E-commerce: serving a new generation of consumers

Around the world, the internet’s impact is being felt in every sphere of our existence. Entertainment has been revolutionized with the advent of streaming services. Instantaneous communication has transformed medicine, working practices, political debate and even personal relationships. And in the commercial sector, the very definition and purpose of retail is being reimagined – shaped for a rising world of online shoppers for whom internet connectivity is now a core aspect of their everyday life.

By 2020, half of all retail growth is expected to come from e-commerce[1]. Online shopping is now growing four times faster than the overall retail sector[2], with changing habits, demographics and technologies all contributing to such a significant shift. While there are differences in market penetration (in 2017, e-commerce accounted for just over 10% of global retail sales, but almost 16% of UK retail sales[3] and – in 2018 – 23% of all retail sales in China[4]), the direction of travel is clear: retail is becoming an increasingly online affair.

The emergence of a new consumer

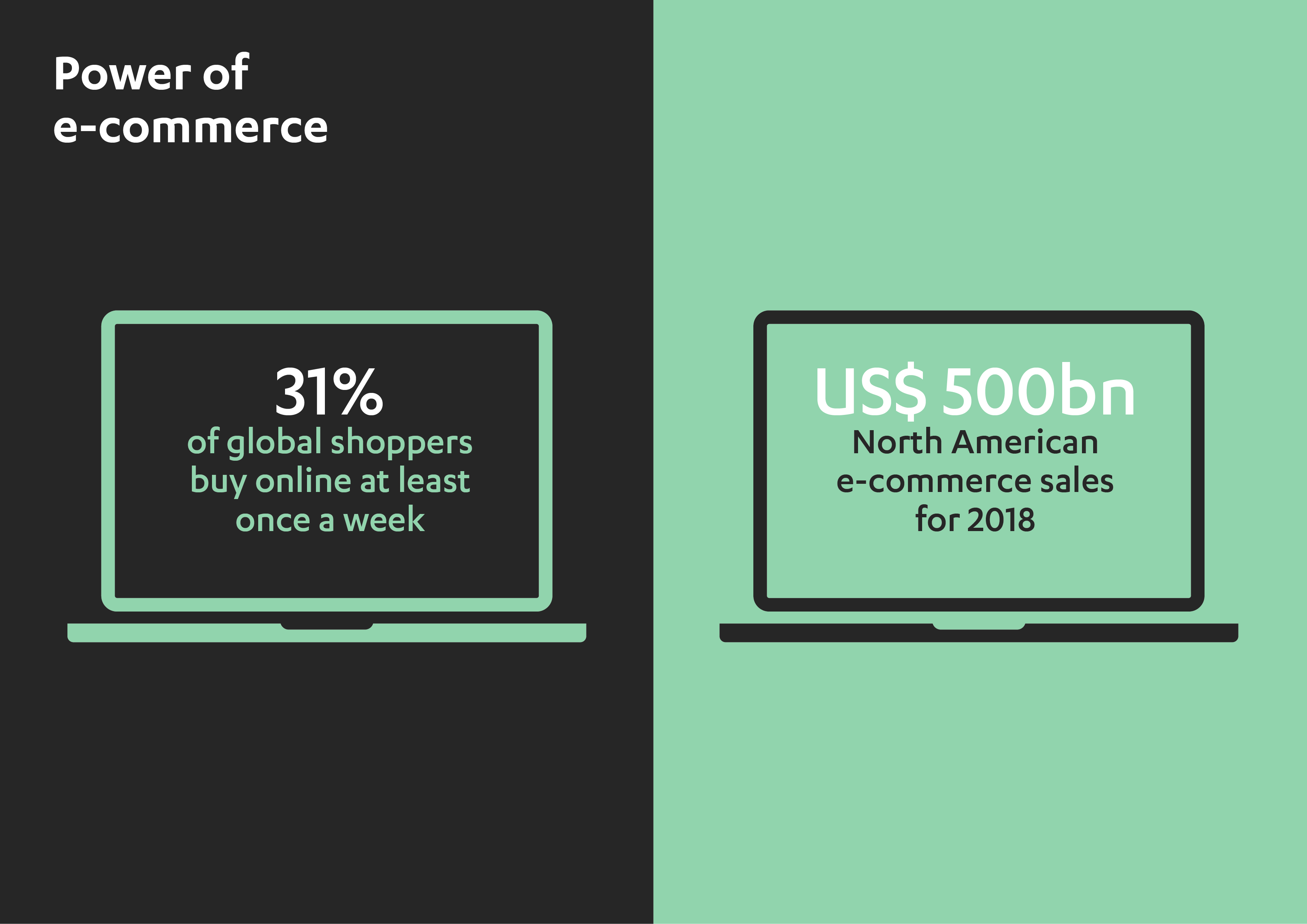

Globally, around one third of consumers (31%) buy online at least once a week, with smartphones and desktop computers both ahead of tablets as devices used to place e-commerce orders[5]. Mobile shopping has been recognised as a key driver taking 2018 e-commerce sales to more than US$ 500 billion in North America[6]. The development of social media as an e-commerce hub is also expected to pay big dividends. More than half of social app users in China already buy items direct through their social channels, while the rumored ‘Instagram Shop’ feature is expected to enable shoppers to order items without leaving the platform[7].

However, these rapid changes are also bringing new challengers, with returns becoming an increasingly complex problem facing retailers around the world. E-commerce return rates are up to four times higher than traditional brick-and-mortar sales, and they surpassed the US$ 400 billion-dollar mark in 2017[8]. In January 2016, UPS braced itself to process one million returns every day for a month following the Christmas and New Year holidays. The cost of these returns is impacting retailers’ margins, with several strategies being implemented to tackle the issue. H&M Canada, for example, is adding an extra deterrent by refusing to accept e-commerce returns in store. Instead, it is insisting shoppers cover the organizational and financial costs of using postal services to return e-commerce orders[9].

What, though, are the regional variations in online shopping habits – and where might be the most significant untapped opportunities? Developed markets show significantly higher frequencies of online shopping (the average U.S. consumer buys online 19 times per year, compared to just four in the MENA region[10]). However, the efforts to drive economic diversification across the Middle East – and particularly in Saudi Arabia, where the ambitions of the government’s Vision 2030 strategy are delivering a new business outlook – are creating notable potential.

Vision 2030, Saudi Arabia’s national development strategy, states:

“We aim to provide job opportunities for an additional million Saudis by 2020 in a growing retail sector that attracts modern, local, regional, and international brands across all regions of the country. We also aim to increase the contribution of modern trade and e-commerce to 80 percent of the retail sector by 2020.”

“We aim to provide job opportunities for an additional million Saudis by 2020 in a growing retail sector that attracts modern, local, regional, and international brands across all regions of the country. We also aim to increase the contribution of modern trade and e-commerce to 80 percent of the retail sector by 2020.”

A landscape to encourage investment

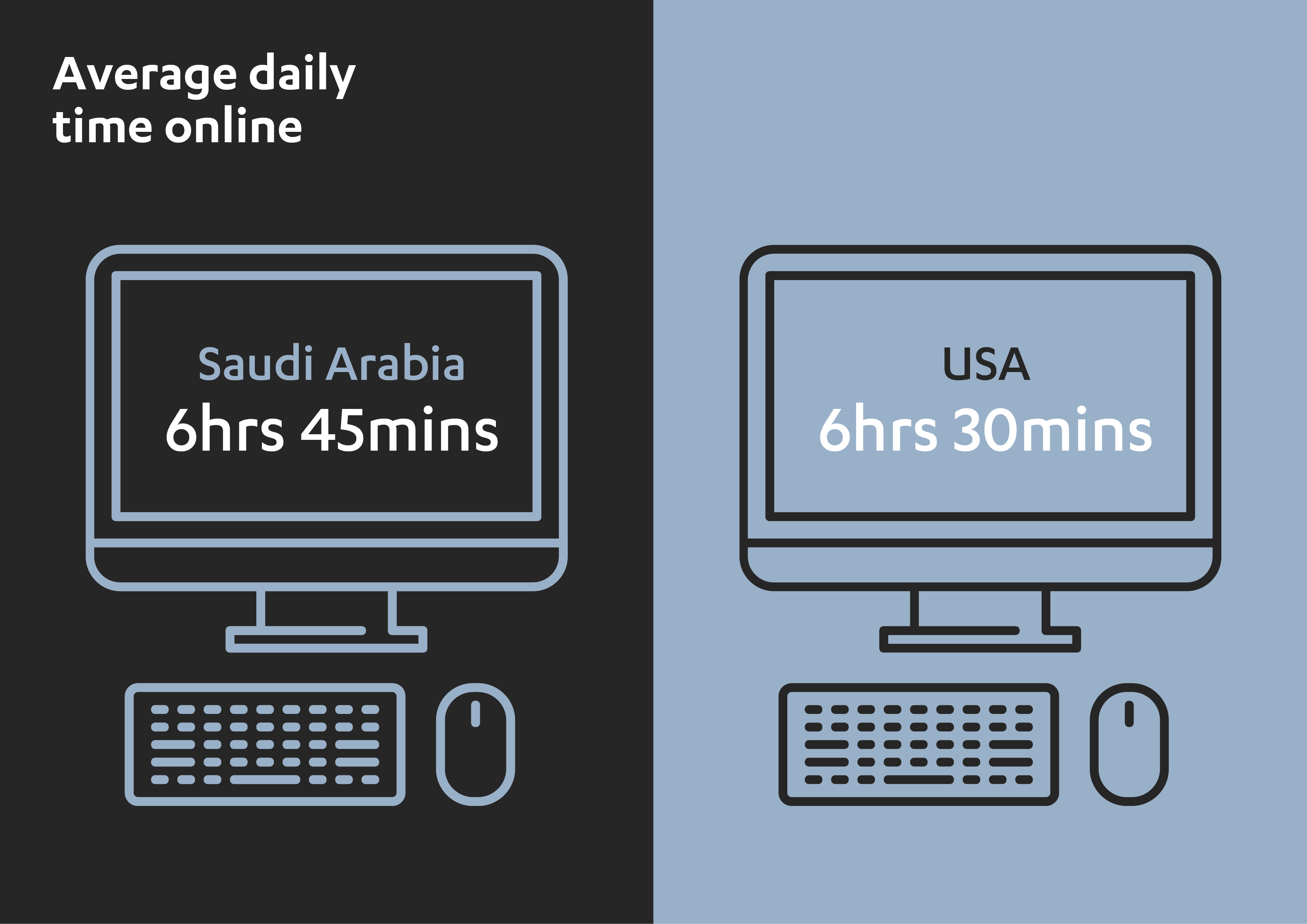

Across the Middle East, 40% of the population is under 25 years old[11]. Demographically speaking, it is a young region with a young outlook. In Saudi Arabia, for example, more than 91% of the country’s citizens use the internet at least once a day[12], while consumers in both the United Arab Emirates and Saudi Arabia are among the most connected and digitally savvy in the world. The average time per day spent online by consumers in Saudi Arabia is six hours and 45 minutes – 15 minutes more than the average American consumer[13].

With an on-going policy of economic reform and diversification that is expanding the inward flow of foreign direct investment, Saudi Arabia appears ripe for a major e-commerce revolution. The MENA e-commerce market is estimated to have a current worth of US$ 8.3 billion. However, analysts expect that figure to rocket to US$ 28.5 billion in the next three years, with an annual growth rate of 25% (powered by an expanding middle class, improvements in logistics, and the rise of working women[14]) and 7% of all GCC retail sales by 2022[15]. The UAE and Saudi Arabia represent the region’s most developed markets, accounting for 60% of the region’s e-commerce transactions[16].

An increasing volume of commercial activity is also reinforcing expectations that the Middle East is on the cusp of an e-commerce breakthrough. In 2017, Amazon’s US$ 580 million acquisition of Souq.com, the largest e-commerce platform in the Arab world, was quickly followed by the news that Saudi Arabia’s Public Investment Fund had backed Noon.com, another leading Middle Eastern e-commerce business created by Mohamed Alabbar, with US$ 1 billion of investment.

Understanding the region’s unique challenges

Behind the impressive figures, however, lies a series of real-world complications. As e-commerce grows across the MENAT region, it will do so while grappling with a series of specific market challenges.

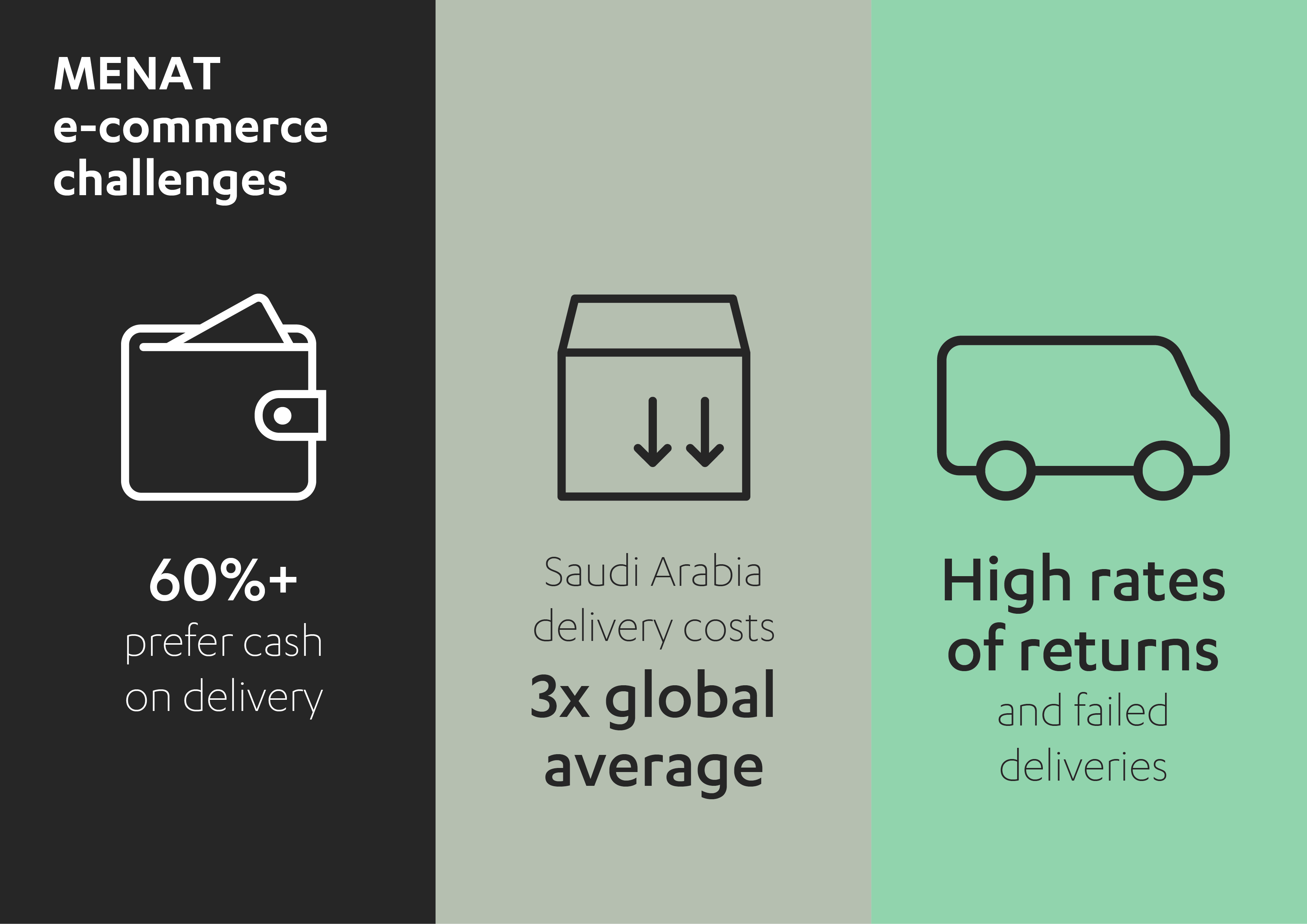

Despite placing their orders online, more than 6 in 10 MENA consumers prefer cash-on-delivery (paying the delivery driver only once the goods arrive at their destination) as their chosen payment method[17].

Despite placing their orders online, more than 6 in 10 MENA consumers prefer cash-on-delivery (paying the delivery driver only once the goods arrive at their destination) as their chosen payment method[17].

A variety of social and cultural factors lie behind this preference, together with a relatively weak level of trust in online payment systems. The challenge for online retailers is how to overcome this and alter long-entrenched behavioral norms. A consistent customer experience and excellent returns process are two fundamental starting points[18], although it will not be easy.

Logistics will also play a significant factor, with estimated package delivery costs in Saudi Arabia three times higher than the global average and cash-on-delivery practices leading to higher rates of returns and failed deliveries.

Finally, poor addressing systems pose another considerable challenge[19]. To help to tackle these issues, Abdul Latif Jameel Logistics has recently launched S:mile, an express delivery service and end-to-end e-commerce logistics solutions brand.

Despite those challenges, there are several signs that the typical Middle East consumer is starting to embrace all aspects of e-commerce. More than 60% of Saudi Arabians have now shopped online at least once[20], and in 2018 45% of Middle East shoppers paid for something using mobile payment services (up from 25% the previous year), making it – alongside Vietnam – the world’s fastest-growing mobile payment region[21].

Product research methods are also changing: instead of visiting a store, 20% of Saudi Arabian consumers now watch videos about their potential item – almost three times higher than in the UK, where just 7% of consumers undertake the same practice[22].

“A huge opportunity…”

Within the MENA e-commerce landscape, one sector stands out above all others: electronics. A tech-friendly population demands the latest smartphone developments as well as large home appliances including televisions, fridges and air conditioning units. In Saudi Arabia alone, the electronics market is worth US$ 13.3 billion per year[23]. It is one of four sectors comprising 80% of MENA’s e-commerce spending[24] and by 2022 it is anticipated that electronics will account for 25% of online sales in the GCC.

Abdul Latif Jameel Electronics is a key presence in the Saudi Arabian electronics sector, with, 19 retail showrooms, 42 branches, 50 service franchises, and over 600 distribution alliances and its distinctive flagship Redsea retail stores serving 11 cities across Saudi Arabia being complemented by the market-leading Redsea.com e-commerce outlet with over 1.5m active unique users.

Lovell Khanna, Deputy CEO of Abdul Latif Jameel Electronics, said: “The demand for electronic goods, from the latest gadgets to household appliances, is massive. And given the demographics of the country, it looks set to grow even further over the next few years.” He added: “For products… that are easy to deliver, there’s a huge opportunity. We’re determined to be part of it.”

To understand more about the Middle East e-commerce market and how Abdul Latif Jameel is helping to drive investment in these exciting opportunities, contact Abdul Latif Jameel Investments today.

[1] MENA E-Commerce Series 2018 Part 1: 5 insights driving regional e-commerce, Think with Google, November 2018

[2] MENA E-Commerce Series 2018 Part 1: 5 insights driving regional e-commerce, Think with Google, November 2018

[3] E-commerce in MENA: Opportunity Beyond the Hype, Bain & Company, 19 February 2019

[4] 10 Ecommerce Trends 2019, Absolunet, accessed April 2019

[5] Global Consumer Insights Survey 2019, PwC, accessed April 2019

[6] 10 Ecommerce Trends 2019, Absolunet, accessed April 2019

[7] 10 Ecommerce Trends 2019, Absolunet, accessed April 2019

[8] 10 Ecommerce Trends 2019, Absolunet, accessed April 2019

[9] 10 Ecommerce Trends 2019, Absolunet, accessed April 2019

[10] E-commerce in MENA: Opportunity Beyond the Hype, Bain & Company, 19 February 2019

[11] Middle East Megatrends, PwC, accessed April 2019

[12] Mobile, internet penetration nears 100% in 2018 in Saudi Arabia, Zawya, 2 January 2019

[13] E-commerce in MENA: Opportunity Beyond the Hype, Bain & Company, 19 February 2019

[14] E-commerce in MENA: Opportunity Beyond the Hype, Bain & Company, 19 February 2019

[15] MENA E-Commerce Series 2018 Part 1: 5 insights driving regional e-commerce, Think with Google, November 2018

[16] MENA E-Commerce Series 2018 Part 1: 5 insights driving regional e-commerce, Think with Google, November 2018

[17] MENA E-Commerce Series 2018 Part 1: 5 insights driving regional e-commerce, Think with Google, November 2018

[18] E-commerce in MENA: Opportunity Beyond the Hype, Bain & Company, 19 February 2019

[19] E-commerce in MENA: Opportunity Beyond the Hype, Bain & Company, 19 February 2019

[20] MENA E-Commerce Series 2018 Part 1: 5 insights driving regional e-commerce, Think with Google, November 2018

[21] Global Consumer Insights Survey 2019, PwC, accessed April 2019

[22] E-commerce in MENA: Opportunity Beyond the Hype, Bain & Company, 19 February 2019

[23] GfK Market-i Kingdom of Saudi Arabia Report September 2016

[24] MENA E-Commerce Series 2018 Part 1: 5 insights driving regional e-commerce, Think with Google, November 2018

1x

1x

Added to press kit

Added to press kit