Not just hot air: why decarbonizing industry is so vital to a sustainable future

The last five years were the warmest on record. At the current rate, the world will be around three degrees warmer by the end of the century[1].

By then, it will be too late.

What we do now will decide the fate of ecologies, economies, and populations. If we can limit warming to 1.5 degrees Celsius over the next 30 years, we might, just might, avert some the worst effects of climate change.

According to the Intergovernmental Panel of Climate Change (IPCC), the world must reduce carbon emissions by at least 49% of 2017, levels and become carbon neutral by 2050, to meet the targets set by the UN-led Paris agreement.[2]

As of 2019, over 75 countries had committed to net-zero carbon emissions by 2050[3]. The UK, France, Sweden, and Norway lead the way in legislation. Others are showing positive signs, such as America’s CLEAN Future Act, which sets out sector-specific and economy-wide solutions to achieve a 100% clean economy by 2050[4].

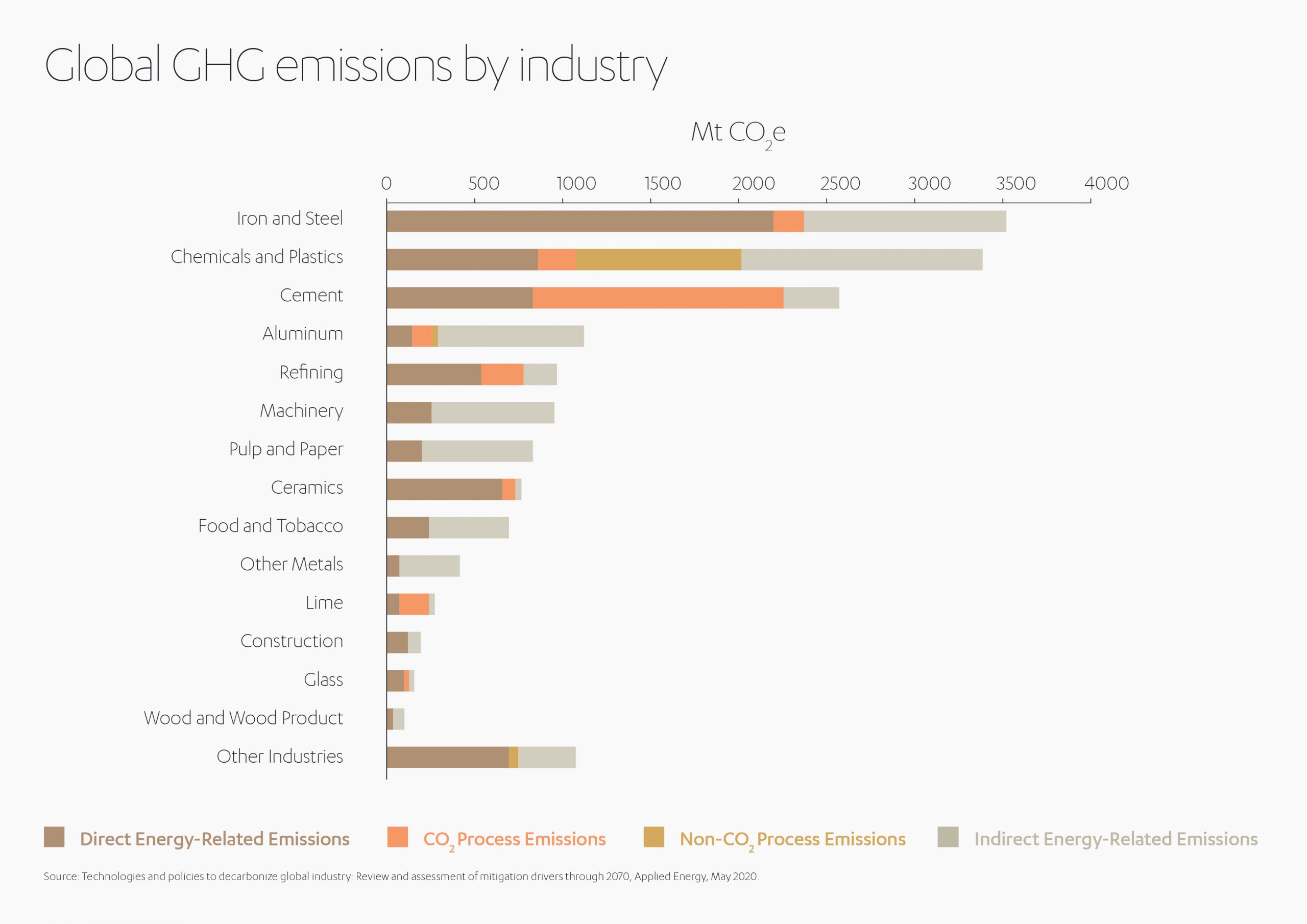

As discussed by Abdul Latif Jameel Deputy Chairman and Vice President, Fady Jameel, in his recent Spotlight article on achieving net-zero, the power, buildings, and transport sectors are all making good progress in reducing emissions. Industry, however, is lagging. Industry emits about 28% of greenhouse gases (GHG) emissions, of which 90% are CO2. These emissions rose by 69% between 1990 and 2014, compared to 23% for buildings, power, and transport.[5]

The production of ammonia, cement, ethylene, and steel accounts for almost half of industrial emissions. Other high emitting sectors include food and tobacco; paper, pulp, and print; and non-ferrous metals. The construction industry is expected to become the largest source of ‘consumption-based emissions’ in the world’s largest cities, accounting for nearly a quarter of all consumption emissions from now until 2050.

Global industry must decarbonize by reducing and removing GHG emissions, principally carbon dioxide (CO2) and methane (CH4), throughout the supply chain. The International Energy Agency (IEA) stresses the importance of prompt action to avoid ‘locked-in’ emissions due to the sector’s long investment cycles.[6] So industry, energy, and government must mobilize now to align innovation, incentives, and investment to support a carbon-free future for industry.

“To successfully achieve so-called ‘deep decarbonization’ over the longer term, we have to be prepared to take fundamental action now, which is likely to be painful, expensive and disruptive to our existing economic and social models,” says Fady Jameel.

It won’t be easy. But it can be done.

Cheap fuel is complex and costly to replace

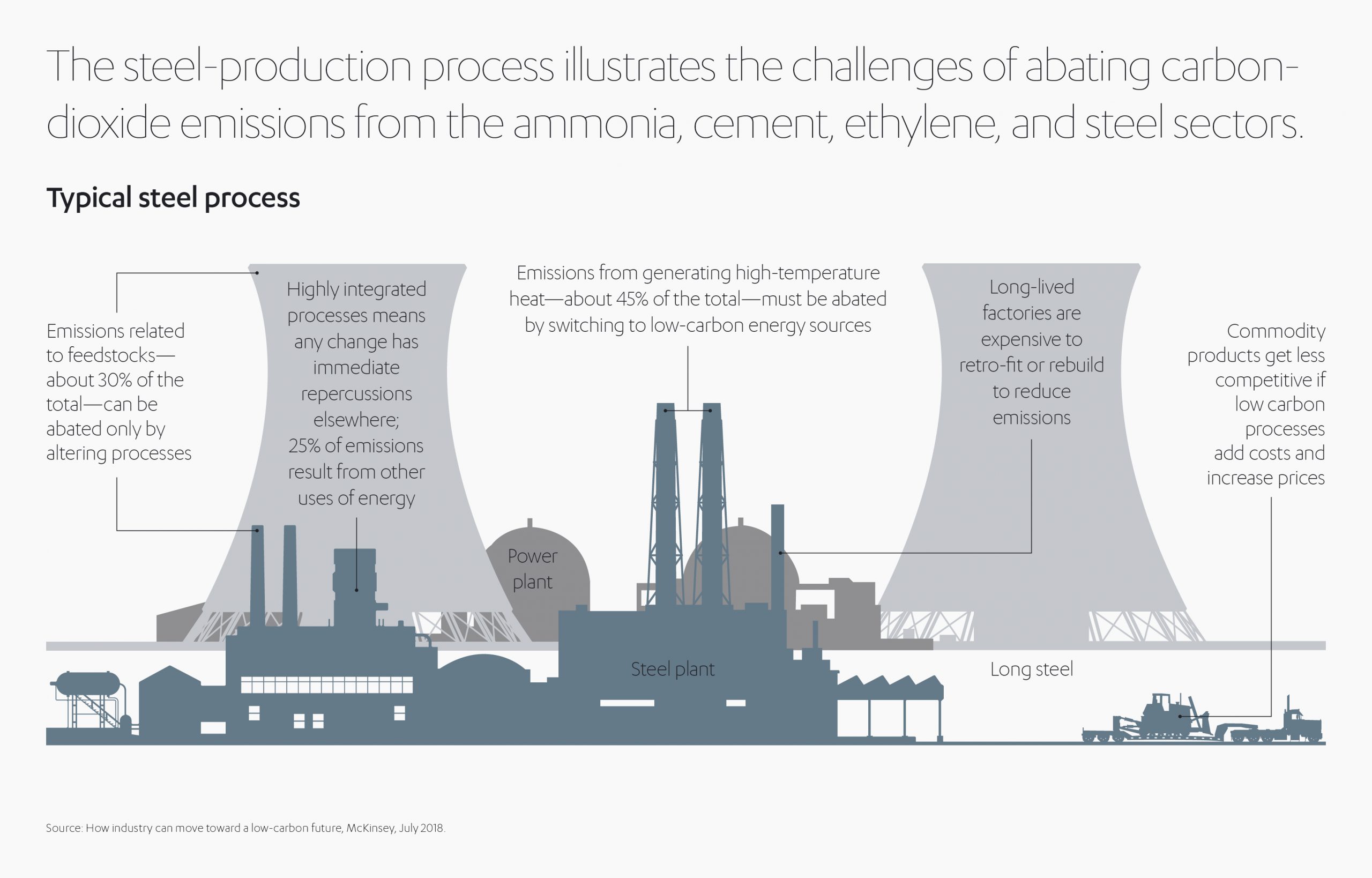

Heavy industry is highly dependent on fossil fuels for feedstock and combustion to generate very high temperatures, both of which emit CO2. This means both fuels and processes must change. Heavy industry will have to design furnaces that run between 700 and 1,600 degrees Celsius on zero-carbon electricity. And because industrial processes are highly integrated, one change to the system will impact other processes and even the finished product.

For example, steel and cement made with reduced carbon may have different specifications that require building codes to be modified.[7] Rebuilds and retrofits are expensive, and production costs are even higher. McKinsey estimates the decarbonization of cement, steel, ammonia, and concrete will cost between US$ 11 trillion and US$ 21 trillion through 2050.[8] A tall order when selling commodities in a global market.

Meanwhile, demand for resources is increasing, driven by a global middle class which is expected to reach 5.3 billion people by 2030[9]. This means industry will have to dramatically increase production, while emitting far less CO2 than it does now.

Global alignment will also prove tricky.

Since 2011, China, the world’s largest steel and cement producer, has consumed more coal than the rest of the world combined.[10] Furthermore, developing nations, which are disproportionately affected by climate change, may be reluctant to forgo cheaper fossil fuels as they try to bridge the gap with wealthier nations, especially since the developed world has caused the vast majority of global warming.

Strategies for reducing industrial emissions

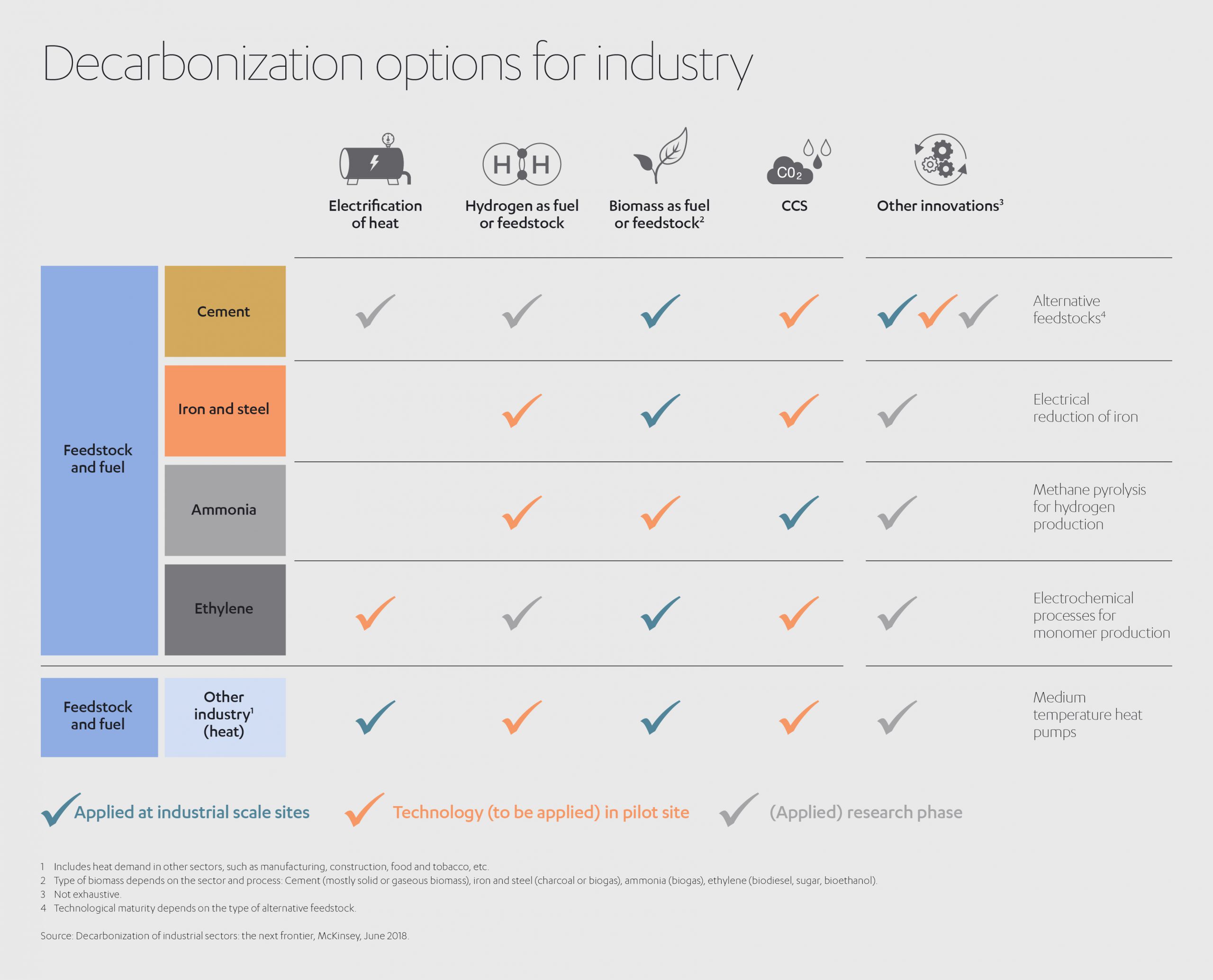

Despite these challenges, decarbonization is technically achievable, even without technological breakthroughs. Specific decarbonization pathways will vary between regions and individual facilities, based on factors including access to renewable energy, feedstocks, infrastructure, carbon storage capability, demand for resources, and access to the right financial and regulatory incentives.

Electrification of heat

Industries that depend on low- and medium-temperature heat, such as construction, food, textiles, and manufacturing, could reduce 90% of their emissions by electrification with clean-energy sources. To achieve this, they would need to electrify at twice their current level by 2050.[11]

Electrification is harder for processes that require high heat, however. According to McKinsey, to decarbonize ammonia, cement, ethylene, and steel would require a “reliable, low-cost supply of approximately 25 to 55 exajoules of zero-carbon electricity per year—about four to nine times the amount they would need in the absence of any special effort to reduce CO2 emissions.”[12]

Industry needs more renewable electricity

Continued innovation and investment in the renewable energy sector are essential to decarbonize industry. Fotowatio Renewable Ventures (FRV), part of Abdul Latif Jameel Energy, recently launched its first utility-scale battery project, as a part of the company’s long-term plan to develop energy storage projects globally. The Holes Bay scheme in the UK is one of the largest battery storage systems in the South of England. It will deploy a system of lithium-ion batteries, with a combined capacity of 15 MWh, providing the capability to store energy and affording flexibility to the grid.

Low carbon energy sources and feedstocks

Industry must replace fossil fuels with low carbon energy sources and feedstocks, specifically zero-carbon renewable electricity, sustainably produced biomass as a feedstock or fuel, and hydrogen as a feedstock or fuel.

When zero-carbon renewable electricity is no more than US$ 50 per megawatt-hour at current commodities prices, using electricity to produce heat or hydrogen is more economical than Carbon Capture and Storage (CCS) in many situations.

This has already been achieved in some places and will probably become widespread.[13]

About 30% of energy-related CO2 emissions across industries are hard to abate with electricity alone, mostly due to the high temperatures involved.[14] That’s where hydrogen and biomass come in. The Hydrogen Council estimates hydrogen could replace up to 18% of final energy consumption by 2050. Hydrogen will play a key role both as feedstock and energy source, particularly in the steelmaking and chemical industries. The Hybrit initiative, backed by Sweden and Finland, is on track to produce low-carbon steel with hydrogen by 2035. Hydrogen will ideally be produced with zero-carbon electricity, although ‘blue hydrogen’, made using natural gases, will also help if combined with carbon capture.

Sustainably produced biomass, such as wood, charcoal, and biodiesel, is also technically and financially viable for newly built cement and steel facilities and can replace fossil-fuel feedstocks for ethylene and ammonia production. In Brazil, for example, steel producers use charcoal as a fuel and feedstock instead of coal, and several European chemicals producers are experimenting with bio naphtha[15].

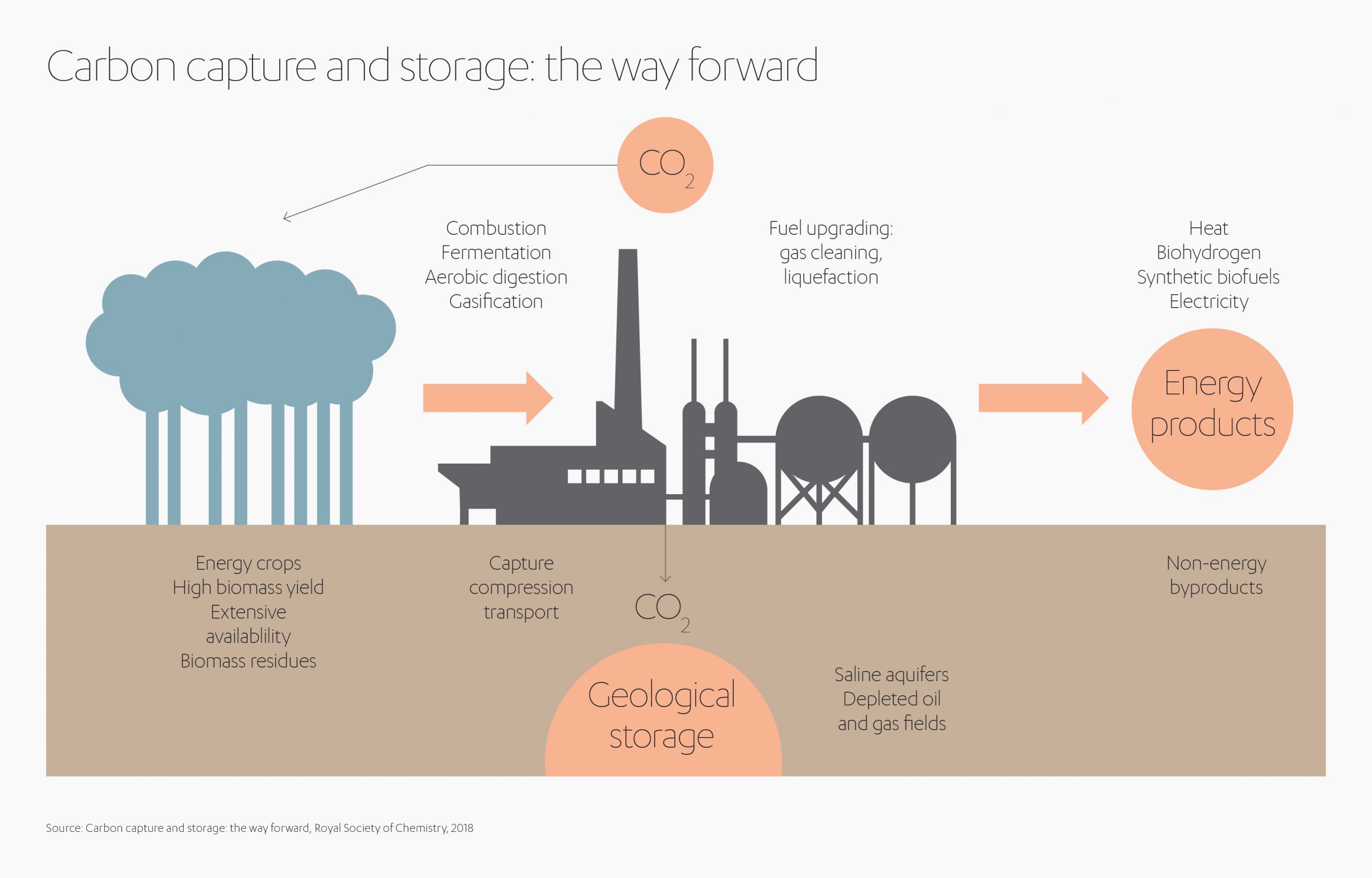

Carbon capture and storage

Carbon can be captured from exhaust gases in industrial processes and stored underground (CCS) or used as a feedstock through carbon capture and usage (CCU). The captured CO2 can be used to produce fertilizer, carbonated drinks, medicines, and treat water. It can also be used in other industries, including power generation, as a feedstock or fuel. Other applications include conversions to polymers or carbonates, concrete curing, and mineral carbonation. Researchers are also investigating the possibility of turning CO2 into transport fuels[16].

Where storage is available, CCS is the lowest-cost decarbonization option at current commodity prices, and the only technology that can fully abate emissions from cement production[17]. The technology remains expensive, though, and relies on public and regulatory support. Lower electricity prices would make electrification and hydrogen-based decarbonization more attractive.

Smarter, more sustainable materials and processes

Using more efficient materials and processes can support decarbonization while saving time and money. Steel (or even aluminum) in cars can be replaced with carbon fiber, and construction can use more wood instead of steel and concrete. Smart materials, such as alternative concretes, new chemical catalysts, and low-GHG steel[18] show promise; Massachusetts-based Boston Metal, for example, is already using a steel-making process that removes the need to use coal as a feedstock[19].

These products can be combined with more innovative processes that use less energy and fewer materials. So-called ‘lightweighting’ drives efficiencies in everything from airplanes to smartphones.

Additive manufacturing reduces lead time, cost, and waste. Automation and analytics improve productivity. Even simple design improvements can have a significant impact; for example, Interface slashed energy use in a Dutch carpet factory by making pipes fat, short and straight, to reduce friction and allow smaller pumps and motors.[20] It is estimated that the construction industry could cut emissions by between 29%–44% by using more sustainable procurement and methods,[21] such as curved fabric molds to reduce the amount of concrete used in buildings.

Integrating different processes, especially the generation and use of heat, is a very effective way to reduce energy and emissions and can have a big payback. Researchers from the Rocky Mountain Institute in the United States calculated that in around US$ 40 billion of diverse industrial projects, whole-system redesign delivered up to 60% energy sayings in retrofits and up to 90% energy savings in newly built facilities[22].

Circular economy principles can be applied to make longer-lasting products that are easier to reuse, refurbish, and recycle. For example, reusing steel requires just a quarter of the energy of brand new steel, and by 2050, nearly 60% of plastics could be replaced with recycled materials.[23] Canadian firm Carbon Cure is already mixing recycled CO2 into cement to reduce its carbon footprint.[24]

Circular economy principles can be applied to make longer-lasting products that are easier to reuse, refurbish, and recycle. For example, reusing steel requires just a quarter of the energy of brand new steel, and by 2050, nearly 60% of plastics could be replaced with recycled materials.[23] Canadian firm Carbon Cure is already mixing recycled CO2 into cement to reduce its carbon footprint.[24]

Finally, changing consumption patterns, enabled by new technology, can reduce demand for materials; for example, new models of mobility could reduce the need for roads and, therefore cement, and precision agriculture could reduce ammonia usage for fertilizer.

Sharing the bill

Although the absolute numbers are daunting, decarbonizing industry would only cost around 0.5% to 1% of global GDP, according to the Stockholm Environment Institute (SEI)[25]. The challenge is how to spread the risk between public and private investors.

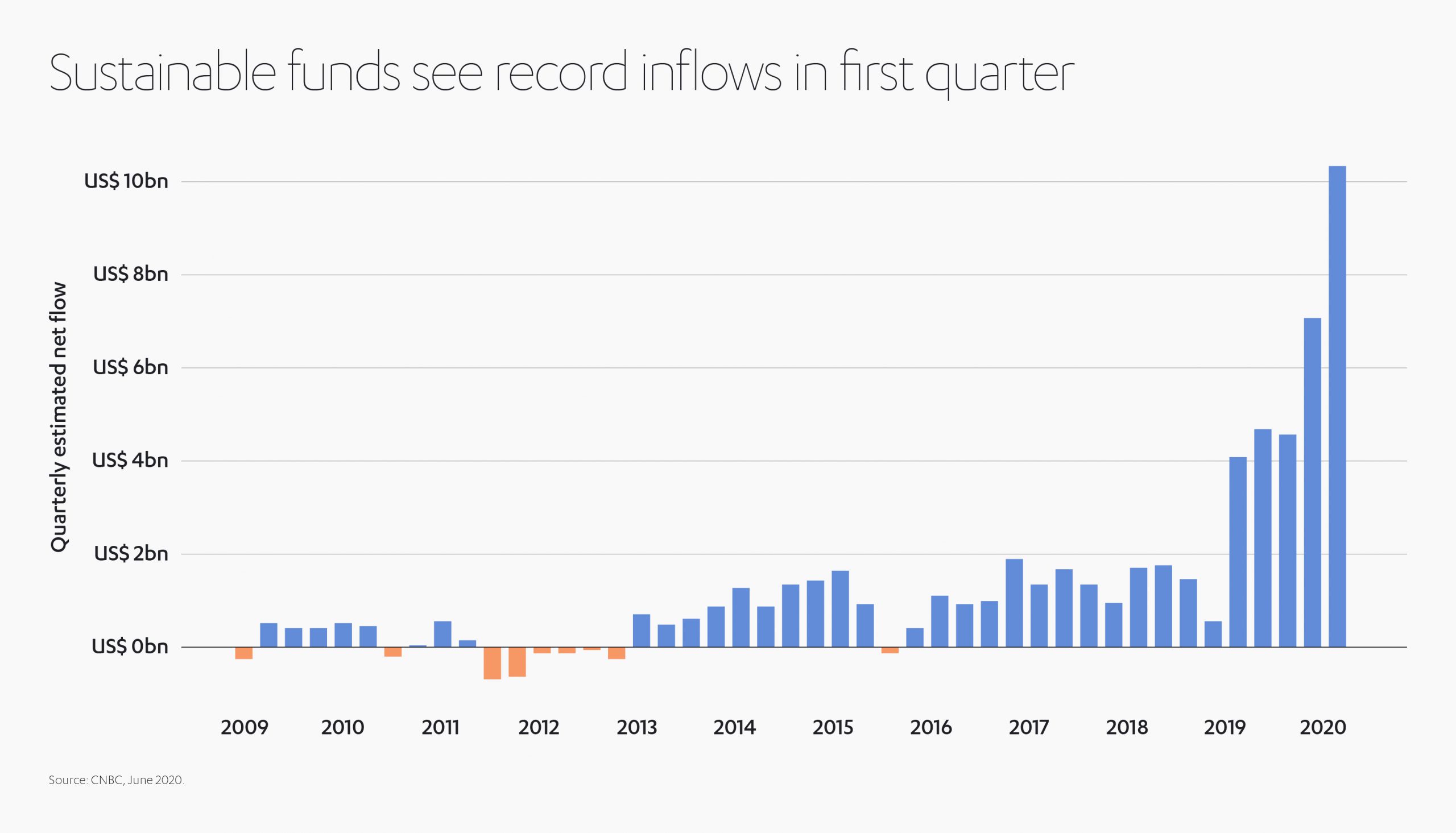

The rise in ESG investing, which evaluates investments on environmental, social, and governance performance, as well as financial factors, proves that sustainability can pay. Despite market turmoil, 2020 is expected to be a record year for ESG investing. Inflows in the first quarter of 2020 were more than half of the record US$ 21.4 billion pumped into sustainable funds in 2019[26].

The German Institute for Economic Research (DIW Berlin) notes that finance is “indispensable” where technologies are yet to achieve market competitiveness: “Green finance in the form of bonds, grants, loans, results-based finance or any other form is crucial for three aspects: R&D, scalability, and affordability.”[27]

Private businesses – like Abdul Latif Jameel – can help to catalyze both business and government investment into solutions to decarbonize industry and combat climate change. Organizations like the Clean, Renewable and Environmental Opportunities Syndicate (CREO Syndicate), are already helping to change attitudes and explore private investment opportunities across the global ESG marketplace.

Private investors can’t do it alone, however. Promising but unproven solutions are inherently riskier, and the absence of fossil fuel bans and higher carbon prices holds back further cash. Greater certainty and clear direction will allow deeper investment. Governments must provide support, regulation, and coordination for the decarbonizing industry, in the same way they supported the cost reduction and scaling of renewable energy.

Government and public institutions can foster partnerships between industry, business, investors, and researchers to champion innovation and provide tax credits and grants for research. They will also need to play a more prominent role in the later stages of development, such as financing pilots and roll-out of carbon-neutral solutions, and setting procurement standards to alleviate risks for early movers[28].

In the UK, the Grantham Research Institute on Climate Change and the Environment at the LSE calls for a:

“National Infrastructure Bank, to provide transparency and credibility around finance for sustainable infrastructure. This institution could align expectations on the future growth path and avoid a muddled path where the UK invests in both inefficient high-carbon technologies and sustainable infrastructure.”[29]

A report from the institute[30] proposes that fiscal policy could be used to make markets more attractive for generating and distributing renewable energy, together with direct incentives to promote low-carbon products and decarbonize facilities. Policies could also encourage sustainable biomass usage and the reuse of steel and the recycling of plastics. Incentives could be combined with more stringent energy efficiency and emission standards, energy audits, and data collection and disclosure requirements. More robust measures are always an option. Mandatory retirement has been used for the highest emitters, mainly coal-powered facilities, from the US to China.

One of the key fiscal tools often mooted is carbon pricing, which aims to leverage the ingenuity – and economic imperative – of industrial companies to find their own way of reducing emissions. It also generates revenue, which can support more decarbonization or social policies. Carbon pricing is most effective when it includes border adjustments to minimize the “leakage” that occurs when carbon emissions are hidden overseas in the supply chain.

Carbon taxes have already shown some success in the energy and transport sectors. Sweden has the highest carbon tax in the world, primarily for heating and motor fuels. It proves it’s possible to decouple decarbonization from GDP while increasing the use of more sustainable fuels. After introducing the carbon tax, Sweden’s biomass usage increased from 25% in 1990 to nearly 70% in 2012[31].

Take a deep breath

Decarbonizing industry will require global commitment and a staggering amount of investment. But the alternative will cost far more. Industrial businesses need to play a central role by reviewing their facilities to determine the optimum mix of technologies and feedstocks, based on the local availability of low-cost electricity, hydrogen, biomass, and carbon storage capacity.

Businesses further down the supply chain, including construction and manufacturing, can redesign their processes to use fewer materials more efficiently while increasing reuse and recycling.

Investors – both public and private – can develop more mechanisms to support innovators and early movers. And crucially, governments must provide fiscal incentives for the development and implementation of promising decarbonization technologies, while expanding support for renewable energy.

Says Fady Jameel:

“There are many choices we can make today that will affect whether we can be close to a zero-emissions energy system in 2050. While some of them are not economically – or politically – viable at present, making the right choices will ultimately help to drive the economy, protect the environment and safeguard our societies in future.”

[1] https://news.un.org/en/story/2019/11/1052171

[2] https://www.nature.com/articles/d41586-018-06876-2

[3] https://www.un.org/sg/en/content/sg/statement/2019-09-23/secretary-generals-remarks-closing-of-climate-action-summit-delivered

[5] Decarbonization of industrial sectors: the next frontier, McKinsey, June 2018

[6] https://www.iea.org/reports/clean-energy-innovation

[7] http://blogs.edf.org/markets/2020/07/10/why-decarbonizing-heavy-industry-is-difficult-but-also-possible/

[8] Decarbonization of industrial sectors: the next frontier, McKinsey, June 2018

[9] https://ec.europa.eu/knowledge4policy/growing-consumerism_en

[10] https://chinapower.csis.org/energy-footprint/#:~:text=From%201990%20to%202018%2C%20China,the%20largest%20consumer%20of%20coal.

[11] Reimagining industrial operations, McKinsey, May 2020

[12] How industry can move toward a low-carbon future, McKinsey, July 2018

[13] How industry can move toward a low-carbon future, McKinsey, July 2018

[14] Climate mate: What a 1.5 degree pathway would take, McKinsey, April 2020

[15] Decarbonization of industrial sectors: the next frontier, McKinsey, June 2018

[16] Five keys to unlock CCS investment, International Energy Agency, 2017

[17] How industry can move toward a low-carbon future, McKinsey, July 2018

[18] https://www.responsiblesteel.org/

[19] https://www.bostonmetal.com/

[20] https://www.greenbiz.com/article/heres-how-decarbonize-industry-and-fight-climate-change

[21] https://www.c40.org/networks/clean-construction-forum

[22]. How big is the energy efficiency resource?, A.B. Lovins, Environ Res Lett, 2018

[23] https://www.mckinsey.com/business-functions/sustainability/our-insights/climate-math-what-a-1-point-5-degree-pathway-would-take

[24] https://www.carboncure.com/

[25] https://www.sei.org/perspectives/a-public-private-path-to-decarbonising-industry/

[26] https://www.cnbc.com/2020/06/07/sustainable-investing-is-set-to-surge-in-the-wake-of-the-coronavirus-pandemic.html

[27] Finance mechanisms for accelerating industry decarbonization, DIW Berlin, January 2020

[28] http://blogs.edf.org/markets/2020/07/10/why-decarbonizing-heavy-industry-is-difficult-but-also-possible/

[29] Decarbonization of the UK economy and green finance, Grantham Research Institute on Climate Change and the Environment, September 2019

[30] Decarbonization of the UK economy and green finance, Grantham Research Institute on Climate Change and the Environment, September 2019

[31] The Carbon Tax in Sweden – IER (instituteforenergyresearch.org)

1x

1x

Added to press kit

Added to press kit