Tunisia: new opportunities for wind energy investors

How is Africa’s northernmost country preparing to advance its renewable energy sector – and what role could wind energy play in that development?

Tunisia, like many economies across the MENAT region, has confirmed it will look to increase foreign direct investment in its renewable energy sector as it aims to redevelop its energy mix over the coming years.

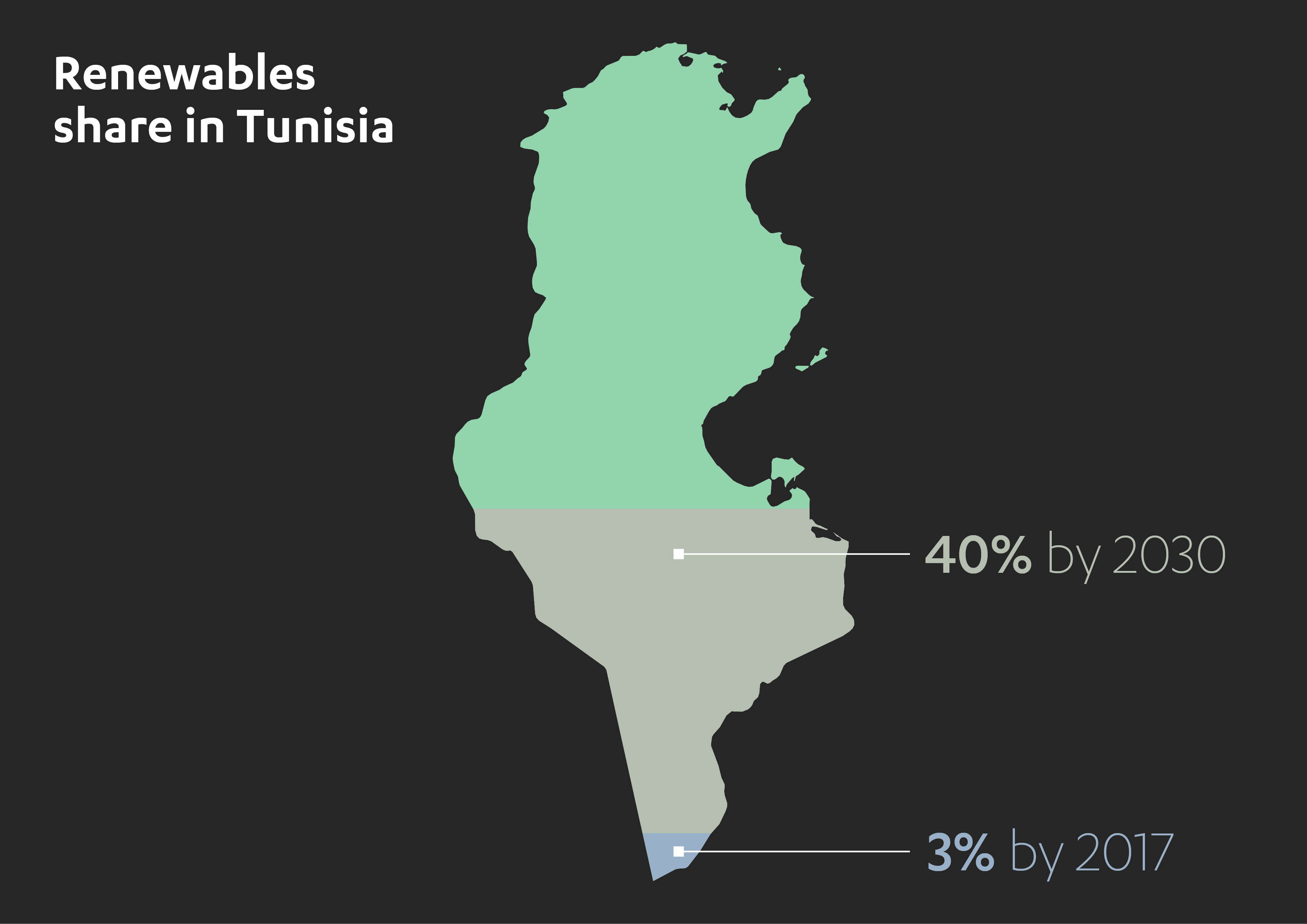

With only 3% of its existing energy supplies coming from renewables[1], and facing the pressure to adapt familiar to all energy-dependent countries, Tunisia’s authorities have – for the first time in the country’s history – allowed the private sector to contribute to its burgeoning wind energy sector.

Four projects, with a combined capacity of 120 MW, were licensed to foreign firms in January 2019[2]. Many more are expected to follow. Tunisian prime minister Youssef Chahed said: “The government (has) made considerable efforts in order to develop the legal and organizational aspects of the (renewables) sector[3].”

Four projects, with a combined capacity of 120 MW, were licensed to foreign firms in January 2019[2]. Many more are expected to follow. Tunisian prime minister Youssef Chahed said: “The government (has) made considerable efforts in order to develop the legal and organizational aspects of the (renewables) sector[3].”

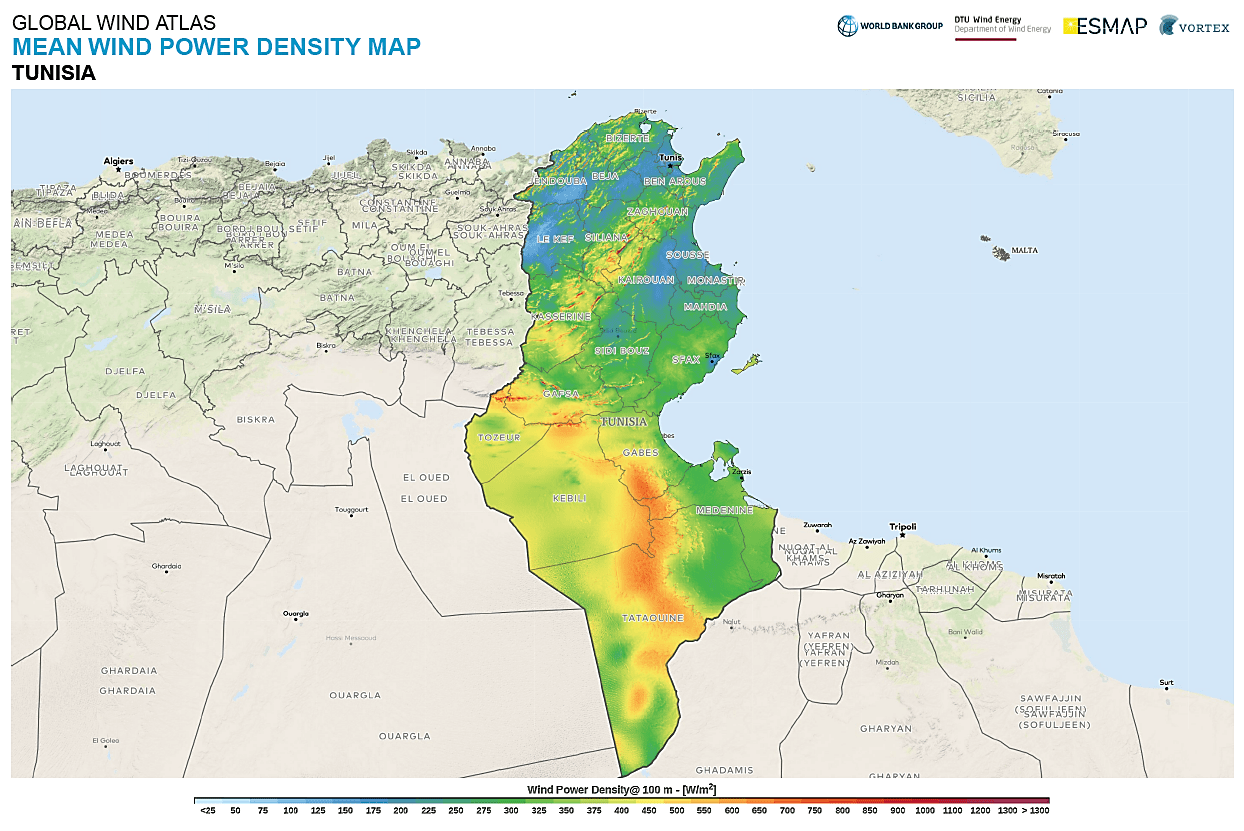

Gas is responsible for the majority of Tunisia’s current energy mix[4]. In 2015, its energy deficit reached 4 Mtep following a doubling of energy consumption between 1992 and 2012[5]. However, by 2030 the north African country is aiming to have 40% of its power provided by renewable sources[6].

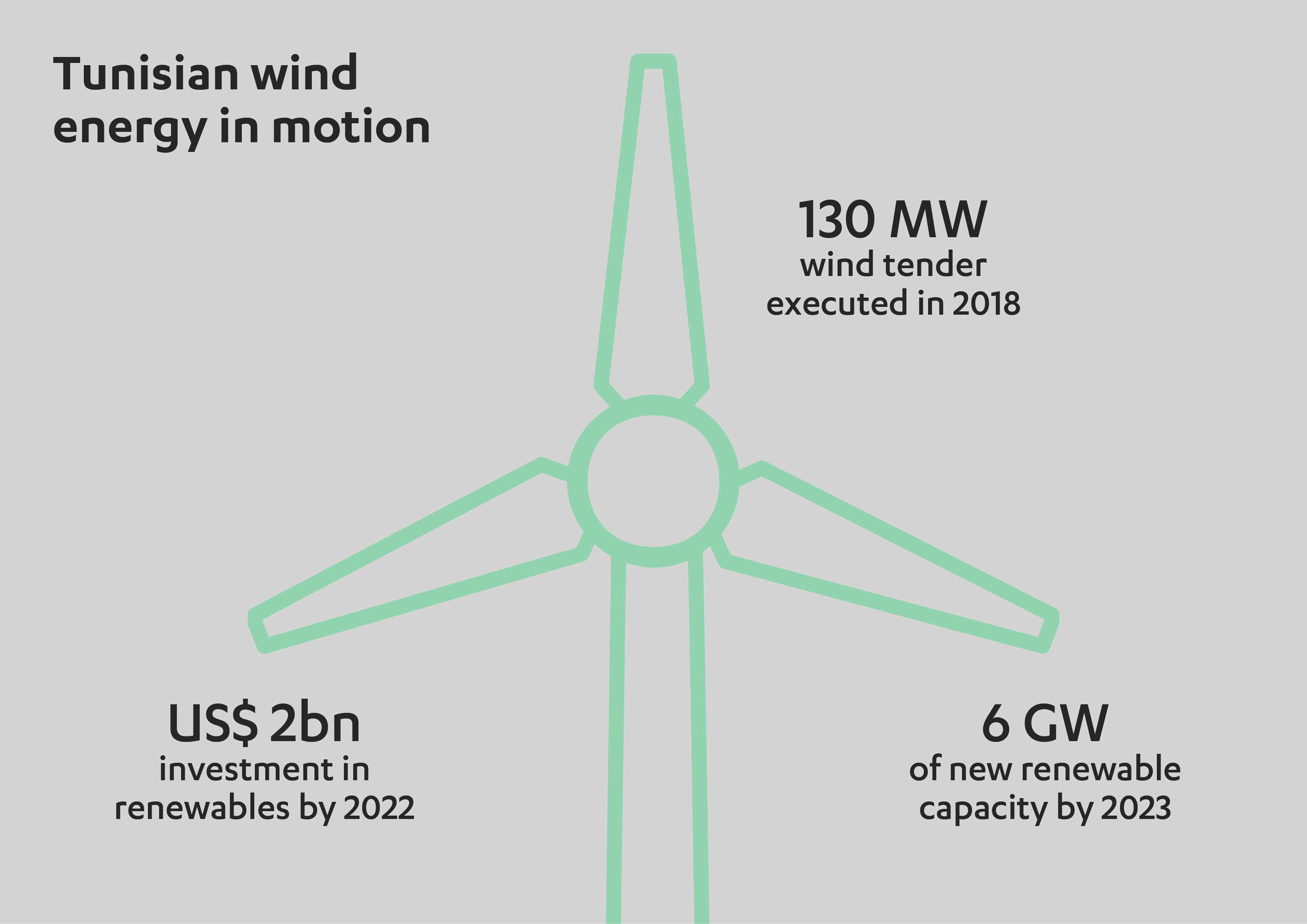

Perhaps conscious that its limited reserves of traditional hydrocarbons will not be able to meet its rising energy demand over the next decade, Tunisia hopes to attract US$ 2 billion of investment to fund 1,900 MW of renewable capacity by 2022[7]. By 2030, it aims to have 1,700 MW of installed wind energy capacity and a further 1,500 MW of installed solar photovoltaic capacity[8].

Initial signs of a change in approach came with the Tunisian Solar Plan, which ran from 2010 to 2016 and was a public-private partnership “promoting renewable energy production through a set of 40 projects and partnerships[9]”. Today, the momentum appears to be growing still further – welcome news for close observers of the country’s plans. “Tunisia’s commitment to energy transition could have a positive impact on the country’s economy[10],” say economists and project managers at IPEMED along with a former Secretary of State for Energy and Mines in Tunisia.

Indeed, Tunisia was named by The World Bank as one of the “three fastest improvers in the renewable energy regulatory framework”, joining Egypt and the United Arab Emirates in earning praise for its progress. According to its RISE Policy Matters report, “By the end of 2017, all three of these countries had legislation in place that allowed private-sector ownership of renewable energy and had a legal framework for renewable energy.”[11]

In 2018, Tunisia successfully executed a 130 MW wind tender. This development is set to be installed by 2021, and is part of a broader swathe of MENA governments reiterating their support of renewable energy[12]. The region is set to install more than 1 GW of renewable energy per year for each of the next five years, putting more than 6 GW of new capacity into its energy mix by 2023[13].

To further strengthen its position and continue to develop its potential in the renewable energy sector, Tunisia has been urged to continue to redefine the state’s role, improve energy governance and its regulatory framework, simplify taxation, and improve professional training opportunities[14].

Morten Dyrholm, Chairman of the Global Wind Energy Council, said: “Wind energy is now one of the cheapest forms of electricity in many markets. (In 2018) Installations of wind capacity overtook new fossil fuel capacity in many mature and emerging markets for the first time. These are strong fundamentals for a now mainstream energy source.[15]”

Mr Dyrholm’s analysis reflects research that suggests the global wind energy market will grow by 2.7% each year up to and including 2023, adding more than 300 GW of capacity worldwide[16]. GWEC’s Global Wind Report 2018 states: “Many markets are reassessing their energy demand and their market design. Wind energy as a flexible and easily-scalable capacity will be part of the solutions for the reassessment.”

Abdul Latif Jameel Energy, through its subsidiary company Fotowatio Renewable Ventures, (FRV) is determined to play its part in ensuring a cleaner, healthier future for communities across the globe. By delivering both wind and solar PV projects around the world, it is proud to be at the leading edge of renewable energy knowledge and expertise, enabling a new generation to benefit from a revitalized energy mix fit for the challenges of the age.

[1] Solar Energy Prospects in Tunisia, EcoMENA, 7 April 2017

[2] How Tunisia’s energy sector is changing, Oxford Business Group, 29 March 2019

[3] Tunis Allows Private Sector to Invest in Renewable Energy, Asharq Al-Awsat, 12 January 2019

[4] Energy strategies and policies in North Africa: Tunisia, The pursuit of energy independence, Bearing Point, accessed April 2019

[5] Energy strategies and policies in North Africa: Tunisia, The pursuit of energy independence, Bearing Point, accessed April 2019

[6] Renewable Energy Country Profile: Tunisia, Regional Centre for Renewable Energy and Energy Efficiency, accessed April 2019

[7] How Tunisia’s energy sector is changing, Oxford Business Group, 29 March 2019

[8] Renewable Energy Country Profile: Tunisia, Regional Centre for Renewable Energy and Energy Efficiency, accessed April 2019

[9] Tunisian Solar Plan (PST) 2010-2016, International Energy Agency, accessed April 2019

[10] Energy challenges facing Tunisia, Economiste Maghrebin, July 2017

[11] RISE Policy Matters: Regulatory Indicators for Sustainable Energy, The World Bank, 9 December 2018

[12] Global Wind Report 2018, Global Wind Energy Council, April 2019

[13] Global Wind Report 2018, Global Wind Energy Council, April 2019

[14] Energy challenges facing Tunisia, Economiste Maghrebin, July 2017

[15] Global Wind Report 2018, Global Wind Energy Council, April 2019

[16] Global Wind Report 2018, Global Wind Energy Council, April 2019

1x

1x

Added to press kit

Added to press kit