Building tomorrow’s hopes and dreams today

If the true measure of a country’s strength is how it weathers adversity, Saudi Arabia is a powerful force indeed. As the world entered 2021 and the effects of COVID-19 reached a global crescendo, Saudi Arabia’s economy was already proving its mettle by rallying instead of reeling.

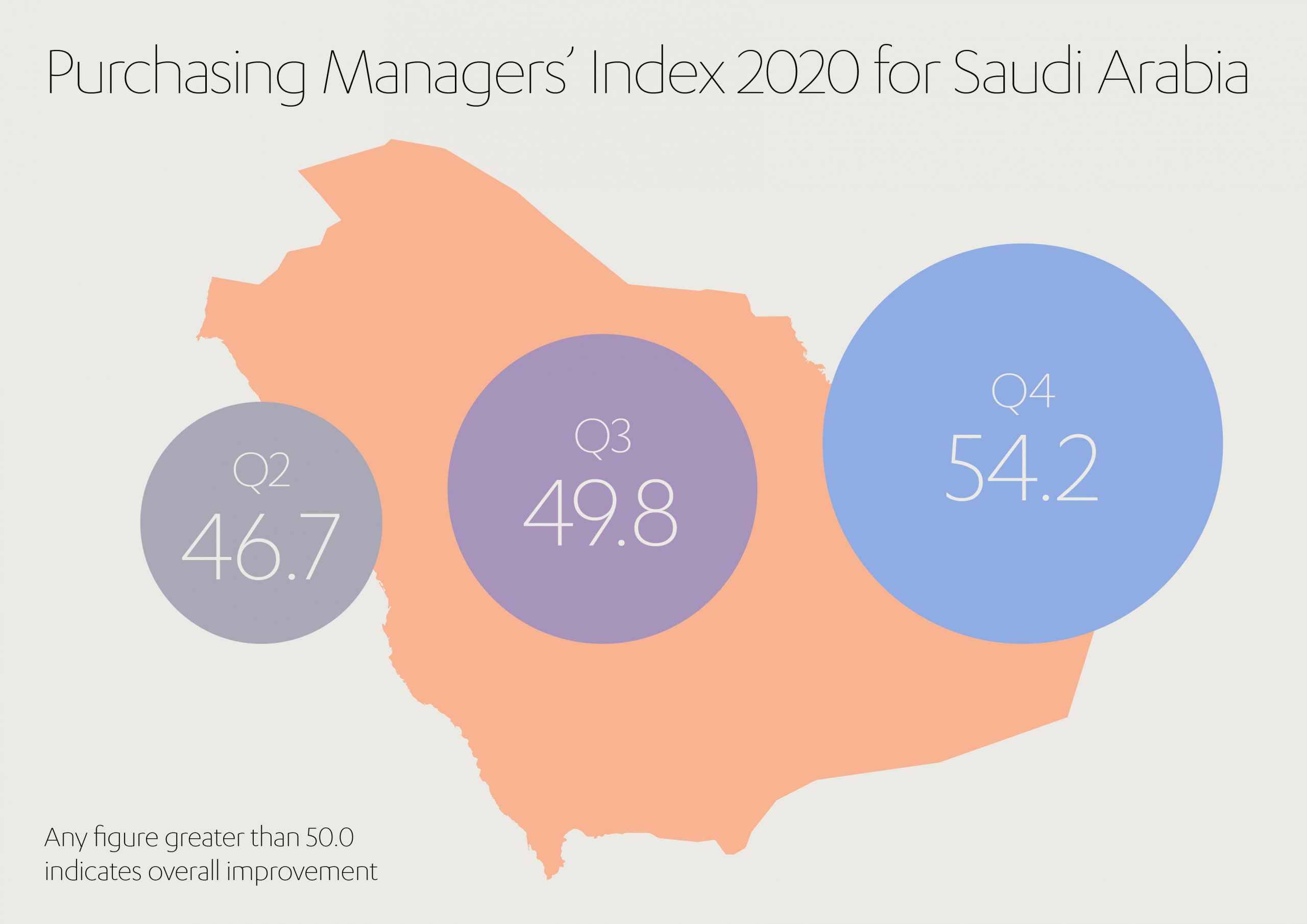

The country’s Purchasing Managers’ Index, which measures Saudi Arabia’s private non-oil economy, averaged 54.2 in Q4 2020, a steep climb from Q2’s 46.7 and Q3’s 49.8. In December it reached its highest level for a year – a strong indication that the country’s GDP decline during this unprecedented tumult will be far less than the 5.4% the IMF initially forecast[1].

Such resilience amply demonstrates why Saudi Arabia is the Middle East’s soar-away success story. And as the country augments its status on the world stage, the citizens driving its economic ascension are increasingly channeling the rewards of their entrepreneurial and industrious spirits into the security of property.

With demographics evolving and prospects broadening, the nation is busy laying the foundations, brick-by-brick, home-by-home, for a real estate revolution befitting Saudi Arabia’s dynamic global profile.

Real estate is a cornerstone of the country’s national development strategy, Vision 2030, which states that: “The real estate industry plays a substantial role in promoting sustainable development in Saudi Arabia; it is a strategic production factor for all vital sectors.

Real estate is a cornerstone of the country’s national development strategy, Vision 2030, which states that: “The real estate industry plays a substantial role in promoting sustainable development in Saudi Arabia; it is a strategic production factor for all vital sectors.

“It is also a vital incentive for income-based, job-creating investment, in addition to being a basis for launching investment projects in miscellaneous economic and social fields.”

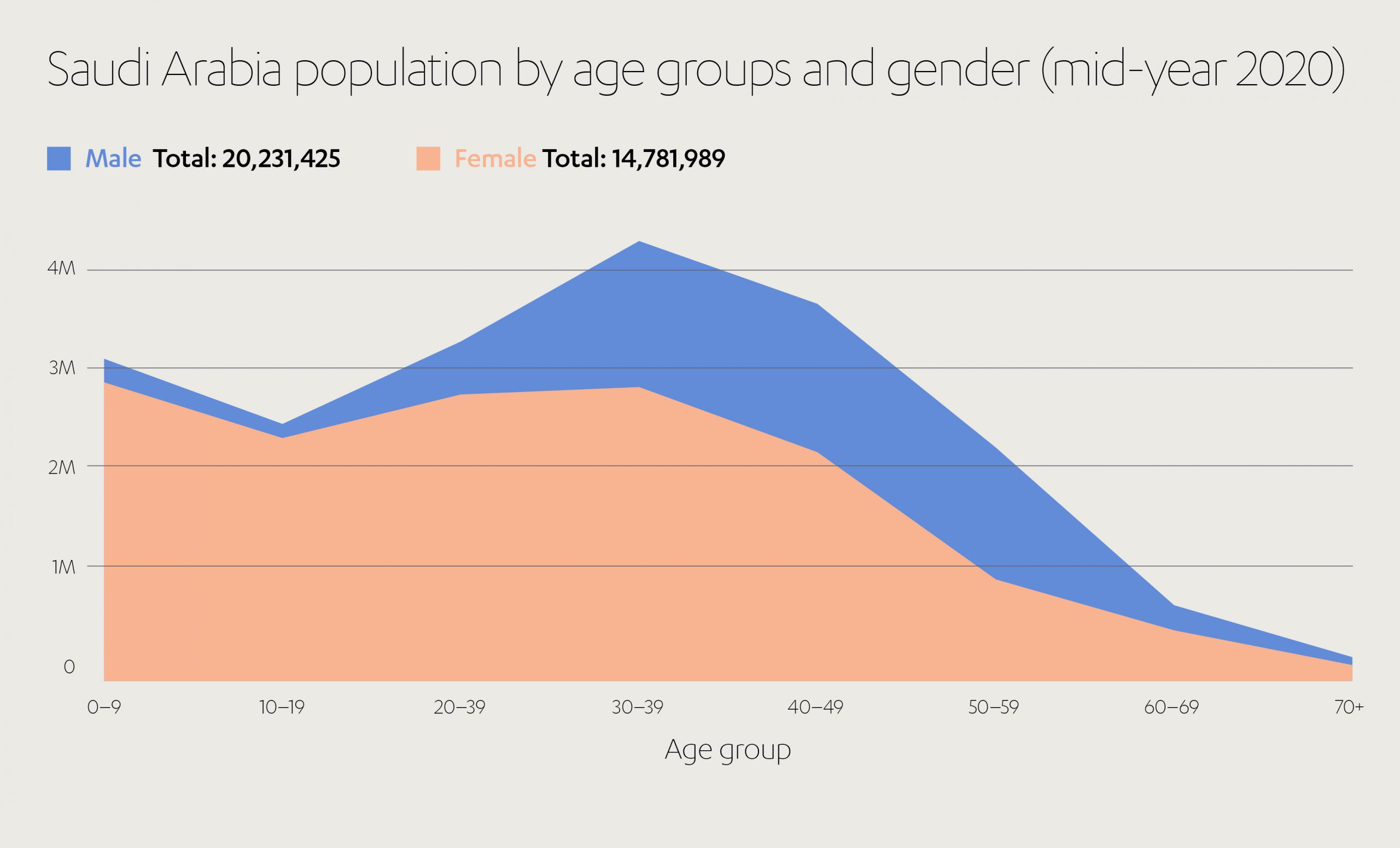

Invest Saudi, one of the public bodies responsible for propelling the nation toward its Vision 2030 goals, acknowledges that the growing real estate market is fueled by rising demand. It notes that Saudi Arabia’s population dwarfs the headcount of other GCC countries – and latest figures show its population exceeding 35 million for the first time[2]. Tellingly, almost half of those people are aged under 30. They’re young, they’re upwardly mobile, and they’re keen to secure their future by laying down roots. These social and economic changes have been under way for decades, and the trajectory is only set to continue, with further population growth tipped to outpace global averages over the next decade.

Already we can see the fruits of this youthful and ambitious mindset, with a speed that is taking many by surprise. Guided by the bold objectives of Vision 2030, the Ministry of Municipal and Rural Affairs and Housing (a product of the recent merger between the Ministry of Housing and Ministry of Municipal and Rural Affairs) had aimed to increase home ownership to at least 70% by 2030. However, more than a million new families have joined the housing ladder in just four years, sending ownership rates skyrocketing from 47% to 60% already.[3] If current trends continue, Saudi Arabia faces the real prospect of hitting its 70% target by 2025, a remarkable five years ahead of schedule.

The Ministry of Municipal and Rural Affairs and Housing, in partnership with the Real Estate Development Fund, will be central in maintaining this momentum.[4] The consolidated body will build on the success of the country’s Housing Program, which granted citizens an immediate right to real estate instead of the traditional 15-year waiting period, effectively doubling the pace of supply and demand.[5]

Any worthwhile real estate strategy is more nuanced than simple numbers on a spreadsheet, and Saudi Arabia’s is no exception. Legislators have been careful to promote the right mix of housing, in the right locations, and to ensure properties are built for a future which might be subtly, or significantly, different from the present day.

Reaching the eventual 70% home ownership goal will require significant input from the private sector – and in the private sector, long-term confidence is key. Thanks to COVID-19 rewriting the rulebook for the global economy, now might not appear a prime time for speculative investment. However, all signs so far point to impressive durability in the Saudi real estate sector. Even a global pandemic, for all its destructive power, has been unable to derail the country’s powerhouse property boom.

Passion for property remains potent

Around the country the residential market reflects this unexpected buoyancy.

In Riyadh, the total volume of residential transactions increased 11% year on year to Q4 2020, led by apartment prices rising 1.6% to an average of SAR 3,317 per square meter.[6] Meanwhile in the Dammam Metropolitan Area, apartment sale prices rose 0.8% to SAR 2,930 per square meter and the total value of transactions increased by 3%. And in Jeddah, over the same period, rising residential volumes (+17%) and values (+16%) were driven by the upswing in the number of mortgages authorized by lenders.

Residential mortgage loans surged by 38% in the 12 months to the end of February 2021, with villa loans comprising around 80% of 26,800 new property contracts that month, accounting for some US$ 3 billion of business[7]. According to the Saudi Arabia Monetary Authority (SAMA), the total value of residential mortgages increased to SAR 16.4 billion[8].

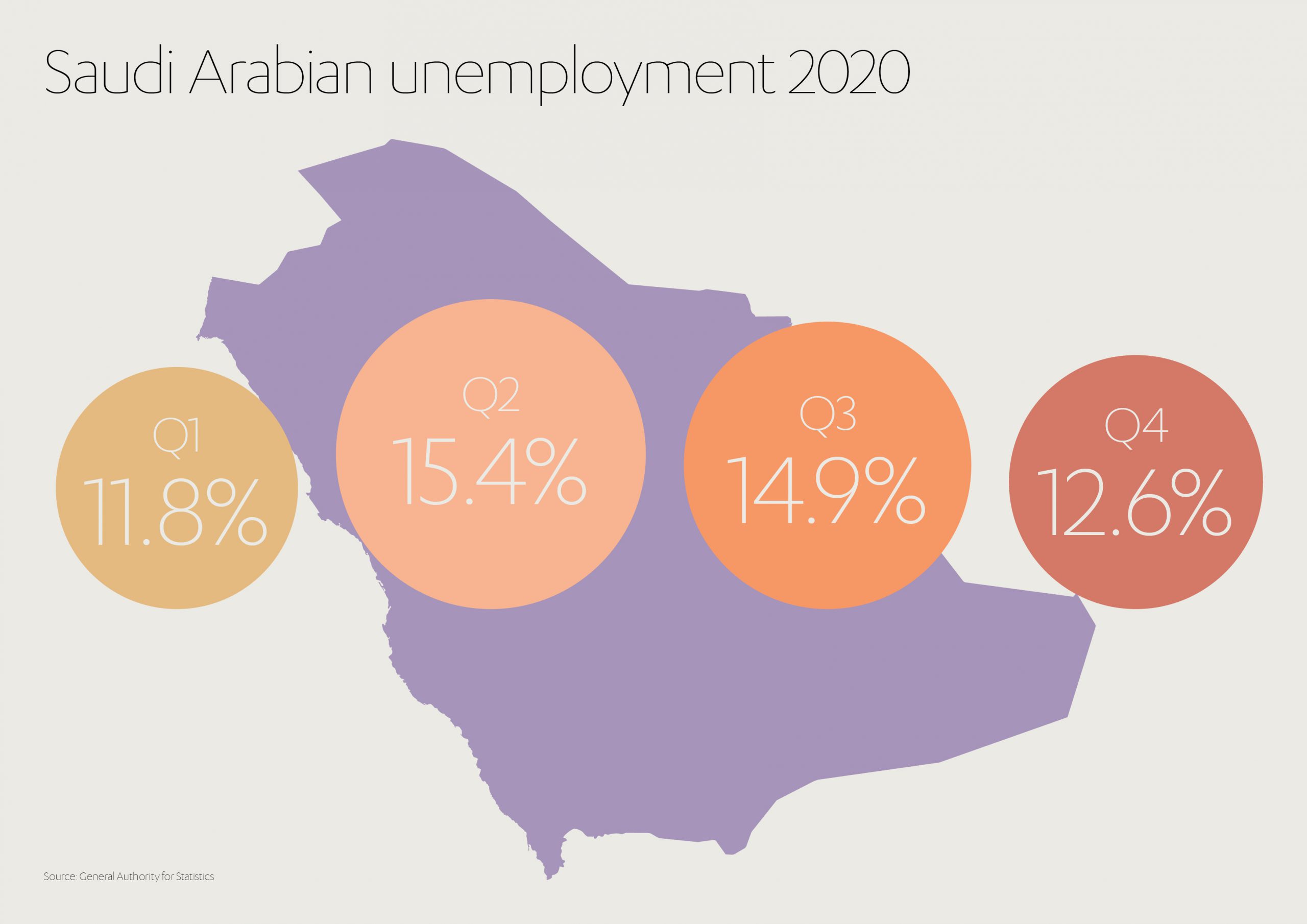

Every tactic is being used to stimulate commerce, with the Ministry of Investment granting 466 foreign investment licenses in Q4 2020, up 60% from the previous year, covering sectors such as Information and Communications Tech. (ICT), retail, e-commerce, logistics and manufacturing[9]. Such steps have had a tangible impact, with the unemployment rate in Saudi Arabia falling to 12.6% in Q4, down from 14.9% in Q3.

Looking ahead, residential stock is predicted to increase in tandem with transactions, guaranteeing a property pipeline as the country emerges from the shadow of the pandemic.

In Riyadh, around 36,000 new units are expected to hit the market in 2021, adding to the existing 1.3 million unit stock. Jeddah is anticipating 12,000 new units during the same period, on top of its current 838,000 total. During Q1 2021 some 7,700 and 2,000 new units were completed in Riyadh and Jeddah respectively[10].

Looking ahead, MENA-based real estate advisory JLL predicts Jeddah’s residential sector will be sustained by local demand, while Riyadh is expected to benefit from government initiatives promoting the city as a regional business hub – spurring a potential influx of buyers from international markets.

A demonstration, if one was needed, of how policymaker incentives can influence real estate performance on the ground.

Policies propel market to new highs

A progressive approach to real estate can help underpin an entire economy. Nimble governments must reliably deliver policies stimulating supply and demand against a shifting economic landscape.

So it was in October 2020 when, amid the global economic maelstrom of Covid, Saudi Arabia introduced a policy to exempt the residential property market from the standard 15% VAT rate, and instead introduce a new 5% real estate transaction tax.

It was a move which, according to Faisal Durrani, head of Middle East research at real estate consultancy Knight Frank, “improved business confidence during the closing months of 2020 . . . and helped drive a turnaround in performance in all main segments of the real estate market”.[11]

The VAT exemption was just one among a range of measures designed to exploit the expertise of the private sector and enable construction to occur more quickly, at higher quality and lower cost.

Saudi Arabia has also been busy adopting new 2D and 3D building models to accelerate the development of new projects, as well matchmaking between financiers and developers, and launching business support initiatives and preferential term loans. All of which will help service the needs of an increasingly agile, mobile and aspirational workforce in years to come.

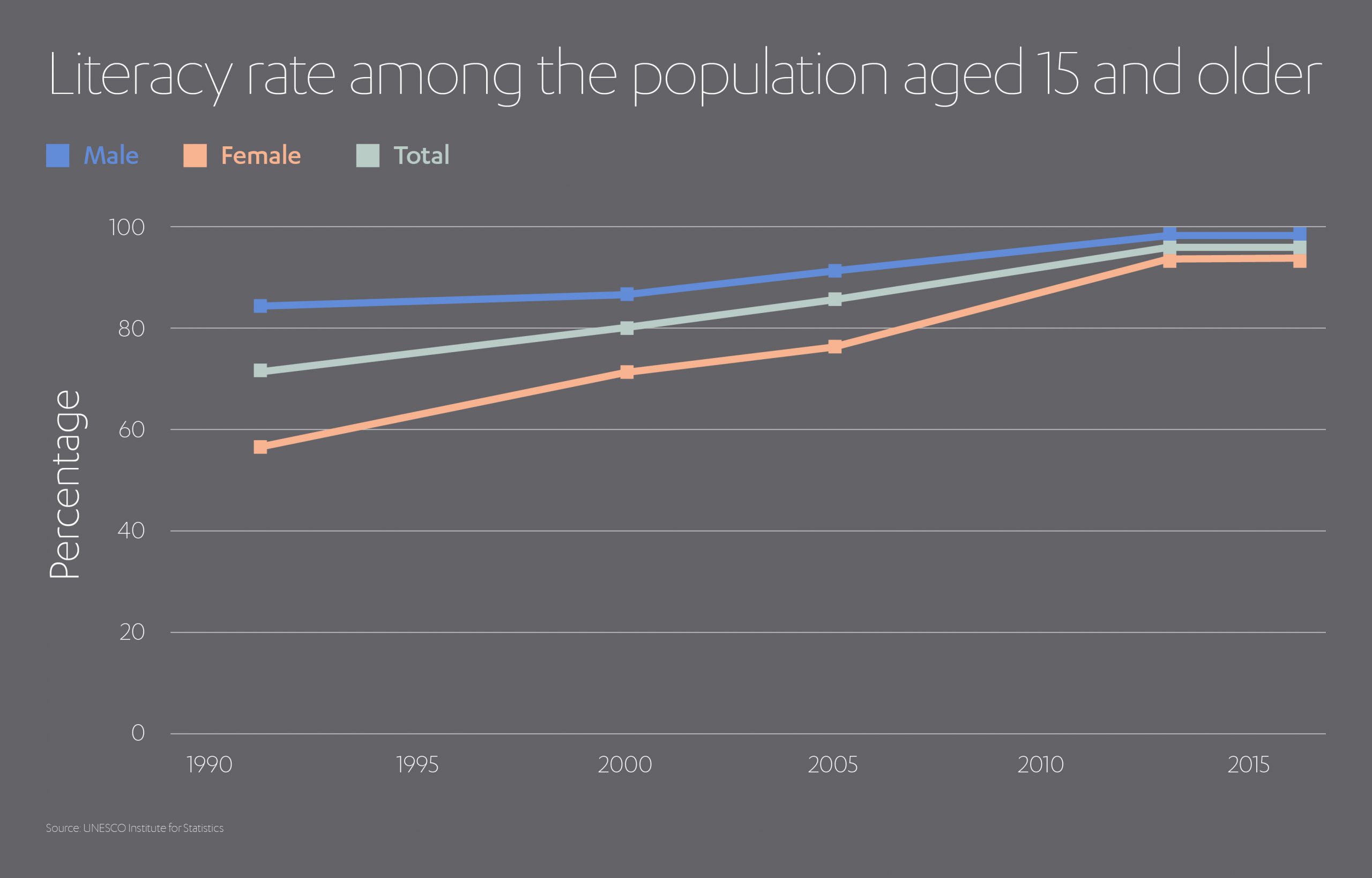

Why so confident? For one reason, the International Institute for Management Development (IMD) notes that Saudi Arabia spends 8.8% of its GDP on education, almost double the global average of 4.6%[12]. Bold investment like this brings rewards: the literacy rate of those aged 65+ in 2017 was just 62.4%, but 99.3% for those aged 15-24. Out-of-school adolescents fell from 44,143 in 2016 to only 15,343 in 2019[13].

All of which bodes well for an even healthier real estate market in the medium and long term.

Confronting challenges; maximizing opportunities

Much of the real housing shortage in Saudi Arabia exists at the lower end of the income spectrum. As such, affordable housing is a key ingredient in the country’s recipe for success over the coming decade.

With a youthful and expanding population, policymakers are grappling with which method of affordable housing creation will have greatest impact on the most lives.

Overcoming such initial hurdles as a lack of experienced developers and a paucity of existing public/private partnerships upon which to build, Saudi Arabia’s Housing Program is fast emerging as a model of best practice for other countries to emulate.

Several innovative steps have helped turbo-charge the market. The launch of online platforms such as Sakani have encouraged partnerships with real estate developers in the private sector. The founding of the National Housing Company and the Etmam Center, meanwhile, have allowed developers to navigate the market using a comprehensive digital platform. And a Developmental Housing program has remedied supply shortages for the most underprivileged families, working alongside the non-profit sector to establish more than 350 residential community associations.

Simultaneously, the legislative environment has vastly improved via the launch of the General Authority for Real Estate to serve as a central regulatory body.

Where next? According to Vision 2030, the Housing Program will continue increasing home ownership rates by “further targeting the most underprivileged segments, in addition to boosting the attractiveness of the sector for investment by the private sector in order to support the stability and sustainability of the sector under different economic conditions”.[14]

Looking ahead to the 70% ownership milestone, a blanket approach seems unlikely within such an economically-diverse country. Instead, planners and researchers will have to gauge what the very word ‘affordability’ means in different regions, and the correct balance of for-sale/for-rent stock.

The successful solution – or mix of solutions – will harmonize national policy goals with local market dynamics, enshrine training and approval standards to ensure sufficient quality developers, and accommodate the commercial realities of private investment.

It is a bold ambition, but it can be achieved – as our ambitious slate of real estate developments at Abdul Latif Jameel testifies.

Turning the key on a real estate revolution

A booming economy and rapidly growing population translate to greater demand for housing.

Historically at Abdul Latif Jameel, the initial core focus for the ‘Land and Real Estate’ division activities focused on developing and delivering the Company’s own corporate real estate projects and to support growth and expansion in its core business. The division’s success in meeting these objectives lead to the official formation of Abdul Latif Jameel Land in 2012, which formally stepped into Saudi Arabia’s real estate market in 2013, with a commitment to fostering a better way of life in the communities that we serve.

Aligned with Vision 2030; where the government is partnering with private sector in helping Saudi Arabians own their own homes; the business moved forward to specialize in developing quality residential properties with modern community lifestyle and a value proposition to the market of enhancing home living experience at an affordable cost, or ‘affordable luxury’.

More recently, Abdul Latif Jameel Land has been refining its priorities to focus more specifically on residential property, with the aim of increasing access to quality home ownership.

Our residential development team has a pipeline of projects completed or under way (including apartments, villas and townhouses) to help address the predicted 3.3 million homes shortage in Saudi Arabia by 2025.

Flying the flag is our J | ONE Residences gated community north-west of Jeddah, comprising 242 one-to-four-bedroom apartments within a 65,000 square meter site. The eco-friendly development, which launched in 2019, includes facilities such as a health club, theatre, pools, nursery and shops.

Also completed is our Gallery N development, a 3/4-bedroom apartment block in the heart of Jeddah’s cosmopolitan Al Nahdah zone, boasting proximity to schools, malls and markets.

Also completed is our Gallery N development, a 3/4-bedroom apartment block in the heart of Jeddah’s cosmopolitan Al Nahdah zone, boasting proximity to schools, malls and markets.

The six-story building on a 5,200 square meter site includes environmental benefits such as green roof space to minimize heat absorption and shading screens to filter daylight inside living spaces.

With these successes under our belt, we are busy under construction on Dari Q, a family-friendly 158-apartment development in Jeddah’s Salamah District. The project follows an integrated-lifestyle ethos and incorporates private parks, pools, play areas and a ballroom for up to 90 guests.

Consisting of two buildings separated into four distinct quarters, Dari Q’s 13 different floor plans are designed to cater for a variety of family types and tastes.

The ‘affordable luxury’ approach was well recognized by potential customers and as a result – and despite the global pandemic crisis – over 80% of Dari Q was sold before completion.

Abdul Latif Jameel Chairman and CEO Mohammed Abdul Latif Jameel says Dari Q is “another proud step as we continue to support residential development and housing ownership goals identified in Saudi Vision 2030, and remain committed to offering community-focused solutions to residential demand in the market”.

Following the success of J|ONE and Dari Q, the launch of Dari II represents another solid step on the way to become a major developer in the market. With its new direction now established as a residential real estate developer, the relaunch of the business with a new – more appropriate – name, reflects this ambition. And so, ‘Abdul Latif Jameel Properties’ was created as a repositioning to come into effect in late 2021. The renaming emerged from the need to highlight the reinvigorated core business and comes as part of the 75th anniversary.

Transformed from a landlord to an active developer set on enhancing the quality life for Saudi homeowner and tenants.

In the new digital world, the business also has an eye to significantly develop its ‘proptech’ capabilities and expand into this sector in the future.

Deputy Chairman and Vice President,

Abdul Latif Jameel

“As lives get back on track after the turbulence of COVID-19, we can, as a nation and as a business, refocus our efforts on ensuring a real estate infrastructure fit for the modern world,” says Fady Jameel, Deputy Chairman and Vice President, Abdul Latif Jameel.

“This means homes designed to reflect contemporary living. Homes that will complement rather than inhibit the environment. Homes that span the affordability spectrum making ownership dreams a reality for more people than ever before. As our growing, youthful and enterprising population knows, the right homes in the right places can empower a better way of life – a focal point not just for the notion of family, but for the wider concept of community.”

But there is an environment imperative too. Concrete – our most widely used man-made material -(second only to water as the most-consumed resource on Earth) has cement as its’ key ingredient.

This substance which has shaped much of our built environment for many decades, also has a massive carbon footprint. If the cement industry were a country, it would be the third largest emitter in the world – behind China and the US. It contributes more CO2 than aviation fuel (2.5%) and is not far behind the global agriculture business (12%) at about 8% of the world’s carbon dioxide emissions, according to think tank Chatham House. This is one of many issues the industry must face. As Fady continues: “And as we seek to build back better, we are actively exploring new techniques and technologies with real estate and construction to decarbonize the building process, including alternative materials or materials production processes. When these technologies are mature enough, we hope to be an early adopter in our future residential development projects.’

The future is ours to build. Indeed, it is down to private sector leaders such as Abdul Latif Jameel to help unlock the country’s potential by providing the growing population with the kind of accommodation it can aspire to.

[1] https://www.knightfrank.com/research/article/2021-02-28-saudi-arabia-real-estate-market-review-q4-2020

[2] https://saudigazette.com.sa/article/607239

[3] https://www.vision2030.gov.sa/v2030/vrps/housing/

[4] https://english.aawsat.com/home/article/2766096/king-salman-orders-merging-ministries-housing-municipal-and-rural-affairs

[5] https://www.vision2030.gov.sa/v2030/vrps/housing/

[6] https://www.knightfrank.com/research/article/2021-02-28-saudi-arabia-real-estate-market-review-q4-2020

[7] https://www.thenationalnews.com/business/property/saudi-arabia-s-property-market-shows-signs-of-post-covid-recovery-1.1217822

[8] https://www.jll-mena.com/content/dam/jll-com/documents/pdf/research/emea/mena/jll-mena-real-estate-market-overview-ksa-q1-2021.pdf

[9] https://www.thenationalnews.com/business/property/saudi-arabia-s-property-market-shows-signs-of-post-covid-recovery-1.1217822

[10] https://www.jll-mena.com/content/dam/jll-com/documents/pdf/research/emea/mena/jll-mena-real-estate-market-overview-ksa-q1-2021.pdf

[11] https://www.constructionweekonline.com/business/272161-improved-business-confidence-drives-ksas-post-covid-real-estate-recovery

[12] https://www.arabnews.com/node/1503356/business-economy

[13] http://uis.unesco.org/en/country/sa

[14] https://www.vision2030.gov.sa/v2030/vrps/housing/

1x

1x

Added to press kit

Added to press kit