Solar, so good

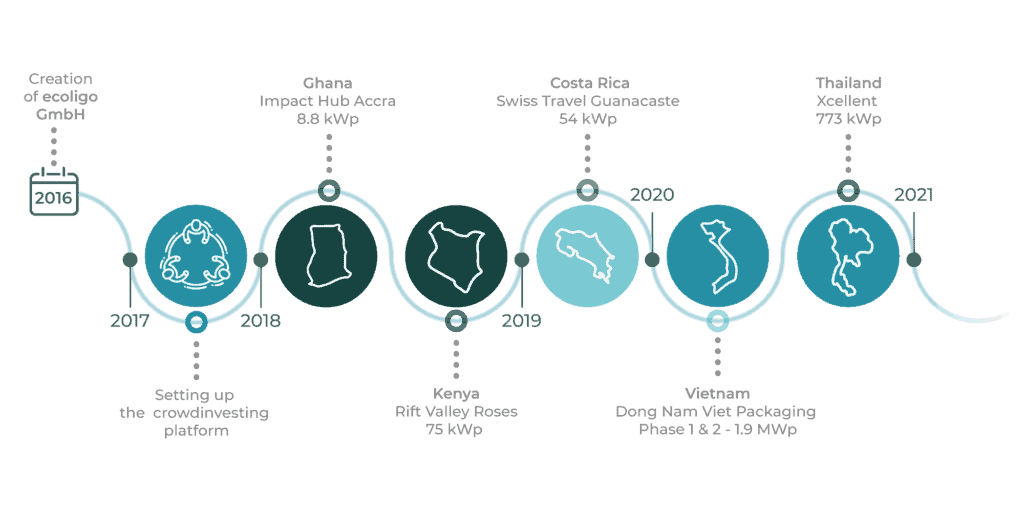

FRV-X, the innovation arm of Fotowatio Renewable Ventures (FRV), part of Abdul Latif Jameel Energy, recently invested US$ 10.6 million in ecoligo, a German-based impact-led ‘solar-as-a-service’ provider. Founded in 2016, ecoligo develops solar power projects for commercial and industrial customers in emerging markets. They currently operate in 11 countries, including Kenya, Ghana, Costa Rica, Vietnam, the Philippines and Chile.

Each project ecoligo develops is financed by individual investors via an innovative crowdinvesting platform. The investment from FRV-X will enable ecoligo to provide solar energy to more customers in emerging markets and accelerate its growth plans. We spoke to the founders of ecoligo, Martin Baart, CEO, and Markus Schwaninger, CFO, about the business, the crowdinvesting model, and their ambitions for the future.

Where did the idea for ecoligo come from?

Chief Executive Officer, ecoligo

MB: I’m an electrical engineer by training and spent my entire career in the solar industry in various roles from product engineering over sales and business development. I was working on the development solar/diesel hybrid projects in East Africa when I met Markus.

We could see there was a demand from local businesses for more solar power generation, and we were keen to do something ourselves, but we realized that no matter how great the need or how clever the technology, by far the biggest problem was always finance.

After two years of trying to get projects off the ground using traditional funding models, we decided to take a totally different approach that would enable us to overcome the finance problem.

MS: My background is in business engineering and finance. I started my career in Kenya, working on commercial and industrial (C&I) solar projects. Part of my role was helping German renewable energy companies to enter the market in Kenya and later also Tanzania, Ghana and Myanmar, find partners, work with the regulators, obtain financing for projects and so forth. And like Martin says, financing was always the biggest headache. Martin was on the private sector side and was working for one of the companies we assisted with market entry, so there was a lot of overlap, and we were both interested in finding a different way to do things. We started chatting about different ways of approaching the market, and eventually that became ecoligo.

How does ecoligo’s crowdfunding model resolve the finance issue?

Chief Financial Officer, ecoligo

MS: One of the main issues with the usual funding models for C&I solar power projects is the ticket size. Traditional lenders and investors, like development banks, local pension funds, private equity funds, were always very keen, but they would only be able to do projects of, say, US$ 5 million and above. The typical size of a C&I project, however, is between US$ 500k and US$ 1 million. So, we knew would need a different approach.

Martin and I had some early conversations about a crowdinvesting model, because we thought it might work. We spent a year or so doing some research in Europe about how crowdinvesting worked, what kinds of projects got funded, who were the investors, the regulatory framework and so on.

Our conclusion was that there was certainly an appetite for crowdfunding renewable energy projects in Europe, so why not in emerging markets? The big difference was the perceived risk, but we thought we could overcome that with our expertise and the trust we had built up in the industry and in those markets.

MB: What makes our model unique is that we control both sides of the business: we secure the capital from investors, and we also own and operate the solar projects. This enables us to scale up quickly, as we have access to the finance and to the projects. We can make sure that whenever there is a new project, we get the finance correct before we start work and then we can move with a high speed of implementation.

How hard was it to attract investors to those first projects?

MB: In the beginning the difficulty lay in finding the C&I customers who would sign-up for a solar plant. Five or six years ago when we were talking to our first customers, the cost to build a solar system was still significantly higher than today, and our track record was still limited. C&I solar projects in emerging markets were not yet a thing, so there weren’t any other references we could use as a showcase. It was really about convincing customers and building up trust in the technology to show them that if they signed up for a 20-year power purchase agreement, there was no risk from a technical perspective.

MS: On the fundraising side it was easier than expected. The first project we put on the crowdfunding platform was financed in four days. The next two in 10 days and seven days, respectively. They went super-fast. And this wasn’t the typical “friends, family and fools” – we attracted a diverse range of investors to the platform; people we’d never met who’d maybe read an article in a newspaper or magazine about what we were doing and wanted to get involved.

What is the typical size of crowd investment?

MS: There isn’t really a typical size, but there tend to be three categories of investor: first are the younger, digital natives. They take a risk diversification approach and invest small sums in many projects. They might also be active on other crowdinvesting platforms. The second category are impact investors. They will select a particular project they really like and invest a significant amount, maybe EUR 10,000. And then in between are a variety of investors that invest between EUR 1,000 and EUR 5,000 across a few different projects.

Are all investors from Germany?

MS: The regulations only permit us to advertise to investors in Germany, so that’s where the vast majority of investors come from and this is also the reason why all investment information are in German language only.

What comes first – do you begin by attracting the investment and then finding a suitable project, or do you find a project first and then secure the investment?

MB: It all starts with the projects. To find a project, we take a B2B sales approach. In all the markets where we are active, we have a local subsidiary and country managers, with bigger sales teams in those markets where we’ve been operating longer.

They are tasked with finding prospective customers. So they go to industrial parks, business parks, agricultural centers; they talk to hotel groups, factories, resorts, and so on, and they explain our proposition. Which is basically, “we can build a solar energy power plant and give you a power purchase agreement that will reduce your energy costs and also reduce your carbon emissions – with no investment required from your side. Are you interested?” We then work with them to assess their site, calculate their energy needs and put a specific proposal together that they can sign up to. We secure around 50% of our projects this way.

The other 50% comes through our trusted engineering, procurement and construction (EPC) partners, who have their own teams and networks in these markets. They might have a customer lined up who wants to build a solar plant but can’t get finance, so they will bring the project to us to see if we can help on the funding side.

It’s only when we have the signed contract with the customer that we present it as an investment opportunity on the platform. As soon as we have sufficient finance from our investors – which doesn’t usually take very long – we can start project delivery. This used to take between six and nine months, but it has slowed down over the past year or two due to the supply chain situation globally.

Are there particular industries or types of business that are more suited to the ecoligo approach?

MB: It depends on the market. In some markets, our customer base reflects the predominant industries in that market. So, in Costa Rica, for example, a lot of our customers are from the hospitality industry: lodges, hotels and so on, while in Vietnam, most of our customers are from the manufacturing industry.

I don’t think there is any overall trend towards specific industry sectors, though. It’s more the case that businesses in general are increasingly aware that not only can they reduce their energy costs through our solution, but it will also help them to decrease their CO2 emissions and give them a competitive edge. If you’re a textile manufacturer in Vietnam, for example, and you want to supply to big international brands like Nike or Adidas or whoever, you need to be able to comply with their ESG standards – and a solar energy plant can help you do that.

What do you think is the biggest motivation for C&I customers to move to solar energy – is it to reduce costs or is it due to supply chain pressure?

MB: I would say it’s equal. Four or five years ago, it was all about reducing costs. And we saw that in the way customers negotiated with us – the focus was always on price. But now there is much more awareness about how much CO2 emissions they are avoiding and getting the data insights so they can report on them and feed that information back to their own customers and stakeholders.

You mentioned the ‘sweet spot’ for the size of your projects was between EUR 500,000 and EUR 1 million. Has this always been the case?

MS: In the early days we deliberately focused on smaller projects so we could get them funded more quickly, typically between 100 kW and 200 kW, with an average ticket size of EUR 100,000. Nowadays it’s much larger, around 600 kW on average, which is around EUR 500,000, so we’ve increased it significantly. We see this trend to continue and soon reach 1 MW on average, at around 750,000 EUR investment volume.

MB: Now we have a track record and several years of experience to point to, it’s also the case that bigger customers are trusting us to build bigger projects for them.

Four of five years ago, it would have been very hard to persuade a customer to let us build a 1 MW or 2 MW system when our track record was only 10 kW or 20 kW projects. But now our track record puts us in a much stronger position, since we have signed more than 200 projects with the largest being 6 MW.

Your focus to date has been on emerging markets in the global south. Is that because those markets have the greatest need?

MS: Yes, this is where the uniqueness of our business model really comes into play. There is a funding gap for C&I solar power projects in these markets that the local financial industry cannot fill. Or at least, cannot fill on financially viable terms. You can get a loan from the bank, but the interest rate will be so high and the terms so restrictive that it would make the project unviable. Through our model, we secure the finance from Europe where cost of capital is attractive, and we deploy it in the emerging market where the cost of capital is high.

Another factor is the potential to make a bigger impact in these markets. There are plenty of companies doing this kind of thing in Europe, for example, but no one is doing it in emerging markets. Yet this is precisely where we really need to leapfrog to renewables, otherwise every new power plant built in these markets will be powered by fossil fuels.

MB: The tariffs for C&I customers in these markets are usually high, too, especially in comparison to the EU. So, a business in an emerging market will typically pay two-to-five times more for its energy than a European company. This means that an ecoligo solar project will have a much greater commercial impact on companies in these markets by allowing them to reduce their costs, while also generating more jobs locally.

Last but not least, these markets tend to have a lot of sunshine, so the same installed capacity will deliver around 50% to 100% – depending on the location – more energy than in northern Europe for example, simply because it is much sunnier. This also means that for the same investment, you are avoiding 50% to 100% more CO2 emissions, so it enables us to make an impact much faster than if we were building with the same money a solar system in, say, Germany.

When you are delivering a project, do you bring in your own teams or do you work with local partners?

MB: We always work with local partners and that’s a key philosophy in our business model. We never just fly in a team from Germany or Europe. We know there is enough talent and expertise on the ground in these markets. Each partner goes through a qualification process to make sure they understand the expectations in terms of quality, health and safety, documentation and so on. Sometimes we get enquiries from local solar installers who we have to reject because they don’t have the necessary skills or capacity, but we also give them guidance and support on how they could improve their capabilities and potentially work with us in future.

ecoligo has come a long way in the past five or six years. How will the investment from FRV-X help you to build on the success you’ve achieved so far?

MB: One of the key things it allows us to do is to scale much faster and accelerate our efforts in the global energy transition. We’re using the funds in several ways. One is to establish more salespeople in the markets we’re already in, and also to enter new markets. A second priority is to invest in technology that allows us to scale and deal with the hundreds of projects we plan to implement over the next few years, automating and digitizing processes and making the impact of investments more tangible and more engaging for our retail investors. We want to present them with real-life data on the impact their investments have generated in terms of emissions avoided and jobs generated. We want to encourage them to invite their friends and family to invest. Technology can help us do this.

How important is it for you to partner with corporate investors that not only provide funding for the company, but also share the vision and the values of ecoligo?

MS: It’s very important and that’s why we made the choice to go with FRV-X. We had options on the table from other investors, too, but we felt FRV-X was the best fit. For us, it is vital that a) any investor is aligned with our vision and mission, and b) that they are able to bring more than just capital; that they can bring expertise and ideas to help develop the business. Given our mission to be a global leader in what we do, it was also important to secure a partner with a global footprint who can help us take ecoligo into new markets around the world. We get all this and more with FRV and FRV-X.

MB: Last but not least is the mindset. With FRV-X, we think we’ve found a partner who thinks like us. It doesn’t matter whether we’re talking to the CEO or an engineer, we really feel the culture and the mindset of how we do business and how we treat people is on the same level. That’s super-important because an investment is almost like a marriage – and we want to make sure it is a long and happy one!

So what’s next for ecoligo? Is it all about scaling up and going into new markets or do you have broader plans?

MB: On the solar side, our focus is on scaling up, maybe entering one or two new markets, and consolidating our presence in existing markets. We’ll also be keeping a close eye on new technologies, like battery energy storage, to see how they might benefit our projects.

MS: As for the impact investing side, first of all we want to significantly improve the user experience on our platform, which is currently quite basic. We want to present more data and make it more engaging, to tell a much stronger story about each project and what it is achieving. So, investors can dig down into the information and really see what a difference they are making with their investment. We also want to explore some new financial products, because different people want different things, so we can offer a diverse range of financial products for every potential investor that visits the website.

1x

1x

Added to press kit

Added to press kit