Embracing digital disruption in financial services

The accelerating pace of technology-driven innovations in the financial services industry are transforming the way we access, use and indeed, perceive financial products and solutions.

Over the past decade, our relationship with finance has been turned on its head by tech. Using our smartphone to pay for goods has become normal. Being able to apply for consumer credit with the click of a button at the online point of sale – and get a decision in seconds – is increasingly common. We can even pay for things on our smartwatches or have taxi fares automatically deducted from our digital payment wallets. This proliferation in computerized convenience for both businesses and consumers has even spawned a new jargon: ‘FinTech’.

Such is the speed of change, that technology seen as ;the future; just a few short years ago – online banking – has already been superseded by a new tech, mobile banking. In October 2020, Virgin Money in the UK even announced plans to close its online portal and move all 2 million of its credit card customers to mobile banking only in January 2021[1].

In the United States, there was a 200% jump in new mobile banking registrations in early April 2020, while mobile banking traffic rose 85%[2]. Although these huge increases my have been partially driven by the pandemic, the behavioral changes they represent are likely to stick long after the crisis is over.

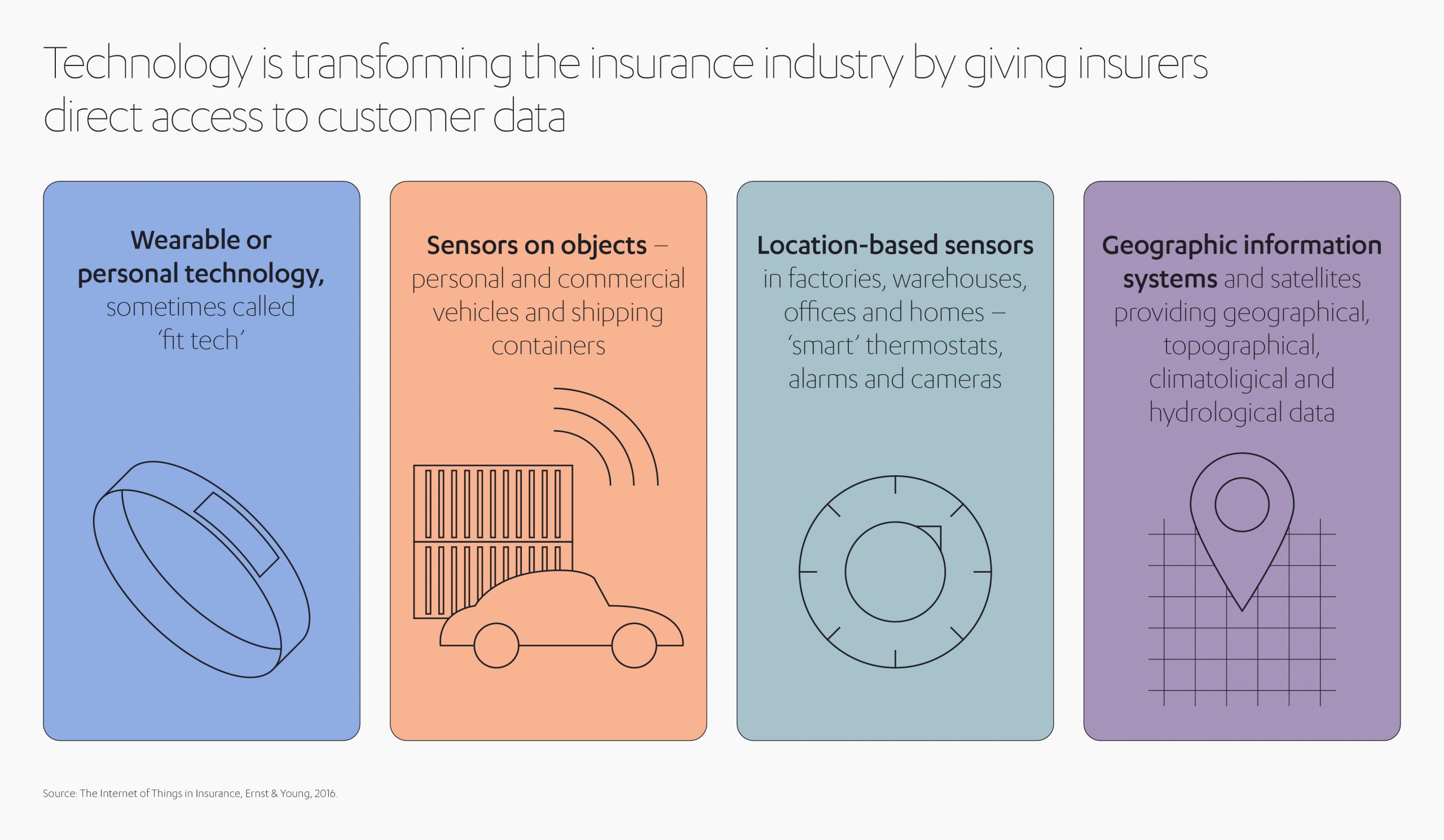

Similarly, in the insurance industry, so-called ‘InsurTech’ innovations are redefining customer experience through innovations such as risk-free underwriting, on-the-spot purchasing, and AI-driven claims processing, making the customer journey ever faster, easier and more efficient. While in the automotive sector, OEMs are forging new partnerships to develop in-car payment systems, enabling drivers to pay for things like fuel, snacks or even hotel bookings directly from their vehicles.[3]

The Big Tech companies, like Apple, Google, Facebook, PayPal, Microsoft and Amazon, are already hugely active in this space. They are experts in the user experience of mass personalization, getting far more daily engagement with their billions of users, app stores, digital wallets and mobile phones than any traditional financial services provider could ever hope to achieve.

This provides plenty of reasons for both incumbent banks – and new fintechs alike – to be concerned with the influence of Big Tech in financial services. They effectively control the user interface for most of the market and the vast repositories of personal data collected by their apps and devices puts them in a uniquely strong competitive position.

So, what do these changes mean for the financial services market? Is there still room for new fintechs to forge their own path in this environment, or is collaboration with Big Tech the only viable option?

We spoke to Nilüfer Günhan, Chief Financial Services Officer at Abdul Latif Jameel Finance, about the digital transformation of financial services and what it means for both consumers and providers.

Abdul Latif Jameel Finance

What changes do you expect to see in the consumer financial services industry over the next few years?

The financial services industry is at the start of the next big evolution, based on fast developing enabling technologies like AI, machine learning, blockchain, 5G and IoT. The speed of these changes is continuing to accelerate. In the consumer space, services like lending, payments, wealth management and insurance will be become a totally seamless part of consumers’ lifestyles. People will increasingly prioritize convenience over choice, choosing the product or solution that suits their needs at the moment they need it. I don’t think people will be interested in preferring one particular brand over another; they will be swayed by the solution that is presented to them at the exact time they are looking for it within their customer journey.

What will these changes mean for financial services providers?

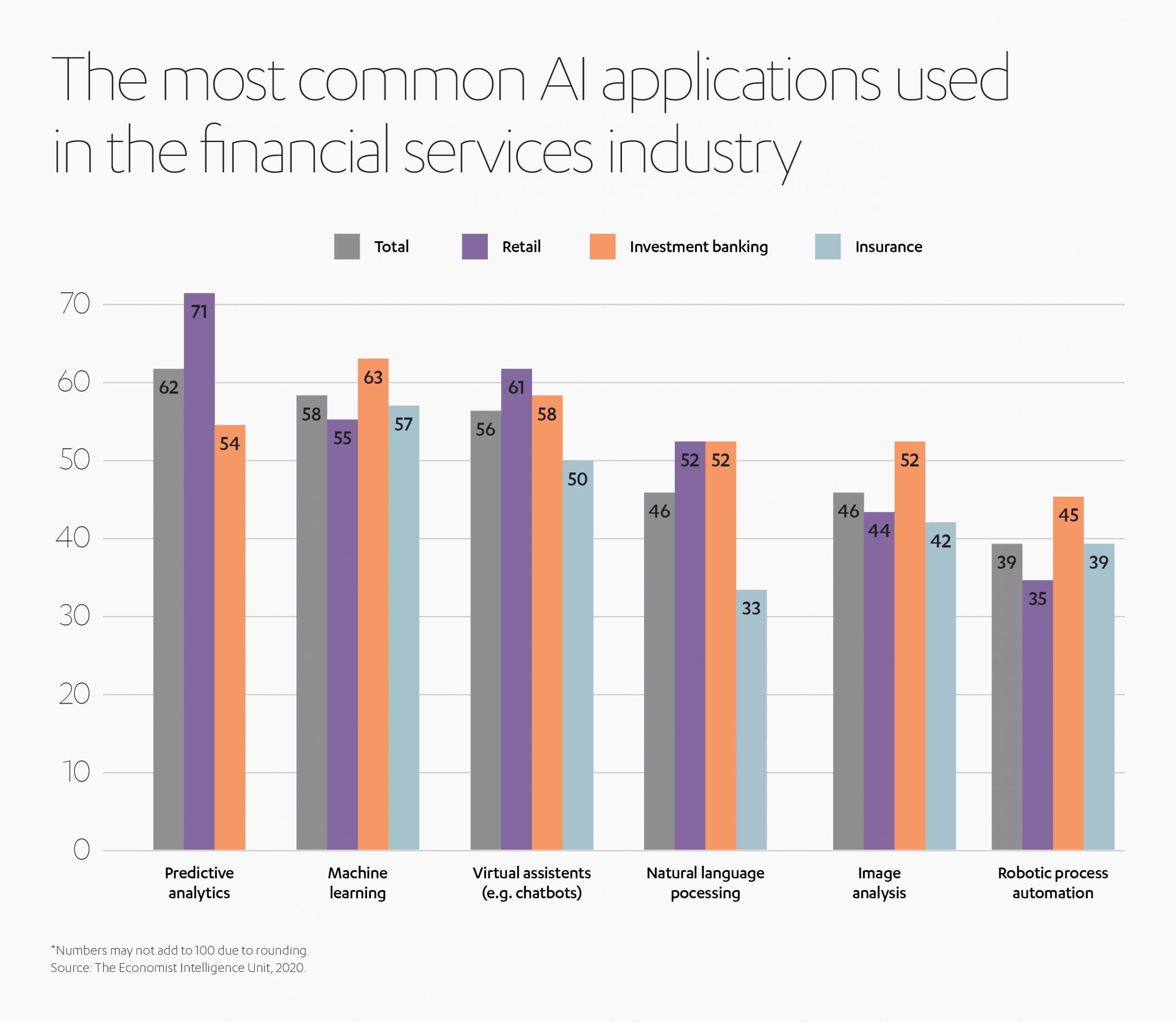

Banks, finance companies, and insurance companies will compete to embed their services within other ecosystems, like fintechs and insurtechs are already doing today. As the number of finance or insurance providers increases within a specific ecosystem, such as an e-commerce site or a comparison site, the one with the best data analytics and predictive capabilities will win the consumer’s business by making sure their solutions are presented to the right consumers, at the right time.

These new technologies will open doors to more and more integrated experiences. But behind every seamless digital user experience will be an intense battle between product and service providers, with the chief weapon being personalization.

How will the dominance of Big Tech firms affect the digitalization of the banking and finance sector?

Big Tech providers know merchants and end-users better than anybody. They have the huge consumer bases, the vast data repositories and the systems to enable them to understand the nuances of the market like never before.

The reason that we, as consumers, use their services is the convenient online experience they present to us. Most of us will abandon our online journeys if they are too long-winded or we perceive we are being required to provide too much information. On the other hand, we are happy to use the Big Techs since they already know us, they already have our data and so do not need to ask us to repeat our information or preferences to them. As strong global brands, they have the advantage of familiarity – so, we also have a degree of trust in them, as they have been around for a relatively long time in digital terms, and we’ve grown accustomed to dealing with them in other areas of our lives.

How do you think this will affect existing providers?

Banking and financial services providers recognize that they have to rethink and redesign their future. They have already been challenged by fintechs and digital banks over the past decade and more. In the early days, I recall many banks trying to fight this uphill battle with them, but today, most banks have chosen either to cooperate and welcome these ‘disruptors’, such as payment fintechs, into their customer processes, or they have chosen to focus on and strengthen those parts of their core business that they believe can compete more effectively with them.

How can smaller providers compete in this environment?

Captive lenders and insurers insurance agents have faced a similar challenge to the banks. As Big Tech becomes more and more integrated into our daily lives, the challenge becomes even harder. Survival depends on the capability to use customer data effectively, to continually digitize the customer journey and become integrated into other ecosystems without insisting on a stand-alone offering.

The competition between providers will be intense, but it will take place completely behind closed doors. In many areas, the battleground will be online marketplaces that offer a range of related services bundled together. For example, it might be a comparison website that presents you with suitable insurance companies based on your criteria, or a car website that links you in directly with a finance provider or an auto-insurance provider. Big Techs already dominate these ecosystems, and so one of the best ways for smaller provider to survive is to partner with Big Tech to make sure their solutions are included in these ecosystems.

Can start-ups and entrepreneurs survive in this increasingly interconnected market?

If you’re offering generic services as a start-up in the fintech arena, it is already very difficult to see how you could navigate a path towards long term success as an independent business, if Big Tech is already operating in the same space. Even if you are extremely good, the likelihood is that Big Tech would just copy and kill you, or, buy your tech and either trash it or take it over. Instead, you tend to see more and more innovators joining the Big Techs’ ecosystems, rather than competing against them.

What strategies could help smaller fintechs to succeed?

The survival kit for start-ups is the uniqueness of their product or service. In my opinion, a new start-up either needs to solve a consumer new pain-point or offer services to a completely new niche.

Finding and solving common pain-points are usually the best anchor for longer term survival. As long as you offer a clever solution and a differentiation in your customer journey that cannot be easily replicated (or easily integrated into an existing system) by Big Tech, you will have more opportunity to survive longer and grow your business. At the same time, you have to have some degree of collaboration and integration with Big Tech ecosystems, as that is the only realistic route to growth over the long term.

Abdul Latif Jameel Financial Services is already active in markets across the Middle East and Turkey, where it has won several awards for its digital innovations and customer experience. As the industry adapts to the digital world, it is our ambition to be at the forefront of the changes to come, as we continually develop and refine our services to meet the rapidly evolving needs of our customers.

[1] Two million Virgin Money credit card holders forced to app banking – Your Money

[2] COVID-19 Is Rapidly Reshaping Consumer Banking and Payments Behaviors, New FIS Survey Finds | FIS (fisglobal.com)

[3] Automakers expand connected car ecosystem with payment technologies | Mobile Payments Today

1x

1x

Added to press kit

Added to press kit