Driving force: EVs accelerate new vehicle sales

The year 2020 was one to forget for most businesses, with unprecedented pressure on sales, revenues and staff and customers alike. Even for those sectors lucky enough to withstand the worst impacts of the pandemic, it was a harsh reminder of the merciless ups and downs of global markets.

Against the backdrop of such economic uncertainty, for an industry to not only survive, but to thrive, is something truly special: a hallmark of some deeper immunity; a sign that momentum is becoming so compelling that it is almost hardwired into a product’s very DNA.

Which is why, perhaps, electric vehicles (EVs) have bucked the recession by booming during these torrid times.

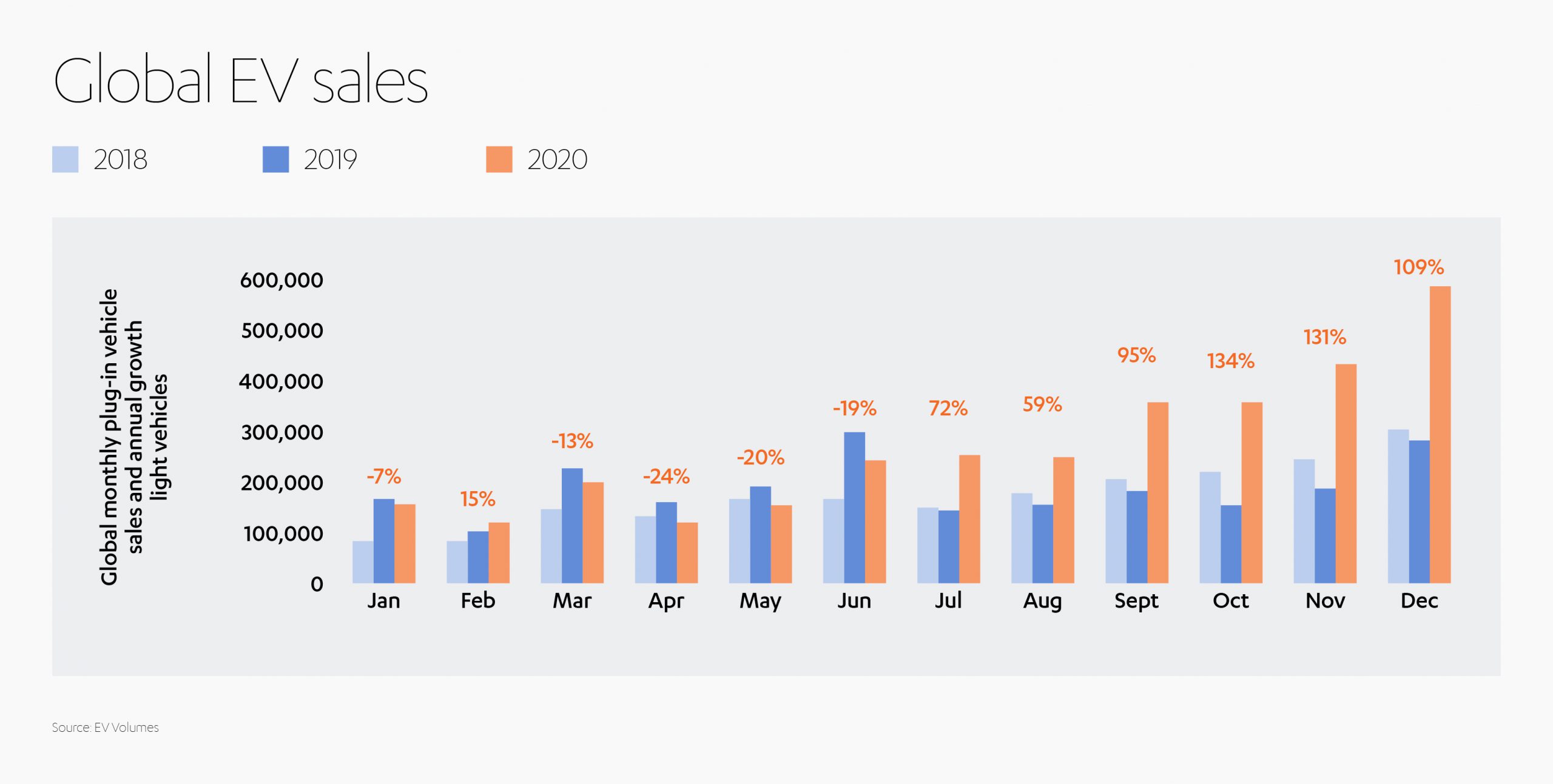

The International Energy Agency (IEA) estimates that EV sales globally grew to more than 3 million during 2020, marking a record-breaking year for electric mobility as market share passed 4%.[1] This translates to a 40% rise in global sales from 2019’s 2.1 million, meaning the number of EVs on roads worldwide now exceeds 10 million.

For those who think that all private vehicles experienced a sales surge during the pandemic, as people shunned virus-prone public transport, think again – because overall car sales fell by a fifth during the same period.[2]

EVs are a genuine economic outlier, a clarion call alerting OEMs and governments alike that buyers have collectively decided on a cleaner, greener future.

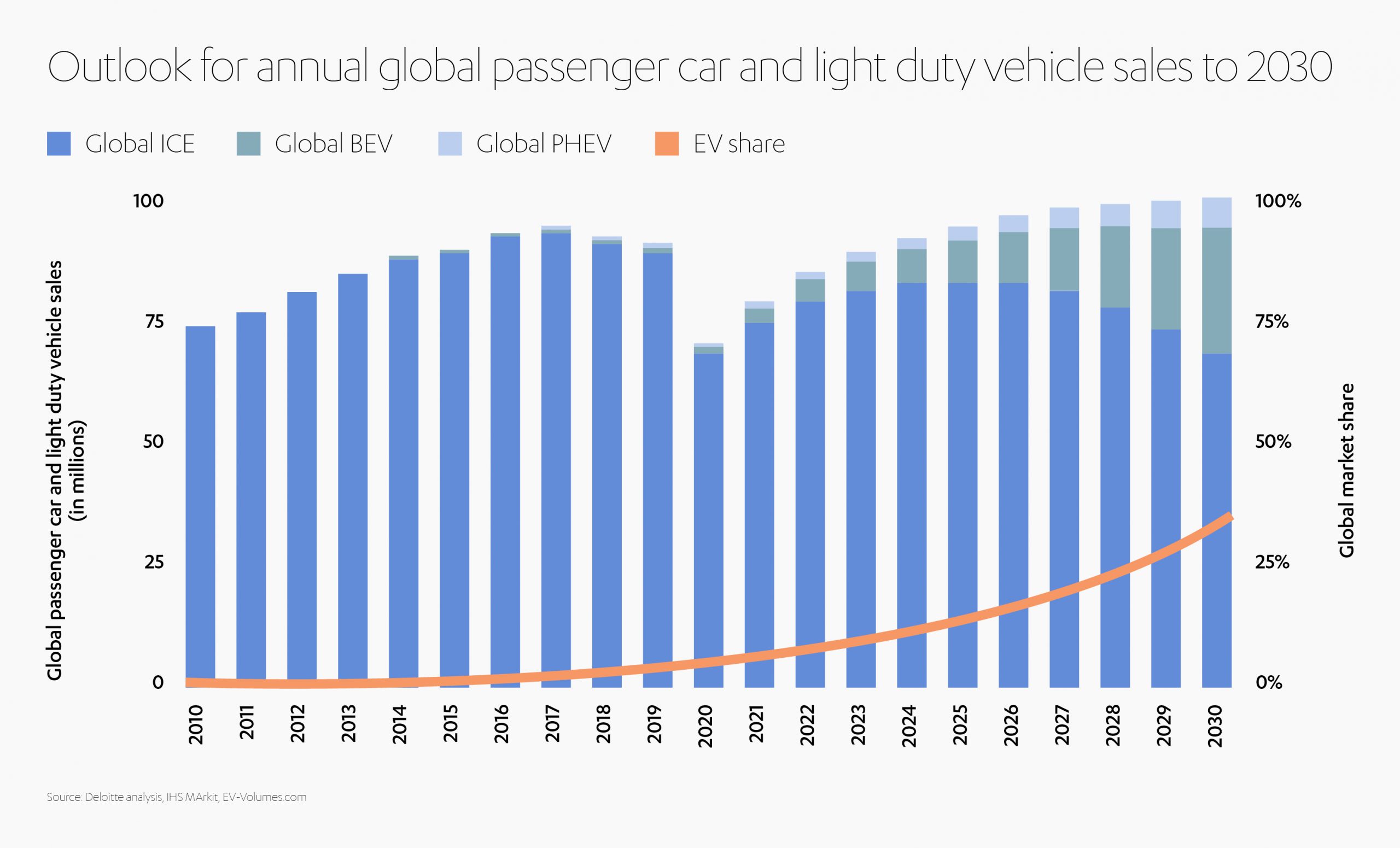

The current 4% market share sounds impressive enough, but it is merely the beginning of a longer-term pattern. Consultancy giant Deloitte anticipates a compound annual growth rate in EV sales of 29% over the coming decade, increasing to 11.2 million in 2025 and 31.1 million by 2030 – by then accounting for a third of all new car sales.[3]

The trend is unmistakable and unrelenting. So, just how have EVs become one of the automotive industry’s recent success stories?

What’s fuelling the EV charge ahead?

The IEA, one of the few organizations to accurately predict the rise in EV sales during the pandemic, identifies several reasons why the sector has experienced such disproportionate growth over the last few years.[4]

- Strong policy support at state level in many key markets around the world

- Declining cost of producing one of the key and most expensive components: batteries

- Wider model choice and upgraded performance across all OEMs (including new market entrants)

- Fleet operators transitioning to greener technologies

- Increased enthusiasm for EV environmental benefits among consumers

Of these, government policy support and targeted stimulus packages (typically in the form of purchase incentives) have – not surprisingly as a stronger driver of consumer behavior than any of the products themselves – proved particularly impactful.

While tactics have varied from country to country, the general strategy has been to encourage more EVs on to the roads in place of less environmentally friendly internal combustion engine (ICE) models.

Looking at some major markets, the European Union set stringent new emission limits of 95g CO2/km for 2020-2021.

France is running a €6,000 subsidy offer for low-emission vehicles, as well as a €2,500 trade-in deal scheme for ICE cars. It is hoping to install 100,000 publicly accessible charge points by the end of 2022.

Italy and the UK have likewise launched purchase subsidies (up to €6,000 and £3,500 respectively).

Germany has decreed that all petrol stations must in future offer electric charging facilities.

Policy impacts could be even more dramatic if the two major markets, China and the United States, join the national stimulus bandwagon. China actually reduced the subsidies available to consumers in 2019, but other incentives remain. The government is investing heavily in the charging infrastructure and there is a continued focus on encouraging Chinese manufacturers to produce and market EVs. In the US, some states – notably California – are taking a massively pro-EV approach. The ‘sunshine state’ has long been a global trendsetter in green mobility. In September 2020, it introduced legislation to require all new cars sold in the state to be zero-emission by 2035, effectively banning the sale of new vehicles that are powered by an internal combustion engine, which includes gasoline, diesel and even hybrid electric vehicles. Used cars that are non-zero-emission will still be able to be operated and sold, however. The new executive order complements a similar regulation announced in 2019 to ban the sale of non-zero-emission trucks by 2045.

At the federal level, President Biden has vowed to tackle greenhouse gas emissions and boost sales of electric vehicles. He has also promised to replace the government’s fleet of roughly 650,000 cars with electric models and to build 550,000 electric vehicle charging stations to forge a clean energy future.

Many of the new EV policies are wrapped up in more general ‘COVID recovery’ programs, similar to those implemented after the 2008-2009 financial crash. However, there are important differences, according to the IEA[5]. First, there is a clearer focus on boosting the uptake of electric and hybrid vehicles. Secondly, several countries are looking at EVs as part of a more integrated approach to mobility, by also – and crucially – considering charging infrastructure and providing support to both public transport and non‑motorized mobility options. This sits in the broader context of commitments to clean energy transitions made prior to the Covid-19 crisis, such as the EU Green Deal[6], and can generally be seen as supporting other commitments to achieving net-zero emissions by mid-century.

As welcome as these policy innovations are, however, they cannot take all the credit for the boom in EV sales. One of the main reasons for the growth in popularity is simple – consumers are increasingly recognizing that electric cars are a better technology. There is no noise, no pollution, better acceleration, and ever more competitive running costs[7]. The main issue at the moment is that the price is a little bit higher, but purchase costs are already coming down, thanks largely to a series of new advances in technology.

Technology transforming the terrain for EVs

An EV is only useful if it is periodically united with a charging point – otherwise, it becomes little more than an attractive driveway adornment.

Fortunately, the charging options for EV owners are rapidly expanding.

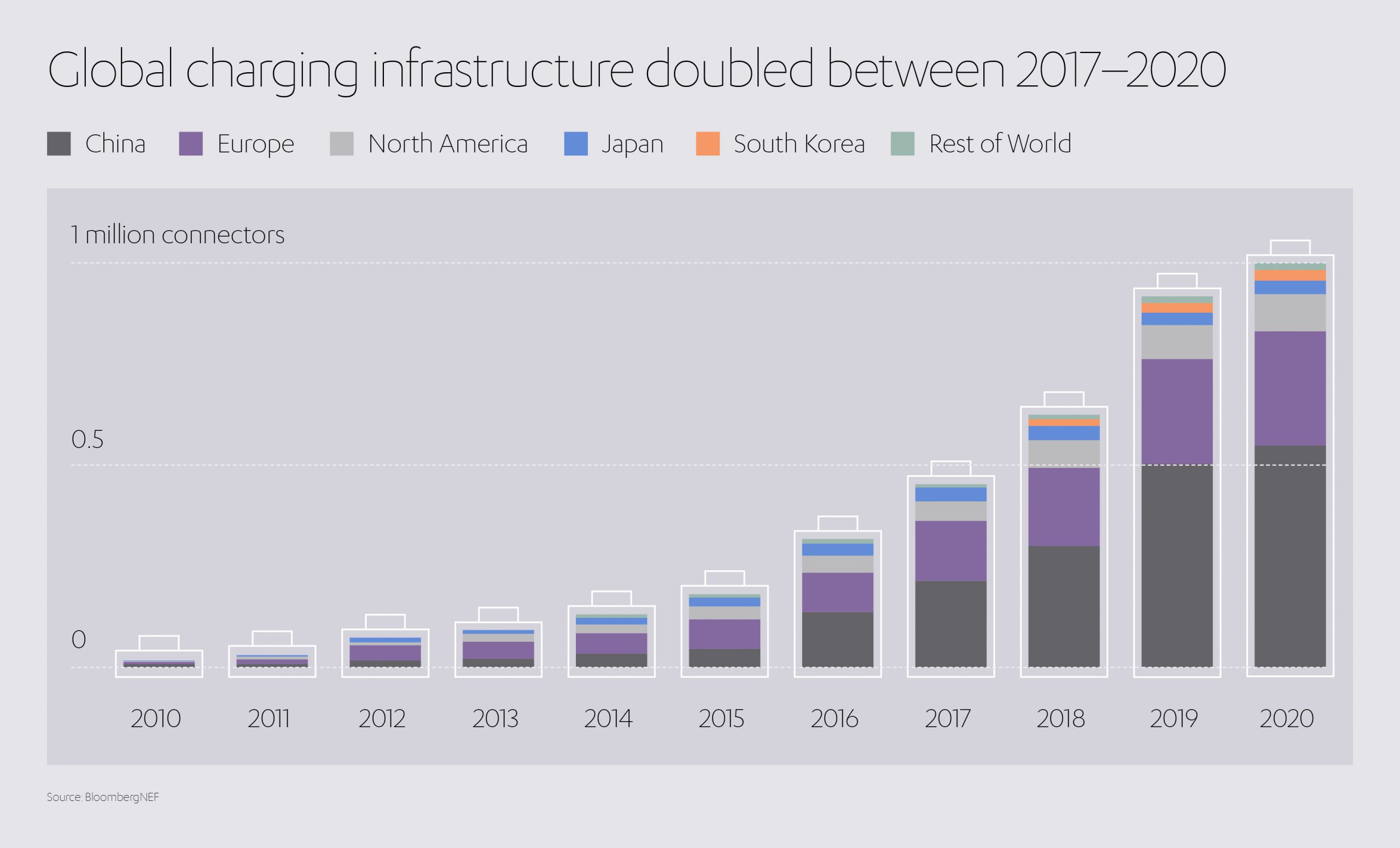

By 2019 there were some 7.3 million charge points worldwide, comprising 6.5 million private domestic chargers (at homes and workplaces) with the remainder being in publicly accessible plug-and-go locations.[8]

This figure of 7.3 million represents a 60% increase on the previous year, a faster rate of increase than the global stock of EVs, meaning more charge points per vehicle – good news for drivers with journeys to make and little time to waste queuing for a top-up.

The European Union has a stated goal of 1 million public chargers by 2025[9]. The UK plans to invest £1.8 billion in charging infrastructure between 2021 – 2025[10], with wireless charging and ‘pop-up’ pavement technologies both winning new funding, and California has unveiled proposals for a US$ 1.5 billion plan to boost the green vehicle market, including US$ 300 million to install electric charging points at all state-owned facilities, ahead of its zero-emission car rules coming into force in 2035.

Batteries themselves are undergoing rapid enhancements, too, as discussed in more detail in this Abdul Latif Jameel Perspectives article, allaying the concerns of those who once feared battery limitations would mean EVs were only ever feasible only for short journeys. By 2030, average battery sizes of 70-80 kWh will provide standard driving ranges of 350-400km; enough, in real terms, to travel the length of the UK with just one charge-up en-route.[11]

So-called ‘rapid battery swap’ technology, where drivers pull into an automated bay to have their depleted EV battery automatically swapped with a fully-charged replacement in just a few minutes, could also help to strengthen confidence in electric vehicles. Renault is reportedly considering introducing battery-swapping capabilities, which would significantly cut waiting times at recharging stations[12], while earlier this year Chinese EV maker NIO reached a milestone of two million battery swaps and plans to double its Chinese network to more than 500 battery swap stations in 2021[13].

In tandem with improved performance and range, battery costs are also falling sharply. Battery pack prices clocked in at an average of US$ 156/kWh in 2019, down from more than US$ 1,100/kWh in 2010, making them all the more enticing to the consumer.

Additional developments in battery design and thermal management systems promise to further cut the costs of both pack and module components. Post-2030, more breakthroughs are expected which could supersede current performance limits of lithium-ion batteries. Lithium-metal solid state batteries, lithium-sulfur, sodium-ion or lithium-air batteries could all trigger improvements in cost, density and life cycle.

With such investments from manufacturers inspiring greater customer confidence in the long-term viability of battery-powered personal transport, it is little surprise EVs have been racing to secure a firm foothold in the automotive market.

And there is more good news for consumers, in that as prices come down, choice is going up. Recent company announcements have made it clear that there will be substantially more EV models commercially available over the next decade than previously thought. According to statistics cited by the European Federation for Transport and Environment, Europe should expect 22 new models in 2021, 30 in 2022 and 33 in 2023[14]. This means that BEV (Battery Electric Vehicle) models available in the EU will surpass 100 in 2022 and reach 172 in 2025. In the United States, IHS Markit predicts there will be 130 available models by 2026, offered by 43 brands[15].

Mapping the upswing in EV adoption

While EV numbers are growing everywhere, the rate of this expansion varies globally – cruising in some markets, finding top gear in others.

Bucking the pandemic’s trend of lower vehicle sales, almost 1.4 million new EVs were registered in Europe in 2020, 137% up on 2019, thanks to a combination of green recovery funds and widespread marketing.[16]

Indeed, Europe has for the first time since 2015 passed China at the forefront of EV growth. Europe’s EV proportion increased from 3.3% in 2019 to 10.2% in 2020, outpacing China’s 5.1% to 5.5% increase in the same period.

China still remained a potent market, of course, its EV sales rebounding strongly in the second half of 2020 and finishing up 12% for the year.

Many European markets double or even tripled their EV sales in 2020, with Germany’s impressive 254% increase seeing it become the second largest single country for EV sales behind only China. The United States witnessed a more modest 4% growth, despite the launch of the Tesla Model-Y, but even this slender expansion left the overall auto-market (-15%) trailing in its wake.

Elsewhere, sales spikes in the UAE, India, Hong Kong, South Korea, Taiwan and Israel offset mild declines in Australia, Canada and Japan.

By 2030, it is estimated that China will hold 49 per cent of the global EV market, Europe will account for 27 per cent, and the United States will hold 14 per cent[17].

With governments and manufacturers firmly on board, and public perceptions ever more positive, the EV takeover is primed to ride out any bumps in the road. It is here where private capital can spur both big business and governments to drive a greener recovery by accelerating the EV transition.

In the front seat of EV opportunities

As passionate about the environment as we are about cutting-edge technology, Abdul Latif Jameel is determined to play its part in the coming EV revolution.

Early champions of the cause, we have been promoting the virtues of EVs almost since their inception. This ethos is evident from our long-standing partnership with Toyota Motor Corporation, a motor manufacturer renowned for its long-term vision and dedication to green principles.

In 2021, Toyota announced the launch of Toyota bZ (beyond zero), its newly established series of battery electric vehicles (BEVs), as it unveiled a concept version of the Toyota bZ4X at the Auto Shanghai motor show.

The Toyota bZ4X is set to launch in Japan and China with a view to worldwide sales of the model starting by the middle of 2022. Toyota has also announced plans to have 70 new or updated electric models on the market by 2025, including 15 BEVs[18].

Other OEMs are following a similar path. General Motors plans to launch 30 new global electric vehicles by 2025[19]; Mercedes-Benz unveiled an electric version of its S-Class saloon (EQS) in April 2021, with eight further models planned within two years[20]; BMW is aiming to get 25 electrified vehicles on the road by 2023, in addition to its existing i3 and i8 BEVs[21]; Nissan has announced plans to sell 1 million EVs annually by 2023, spearheaded by its Leaf and Ariya models[22]; while Volkswagen has set itself a 2025 deadline for overtaking Tesla as the world’s biggest seller of EVs, a plan that includes building six battery factories in Europe alone by 2030.

Another trail-blazer is US-based EV startup RIVIAN, in which Abdul Latif Jameel is a major investor. RIVIAN’s range of trucks and SUVs (with a 105kWh lithium-ion battery for a 109 mile range, or a 180 kWh battery for a 400 mile range) use AI technology to help drivers extend their battery life threefold by optimizing their charging habits – just the kind of innovation that can provide a further jolt to the flourishing EV market.

Already, online retail behemoth Amazon has ordered 100,000 electric delivery vans from Rivian to help fulfill its pledge (Climate Pledge 2040) of running a 100% renewable energy fleet by 2030.[23]

Our investments at Abdul Latif Jameel now span the whole EV value chain: from vehicles, to parts and fleet servicing, even to clean energy generation, distribution and storage, via Fotowatio Renewable Ventures (FRV), part of Abdul Latif Jameel Energy.

Technology, legislation and investment aside, EVs remain for the moment partially a hearts-and-minds proposition. And yet it appears consumers are increasingly shopping with their conscience.

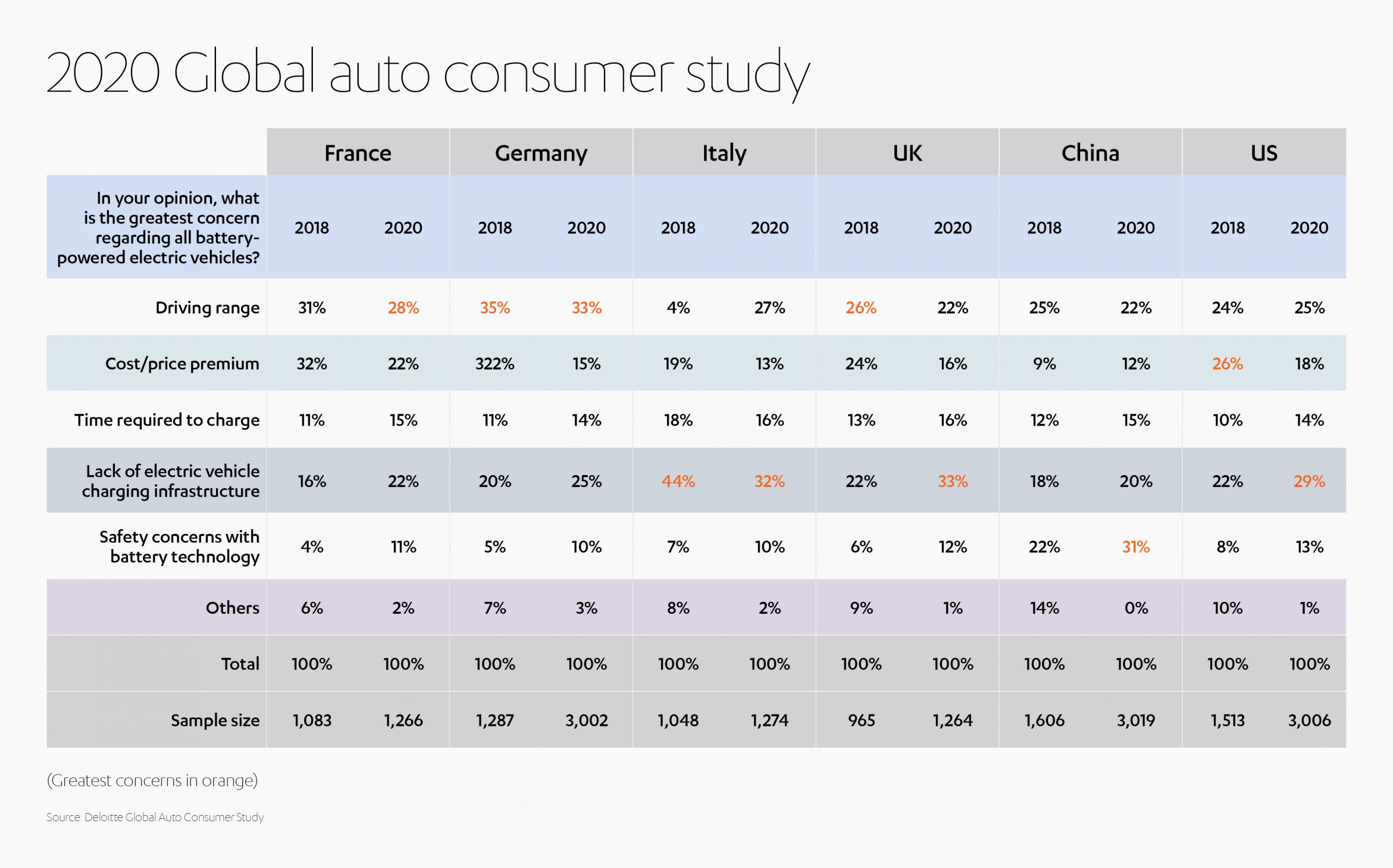

A recent survey by global consultancy Deloitte indicated that more than half of respondents purchasing a new car in the next three years would consider an EV – considerably more than the 35% leaning towards a petrol or diesel vehicle.[24]

The direction of travel seems assured. Only the speed of the journey remains to be determined.

[1] https://www.iea.org/commentaries/how-global-electric-car-sales-defied-covid-19-in-2020

[2] https://www.theguardian.com/environment/2021/jan/19/global-sales-of-electric-cars-accelerate-fast-in-2020-despite-covid-pandemic

[3] https://www2.deloitte.com/uk/en/insights/focus/future-of-mobility/electric-vehicle-trends-2030.html

[4] https://www.iea.org/commentaries/how-global-electric-car-sales-defied-covid-19-in-2020

[5] How global electric car sales defied Covid-19 in 2020 – Analysis – IEA

[6] EUR-Lex – 52019DC0640 – EN – EUR-Lex (europa.eu)

[7] Electric cars are already cheaper to own and run, says study | Electric, hybrid and low-emission cars | The Guardian

[8] Global EV Outlook 2020, IEA

[9] https://www.bloomberg.com/news/articles/2020-06-23/electric-car-charging-stations-are-finally-about-to-take-off?sref=JuSsFiEr

[10] Government powers up electric vehicle revolution with £20 million chargepoints boost – GOV.UK (www.gov.uk)

[11] https://www.iea.org/reports/global-ev-outlook-2020#batteries-an-essential-technology-to-electrify-road-transport

[12] https://www.ft.com/content/cac5c438-900a-46ee-9564-43aa905db4b6

[13] NIO completes 2,000,000 battery swaps – Green Car Congress

[14] Electric surge: Carmakers’ electric car plans across Europe 2019-2025, European Federation for Transport and Environment

[15] Outside of Tesla, future EV sales in U.S. may be thin for most brands: study”, Reuters

[16] https://www.ev-volumes.com/

[17] Electric vehicle trends | Deloitte Insights

[18] Toyota Beyond Zero. Let’s go beyond zero. | Toyota UK

[19] GM’s Path to an All-Electric Future | General Motors

[20] Mercedes kick-starts Tesla offensive with luxury electric car | Financial Times (ft.com)

[21] BMW electric: Munich’s present and upcoming EVs in detail | CAR Magazine

[22] Electric dreams come true as the world’s first mass-market electric vehicle reaches historic milestone (nissannews.com)

[23] https://www.cnbc.com/2019/09/19/amazon-is-purchasing-100000-rivian-electric-vans.html

[24] https://www2.deloitte.com/uk/en/insights/focus/future-of-mobility/electric-vehicle-trends-2030.html

1x

1x

Added to press kit

Added to press kit