Steel deal: how could decarbonizing steel help build a greener future?

Steel plays an integral role in all our lives. From transport, construction and infrastructure to consumer products and medical devices implanted in our bodies. Steel is, literally, everywhere.

Why is it so indispensable? Well, not least because steel is strong, long-lasting and infinitely recyclable without any loss of properties.

But there’s a hitch. Steel production is highly energy-intensive, involving processes that traditionally rely on fossil fuels. The world needs steel for a very wide range of somewhat essential purposes for modern life, but can we continue at an unsupportable cost to the planet?

As demand increases, so does steel’s negative environmental impact. The success of steel in supporting future global economic growth therefore poses challenges in terms of how we can produce it in more sustainable ways. Both steel manufacturers and governments are committed to reducing carbon emissions from industry. But while there is a lot of exciting innovation taking place around the world, is it enough to reduce the negative impact steel production has on our environment?

How does steel drive the global economy?

Iron is hard, but it isn’t particularly strong. Steel, on the other hand, which is produced by melting iron and combining it with carbon, is super strong and surprisingly versatile.

Unfortunately, the steelmaking process requires extremely high temperatures – and this requires considerable amounts of energy.

Blast furnaces have been generating the necessary heat since about the 14th Century when blacksmiths first discovered how to make steel. A more recent upgrade, in the shape of electric arc furnaces, began in the late 19th Century. The electric arc furnace process sends a current through a mix of scrap metal and iron to create molten steel. They are much more efficient, but as they traditionally rely on carbon-based energy sources, the carbon emissions are still high.

As steel production techniques have advanced over the decades, so too has our love for the material. In fact, it’s almost impossible to imagine a world without it: cars, homes, offices, ships, trains, most medical devices . . . and many commercial buildings – a world without steel would be almost unrecognizable. You only have to look at the automotive industry to understand our high dependency on steel. Steel comprises well over half of the mass of an average vehicle and has done pretty much since the first cars began rolling off production lines in the 19th Century[1]. No wonder the International Energy Agency (IEA) predicts steel demand will rise by over one-third between 2020 and 2050[2].

The undoubted positives that steel brings to our lives, however, need to be weighed against its environmentally unfriendly production methods. Those positives run deep: one reason steel provides a strong backbone to the global economy is because it currently has few rivals. As the World Economic Forum (WEF)[3] points out: “There are no scalable substitutes for steel as of today”.

If there’s no realistic alternative, the only answer is to find better ways to manufacture the same material. More sustainable methods that can contribute to, rather than detract from, a net-zero carbon world.

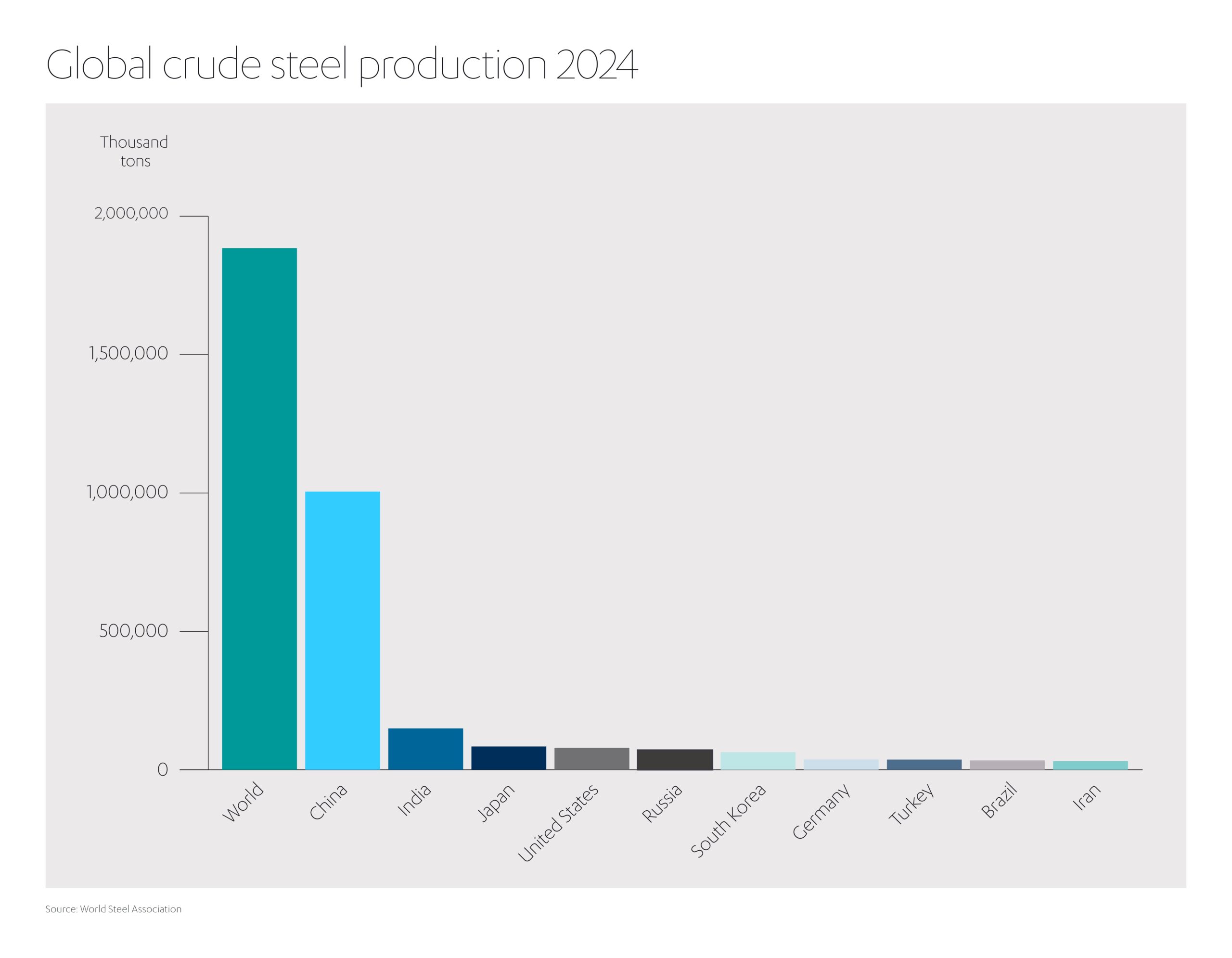

Steel production is a global activity, which makes the transition to greener methods a relatively tricky proposition. Today, production is increasingly concentrated in low-cost production regions, notably Asia, which accounts for more than 70% of global steel production[4]. In total, more than 1.8 billion tons of steel were produced in 2024, with China leading production by some considerable way[5], accounting for over 50% of global annual steel production.

As may be expected, there are stringent decarbonization targets to reduce these figures. The IEA warns that carbon emissions from steel production must at least halve by 2050 to meet global energy and climate goals[6]. It says decarbonization efforts in the iron and steel sector must “accelerate significantly” in order to align with the ‘Net Zero Emissions by 2050’ scenario[7]. It’s a big ask. Nothing short of “the biggest-ever asset reconfiguration of the steel industry is needed,” according to experts at McKinsey[8]. And, unsurprisingly given the industry’s scale and complexity, it won’t be cheap. According to a report from Deloitte[9], decarbonizing the steel industry will need investment levels of around US$ 800 billion by 2050.

Fortunately, the private and public sectors are both committed to working together to tackle this urgent, yet expensive challenge.

Are there targets for decarbonizing steel?

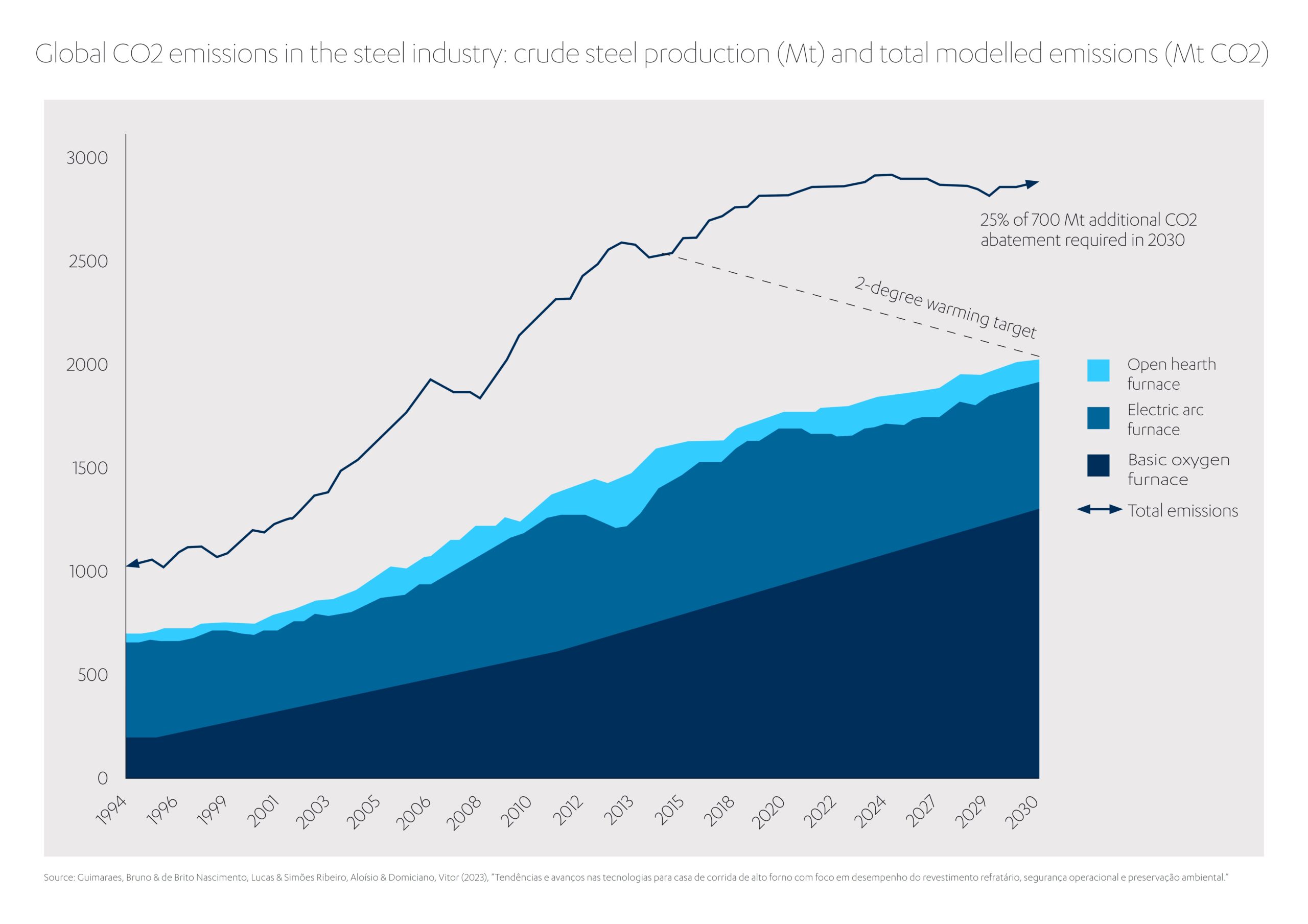

In terms of its environmental impact, the current outlook for steel manufacturing is not good: it accounts for about 8% of total global carbon dioxide emissions – more than any other heavy industry[10].

This makes the challenge to decarbonize immense. The good news is the sheer range and depth of innovation underway to take steel production to greener pastures. These include state-of-the-art electric arc furnaces that use less fossil fuel, and furnaces that run on green hydrogen to reduce carbon emissions. There are companies busy innovating with low-carbon iron and others embracing the idea of green-steel hubs that reconfigure the steel value chain in more efficient, less carbon intensive, ways. In fact, the WEF considers steel “one of the best candidates to lead decarbonization efforts”[11].

In its ‘Iron & Steel Technology Roadmap’[12], the IEA examines how best to make trade-offs between adopting different technologies. It says the onus is on both the private and public sectors to take responsible actions to help achieve this. Governments need to set and support green steel production targets, and manufacturers must invest in the technologies to achieve those targets.

So far, momentum appears to be moving in the right direction. For instance, the Organisation for Economic Co-operation and Development (OECD) points out that over 90% of steelmaking capacity is in countries that have set net-zero carbon emission targets[13].

Steel manufacturers themselves are keen to evolve strategies that comply with these objectives, and many have set their own decarbonization targets to guide the way. In its analysis of major steel producers, the OECD reports that “most [steel] companies… have set a decarbonisation target (88%), with 65% of the companies in the sample having set net-zero targets”[14]. However, it’s not all plain sailing. Most companies analysed by the OECD have set themselves post-2050 targets, with only two companies aiming for more ambitious dates ahead of this milestone year.

What are the main approaches to decarbonizing steel?

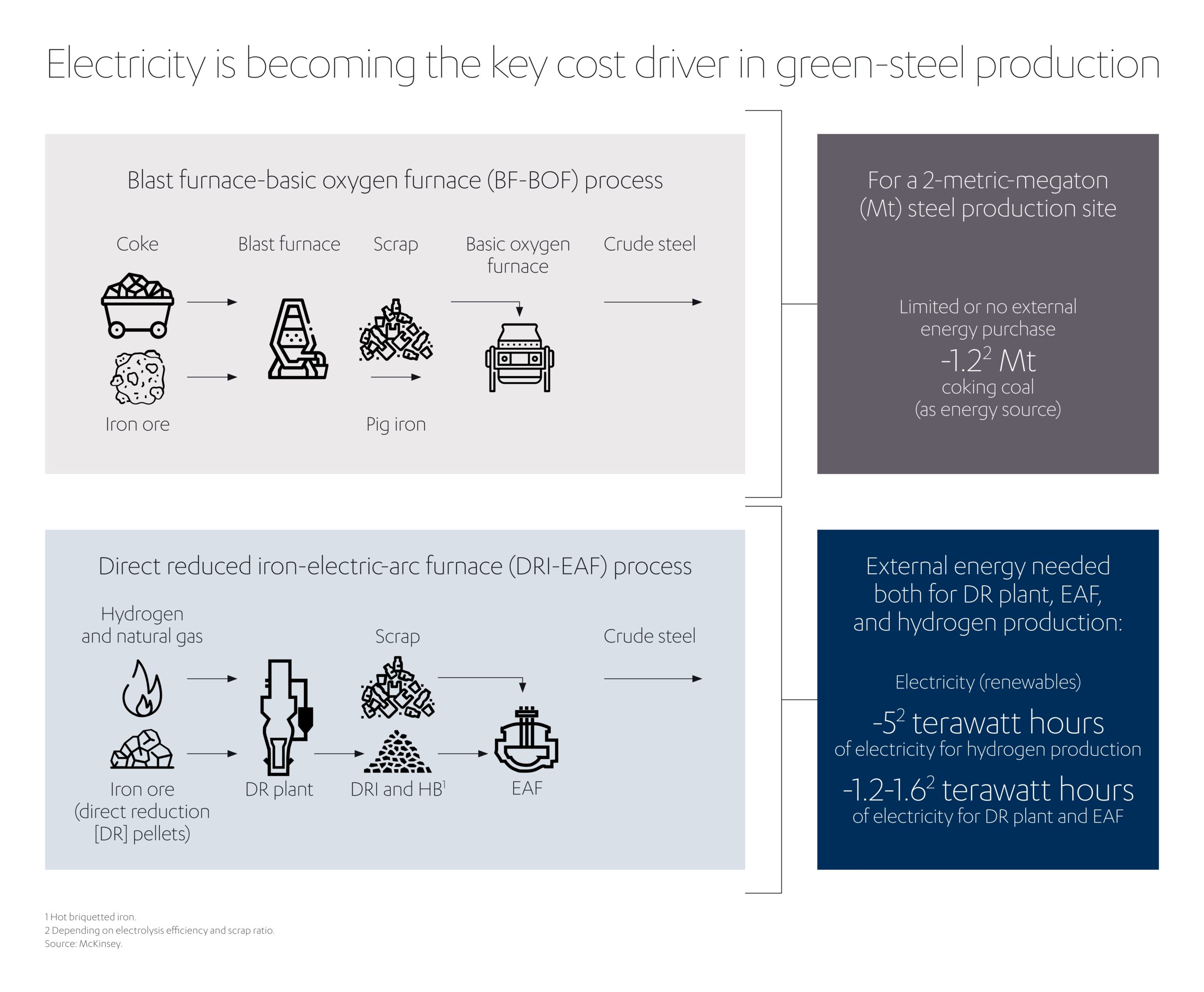

As the WEF notes, steel is a logical choice to focus on for decarbonizing, largely because in technology terms it is a highly advanced industry. Modern electric arc furnaces are less fossil-fuel intensive than traditional blast furnaces and already manufacture about 29% of conventional steel[15]. Indeed, the cost of electricity to power these furnaces is a key driver in the competitiveness of steel manufacturers, as highlighted in a green steel report from McKinsey[16].

Building more electric arc furnaces alone, however, is not the answer, as most of the power still comes from fossil fuel sources. To make a tangible difference, the same ingenuity that helped to turn iron into steel all those centuries ago is needed again for a fundamental step-change in production methods.

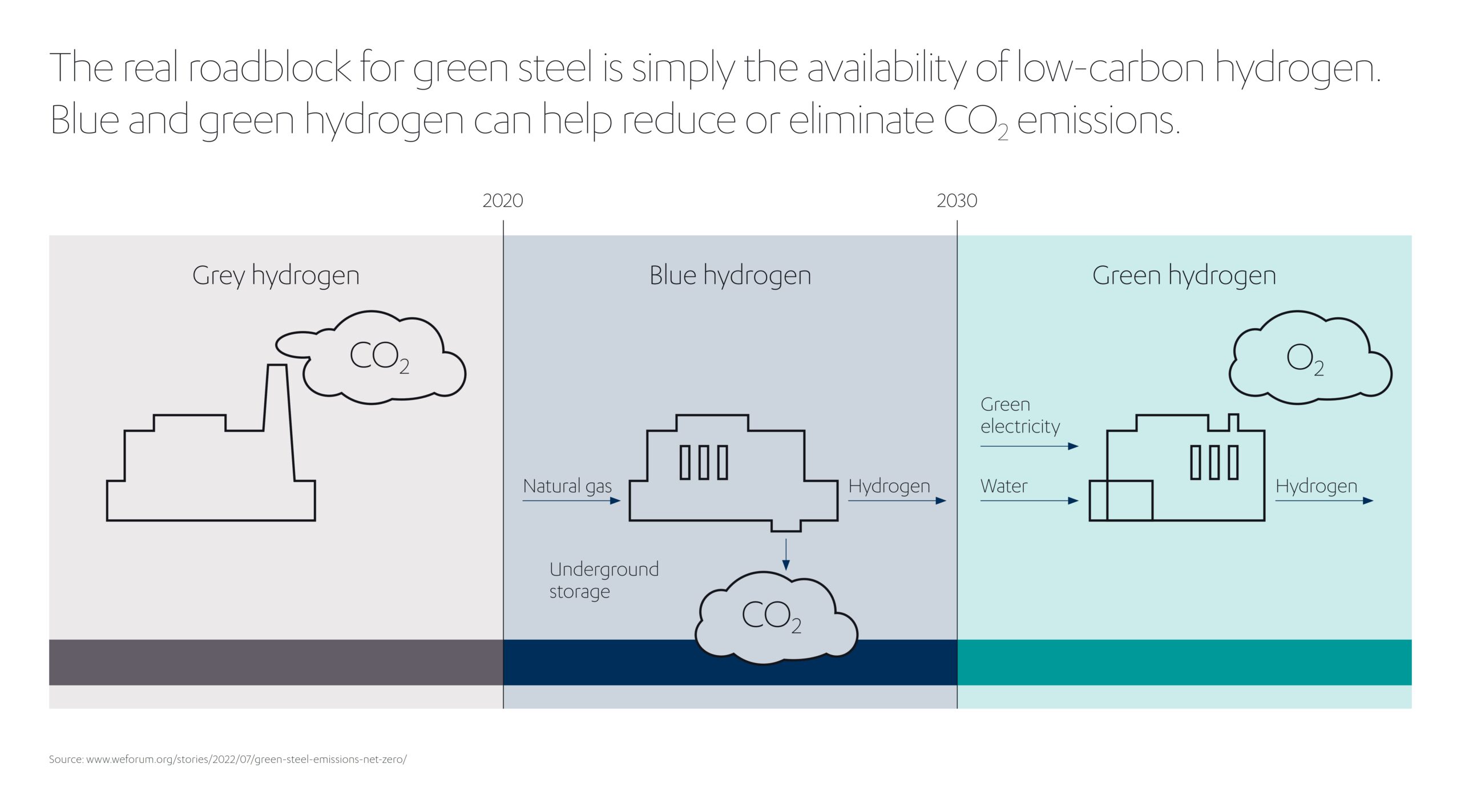

One of the most promising technologies is to use hydrogen rather than fossil fuels, which dramatically reduces the carbon footprint[17]. However, using the ‘right’ type of hydrogen is critical. Blue hydrogen is created from natural gas, with the resulting CO2 pumped into underground storage tanks or captured via CCUS technologies, while green hydrogen relies on green electricity and water, with little or no carbon emitted during production. In contrast, grey hydrogen is generally produced using fossil fuels to generate energy, so the overall carbon footprint is much higher.

Progress so far is promising. In the UAE, for example, Masdar (the national renewable energy company) and EMSTEEL have completed the region’s first pilot project using green hydrogen to produce green steel. The facility uses hydrogen generated via renewable-powered electrolysis to extract iron from ore, replacing natural gas in the direct reduction process. The project is fully operational and certified to international standards, with the potential to reduce CO₂ emissions from steelmaking by up to 95%[18].

A similar project in Boden, northern Sweden, is Europe’s first large-scale green steel plant. The H2 Green Steel facility replaces coal with green hydrogen, produced onsite using renewable electricity from hydropower and wind, to reduce iron ore in a direct reduction reactor. This process emits only water vapor, also cutting carbon emissions by up to 95% compared to traditional blast furnace methods. The plant aims to produce five million tons of green steel annually by 2030. H2 Green Steel is also developing additional projects in partnership with energy companies, such as a solar-powered plant in Spain[19].

Another approach being adopted is to use carbon capture technology to reduce the carbon footprint of steel production. In the United States, U.S. Steel has partnered with CarbonFree to construct North America’s first commercial-scale carbon capture utilization plant at its Gary Works facility in Indiana. The SkyCycle technology will capture up to 50,000 metric tons of CO₂ annually, mineralizing emissions into calcium carbonate for use in various industries. This project, operational by 2026, is a pioneering step in integrating carbon capture into traditional steelmaking and could be scaled across other facilities[20].

Of course, there is no steel without first making iron. But like steel manufacturing itself, producing iron is also rather energy hungry, with high carbon emissions due to the dominance of fossil fuels in the iron manufacturing process. Decarbonization initiatives are therefore focusing on greener technologies in the ironmaking part of the process. Worcester Polytechnic Institute in the US, for instance, is researching a method that uses low carbon electrolyzed iron powder to produce steel, significantly reducing energy use and greenhouse gas emissions[21].

In another example, Swiss-based mining and commodities business Ferrexpo estimates the iron ore pellets it supplies to industry can reduce carbon emissions by 40% for each ton of traditional iron ore sinter fines (or dust) that is replaced with its pellets[22]. Another mining company, Rio Tinto, uses raw biomass and microwave energy rather than coal to convert iron ore to iron, a process it claims “has the potential to reduce CO2 emissions by up to 95% compared with the current blast furnace method”[23].

Another area gaining traction is the concept of so-called ‘green-steel hubs’. As outlined in a report by McKinsey[24], a green steel hub is a strategically located industrial cluster or facility dedicated to producing low-carbon steel by integrating renewable energy, green hydrogen, and innovative technologies such as direct reduced iron (DRI) and electric arc furnaces. The hubs are deliberately sited in regions with abundant access to low-cost renewable energy (such as solar, wind, or hydro), suitable raw materials (like high-grade iron ore), and infrastructure that supports advanced, low-emission steelmaking processes.

Unlike traditional steel plants, green steel hubs focus on processes that drastically reduce or eliminate carbon emissions. This is typically achieved by:

- Using green hydrogen or natural gas (as a transitional step) instead of coke to reduce iron ore in DRI plants.

- Melting the resulting iron in electric arc furnaces powered by renewable electricity.

- Incorporating carbon capture, utilization, and storage (CCUS) where possible.

However, on the downside, experts say the cost of establishing hubs would be high and involve agreement from many stakeholders, including mining companies, energy providers, logistics companies, investors and governments.

What role can governments play in decarbonizing steel?

Governments have a significant role to play in terms of policy and regulation of the steel industry. Indeed, partnerships between governments and the private sector are deemed “fundamental to a sustainable future” by the World Steel Association[25].

The World Steel Association recommends that governments take steps to:

- Support multiple technologies

- Increase demand for low-carbon steel, despite its higher price

- Reward green steel products without disadvantaging companies that have already invested in efficient manufacturing techniques

- Provide funding to transition to green steel manufacturing

- Support the circular economy, particularly end-of-life scrap metal

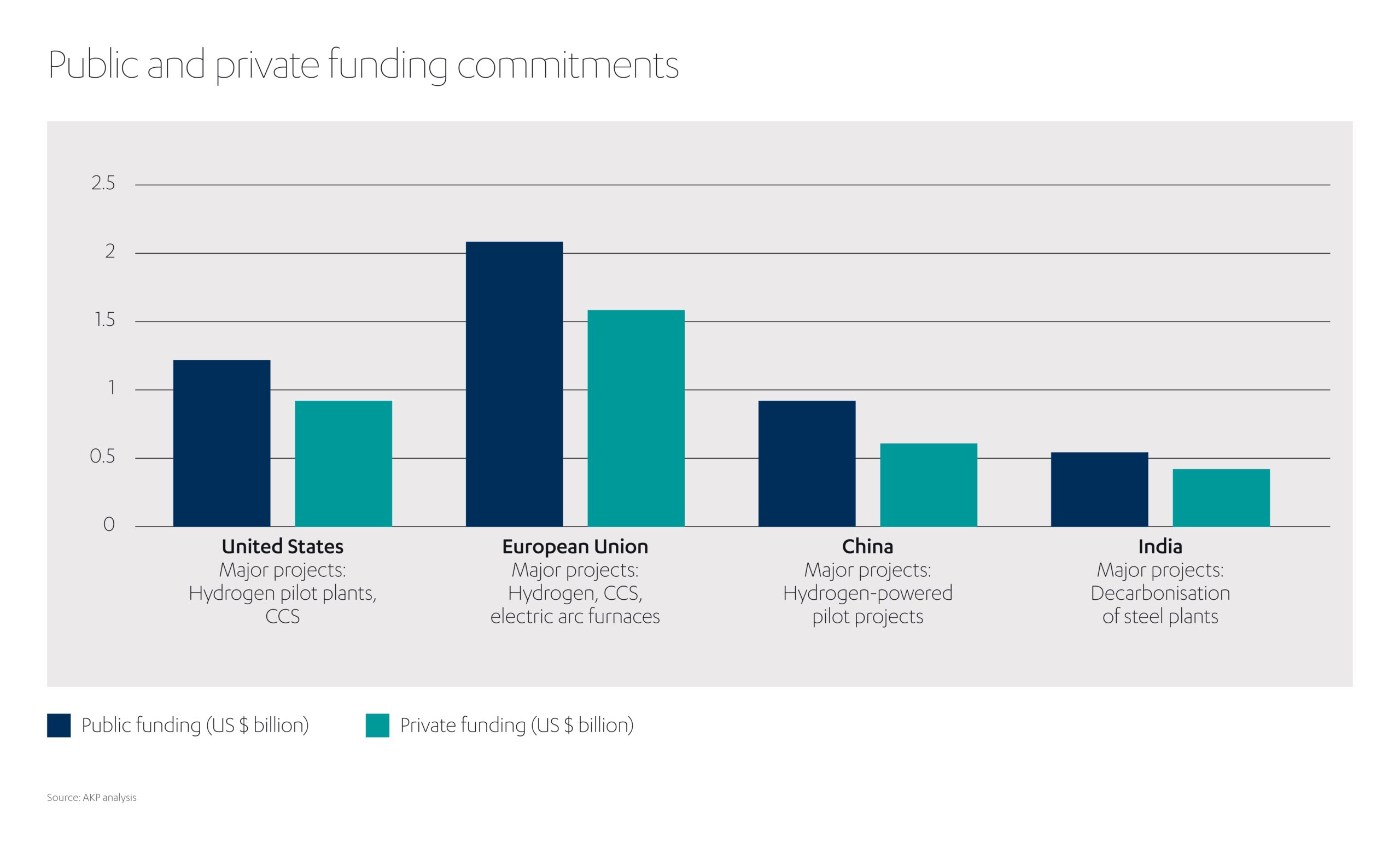

According to analysis by research and technology solutions firm Acuity Knowledge Partners, governments appear to be stepping up to the (steel) plate by putting up funds to support decarbonizing efforts[26] (see graph).

The European Commission, for example, is funding “clean steel” that focuses on lowering energy costs and creating markets for low-carbon products[27]. In Japan, the government’s Green Innovation Fund is channeling billions of yen into using hydrogen in iron and steel production[28]. Research into lowering carbon emissions in steel production in the US has received hefty funding from the government to the tune of US$1.2 billion[29].

Is there a consensus for change?

It’s not just governments and manufacturers who are keen for change to a greener future. Another encouraging aspect is how the attitudes of steel product purchasers are changing. It helps if people are happy to pay more for greener products – and steel is a case in point. In the short term at least, ‘green steel’ is more expensive steel, due to the additional costs involved in switching to more sustainable production methods. One way round this is to focus on the ‘green premium’ – that is, the extra cost that buyers are prepared to absorb, based on the additional value they perceive in doing so.

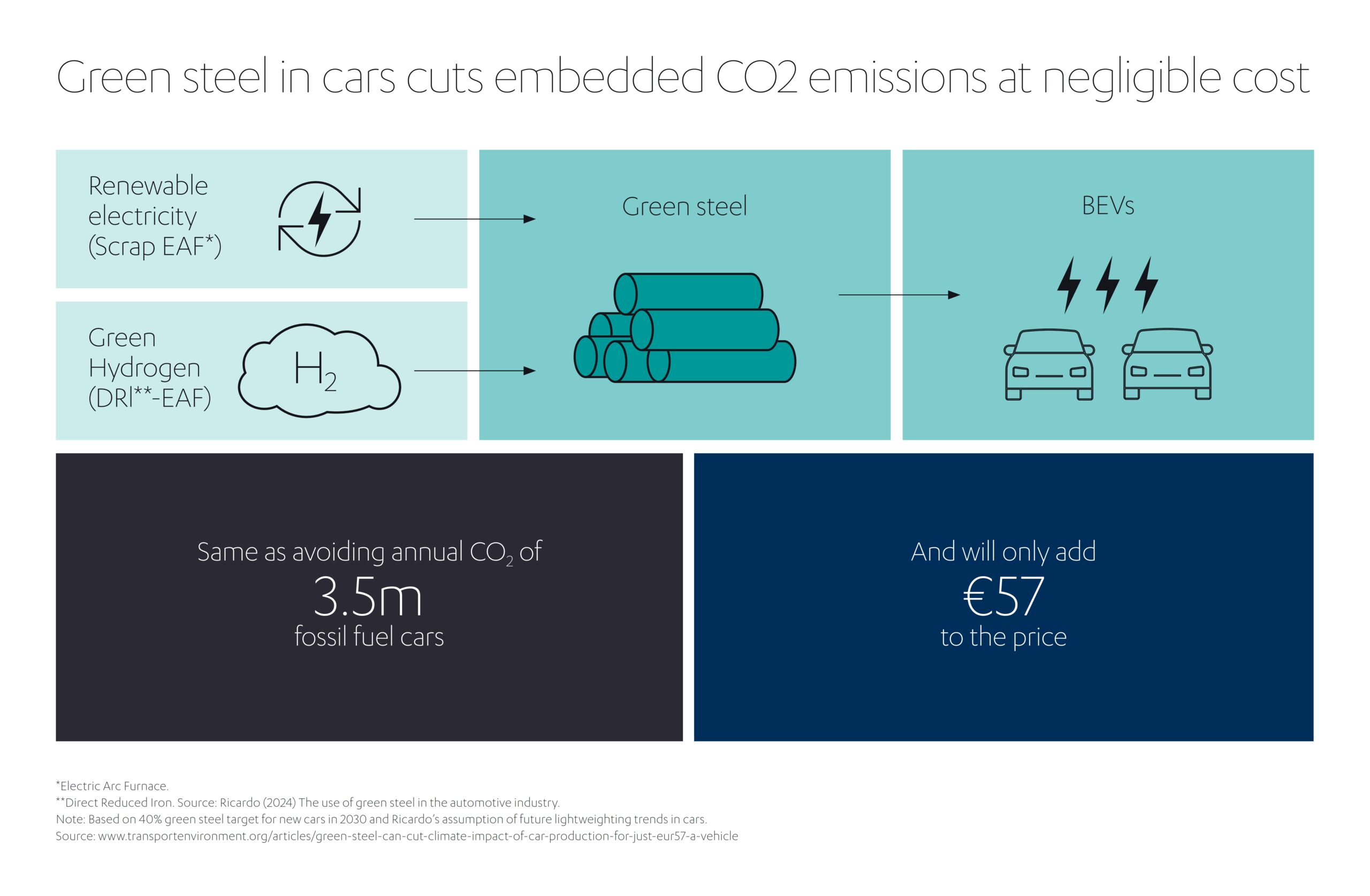

In the case of green steel, this covers things like better environmental sustainability, complying with regulatory rules on low-carbon production, and enhancing their brand reputation. In some industries, the estimated cost of green steel is negligible anyway. Take vehicle production. Transport & Environment, a leading European advocacy organization for clean transport and energy, estimates that switching to 40% green steel would add only €57 to the price of an electric vehicle in 2050[30]. A relatively small price, you would think, to help preserve the planet.

With the negative impacts of climate change being felt all around us, there is no time to lose in making the transition to greener steel. The WEF sees the next few years as make-or-break if the steel industry is to become a leading player in decarbonization[31]. The organization states: “The global economy needs to start applying resources efficiently to produce the biggest and fastest reduction of emissions possible, making the argument for prioritizing steel a strong one.”

Momentum is building, with the OECD identifying a growing number of low-carbon steel industry projects in recent years. Similarly, the IEA[32] calls for a “level playing field” for steel companies so they can move collectively down the decarbonization route.

The fact that steel is recyclable makes it a green product from the outset. With efforts underway to decarbonize its production process, steel’s green credentials can be burnished even further.

Governments are taking the challenge seriously. They understand the economic realities of having a strong, decarbonized steel sector. The private sector is likely to be comfortable investing in new steel production technologies when it can see risk and opportunity is suitably balanced.

The hurdles around the higher cost of green steel can be overcome with government support and efforts to educate purchasers, so demand gradually switches to decarbonized alternatives. The next steps in transforming the steel industry could be as crucial, and impactful, as the invention of steel itself.

Five fast facts on decarbonizing steel

- What percentage of global carbon dioxide emissions does steel production account for?

Steel manufacturing accounts for about 8% of total global carbon dioxide emissions – more than any other heavy industry. - How much investment is needed to decarbonize the steel industry by 2050?

According to Deloitte, decarbonizing the steel industry will need investment levels of around US$ 800 billion by 2050. - Which country dominates global steel production?

China leads global steel production by a considerable margin, accounting for over 50% of global annual steel production, with more than 1.8 billion tons produced worldwide in 2024. - How much can green hydrogen reduce carbon emissions in steel production?

Projects using green hydrogen to produce steel, such as those in the UAE and Sweden, have the potential to reduce CO₂ emissions from steelmaking by up to 95% compared to traditional methods. - How much would switching to green steel add to the cost of an electric vehicle?

Transport & Environment estimates that switching to 40% green steel would add only €57 to the price of an electric vehicle in 2050.

[1] https://www.sciencedirect.com/topics/engineering/automotive-steel

[2] https://www.iea.org/reports/iron-and-steel-technology-roadmap

[3] https://www.weforum.org/publications/the-net-zero-industry-tracker/in-full/steel-industry/

[4] https://worldsteel.org/climate-action/climate-change-and-the-production-of-iron-and-steel/

[5] https://worldsteel.org/media/press-releases/2025/december-2024-crude-steel-production-and-2024-global-totals

[6] https://www.iea.org/reports/iron-and-steel-technology-roadmap

[7] https://www.iea.org/energy-system/industry/steel

[8] https://www.mckinsey.com/industries/metals-and-mining/our-insights/green-steel-hubs-a-pathway-to-decarbonize-the-steel-industry

[9] https://www.deloitte.com/content/dam/assets-shared/docs/collections/2023/gx-greenspace-tech-research-green-steel.pdf

[10] https://www.weforum.org/stories/2022/07/green-steel-emissions-net-zero/

[11] https://www.weforum.org/stories/2023/08/why-steel-can-be-an-unexpected-leader-in-decarbonization/

[12] https://www.iea.org/reports/iron-and-steel-technology-roadmap

[13] https://www.oecd.org/en/publications/addressing-steel-decarbonisation-challenges-for-industry-and-policy_e6cb2f3c-en.html

[14] https://www.oecd.org/en/publications/addressing-steel-decarbonisation-challenges-for-industry-and-policy_e6cb2f3c-en.html

[15] https://www.weforum.org/stories/2023/08/why-steel-can-be-an-unexpected-leader-in-decarbonization/

[16] https://www.mckinsey.com/industries/metals-and-mining/our-insights/green-steel-hubs-a-pathway-to-decarbonize-the-steel-industry

[17] https://www.weforum.org/stories/2022/07/green-steel-emissions-net-zero/

[18] https://masdar.ae/en/news/newsroom/masdar-and-emsteel-announce-successful-pilot-project-using-green-hydrogen-to-produce-green-steel

[19] https://www.mining-technology.com/news/green-steel-hydrogen/

[20] https://www.esgtoday.com/u-s-steel-launches-project-to-capture-50000-tons-of-carbon-per-year-at-steel-plant/

[21] https://arpa-e.energy.gov/programs-and-initiatives/search-all-projects/low-carbon-iron-production-and-high-silicon-steel-manufacturing-lciphssm

[22] https://www.ferrexpo.com/what-we-do/a-low-carbon-pathway/

[23] https://www.riotinto.com/en/news/stories/decarbonising-steel-making

[24] https://www.mckinsey.com/industries/metals-and-mining/our-insights/green-steel-hubs-a-pathway-to-decarbonize-the-steel-industry

[25] https://worldsteel.org/climate-action/climate-change-and-the-production-of-iron-and-steel/

[26] https://www.acuitykp.com/blog/public-private-funding-green-steel-production/

[27] https://hadea.ec.europa.eu/news/european-clean-steel-discover-hadeas-projects-towards-climate-neutrality-and-circularity-2025-03-19_en

[28] https://www.iea.org/policies/13515-green-innovation-fund-hydrogen

[29] https://www.acuitykp.com/blog/public-private-funding-green-steel-production/

[30] https://www.transportenvironment.org/articles/green-steel-can-cut-climate-impact-of-car-production-for-just-eur57-a-vehicle

[31] https://www.weforum.org/stories/2023/08/why-steel-can-be-an-unexpected-leader-in-decarbonization/

[32] https://www.iea.org/reports/iron-and-steel-technology-roadmap

1x

1x

Added to press kit

Added to press kit