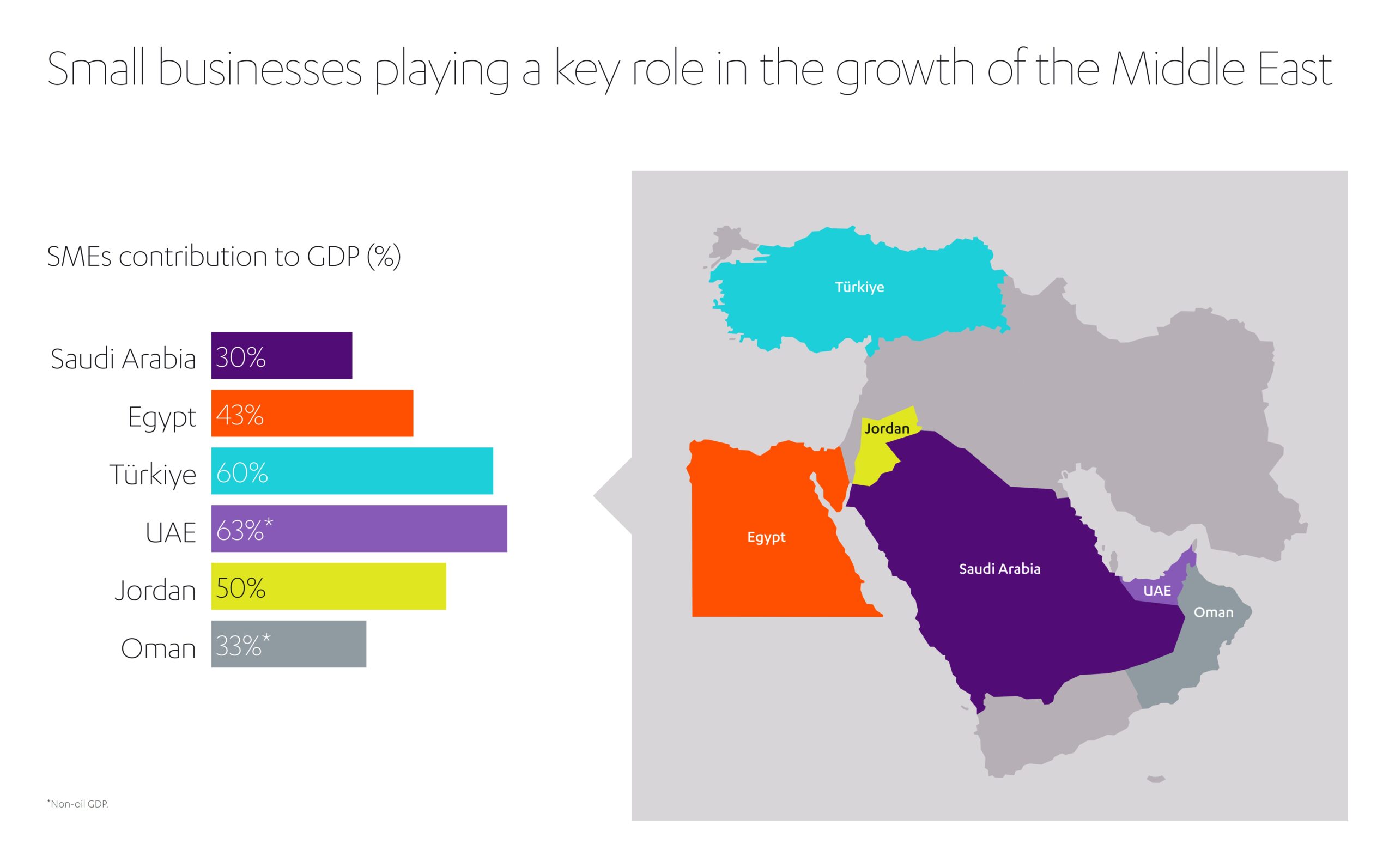

In countries like Saudi Arabia, a vibrant network of SMEs underpins the national economy. They are responsible for some 30% of the country’s GDP,[5] or almost a third of the US$ 1.09 trillion[6] Saudi Arabia collectively generated in 2024.

Elsewhere, the figures are similarly buoyant for the SME ecosystem. In Egypt, for example, SMEs’ share of the national GDP had reached 43% by 2024. In Türkiye, SMEs account for 70.5% of employment and around 60% of GDP.[7] In the UAE, the number of SMEs exceeds half a million, generating more than 63% of non-oil GDP.[8] Jordan’s SMEs contribute more around 50% of the country’s GDP, providing 60% of all jobs and 45% of national exports.[9] In Oman, SMEs constitute 98% of businesses and contribute 33% of non-oil GDP, while employing around 76% of the private sector workforce.[10]

Overall, the International Monetary Fund (IMF) estimates that SMEs across the Arabian Gulf states account for anywhere from 15% to 30% of combined GDPs – a sizable share by the standards of any economy.[11]

How do sovereign wealth funds support SMEs?

Across the MENAT region, confidence in the SME sector remains buoyant, with more than 70% of SME leaders anticipating stable or enhanced financial performance in the near future.[12] In Saudi Arabia, the government is planning for SMEs to raise their GDP share to 35% by the end of the decade as part of its Vision 2030 national development program.[13] In Oman, SMEs are projected to create around 50,000 new jobs annually. The UAE, meanwhile, expects to germinate at least 20 ‘unicorn’ businesses (startups valued at more than US$ 1 billion) by 2031 at the latest.

While the relative importance of SMEs varies from country to country, several SME epicenters are emerging that highlight particular influence with national economies.

Increasingly these are signified by technology startups, which thrive by capitalizing on the healthy appetite for investment in ‘industries of tomorrow’ such as fintech, e-commerce, and health tech. From an investment perspective, these tech-heavy sectors appear comparatively future-proof, given emerging trends such as AI, the Internet of Things, smart cities and smart cars.

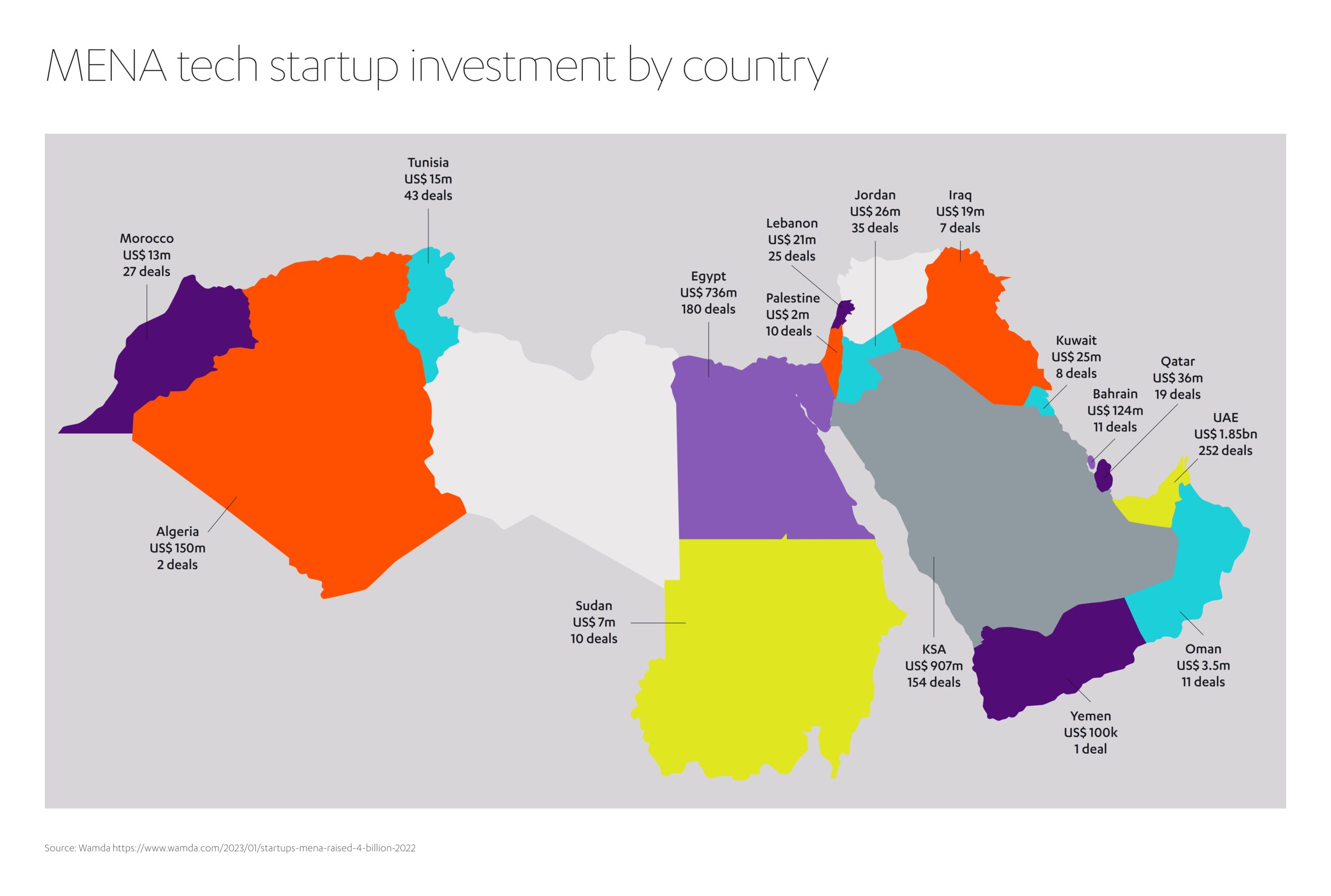

One study showed that almost 750 small technology firms across the MENA region crossed the threshold into ‘scaleups’ (attracting US$ 1 million or more of funding) during a single year, totaling US$ 19.5 billion of inward investment for a commanding 50% annual growth.[14] The UAE led the surge within MENA, hosting 339 scaleups, with Egypt (140 scaleups) and Saudi Arabia (132 scaleups) in second and third places. All other MENA territories combined accounted for less than 20% of scaleups.

What do the UAE, Saudi Arabia and Egypt have in common which has made them such fertile ground for tech SMEs? Access to robust sovereign wealth funds; formalized government mandates to support technology growth and gravitate away from fossil fuel economies; and a healthy rivalry to attract the cream of global technology entrepreneurs.

The UAE leads the way in terms of sovereign wealth funds, its Abu Dhabi Investment Authority (ADIA) managing total assets of US$ 853 billion, and a separate Investment Corporation of Dubai (ICD) with US$ 320 billion of funds at its disposal.[15] The Public Investment Find (PIF) of Saudi Arabia is close behind with US$ 776 billion asset value – much of this kitty waiting to be deployed in small- and medium-sized businesses geared to make the leap into larger, self-sustaining enterprises.

All of these initiatives are to be encouraged, considering that a vibrant SME community brings benefits far beyond job creation and financial growth.

How do SMEs help to raise living standards?

As dynamic drivers of regional growth, SMEs are vital to raising living standards and improving equality across the developing world.

At state level, SMEs provide a significant proportion of GDP, particularly in developing countries – money which can be made to work for the good of the entire population in healthcare, housing or education, for example.

At a more localized level, SMEs provide employment to millions. These jobs guarantee a secure income for workers and enable families to put food on the table, heat homes, pay medical bills, and invest in modern conveniences. SMEs encourage money to remain within local economies, directly supporting families and businesses, rather than transferring those same profits to a remote corporate giant. They also help keep taxes closer to communities, supporting the improvement of facilities like green spaces and public transit systems.

SMEs have also been shown to play a crucial role in diversifying local economies, thus bolstering communities against the kind of ‘shocks’ that can transpire if a major employer departs the neighborhood or a particular industry enters decline. In Saudi Arabia, for example, 14% of SMEs focus on retail, 13% on construction and 10% food and drink[16] – low percentages which illustrate a truly diverse SME ecosystem.

Hyper-local SMEs are also instrumental to fostering a sense of community identity, strengthening the fabric which keeps societies functioning. They represent the people, and the character, of a community far more intimately than any faceless corporate entity. They also have a tendency to support charitable causes. One survey suggests that more than half of all small businesses donate to good causes.[17]

Yet another beneficiary of the rising influence of SMEs is one that affects us all – the environment.

What’s the role of SMEs in combatting climate change?

As the world confronts its looming climate crisis, SMEs are proving to be comparatively beneficial for the environment. Small businesses tend to inhabit existing buildings since they cannot afford the costs routinely invested by larger companies in purpose-built facilities. In so doing, they breathe new life into neglected infrastructure and help prevent further development encroaching on natural landscapes. In addition, smaller businesses tend to specialize in locally-sourced materials, reducing the carbon footprint of end products. Likewise, being community-based, workers are more likely to access their jobs on foot or by cycle rather than fossil-fuel alternatives.

Given that global warming is the defining challenge of our lifetimes, one doesn’t have to look far across the Middle East to find evidence of SMEs contributing directly to the environmental fightback.

Green Touches, for instance, is a small eco-friendly environmental cleansing company based in Dubai, UAE. It eschews all toxic chemicals, using only sustainable products made in-house via nanotechnology to clean homes and offices. In a drought-prone climate like the UAE’s, its methods also consume less water than those favored by larger, more commercial rivals.

One could also look at the example of RePlaste, based between Abu Dhabi and Lahore, Pakistan. RePlaste is a sustainable design studio which upcycles plastic waste into circular products using its own trademarked composite material known as Sapore, billed as the ‘marble of the future’.

In Saudi Arabia, SecondSky is one of a myriad of eco-focused SMEs providing local employment opportunities while attempting to safeguard the environment for future generations. SecondSky, based in Thuwal, Makkah Province, manufactures radiation-blocking nanocomposite materials for greenhouses. The material, designed to combat heat stress in agriculture while allowing light photons to penetrate, increases plant resilience and extends growing seasons, all helping to feed a growing population.

In Egypt, Flexstock, an investee of the Jameel Investment Management Company (JIMCO), provides tech-enabled fulfilment solutions that help both consumers and businesses to manage their online ecommerce and fulfilment operations more efficiently and more sustainably.

In Egypt, Flexstock, an investee of the Jameel Investment Management Company (JIMCO), provides tech-enabled fulfilment solutions that help both consumers and businesses to manage their online ecommerce and fulfilment operations more efficiently and more sustainably.

SMEs like these demonstrate that, contrary to popular wisdom, size does not always matter. SMEs might not have the headcounts or balance sheets to challenge larger rivals, but they flourish due to their sheer numbers and variety, alongside the individual passions which drive their momentum.

Given their centrality to our economy and environment, how are governments across MENAT supporting SMEs, and what more could be done to encourage their further proliferation?

What strategies are countries using to support SMEs?

In Saudi Arabia, where the Vision 2030 strategy emphasizes the importance of economic independence and reducing reliance on imports, several initiatives provide vibrant support for SME entrepreneurs.

Kafalah is Saudi Arabia’s official Small and Medium Enterprises Loan Guarantee Program, which as of September 2024 had arranged more than US$ 26.6 billion in financing guarantees.[18] Kafalah, run in coordination with Saudi Central Bank, National Development Fund, and the General Authority for Small and Medium Enterprises, has since its founding in 2006 supported more than 23,000 separate SMEs and created almost one million jobs.

Supporting sectors such as tourism, manufacturing, and entertainment, Kafalah assumes up to 95% of the risk exposure in a given agreement and is aiming to increase its investments by a further 20% during 2025. Businesses supported by Kafalah have high growth potential, with 8% of micro-enterprises transitioning into small businesses, and a further 4% of small businesses expanding into medium-sized enterprises. Moving with the times, Kafalah has started using AI-driven systems to cut processing times from 48 days to 36 hours.[19]

Saudi Arabia’s General Authority for Small and Medium Enterprises (also known as Monsha’at) aims to propel SMEs towards 35% of national GDP by 2030.[20] Among its many initiatives, Monsha’at offers training and advisory services for participants on the Social Development Bank’s Entrepreneurs Program, with support centers in Riyadh, Al-Khobar Jeddah and Madinah. Monsha’at staged an e-commerce promotional tour across 14 cities and regions, specifically to nurture entrepreneurialism in the burgeoning e-commerce field. Looking to the future, Monsha’at has also launched a University Entrepreneurship Council to emphasize the value of entrepreneurship among students.

In the UAE, the government is keen to capitalize on this same spirit of industrialism. In 2022 it launched its Entrepreneurial Nation 2.0 scheme, intended to develop a further 8,000 SMEs and startups by the decade’s end. Its predecessor scheme deployed 10 separate programs centered around financing solutions and digital tools and attracted a multi-million dollar array of private sector partners. The UAE has also introduced ‘golden visas’ to attract top entrepreneurs to the region.

Smaller neighboring states are likewise keen to incubate further SME activity. Qatar has launched bespoke funding instruments such as Al Dhameen – providing credit and guarantees to de-risk SMEs – and Ma’an, an entrepreneurial support partnership with Qatar Development Bank and Qatar University. Oman has designed several initiatives of its own to support SME growth, including an Entrepreneurship Card scheme, currently giving privileged access to training and finance opportunities for almost 30,000 SMEs.

In the wider region, Egypt has introduced new tax laws to incentivize SMEs. Its ‘Law No. 6’ offers tax breaks and a simplified accounting process for SMEs, including a tax rate of no more than 1% for businesses with revenues less than US$ 200,000, alongside exemptions from stamp duty and capital gains. Similarly, earlier this year Turkey announced a new US$ 1.13 billion support package for export businesses and companies sensitive to foreign exchange fluctuations – with a tranche set aside for SMEs. Further legislation is in the works to simplify commercial administration and limit inflationary effects within the economy.

Even with this kind of supporting program infrastructure in place, however, more could still be done to energize SME dynamism throughout the region.

Why is access to finance vital to unlocking SME growth?

One of the main challenges is that SMEs in the region need better access to finance. The World Economic Forum (WEF) reports that despite representing 96% of all registered companies across MENAT, SMEs have access to just 8% of bank lending for operations and capital.[21]

To address this imbalance, the WEF calls for an organized audit and regulatory framework to calculate SMEs’ creditworthiness and increase confidence in their financial longevity. Central to this will be a widely accepted ‘credit readiness’ system, based around standardized tools designed by governments, auditors, banks and private investors.

Underpinning such an initiative would be a raft of new regulations on a country-by-country basis – laws strengthening property rights, contract enforcement, and collateral and insolvency regimes. Such measures could have a tangible impact on the confidence levels of both private investors and government investment vehicles. Together, it is estimated that a more robust legal environment could unlock millions of new jobs per year.[22]

Lawmakers could appeal specifically to innovators in up-and-coming sectors like technology by formalizing regulations around intellectual property (IP) and data protection. How else to ensure that every dollar of investment returns its maximum value for shareholders?

Initial public offerings (IPOs) are another potential strategy for boosting SMEs within the region, providing access to capital and an opportunity for raising a company’s profile. Such a step requires careful advance planning: Businesses will need to select the right market, evaluate any tax implications, plan for post-IPO dividends, and ensure the readiness of transparent financial data. Parallel equity markets such as Saudi Arabia’s Nomu and Abu Dhabi’s ADX Growth Market, with lighter listing mandatories than main market equivalents, provide a pathway for smaller companies to secure growth funding.

Satisfying the needs of the SME sector will require a constellation of the above tactics – all of which will be vindicated if employment, revenues and GDPs continue to rise.

What other policies can support the SME ecosystem?

There are successful strategies being deployed across the world that show possible pathways for enabling SMEs flourish.

In Canada, France, Malaysia, the UK and USA, for example, SMEs can access dual financial and advisory support through ‘national champion’ programs. These include one-to-one counselling on critical disciplines such as digital marketing, leadership skills and overseas trading – vital tools for success in today’s competitive marketplace. SME leaders also learn how to attract diverse demographics to their workforces and prepare to embrace sustainability, pivotal to ESG credibility as they expand.

The most successful support programs, experience suggests, entail a diligent selection process. They tailor solutions to specific needs, offer incentives for adherence, and harvest the skills of established private sector players.

The World Bank Group (WBG) highlights several examples of successful SME support initiatives which could inspire similar strategies in developing regions:[23]

- The UK offers tax credits for SMEs involved in research and development.

- Canada and Malaysia run mobile SME networks to help entrepreneurs in remote communities access support.

- India provides streamlined access to procurement opportunities.

- Nigeria offers guidance on IT strategies for small businesses.

- Guyana operates a Green Business Technology Fund to turn eco-business concepts into reality.

The global banking system must play its part too by ensuring financial backing for innovation wherever it emerges. Liberty and growth can only be unleashed within a culture of financial inclusion, but this is far from the reality we inhabit. Instead, we live in a world where some 1.7 billion people lack access to basic banking and finance facilities, leaving almost a quarter of the global population unable to borrow money safely and invest their way out of poverty.

The WBG’s Universal Financial Access 2020 initiative aims to increase the number of adults able to receive money via transaction accounts – mandatory for any SME seeking a loan.[24] Yet economic blackspots still exist, with 75% of financially excluded people worldwide inhabiting just 25 countries, including significant economies such as Türkiye and Egypt. Turbocharging the SME ecosystem will require addressing this persistent imbalance.

How can private capital help to drive the growth of SMEs?

As well as state-run financial and regulatory frameworks to support the growth of SMEs, private capital, too, has an important role to play.

Private capital is patient capital – it doesn’t need to deliver a deliver a short-term blockbuster quarterly return. Instead, it can support promising SMEs and innovative ideas to ride out the ripples of our changing world in pursuit of longer term, sustained benefits.

Channeling private capital into promising business action is a core aim of the Jameel Investment Management Company (JIMCO). Since 2018, JIMCO has injected capital into teams and technologies with the potential to grow and contribute to the dynamism of markets and communities worldwide. SMEs like Ziina, the UAE’s leading financial platform, which empowers individuals and businesses to get paid instantly. Since 2021, Ziina has processed over 800 million dirhams annually with a remarkable 10x year-on-year growth.

Channeling private capital into promising business action is a core aim of the Jameel Investment Management Company (JIMCO). Since 2018, JIMCO has injected capital into teams and technologies with the potential to grow and contribute to the dynamism of markets and communities worldwide. SMEs like Ziina, the UAE’s leading financial platform, which empowers individuals and businesses to get paid instantly. Since 2021, Ziina has processed over 800 million dirhams annually with a remarkable 10x year-on-year growth.

Other examples include Lean Technologies, a Riyadh-based B2B fintech platform that builds developer-friendly APIs; or Rain Financial, a Bahrain-based crypto asset trading platform.

The Jameel family were also an early investor in electric truck pioneer RIVIAN and electric aircraft innovator Joby Aviation – two former SMEs that have gone on to achieve remarkable growth.

The simple fact is, in a more uncertain world, with global tariffs and trade wars appearing to constitute the new norm, SMEs can provide protection from these headwinds, not only driving growth and providing local jobs, but also keeping money within communities where it is needed most. They warrant energetic public and private sector support – especially in vulnerable economies, where innovation and ambition are high, but financial access may be weak. SMEs, by definition, may be small in size. But their role in achieving a more sustainable, equitable future is enormous.

SMEs in MENA: Five fast facts

- What percentage of businesses in the MENA region are SMEs?

More than 90% of all businesses in the MENA region are small and medium enterprises (SMEs). - How many jobs do SMEs provide in the region?

Outside the farming sector, SMEs provide approximately 70% of all jobs in the MENA region. - What is Saudi Arabia’s goal for SME contribution to GDP by 2030?

Saudi Arabia aims to increase SMEs’ contribution to GDP from 30% to 35% by the end of the decade as part of its Vision 2030 program. - What percentage of bank lending do SMEs in MENA have access to?

Despite representing 96% of all registered companies across MENA, SMEs have access to just 8% of bank lending. - How many countries host the majority of tech startup “scaleups”?

Three countries (UAE, Egypt, and Saudi Arabia) host over 80% of all tech startup “scaleups” in the MENA region, with the UAE leading at 339 scaleups.

[1] https://www.aramco.com/en/investors/annual-report

[2] https://www.arabianbusiness.com/industries/energy/adnoc-companies-report-50bn-revenue-and-9bn-net-profit

[3] https://www.weforum.org/stories/2021/11/improving-access-to-finance-for-businesses-mena-region/

[4] https://leadersinternational.org/results-insights/how-ready-are-smes-in-the-mena-region-for-a-greener-more-sustainable-future/

[5] https://sidracapital.com/insight/unlocking-saudi-smes-growth-potential-ipos-as-catalysts-for-growth-and-innovation/

[6] https://www.arabnews.com/node/2592994/business-economy

[7] https://data.tuik.gov.tr/Bulten/Index?p=Small-and-Medium-Sized-Enterprises-Statistics-2023-53543&dil=2

[8] https://u.ae/en/information-and-services/business/small-and-medium-enterprises

[9] https://meii.org/programs/countries/jordan/

[10] https://www.elibrary.imf.org/view/journals/002/2025/014/article-A003-en.xml

[11] https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/12/13/Enhancing-the-Role-of-SMEs-in-the-Arab-World-Some-Key-Considerations-48873

[12] https://www.zawya.com/en/smes/finance/72-of-mena-smes-eye-similar-or-increased-revenue-in-2023-t6t1bd29

[13] https://clarixconsult.com/smes-role-in-driving-economic-growth-in-the-middle-east/

[14] https://www.entrepreneur.com/en-ae/entrepreneurs/infographic-the-top-10-mena-countries-for-tech-startups-in/456413

[15] https://businesschief.ae/corporate-finance/top-10-biggest-sovereign-wealth-funds-in-the-arabian-gulf

[16] https://thebusinessyear.com/article/smes-in-saudi-arabia/

[17] https://smallbiztrends.com/food-prices-rising-october-2022/

[18] https://www.arabnews.com/node/2572837/business-economy

[19] https://www.arabnews.com/node/2572837/business-economy

[20] https://fastcompanyme.com/impact/small-and-medium-businesses-are-vital-to-the-middle-east-how-can-they-grow/

[21] https://www.weforum.org/stories/2021/11/improving-access-to-finance-for-businesses-mena-region/

[22] https://www.weforum.org/stories/2021/11/improving-access-to-finance-for-businesses-mena-region/

[23] https://blogs.worldbank.org/en/psd/center-attention-lessons-small-and-medium-enterprise-support-centers-across-globe

[24] https://www.worldbank.org/en/topic/financialinclusion/brief/achieving-universal-financial-access-by-2020

1x

1x

Added to press kit

Added to press kit