Finance primed for tech transformation

With technology evolving at dizzying speeds, the future successes of the financial services industry will be dictated by who can capitalize on these changes most quickly and exploit them with maximum impact.

Gone is the image that finance firms used to project: of stolid, august institutions, standing steady against the changing trends of the world around them.

Instead, today’s financial services businesses must, by necessity, present a more dynamic persona; one nimble enough to meet the fast-changing needs of consumers, while making the most of the latest innovations.

Technology is both a driver and enabler of this revolution. Traditional banks have lost ground – and custom – to the Big Tech behemoths: to Apple, Google, Facebook, Microsoft, Amazon and others. Similarly, startups have struggled to maintain momentum against these industry titans who, by their very nature, have their finger on the button of . . . well, everything!

Each of these Big Tech ‘disruptors’ have proved hyper-responsive to changing patterns of behavior. Each comes ready-equipped with the technology to slip effortlessly into new markets. It’s a formidable proposition for both financial services mainstays and startups alike to counter.

Understanding this new technological environment, while incorporating its infinite possibilities into existing practices, is vital for navigating the future financial services landscape. Not just for businesses, but for customers, too. The last few years have seen a fundamental reinvention of the way we , as individuals, interact with our finances. There have been huge benefits for the customer, but also considerable challenges and opportunities for providers. And the tech transformation is only just beginning.

How innovation will become embedded

If financial services providers don’t adapt quickly enough to changing consumer needs, Big Tech firms categorically will. At a consumer level, consider the declining use of ATMs for cash withdrawals or deposits. A decade ago, cash was used in six out of 10 transactions, but by 2019 it was used in fewer than three in 10 purchases[1]. Even a few short years ago, the future of personal and business banking appeared to be online; now, mobile is here to make even online banking appear old and outdated. And banking is merely the tip of the financial services iceberg.

Welcome to the world of ‘embedded finance’.

Embedded finance describes how a non-finance business can connect its customers into financial transactions systems directly, enabling customers to forego the need for a separate interaction with the finance provider altogether. It is so seamless, it is sometimes barely noticeable. A sat-nav that offers the option to make and pay for a booking at hotels or restaurants displayed on its maps. Or an online retailer that provides a ‘pay monthly’ package at point of sale, saving customers the trouble of sourcing credit elsewhere.

For consumers, innovations like these mean less time and less hassle – and in today’s world, convenience is king.

Abdul Latif Jameel Finance

According to Nilüfer Günhan, Chief Financial Services Officer at Abdul Latif Jameel Finance, personal lending, payments, wealth and insurance are likely to be the first services that become an integrated part of consumers’ lifestyles, while loyalty to a single provider will disappear.

“In the very near future, as consumers, we will not care which bank, consumer finance company or insurer sells us what we need. We will just accept the offer or solution that suits our needs and presents itself to us at the precise moment we need it,” she says.

Companies old and young will need to move quickly to seize the potential of this new frontier.

“The question is not how fast tech companies will become car companies, but how fast we will become a tech company,” one global car boss explained to management consultancy McKinsey.[2]

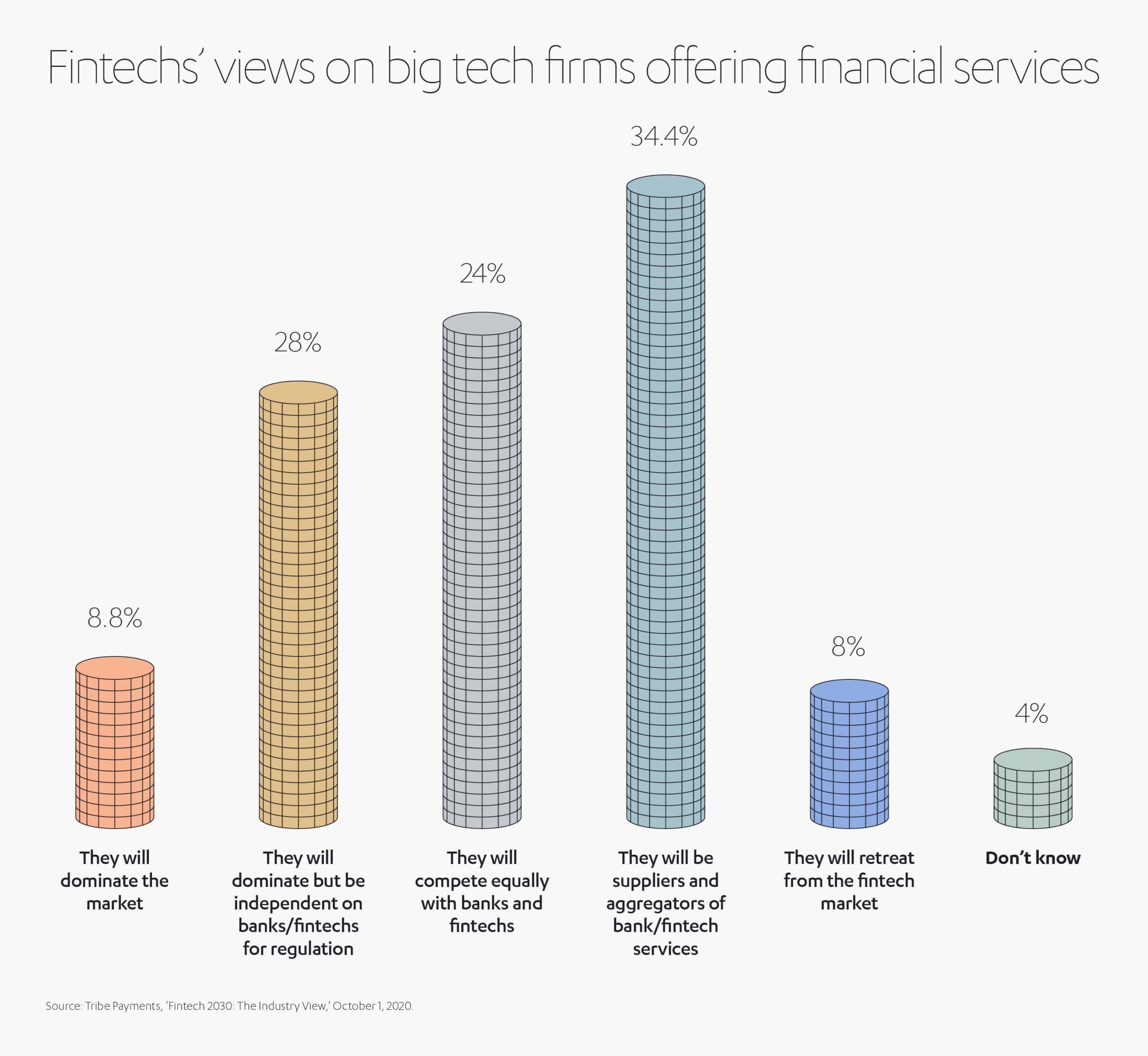

Indeed, the financial technology (fintech) industry expects embedded finance to become the norm by the end of this decade, with Big Tech firms taking the lead or competing equally with banks. In an insider survey of 125 fintech executives, 8.8% of respondents predict Big Tech firms by 2030 will dominate the financial services market, 28% anticipate Big Tech dominating but remaining dependent on banks for regulation, while 24% foresee Big Tech competing equally.[3]

The trajectory is already evident, as Big Tech firms seek partnerships with experienced financial services providers to gain a foothold in the finance sector.

Apple, for example, launched its first ever credit card in 2019. The card, run in affiliation with Goldman Sachs, integrates with the iPhone’s digital wallet.

Apple, for example, launched its first ever credit card in 2019. The card, run in affiliation with Goldman Sachs, integrates with the iPhone’s digital wallet.

There are no fees for using the card or for missed payments, and the deal offers 3% cash back for third-party providers such as Uber’s ride-hailing and food delivery services. Tech-savvy millennials are the core market.

Google, meanwhile, is inviting consumers to open digital bank accounts from 2021. Its Plex accounts, run in association with 11 banks and credit unions including Citibank, will operate within the Google Pay framework. Google is exploiting the renowned searchability of its Gmail software to help customers better categorize and understand their spending.

Not to be left out, Facebook is investigating the possibility of introducing its own digital currency, Libra, “tied to a basket of currencies and government debt”[4]. Facebook’s aim is to make global payment systems speedier and cheaper.

The story of Libra so far, however, has been far from smooth. It is seen as an example of what can go wrong if Big Tech firms underestimate the challenges that need to be overcome in such a sensitive market, not least in terms of legislation and regulatory compliance.

Holding hands helps overcome obstacles

When Facebook outlined its plans for Libra, the firm was pressured by the US government to seek a federal bank charter before proceeding. Hardly surprising, given that potentially millions of people withdrawing their deposits from conventional banks could irreparably damage world economies.

Elsewhere, online retail giant Amazon has endured two false starts. Its student loan scheme in the US, launched in 2016 and promising Prime customers a 0.5% reduction on their loans, proved short-lived. At time of abandonment, the deal was being probed by a pair of US regulators: the Consumer Financial Protection Bureau (CFPB) and the Office of the Comptroller of the Currency (OCC). Then, in 2019, Amazon jettisoned plans to launch its own checking accounts, citing regulatory concerns to investors.

Google has had problems of its own, facing an antitrust lawsuit from the US Justice Department over concerns it holds a monopoly over search and search-based advertising. At time of writing, the lawsuit is ongoing. Such scrutiny is not limited to the USA. In the UK a new tech regulator, the Competition and Markets Authority (CMA), has launched a Digital Markets Unit to investigate the search and social media dominance of Google, Facebook and other tech platforms. UK business secretary Alok Sharma said the new “pro-competition regime” would ensure smaller tech firms weren’t “pushed out”.[5]

All of which helps explain why Sarah Kocianski, from fintech consultancy 11:FS, argues that Big Tech firms will favor partnerships with financial services providers over becoming fully-fledged lenders themselves. “The headache of getting and maintaining a banking license would likely be considered too big a risk,” she says.[6]

Working together, rather than in conflict, may indeed be the future – hence those eye-catching Apple/Goldman Sachs and Google/Citibank link-ups. Several other partnerships are likewise demonstrating that the fusion of technological innovation with industry experience has greater potential than going it alone.

Tech specialist Parsyl, for instance, has teamed up with Lloyd’s insurance market to devise a new cargo insurance product. It uses Parsyl’s specialist sensors to monitor storage and transportation conditions. In an industry like insurance, pivoting predominantly on risk, technology can help provide the holy grail of certainty.

Elsewhere, Google has forged a 10-year alliance with Deutsche Bank, enabling the bank to digitize its operations, while co-investing in other new technologies across the banking sector.

From a financial services perspective, if banks cannot compete with tech firms at their own game, it might be better to join them rather than try to beat them. Considering the ongoing pace of technological development, such mutually-beneficial arrangements might prove the only financially-durable strategy for established providers.

Phenomenal pace of technological change

Financial services providers are already playing innovation catch-up, according to the World Economic Forum, which notes that as of 2019, 43% of US banks were still using the coding language COBOL dating back more than half a century.[7] For a worrying number of executives, the WEF declares, the link between emerging tech and tangible business outcomes remains hazy.

Financial services providers are already playing innovation catch-up, according to the World Economic Forum, which notes that as of 2019, 43% of US banks were still using the coding language COBOL dating back more than half a century.[7] For a worrying number of executives, the WEF declares, the link between emerging tech and tangible business outcomes remains hazy.

Against this reactionary backdrop, a suite of technologies is maturing concurrently which together have the power to radically alter the banking and wider financial services industry.

These include:

- Artificial intelligence, offering the potential to become a cross-business strategic tool in cost-cutting and investment forecasting

- Hybrid quantum computing, enabling new speed and accuracy levels for industry calculations

- Blockchain distributed ledger technology (DLT), allowing vast swathes of live data to be shared between disparate business networks, simultaneously revolutionizing every kind of interaction – from payments and real estate deals to healthcare information and supply chains

- Virtual or augmented reality, transforming how customers source information and pay for services

- The Internet of Things (IoT), providing an unprecedented amount of live, contextual data across the logistics and mobility spectrum

- 5G technology, improving security for remote working and coordinating autonomous networks across the entire IoT

- Cloud computing, offering remote repositories of versatile computational power, soon to account for almost half of the financial services industry’s IT spend

“These technologies will open doors to more and more integrated experiences that will automate our lives, with very little thinking or decision-making from the consumer themselves,” explains Nilüfer Günhan.

Mastering the possibilities of these new technologies and understanding how they can operate in harmony will increasingly be a hallmark of success for financial firms.

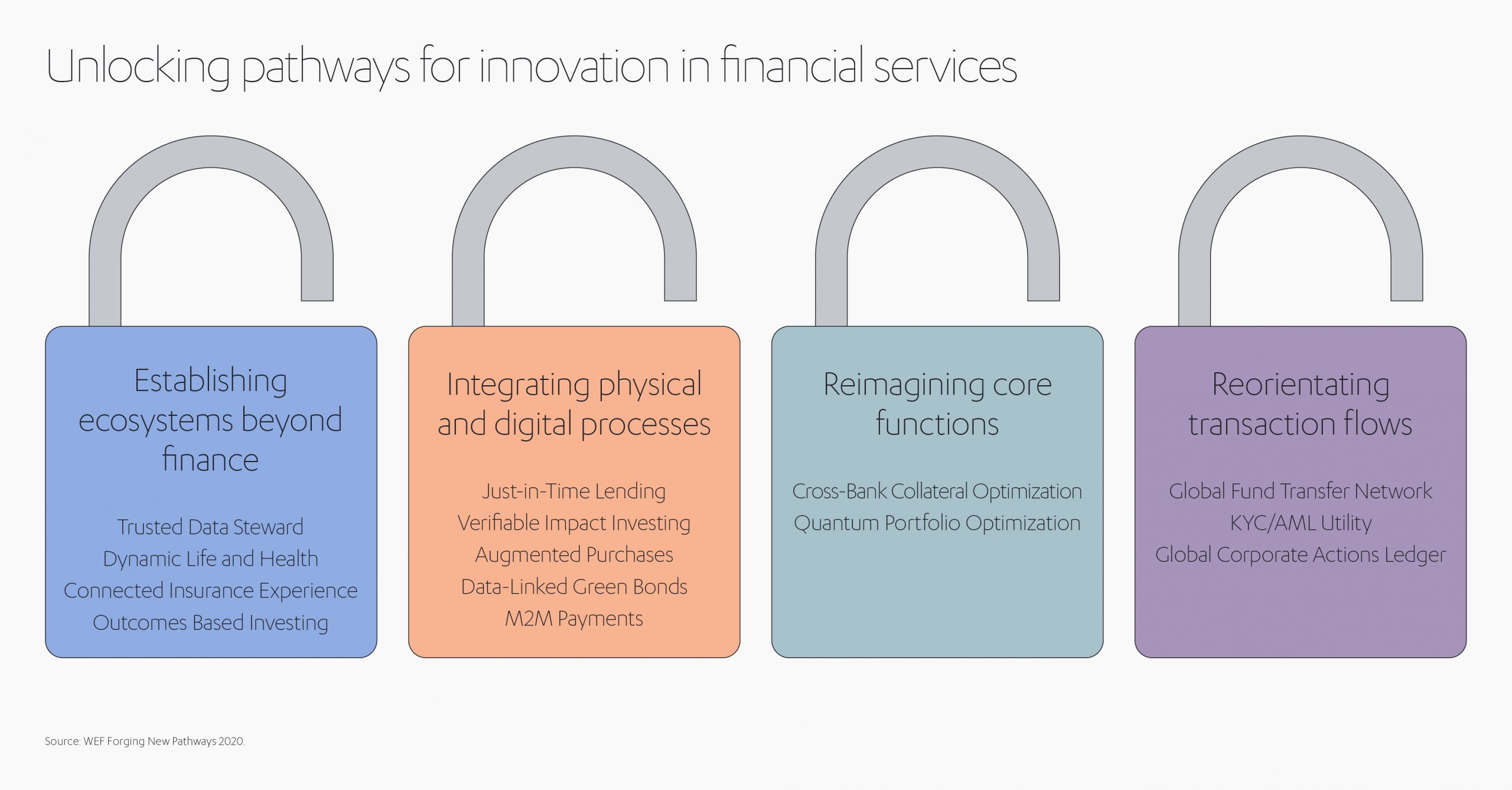

The WEF is clear on which two of these technologies will organically unlock the others and should therefore receive the most urgent funding.

It explains: “By anchoring investments in AI and cloud computing, and viewing other technologies as specifically enabled by them, financial institutions will be able to more easily access and implement the clusters of emerging technology most important to solving their key business problems.” [8]

Startups can survive tech tug-of-war

A report by business consultancy PwC suggests that far from being the preserve of established Big Tech players, next-gen fintech will pave the way for market newcomers. Or at least, for those shrewd enough to capitalize on a particular innovative technology or process.[9]

In its survey of tech business leaders, PwC found that up to 28% of established banking and payments businesses were projected to be “at risk” in 2020, and up to 22% of insurance, asset management and wealth management businesses.

If there is still room for entrepreneurial startups – and evidence suggests there is – the future might belong to those that focus on niche value propositions.

While Google remains the granddaddy of search engines, for example, other search startups have still managed to attract almost US$ 700 million in fund-raising over the past two years.[10] In most cases they have achieved this by focusing on ancillary areas or by developing core technology.

Algolia, for instance, which helps companies develop faster and more intuitive search functions for their own websites, has netted US$ 184 million in venture capital funding. Reputation.com, which helps companies monitor and improve their perception on social media and within search tools, has attracted US$ 117 million. Botify, which aims to fix the problem of Google overlooking about half of the content on large websites, has secured US$ 20 million funding, and DuckDuckGo, a search engine that prioritizes privacy, has raised US$ 13 million.

If privacy is one buzzword to watch closely, so too is its close cousin, security.

If privacy is one buzzword to watch closely, so too is its close cousin, security.

The PwC survey shone a light on one of the biggest challenges facing financial institutions: cyber-security.

Almost 7-in-10 CEOs of finance firms reported concerns about cyber-threats, compared to 61% of CEOs across all sectors.[11]

The issue is predicted to snowball in the coming years due to the increased use of third-party vendors, the rapid pace of technological change, more cross-border data exchanges, and customers’ escalating reliance on mobile apps for transactions.

Firms providing Pseudonymization and Format-Preserving Encryption (FPE) software (used for protecting personal information and enabling legislative compliance while preserving data useful for business processes) will therefore be at a competitive advantage.

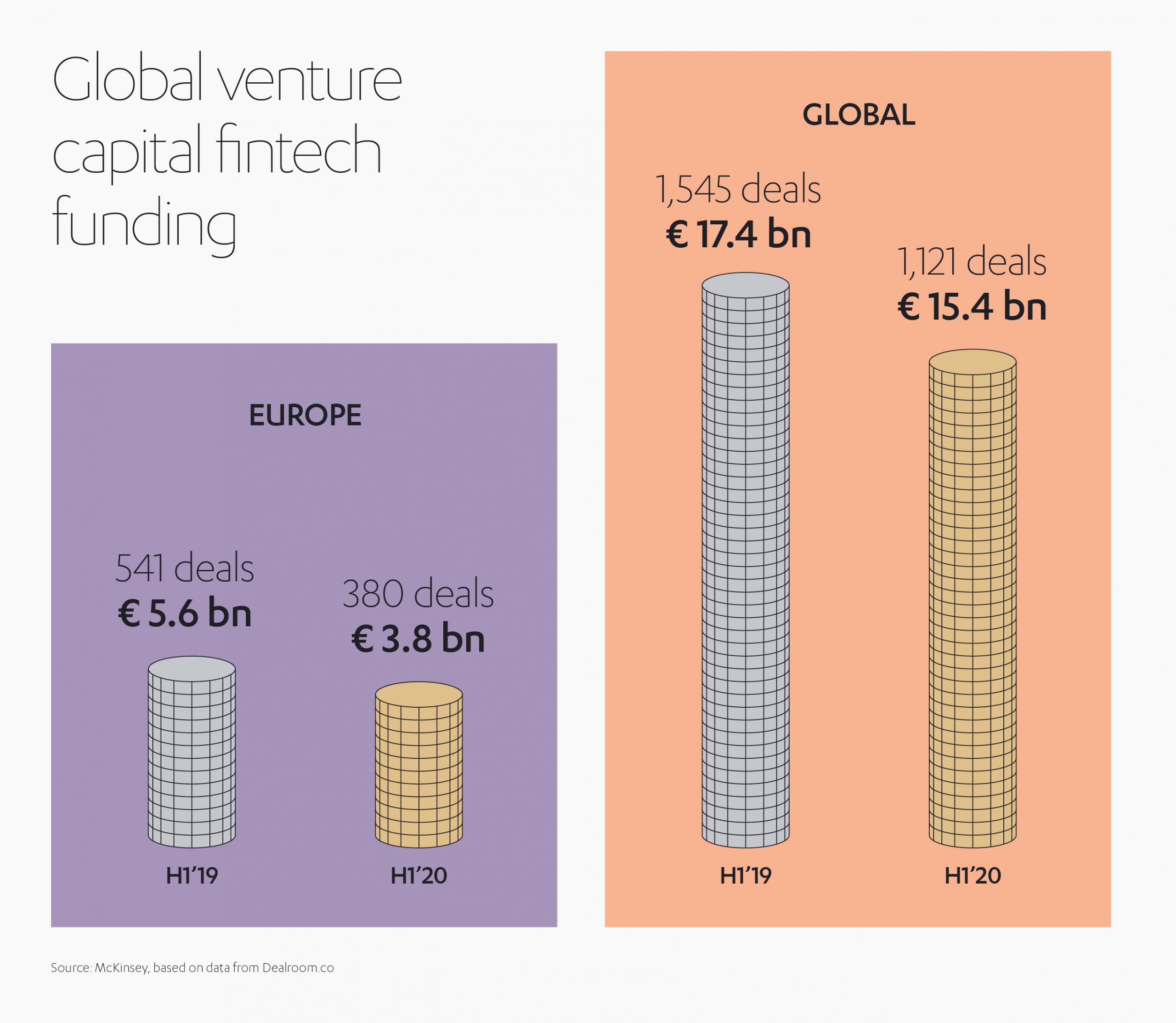

Even during the pandemic, European lenders have continued making investments in tech startups, albeit at a lower rate than in previous years.[12] The first half of 2020 saw €3.8 billion of venture capital plowed into European fintechs, as opposed to €5.6 billion during H1 2019.

German fintech Solarisbank, for example, a banking infrastructure provider that also supplies prepaid and debit cards, raised €60 million in one funding round. Another German startup, credit scoring specialist Forteil GmbH, won financial backing from Santander, while British fintech Meniga, a digital banking services provider, secured €8.5 million of funding from Caixa Central de Crédito Agrícola Mútuo CRL, UniCredit and Groupe BPCE.

Even during a once-in-a-generation crisis like the pandemic, confidence and funding demonstrably remains in place for fintech startups. It is these youthful, agile outfits that are sometimes best placed to anticipate and accommodate future trends – and perhaps join the Big Tech elites of tomorrow.

Why we’re all invested in a financial future

The new financial services paradigm has opportunities for players at all levels: from banking stalwarts with their heritage of customer loyalty and industry experience; to Big Techs with their nuanced grasp of cutting-edge systems; and to startups with their innovation, adaptability and capacity for attracting enterprising venture capital.

Far from competing in a frenetic, fast-moving market, experience so far suggests that the most robust transformational innovations may in fact prove to be collaborations, utilizing the varying strengths of these different players.

In these exciting times, global investors like Abdul Latif Jameel will find new ways of bringing financial services and insurance solutions direct to customers.

Get ready for a future of embedded finance, where loans, payments, insurance and wealth management become a seamless part of our daily lives. Traditional brand loyalties to familiar names are likely to diminish as we opt for convenience and functionality from the finance solutions that present themselves when we most need them.

This sea-change in finance services means money matters will become both more automated and more integrated. The rapid growth of technologies such as AI, blockchain, 5G, IoT and virtual reality will together create a tsunami of efficiencies and synergies. In an ideal scenario, one coming into greater focus with each passing day, that means new savings for customers and new revenue streams for businesses.

“Behind every digital user experience there will be a big battle behind the curtains among product and service providers, with the central weapon of personalization,” says Nilufer Gunhan.

Whatever your stake in the finance field, from busy consumer, to entrepreneur with a brainwave, to big bank CEO, technology is destined to transform the way our society operates.

That is where the smart money lies.

[1] Will we be getting our cash from shops, not ATMs? – BBC News

[2] https://www.mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/Next-gen%20technology%20transformation%20in%20financial%20services/Next-gen-technology-transformation-in-financial-services.pdf

[3] https://www.businessinsider.com/embedded-finance-expected-to-blur-fintech-lines-by-2030-2020-10?r=US&IR=T

[4] https://www.cnbc.com/2020/01/03/big-tech-will-push-into-finance-in-2020-while-avoiding-bank-regulation.html

[5] https://www.theguardian.com/technology/2020/nov/27/new-uk-tech-regulator-to-limit-power-of-google-and-facebook#:~:text=A%20new%20tech%20regulator%20will,a%20fair%20market%20for%20consumers.

[6] https://www.cnbc.com/2020/01/03/big-tech-will-push-into-finance-in-2020-while-avoiding-bank-regulation.html

[7] http://www3.weforum.org/docs/WEF_Forging_New_Pathways_2020.pdf

[8] http://www3.weforum.org/docs/WEF_Forging_New_Pathways_2020.pdf

[9] https://www.pwc.com/gx/en/industries/financial-services/publications/financial-services-technology-2020-and-beyond-embracing-disruption.html

[10] https://news.crunchbase.com/news/money-insider-googlelawsuit/

[11] https://www.pwc.com/gx/en/industries/financial-services/publications/financial-services-technology-2020-and-beyond-embracing-disruption.html

[12] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/vc-funding-for-fintechs-is-down-but-big-banks-are-quietly-investing-in-startups-60607005

1x

1x

Added to press kit

Added to press kit