Driving force: meeting the power demands of the EV revolution

Electric vehicles (EVs) are without doubt, a continuing modern transport success story.

The Toyota Prius was the first modern mass-produced car to use electric propulsion[1], pairing a small, efficient, 1.5-liter petrol engine with an electric motor and recovering energy from braking (regenerative braking) to improve fuel efficiency. Since Toyota – a business partner of Abdul Lateef Jameel for approaching seven decades – launched the Prius in 1997, sales of cars that use battery power to supplement or replace internal combustion have risen constantly, powered by advantages to the motorist such as economy and performance gains, as well as environmental and regulatory concerns, and driven in many countries by incentives in the form of taxation, or practical gains including free in-city parking, for example.

By the end of 2021, one new car in five in Europe[2] and one in seven in China[3] could be plugged in and charged rather than filling up at the pumps. Initially, it was hybrids like the Prius that began to win over public opinion. But with battery technology advancing exponentially in the past five years, pure electric vehicles (EVs) are increasingly common sights on our roads.

EVs are booming at a time when overall car sales are slipping downwards[4]. In the UK and Denmark, it will be illegal to sell a new car with no electric drivetrain by 2030[5][6]. Even hybrids will be banned by 2030. Most European countries have similar targets, and China will outlaw pure diesel or gasoline cars by 2035.

Consumers are enthusiastically taking up electric cars, captivated by the lower running costs, quieter and smoother ride, easier maintenance, and green credentials. Manufacturers – including all-electric disruptors like Tesla, RIVIAN, NIO and Polestar – are rapidly stepping up their ability to supply rising demand with new, innovative models in every segment of the market. For its part, Toyota is planning to offer 30 battery-electric models, including delivery vans, by 2030, as part of its ambition to sell 3.5 million battery electric vehicles (BEVs) a year (up from today’s 2 million), from a global total of 10 million vehicle sales.

EVs in all sectors

Electric passenger cars may already be a common sight on the high street, but battery power is not confined to one type of transport. Electric buses are taking over from diesel, with Shenzhen, China, being the first to electrify its entire fleet in 2020.

Electric vans have been slower to appear en-masse, but Nissan, Renault and Mercedes now have electric ranges and with the arrival of the electric Ford Transit[7], there can be no doubt that they, too, are reaching the mainstream.

Startups Arrival[8] and Volta[9], as well as established players Volvo, DAF and Mercedes, are making larger commercial vehicles.

Even the biggest articulated trucks will soon move over to battery power, with huge batteries and charging systems delivering up to 2MW[10] in development to take on the long distances and heavy loads required.

Away from the showrooms, an equally bigger although less visible shift is having to take place.

Where internal combustion cars have required a giant infrastructure of tankers and filling stations to keep them moving, electric cars require a power grid to keep them moving – an infrastructure that our existing power systems were not built to cope with. Regulators, supply companies, grid operators, local delivery networks and charging point operators across the world are facing a huge challenge: as EVs become more and more popular, how do we make sure there is enough power at the right time to keep everyone moving?

A challenge, not a problem

Power supply experts are keen not to downplay the seriousness of the transformation required, but also clear that with proper planning and investment, we are more than capable of providing plenty of power for an electrified transport future[11]. Partly this will be down to upgrades to the grid and new generation facilities, but it will also be possible thanks to clever optimization of existing assets and the use of data to spread the extra load.

Experts at McKinsey & Co. found that in Germany, for example, the grid would likely to require an extra 5GW of peak capacity by 2030[12] in an entirely unmanaged possible scenario where everyone plugs in their EVs to charge immediately. This is equivalent to six large modern gas-fired power stations, which would dent the country’s ambition to achieve a net zero power grid by 2035[13]. Fortunately, there are many solutions to minimize the peak and use clean power instead.

Local delivery networks can see where the peaks in demand occur, and when. In an area where there is a high concentration of electric cars – a residential suburb, for example, with drives, garages and home chargers, or a commercial vehicle depot – there will be a peak at the end of the working day when the vehicles are finished with and plugged in to be ready for the next morning. This puts a strain on the local exchange, which can either be met, in the short term, by ramping up power generation using oil and gas or, more sustainably, by using more efficient, low- or zero-carbon energy sources.

Active and passive solutions

Power companies, governments and, increasingly, public opinion, agree that simply building new power stations is not the way to meet the coming challenge. It is expensive and wasteful to build large, centralized greenhouse-gas emitting facilities that will only be required for a few peak hours a day in particular areas.

The smarter solutions to this localized strain on the grid can be divided into two categories: active and passive.

Passive solutions place the actions in the hands of the consumer, incentivizing them to use timers to take advantage of overnight off-peak supply with lower prices. The Octopus Go[14] tariff in the UK, for example, currently charges just 7.5p per kWh in the early hours of the morning, less than half the average national cost and equivalent to about 3p per mile in popular electric cars.

Some tariffs reflect the constantly changing price of electricity, so homes with their own storage – home batteries or smart hot water and heating systems – can take advantage of lower prices in particularly windy or sunny conditions. Sometimes the price of power even drops below zero, effectively paying the householder to absorb excess electricity and balance the grid[15].

Active solutions involve the power supply companies, grid operators and local delivery networks using data to remotely control charge points, both public and private. They ensure that cars are correctly charged in plenty of time for when they’re required, but not necessarily immediately on plugging in.

This control can start at the exchange, where local storage facilities can be deployed for a reasonable cost, much lower than building new generators. These would be charged slowly during non-peak hours using excess supply from renewable sources such as solar and wind that are more plentiful during the day and supplementing the supply when charging begins[16]. Alternatively, smart meters and chargers can take note of when the cars will be required, then communicate among themselves to balance the load across the area throughout the night[17].

Similarly, a commercial vehicle depot could use its own scheduling software to create its own local version of the same thing, minimizing the required capacity, and therefore the cost, of their private wire network, but still meeting the needs of a large fleet by spreading the charging across a number of vehicles through the night.

EVs themselves can become grid assets as vehicle-to-grid capabilities become more common. A plugged-in vehicle that does not need charging can smooth out demand in an area by absorbing excess renewable and zero-carbon generation when it’s available and discharging it when needed. This would bypass the need for stationary batteries that require land and investment, but still providing a good quality stable supply for the neighborhood.

While the first generations of EVs might not have featured vehicle-to-grid charging, it is increasingly common.

Ford’s F150 Lightning electric pickups all have it as standard, as do many Nissans and the popular Hyundai Ioniq5.

Upcoming models from Volkswagen, Renault, Polestar and Volvo will all be capable of giving back to the grid when needed. In rural and suburban areas, where driveways and garages are more common and unused cars are more likely to be able to be plugged in, vehicle-to-grid capacity will also greatly lessen the need for surge upgrades.

Smart upgrades away from population centers

Rural areas are likely to need the most extensive and expensive grid upgrades to meet fast charging requirements, and local storage capacity can provide a very cost-effective solution here, too.

Individual properties or small groups can share low-cost batteries that have been retired from use in electric vehicles with a low-voltage supply. This local surge capacity can be trickle charged for most of the day, then step in at peak times to provide the 7kW of power that modern drivers will expect.

Installation of local storage not only avoids the high cost of upgrading the grid in more remote communities, but also the delays. Local solutions side-step the necessity of reinforcing the grid all the way from the big exchanges to every farmhouse and hamlet, allowing rural homeowners to enjoy the advantages of electric driving, without worrying about overloading their outdated circuits.

Scarce engineering capacity and regulatory requirements often make rural grid reinforcement work more time-consuming than it needs to be. This could make it hard for networks to keep up with demand – which is growing fast.

Studies in areas with long waiting times or unreliable charging point networks report a much lower level of EV takeup. Northern Ireland[18] is a case in point, where a lack of investment in the public charger network and regulators dragging their feet over grid work has sapped consumer confidence and stalled the level of electric cars on the road at 0.4%, a tiny number compared to Norway’s 17%, the highest in the world.

Lack of charging standards

Another factor that could hinder the take-up of EVs is the lack of global charging standards.

There are three levels of charging available for EV owners:

- AC Level 1: This will charge a vehicle at a rate of 5 miles per hour using a standard 110V outlet.

- AC Level 2: The most popular type of charger for those who charge at home. Charges at between 10 and 30 miles per hour using a 240V outlet.

- DC Rapid Charge (Level 3): Most common in commercial or industrial settings. Rapid chargers can provide as much as 150 miles of charge in an hour.

Rapid charging is the ‘gold standard’ for publicly accessible chargers, but the picture is further complicated by the existence of four competing rapid electric charging protocols across the world, each using a range of different connectors, as summarized in the table below:

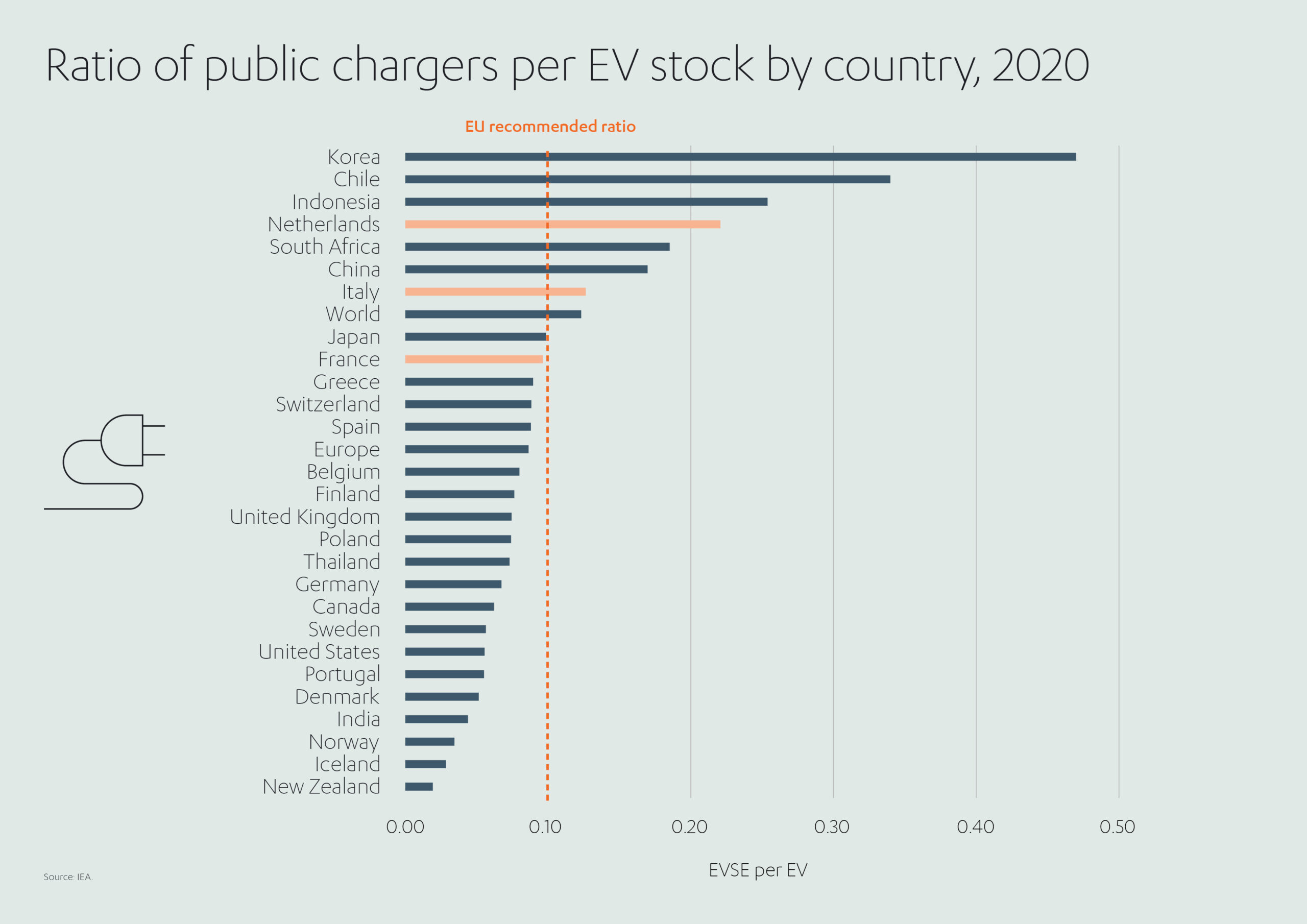

In the long term, much like the Betamax/VHS ‘video wars’ of the 1980s, it is inevitable that one or two standards will dominate. But in the short term, it is another factor to be considered by EV owners, manufacturers and regulators. As, too, is the inconsistent investment in public charging infrastructure globally. Although the rollout of public chargers (both fast and slow) is picking up pace in all markets – up to 1.8 million public charging points in 2021 [19]– there is considerable disparity between countries. In the EU, for example, most countries failed to meet the recommended ratio of public chargers to EVs in 2020[20].

Driving electric is a premier experience

Despite these challenges, Governments all over the world are determined – and committed – to reach a future where human activity does not continue to harm the climate by emitting harmful carbon-based greenhouse gases. The burgeoning alternative fuels industry wants to grow, consumers are increasingly receptive to EVs, and greater diversity of fuel sources is good for us all. So, what’s in it at the personal level for individual vehicle owners?

Traditionally, consumer confidence in EVs has been hindered by concerns over so-called ‘range anxiety’, the lack of convenient charging points and purchase price[21]. But all these factors are now being addressed through advances in technology, more investment, and more EV-friendly regulatory strategies.

EVs are not just a feel-good decision to help save the planet. Consumers are realizing that driving electric can be a better experience all-round than petrol or diesel – and it’s getting better all the time. The ride is smoother and quieter, braking is sharper and quicker, and acceleration can be ‘blisteringly’ fast, adding some ‘fun-based’ incentive to switch.

Electric motors are smaller than their internal combustion equivalents and batteries are designed to fit under the vehicle’s floor, so electric cars have more space inside. Fewer moving parts means less to go wrong and. And with a reliable place to charge, even the inconvenience of stopping for fuel is eliminated as the battery-powered motorist simply plugs in when they’re finished for the day.

Rapidly falling battery prices and government subsidies mean that the cost of new EVs is moving closer to their more traditional counterparts and the hugely reduced cost of fuel and maintenance means that the lifetime cost of owning an EV fell below that of petrol years ago[22].

Less than 1% of EV drivers would go back to petrol or diesel cars[23], even before the large-scale deployment of fast home chargers or rapid public chargers in workplaces or car parks. Once they have experienced one, drivers realize that it is simply better to own an EV. It is this very attractiveness to the consumer that is driving fast uptake of EV technology and placing new demands on the electricity grid.

Virtual power plants

Stationary storage, smart charging, and vehicle-to-grid cars, combine to create what has become known as a virtual power plant, a key factor in the power infrastructure that will keep EVs moving without breaking government carbon targets. This paradigm shift from centralized planning and large industrialized power generation to smaller autonomous units, circular economy planning, and smart distribution will eventually remove the need for peak power plants and allow for true zero carbon e-mobility. This transformation will be aided by an array of exciting new EV charging technologies, from wireless charging or battery swapping, to rooftop solar panels and roads that charge your vehicle while you drive.

Governments achieve their carbon targets, electricity companies are saved the expense of building new power stations and the consumer has a more reliable and flexible power supply at a lower cost, all through the power of planning and smart engineering. A zero-carbon sustainable future is not only desirable, but also within our reach.

The EV sales boom shows that the adoption of battery-powered vehicles is on a one-way trajectory. With planning and co-operation between manufacturers, power generators, distributors and, crucially, local government, this huge shift in mobility can be achieved smoothly and without disruption, for the great benefit of both consumers and the planet.

[1] https://global.toyota/en/prius20th/evolution/

[2] https://www.ey.com/en_gl/energy-resources/as-emobility-accelerates-can-utilities-move-evs-into-the-fast-lane

[3] https://www.scmp.com/business/china-business/article/3163005/electric-cars-account-over-20-cent-chinas-new-vehicle-sales

[4] https://www.oica.net/category/sales-statistics/

[5] https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/111820-factbox-uk-brings-forward-ban-on-new-ice-cars-to-2030

[6] https://www.euractiv.com/section/electric-cars/news/denmark-to-ban-petrol-and-diesel-car-sales-by-2030/

[7] https://www.ford.co.uk/vans-and-pickups/e-transit

[8] https://www.thetimes.co.uk/article/electric-van-maker-arrivals-big-plan-to-start-small-ch3cb9s2q

[9] https://www.commercialfleet.org/news/truck-news/2021/11/03/volta-zero-revealed-in-production-ready-form

[10] https://electrek.co/2018/05/10/chargepoint-2-mw-charger-electric-aircraft-and-semi-trucks/

[11] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-potential-impact-of-electric-vehicles-on-global-energy-systems

[12] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-potential-impact-of-electric-vehicles-on-global-energy-systems

[13] https://time.com/6124079/germany-government-green/

[14] https://octopus.energy/go/

[15] https://www.sciencedirect.com/science/article/pii/S2666792421000652

[16] https://new.abb.com/news/detail/46325/the-future-of-the-power-grid-in-the-coming-era-of-e-mobility

[17] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-potential-impact-of-electric-vehicles-on-global-energy-systems

[18] https://www.assemblyresearchmatters.org/2021/11/02/are-electric-cars-a-realistic-alternative-to-petrol-and-diesel-in-northern-ireland-today/

[19] https://vehiclefreak.com/ev-statistics/

[20] https://iea.blob.core.windows.net/assets/ed5f4484-f556-4110-8c5c-4ede8bcba637/GlobalEVOutlook2021.pdf

[21] https://today.yougov.com/topics/consumer/articles-reports/2020/10/23/whats-stopping-americans-buying-electric-cars

[22] http://evtc.fsec.ucf.edu/research/project6.html

[23] https://www.energylivenews.com/2022/01/12/ev-drivers-have-no-interest-in-returning-to-petrol-or-diesel/#:~:text=Less%20than%201%25%20of%20electric,cars%20and%20lower%20running%20costs.

1x

1x

Added to press kit

Added to press kit