Setting a shining example

In amongst the uncertainty, disruption and economic contraction caused by the recent pandemic, it is encouraging, and heartening, to see there are still some positive indicators of a brighter future not too far around the corner.

Take the global energy sector. Although global consumption of most fuels fell during this ‘outlier’ of a year, renewables bucked the trend, experiencing unprecedented demand. Spearheading this growth was solar power. In 2020, solar recorded a 23% expansion of new PV installations to almost 135GW worldwide.[1] A burst of new activity that pushed global solar power capacity over the 700GW threshold[2] for the first time.

Little wonder the International Energy Agency (IEA) has crowned solar ‘the new king’ of global electricity markets. Moreover, the IEA notes that this solar shift shows no sign of abating.

Little wonder the International Energy Agency (IEA) has crowned solar ‘the new king’ of global electricity markets. Moreover, the IEA notes that this solar shift shows no sign of abating.

Indeed, it is tipping solar expansion to hit 145GW in 2021 and 162GW by 2022 (almost 50% higher than pre-pandemic levels of 2019), together representing more than half of all green energy expansion over that two-year period.[3] Hardly surprising, given that solar power is now the lowest-cost method of power generation in many countries boasting the right mix of plentiful sunshine and ready financing.

Solar dazzles around the world

Breaking down the figures, 2020’s 135GW of new solar energy spanned the market, comprising 75.9GW utility-scale installations, 30.1GW commercial/industrial installations, 27.5GW residential installations, and 0.5GW off-grid installations.

Not only has solar power proved versatile in 2020, but this growth has also been truly global.

China led the solar surge with 48.2GW of additional capacity, prompted partly by the imminent conclusion of its solar subsidy schemes.

Elsewhere, Europe recorded 20.4GW of solar growth, the USA 19.3GW, ASEAN (Association of Southeast Asian Nations) 12GW, Japan 9GW, Latin America 6GW, Australia 5GW and India 3.9GW[4].

The USA’s 19.3GW growth, overshadowing 2019’s 13.2GW, affirmed its status as the world’s largest power purchase agreement (PPA) market for utility-scale projects. So active was the second half of the year that it more than offset the Covid-induced lethargy of the first six months, carrying the USA past the 100GW total installed solar capacity mark.

Europe’s expansion represented the second-best year ever for solar growth in the EU, according to Solar Power Europe. The top three performing markets were Germany, The Netherlands and Spain[5]. Germany consolidated its position as Europe’s solar leader, with investors capitalizing on preferential feed-in premiums for medium and large-scale systems from 40kW to 750kW, supported by a raft of auctions for systems up to 10MW. Solar power grew in Germany by 4.8GW in 2020, 25% higher than the previous year.

The Netherlands became Europe’s second largest solar market with 2.8GW of new installations in 2020, a 23% rise year-on-year, with commercial rooftop installations accounting for almost half of its solar total. The Netherlands’ largest solar plant to date commenced operations this year, a 110MW facility in Groningen province.

Spain expanded its solar capacity by 2.6GW, down sharply from the previous year’s 4.8GW (when figures were skewed by two power plant tenders coming online), but enough to maintain its position as one of Europe’s key solar sites. Some 1.5GW of Spain’s 2020 installations came via PPAs stemming from an in-progress 100GW pipeline.

Such enthusiasm for solar power should come as little surprise given that the industry has the potential to meet one-fifth of Europe’s electricity demand by 2030, providing up to 4 million jobs in the process.[6]

Bright future despite supply chain setback

The data is proof, if any were needed, that solar is here to stay – despite sporadic logistical bumps in the road. Fires at two silicon manufacturing plants in China (a key exporter of solar PV modules) halved the country’s silicon output in 2020, for example. The incidents reversed the 25% price drop in solar modules achieved during the first half of 2020, and by September had sent silicon prices soaring 60%.[7]

Other materials critical for solar panels also escalated in cost in the second half of the year. PV glass prices, for instance, rose by half due to delays in modernizing production lines, while steel and copper prices increased 40% from September 2020 to March 2021 as industries bounced back from Covid slowdowns and demand increased. High oil prices trebled freight costs, affecting profitability at a crucial period.

Fortunately, these supply chain issues and resultant higher costs are not expected to be long term. A new wave of silicon plants are scheduled to be operational in China by mid-2022, while glass manufacturers are likewise predicted to increase their output, bringing module prices back down from their US$ 0.205/watt high of 2020.

Around the world, buoyed by supportive policy environments, investors are waiting to pounce on the potential of solar power in the near future, as illustrated by developments in some key markets[8].

The United States is expecting to see 44.3GW of new solar capacity over 2021/2022, fueled by a year-long extension to the country’s Investment Tax Credit (ITC). The number of utility-scale projects will rise due to higher corporate demand via PPAs, largely driven by falling costs.

Europe is forecast to host 49.1GW of new solar capacity in 2021/2022, thanks to auctions in Germany, France, Poland and Turkey, as well as Spain’s corporate PPAs.

In China, 110.5GW of new solar capacity is predicted for 2021/2022. Some 40GW of subsidy-free schemes will be greenlit under 20-year contracts, despite the recent axing of subsidies for utility-scale and commercial/industrial PV projects. Residential solar subsidies are expected to remain, maintaining the upward trend in smaller PV installations.

In Latin America, meanwhile, 21GW of new solar capacity forecast for 2021/2022, with brisk solar growth expected in Brazil and Chile. Brazil’s beneficial net-metering scheme will trigger a rapid expansion of distributed PV projects, while Chile’s utility-scale market is anticipating high levels of activity spurred by earlier auctions. The cancellation of clean energy certificate auctions is expected to hinder new developments in Mexico. However, many utility-scale projects already in the pipeline will become operational in 2021/2022 before any new rules take effect.

Australia weathered an oversupply of clean energy certificates in 2020 which hampered profitability at utility scale-level. Corporate PPAs are likely to restore commercial confidence and 9GW of additional solar capacity is forecast for 2021/2022. Lower down the policy chain, some states are encouraging distributed PV growth by supporting the expansion of battery storage facilities.

India’s solar capacity additions trebled in 2021 compared to 2020 as several utility-scale projects belatedly came online. The government granted 27GW of solar contracts during 2020 via auctions, ensuring continued PV growth this year and next. However, regulatory disharmony between states continues to constrain distributed PV expansion. Overall, India is anticipating 26.1GW of new solar capacity in 2021/2022.

Policy, as we can see, is pivotal to a thriving solar energy market. And 2021 could be a landmark year for renewable energy policies globally.

Policymakers take a shine to solar

Solar power’s limitless potential has seared itself indelibly into the public consciousness during 2021’s COP26 gathering of world leaders. The watershed UN Climate Change conference took place in Glasgow, UK, during November, billed as a last-ditch chance to avert environmental breakdown over the coming decades.

The timing is critical, with pre-COP26 plans to cut global carbon emissions falling 60% short of targets necessary for net zero, according to the IEA.[9] The IEA estimates an extra US$ 4 trillion of investment is essential for transforming the concept of net zero from pipe dream to reality. This will require a substantial shift in public sector investment policies: pre-COP26, for every US$ 1/capita earmarked for clean energy in COVID-recovery packages among G20 countries, US$ 1.05/capita was being spent supporting fossil fuel industries.[10]

As state leaders departed the conference and left further dealmaking to negotiators, it was clear solar will play a major part in the global transition to clean energy. Trade body SolarPower Europe is already pushing for a 45% EU renewable energy target by 2030, which it says offer the most cost-effective path to keeping the 1.5°C Paris limit alive and would put the continent on the trajectory towards achieving climate neutrality by 2050[11].

CEO, SolarPower Europe

“Increasing the EU’s renewable energy ambition is possible and will shield consumers from high energy prices while stimulating the growth of a domestic solar manufacturing industry…

Solar will continue to be crucial tool in the fight against climate change as it prevents over 90% of carbon emissions compared to gas or coal, while creating the most jobs of any energy generation technology,” said Walburga Hemetsberger, CEO of SolarPower Europe.

India and the UK also launched a project to create a solar grid connecting countries around the world.[12] The so-called Green Grids Initiative has the potential to transfer solar power from one country to another as the sun rises and sets, allowing round-the-clock green energy, even at nighttime. Around US$ 10 billion funding is being sought to get the project under way, though operations are unlikely to commence for at least a year.

India was absent though from another major deal, in which more than 40 countries pledged to phase-out use of coal-fired power entirely and refocus on renewables instead.[13] Canada, Poland, South Korea, Ukraine, Indonesia and Vietnam will cease using coal for electricity generation during the 2030s and 2040s. Apart from India, several other coal-dependent economies likewise refused to sign up to the deal including China, Australia and the USA – but green campaigners vowed to keep applying pressure to these holdouts.

Also unveiled during the conference was a US$ 8.5 billion international grant to assist South Africa – currently one of the world’s largest coal polluters – to boost renewables and stop burning fossil fuels.[14] Six 75 MW solar parks are due to be built in Tokologo, in the Lejweleputswa District of the Free State region.

More initiatives are set to follow as the commercial case for solar becomes increasingly watertight. With the cost of renewable energy continuing to decline, solar power is joining wind as the cheapest source of electricity in many markets.

Solar power prices fell to an average of US$ 0.057/kWh in 2020, down from US$ 0.381/kWh a decade earlier.[15] Only hydropower (US$ 0.044/kWh) and onshore wind (US$ 0.039/kWh) hit a lower price point among renewables in 2020.

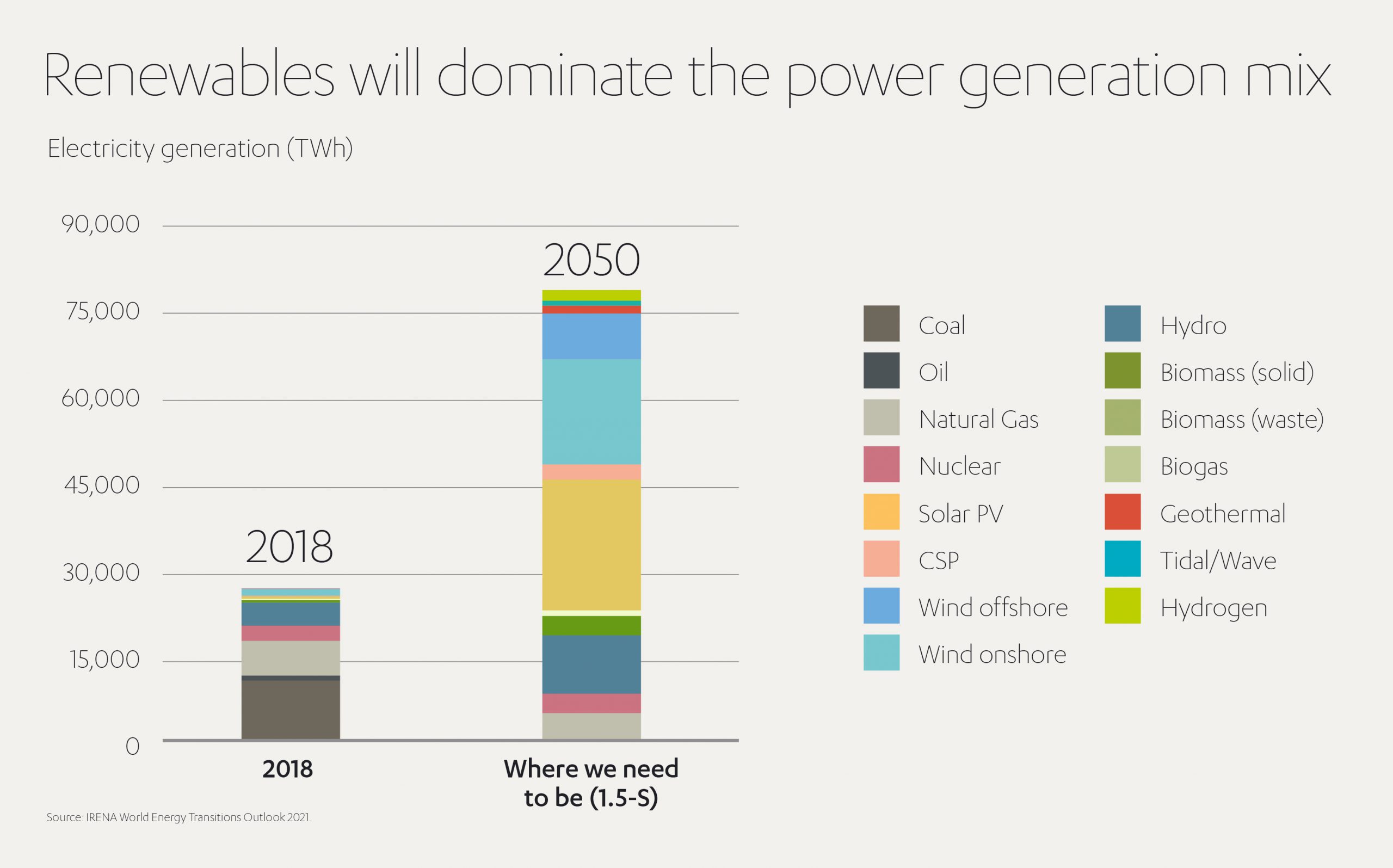

The International Renewable Energy Agency (IRENA) estimates that in order to hit 2050 climate goals, solar power must by that date achieve 15,000GW global capacity. That’s big business, and a mission which will entail harnessing the vision, skills and spending power of the private sector.

At the forefront of the green energy transition

At Abdul Latif Jameel we are committed to playing our part in the energy transformation through our flagship renewables business Fotowatio Renewable Ventures (FRV), part of Abdul Latif Jameel Energy.

With a presence on five continents, FRV has developed over 50 renewable energy plants and has a project portfolio of over 2.5 GW in global solar markets across Australia, the Middle East, India, Africa, USA and Latin America.

One of its most active markets is Australia where, in December 2020, it secured financing for the 150MW Metz Solar Farm in New South Wales, scheduled to power some 40,000 homes. It also won planning approval for the 300MW Walla Walla Solar Farm in New South Wales to power a further 90,000 domestic and business properties. These schemes add to FRV’s existing Australian developments at Sebastopol, Goonumbla and Moree (all New South Wales), Lilyvale (Queensland), Winton (Victoria) and a hybrid solar PV/battery storage project at Dalby (Queensland).

Meanwhile, FRV continues to expand its presence Latin America. In Chile, it is backing a hybrid solar-wind project to supply almost 250,000 homes with clean energy. It developed the huge 65MW La Jacinta solar plant in Salto, Uruguay, and there are two major FRV solar developments in Mexico: the Potosi solar plant in San Luis de Potosi, which began operations in 2019 and generates 815,000MW annually; and the Potrero solar plant in Jalisco, powering 128,000 homes since 2020.

In addition it has a growing portfolio across Europe, Armenia and Jordan, where the Al Safawi, Mafraq 1 and Empire solar plants supply 435 million kWh of electricity per year, powering 65,500 homes across the country.

FRV is also at the vanguard of high-tech battery technologies, through its dedicated innovation arm, FRV-X.

Battery technology is already transforming renewable energy’s potential, hastening solar’s journey to the top of the power agenda. Two landmark battery storage projects in the UK in partnership with Harmony Energy demonstrate FRV’s commitment to cutting edge energy storage solutions.

Chief Executive Officer, FRV

The first, a 15 MWh utility-scale battery array at Holes Bay, Dorset, which links to the Southern Electric Power distribution network, began operating in July 2020. The second, the Contego project near Burgess Hill in West Sussex, boasts a system of 28 Tesla Megapack lithium-ion batteries, employing Tesla’s Autobidder AI software for real-time trading and control. FRV’s latest project – and the UK’s largest battery energy storage system (BESS) – was also recently announced at Clay Tye in Essex.

“We are proud to be at the heart of the battle, driving forward a new vision for the world’s energy landscape and transferring world-class skills, knowledge and best practice to the communities in which we operate,” says Daniel Sagi-Vela, Chief Executive Officer, FRV .

Solar’s time to shine

Deputy President & Vice Chairman,

Abdul Latif Jameel

As the reams of evidence and data continue to stack up about the urgent need to act now in order to avoid a climate calamity. And with the hopes and ambitions – and warnings – laid out at the COP26 climate summit still ringing in our ears, the unstoppable growth of solar power, and its potential to make a significant contribution to a carbon-free future, is an opportunity we must not pass up.

With its sharply declining costs and ever-greater energy yields, solar power provides us with a life-raft. It is pivotal to the climate fightback, a fightback that must begin today.

“In a rapidly warming world, utilizing our sun’s free, clean energy can help us reverse the deteriorating state of our planet’s biodiversity and climate,” says Fady Jameel, Deputy President and Vice Chairman, Abdul Latif Jameel.

“At Abdul Latif Jameel, we aim to demonstrate day-by-day, deal-by-deal, how the private sector can encourage the solar transition, inspiring governments and businesses around the world to safeguard our environment for generations to come.”

[1] https://www.iea.org/reports/renewable-energy-market-update-2021/renewable-electricity

[2] https://ourworldindata.org/grapher/installed-solar-pv-capacity

[3] https://www.iea.org/reports/renewable-energy-market-update-2021/renewable-electricity

[4] https://www.iea.org/reports/renewable-energy-market-update-2021/renewable-electricity

[5] https://www.solarpowereurope.org/wp-content/uploads/2020/12/3520-SPE-EMO-2020-report-11-mr.pdf?cf_id=42694

[6] https://www.solarpowereurope.org/wp-content/uploads/2020/12/3520-SPE-EMO-2020-report-11-mr.pdf?cf_id=42694

[7] https://www.iea.org/reports/renewable-energy-market-update-2021/renewable-electricity

[8] https://www.solarpowereurope.org/wp-content/uploads/2020/12/3520-SPE-EMO-2020-report-11-mr.pdf?cf_id=42694

[9] https://www.iea.org/reports/world-energy-outlook-2021

[10] https://gwec.net/wp-content/uploads/2021/03/GWEC-Global-Wind-Report-2021.pdf

[11] https://www.solarpowereurope.org/post-cop26-the-eu-must-increase-its-renewable-energy-target-to-meet-the-paris-agreement-goal/

[12] https://www.independent.co.uk/news/india-scotland-glasgow-france-paris-b1948542.html

[13] https://www.theguardian.com/environment/2021/nov/03/more-than-40-countries-agree-to-phase-out-coal-fired-power

[14] https://www.pv-magazine.com/2021/11/02/south-africa-gets-8-5-billion-to-phase-out-coal-boost-renewables/

[15] https://www.irena.org/publications/2021/Jun/World-Energy-Transitions-Outlook

1x

1x

Added to press kit

Added to press kit