Navigating the future of finance

Financial technology, or ‘fintech’, is the biggest disruptor of our time for the financial services industry. Whether it’s finding new ways to improve the customer experience, responding to regulatory changes, innovating new delivery models, or improving the efficiency of back-office functions, digital technologies are rapidly reinventing the entire value chain of financial services.

The swift evolution of fintech has forced traditional financial institutions, such as banks, insurers and asset management companies, to reassess virtually every aspect of their operations. Products, services and business models that have worked for decades are no longer a meaningfully viable option in the digital world. Systems and infrastructure must be replaced or upgraded with newer technologies.

A 2019, survey by global accountancy firm BDO found that 97% of financial services firms are already implementing some kind of digital transformation within their business, with 73% forecasting that digital technology will enable them to achieve a 10%+ increase in turnover by 2022[1].

There is virtually no area of fintech that does not have the potential to disrupt traditional financial services, but the three main areas driving digital transformation are:

- Big data: the increased availability and size of data about consumers across every aspects of their lives.

- Internet of Things (IoT): sensors and connected devices, from home appliances to wearable technology, generating ever more data about consumers and their lifestyles.

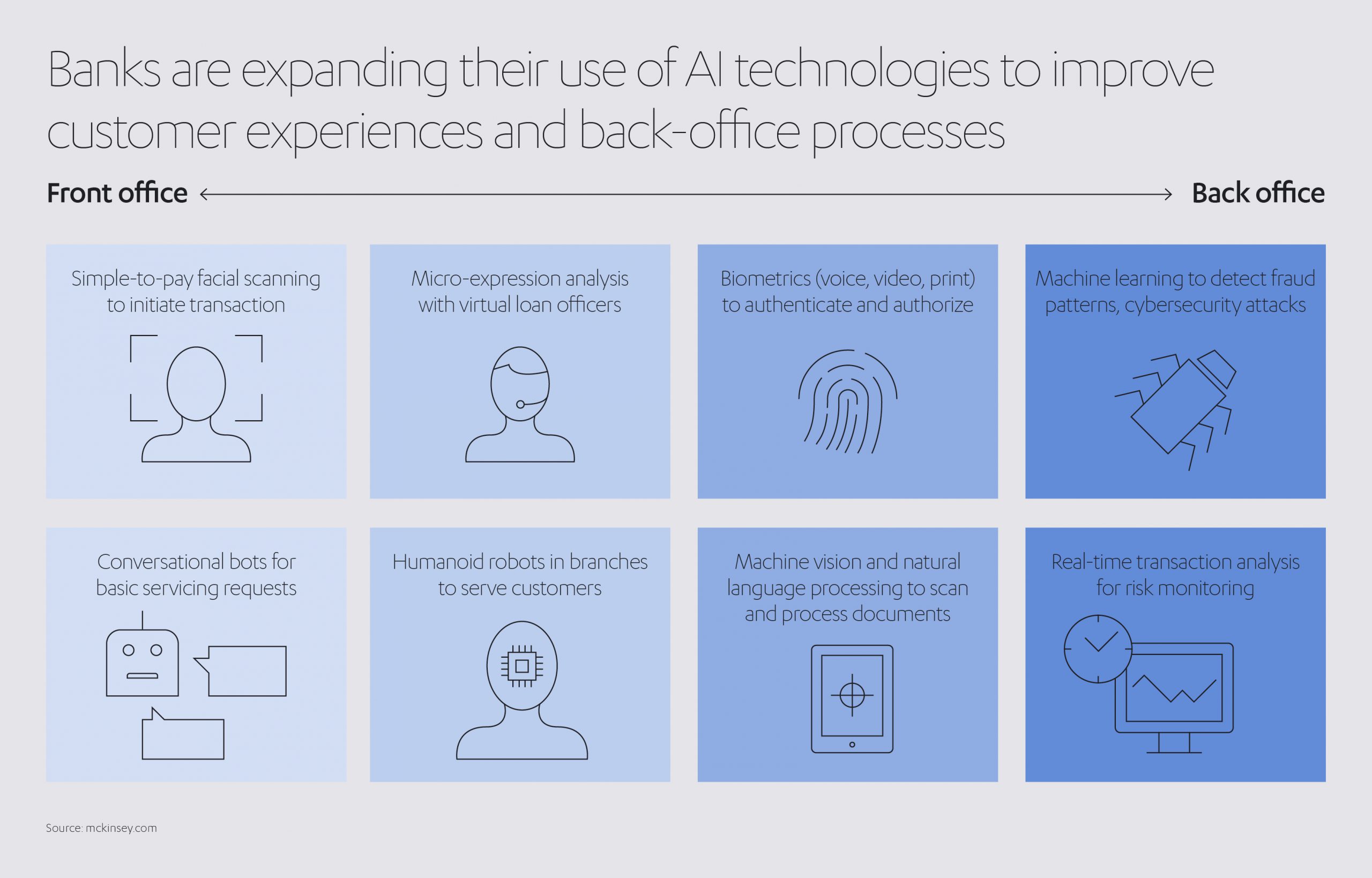

- Artificial intelligence: processing and analyzing these vast quantities of data can only be done using artificial intelligence and algorithms, which can identify patterns of behavior across billions of data points.

- Blockchain: distributed ledger technology (DLT) allows vast swathes of live data to be shared between disparate business networks, bringing lower costs, faster execution of transactions, and improved transparency and auditability, among a host of other benefits.

- Cloud computing: offering remote repositories of versatile computational power, soon to account for almost half of the financial services industry’s IT spend.

Alongside this technological step-change, there has also been a rapid shift in how consumers view financial services companies, and the level and type of service they expect. Influenced by the way technology has changed their lives in other areas, consumers increasingly want financial institutions that can respond quickly to their needs with products tailor-made to them. In an era where people can order a product online and have it delivered the same day, it’s no surprise they want their financial transactions to occur in real time, too, and for the time needed to make decisions on their banking, mortgages, insurance or other financial needs to be measured in hours, rather than the days or weeks it often took even a few years ago, a topic that is explored further in our Abdul Latif Jameel Perspectives article with Nilüfer Günhan, Chief Financial Services Officer at Abdul Latif Jameel Finance.

Abdul Latif Jameel Finance

“In the very near future, as consumers, we will not care which bank, consumer finance company or insurer sells us what we need. We will just accept the offer or solution that suits our needs and presents itself to us at the precise moment we need it,” says Nilüfer.

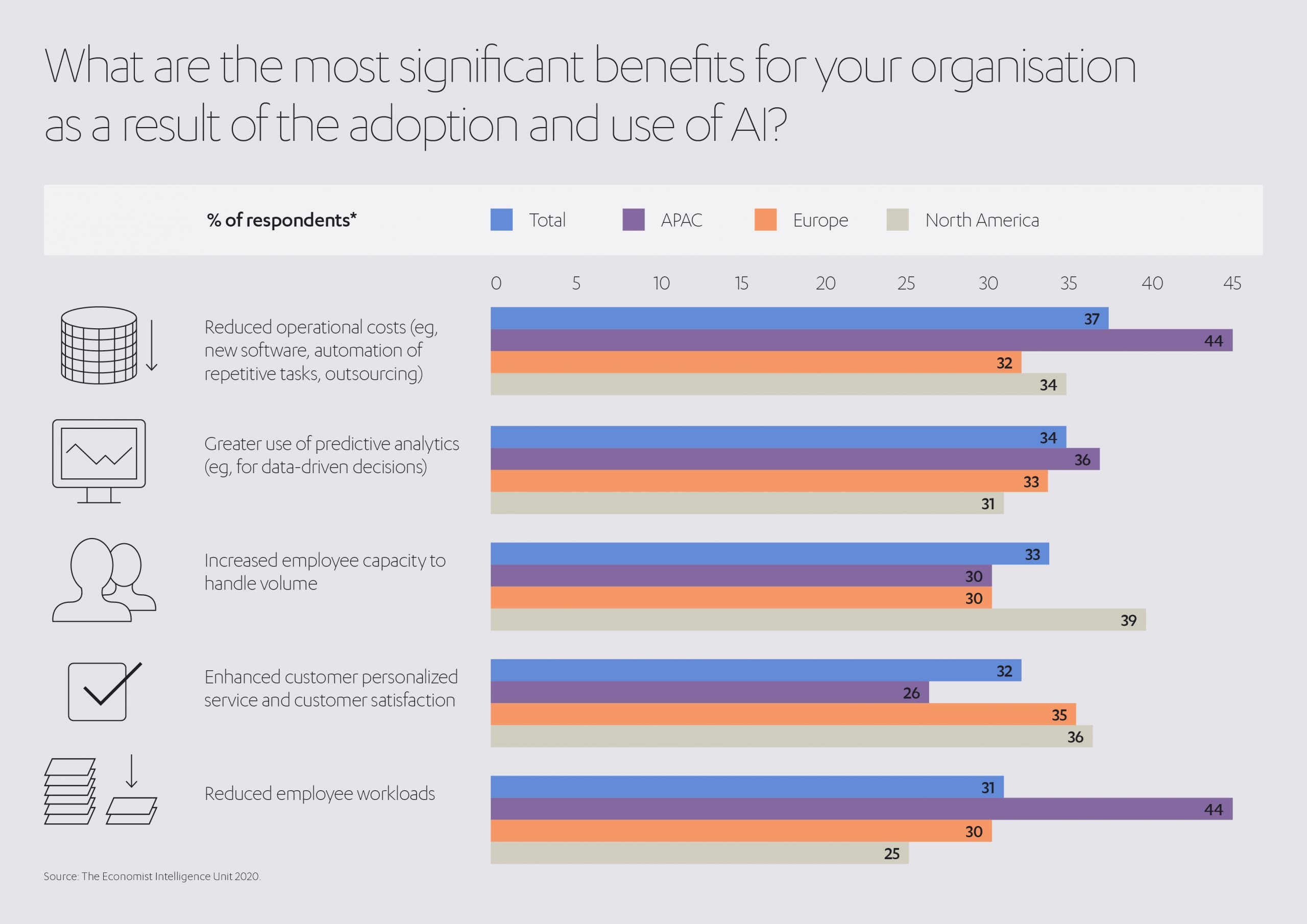

The increasing pressure from both consumers and organizational stakeholders, combined with the type of advances in digital technology outlined above, has moved fintech to the top of the growth agenda for financial services businesses. A financial services industry survey by the World Economic Forum in 2020[2], for example, found that 85% of respondents are already using some form of AI and 77% expected AI to have high or very high importance to their businesses within two years.

It is not hard to understand why financial services firms are so keen to leverage the potential of technology.

The benefits for both customers and firms are clear. Among the key benefits listed by the European Commission’s Financial Services User Group[3] are:

- Major cost savings: Digital services such as online payments or money transfers can be carried out at a fraction of the cost compared to traditional banking.

- Enhanced security and transparency: via leading-edge technologies like Blockchain.

- Speed: Big Data and AI enables processes to be performed much more quickly.

- Faster innovation: firms can leverage Big Data to rapidly respond to changes in the market, bringing new products to consumers much faster.

- Tailored services: providers are more able to deliver to personalized products tailored to consumers’ needs based on their data.

- Fraud prevention: by gaining a deeper insight into consumers’ behavior, fraud can be prevented by early or even instant identification of suspicious activity.

- Preventing over-indebtedness: problematic spending patterns can be identified early, helping consumers avoid falling into over-indebtedness.

- Increased competition: new technologies lead to new opportunities, encouraging competition and innovation, which should benefit consumers as providers compete to win their business.

Not only is technology changing the way established financial services brands approach the market, it is changing the nature of the market itself, too. Dynamic new fintechs are using technology to explore new opportunities and leverage their agility and speed to win over new customers. At the same time, as discussed in our Abdul Latif Jameel Perspectives article on the tech takeover of financial services, established big tech giants like Apple, Amazon, Microsoft, Google and Facebook are moving ever further into this area as they seek to provide the financial services customers want. While in the insurance industry, so-called ‘InsurTech’ innovations are redefining customer experience through digitally enabled advances such as risk-free underwriting, on-the-spot purchasing, and AI-driven claims processing, making the customer journey ever faster, easier and more efficient.

Although the big tech brands may be entering the financial services market for slightly different reasons and from different angles, they all excel in delivering fast, seamless integrated services, financial or otherwise, based largely on their expertise in precisely those areas that are driving change in financial services: Big Data, AI and IoT. These firms also have advantages over traditional financial players, such as a lack of legacy and ongoing investment in new technologies, not to mention vast experience and knowledge in managing and analyzing data to deliver positive outcomes for customers and clients. For their part, financial institutions have strong existing customer bases, which trust them to safely and securely hold their money, but they do not tend to have the resources or technological expertise to match big tech players.

Financial services providers cannot afford to ignore the threat from Big Tech, but nor can Big Tech expect to steamroll into a global industry worth over US$ 22 trillion[4]. The answer appears to lie in partnerships, as Big Tech firms seek partnerships with experienced financial services providers to grow their presence in the sector.

Apple launched its first ever credit card in 2019, for example, in affiliation with Goldman Sachs. While Google is inviting consumers to open digital bank accounts from 2021. Its Plex accounts, run in association with 11 banks and credit unions including Citibank, will operate within the Google Pay framework.

Consumers themselves appear more than ready for the changes. In the United States, for example, there was a 200% jump in new mobile banking registrations in early April 2020, while mobile banking traffic rose 85%[5]. Although these huge increases may have been partially driven by the pandemic, the behavioral changes they represent were already growing exponentially and are likely to stick long after the crisis is over.

At Abdul Latif Jameel, we are on a constant journey to meet the evolving needs of our customers. Our financial services business, Abdul Latif Jameel Finance, began over 40 years ago in Saudi Arabia, providing automotive finance to help people buy a car.

We have since expanded into Egypt and Turkey and have grown into one of the largest auto-leasing and finance providers in the Middle East, financing around 2 million vehicles. We now also provide finance for consumer products, commercial equipment, and real estate, and we have launched a Lloyds broker affiliated reinsurance broker in London called JENOA, to enable us to develop and deliver innovative insurance products for our customers worldwide.

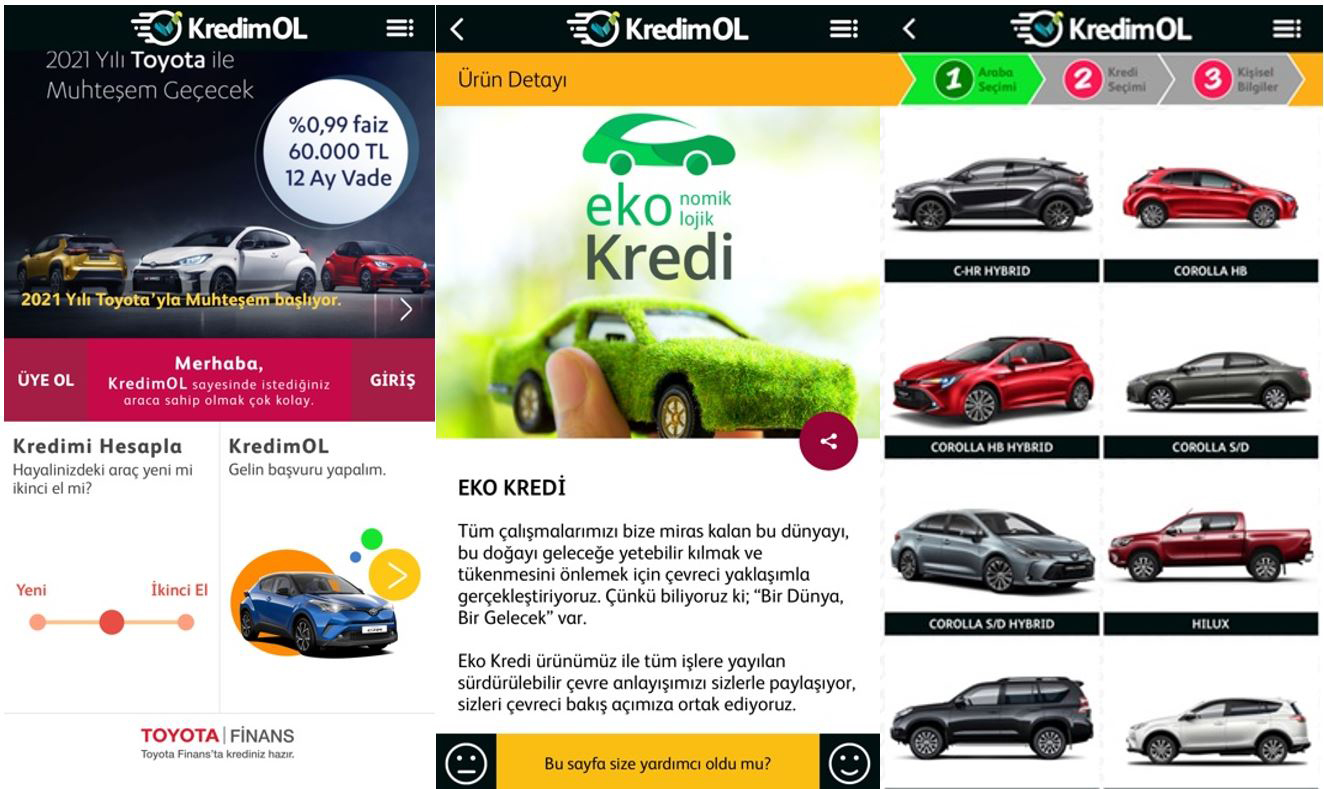

To enable us to achieve our objectives and satisfy the demands of our customers, we are continually investing in innovation to drive our business forward. Our digitally-enabled risk management and collection systems are among the most advanced in the Middle East, for example, while in Turkey, one of the most advanced auto and consumer finance markets in the region, we have developed an end-to-end digital process which allows the consumer to manage the whole process on their smartphone.

The financial services landscape is fundamentally changing.

The future will be built on data and technology. Today’s financial services firms need to shift to accommodate the opportunities and challenges created by new technologies and evolving customer needs. Cultures and operating models must adapt to this new reality. This may mean embracing new routes to profitability, new approaches to customer engagement, and attracting and hiring a new type of employee.

At Abdul Latif Jameel, this is where we are prioritizing our investments, to open up new opportunities for greater growth and ever sharper customer focus. There is no doubt that accessibility to goods and services – and a better life – in the modern world, is linked to money. Understanding and planning for acceptable risks frees businesses and individuals to invest in their future. We will continue to look beyond established financial services models driving connected change and real-world digital convenience that enable enterprises and provides consumers with the means for the moments that matter.

[1] Digital Transformation in Financial Services | BDO Insights

[2] WEF_AI_in_Financial_Services_Survey.pdf (weforum.org)

[3] 1606-big-data-on-financial-services_en_0.pdf (europa.eu)

[4] Global Financial Services Market Data And Industry Growth Analysis (thebusinessresearchcompany.com)

[5] COVID-19 Is Rapidly Reshaping Consumer Banking and Payments Behaviors, New FIS Survey Finds | FIS (fisglobal.com)

1x

1x

Added to press kit

Added to press kit