Shared mobility shows the way

“Is the car – in more senses than one – taking us for a ride?” asked JG Ballard, one of the leading science fiction writers of the 20th Century[1]. Even when Ballard was writing back in 1971, it was apparent that urban landscapes were being designed around the needs of the car, a phenomenon that was epitomized by the US city of Los Angeles, with its “clouds of exhaust gases and its man-made horizons formed by the raised embankments of gigantic freeway systems.”[2]

At that time, when automobiles were seen as catalysts to a fairer, more prosperous society, such opinions were controversial. Now, more than half a century later, it’s encouraging to see that these same concerns are mainstream and cities, old and new, are moving away from the private car and individually owned means of transport. In this new world, the focus is not only on new mobility solutions, like electric vehicles, e-scooters and flying taxis, but also on new mobility behaviors, the most prominent being shared mobility, a sector that is forecast to generate up to US$ 1 trillion in consumer spending by 2030[3].

What is shared mobility?

Shared mobility is defined as the shared use of a vehicle, motorcycle, scooter, bicycle, or other travel mode, providing users with short-term access to one of these modes of travel as they are needed – on demand. The ‘on demand’ element is significant, otherwise it could just be another way of referring to a bus or other form of public transport. In the same way that few people now own DVDs or CDs and instead pay a monthly streaming subscription, consumers are increasingly ditching individual car ownership in favor of more sustainable alternatives. According to research from McKinsey[4], there are three main trends driving the growth of shared mobility:

- the shift away from individual use of vehicles towards sharing a pool of vehicles

- a switch from driving yourself to being driven

- and the move towards smaller vehicles – micromobility.

What’s mine is yours

Owning a vehicle in a city is becoming less and less attractive. Urban growth is accelerating quickly, creating ever-worse congestion challenges and slower traffic in cities. But as the traffic slows down, the costs of owning and running a vehicle are going up – mostly driven by the rising cost of oil, and government taxes on fuel. Research published in the 2022 TomTom Traffic Index[5] found that drivers around the world spent 27% more on average to fill up their petrol tanks than in 2021, while those driving diesel cars shelled out 48% more in 2022 than the year before.

All the more reason, then, for ridesharing. It appeals to passengers because it is cheaper – the costs are shared – and it is convenient as it offers a door-to-door service without the need for personal driving. Meanwhile, cities are making strong efforts to discourage private vehicle use by tightening regulations with measures such as car-free zones, fees for cars entering the city, a decrease in parking availability, and an increase in parking rates. All these measures encourage shared mobility.

One response to this is peer-to-peer (P2P) car-sharing, where car owners allow other drivers to use their vehicles for a charge. In the past this was community-based but now, influenced in large part by the rise of social networks and smartphone technology, it is poised for explosive growth[6]. The number of P2P car-sharing vehicles globally grew from approximately 200,000 in 2015 to more than 440,000 in 2020, and that figure is expected to more than double by 2025, to approximately 990,000 vehicles. According to research by Accenture,[7] the value of the P2P market is expected to grow to US$ 21 billion by 2030 in China, the US and Germany alone.

OEMs see the opportunities

Automotive OEMs have not been slow to recognize the potential opportunities in shared mobility. Several have tried to enter the market in various ways, either investing in newcomers or creating their own shared mobility enterprises. ShareNow, a joint venture formed from the merger of Daimler’s car2go and BMW’s DriveNow, is one of the world’s largest shared-mobility companies, with more than 4 million registered members and a fleet of more than 14,000 vehicles in 18 cities across Europe.[8]

In 2016, GM launched Maven, a brand offering car-sharing and peer-to-peer rental. The same year Ford acquired Chariot, a shared minibus service, and Volkswagen launched MOIA, which employs 1,300 people developing on-demand transport. In 2019 BMW and Daimler combined their mobility businesses into a joint venture called Free Now, and Toyota launched its car-sharing and travel-planning platform, Kinto, which has since expanded to 14 European countries.

Some of these shared mobility projects have already fallen by the wayside. But MOIA, among others, is thriving, operating ride-pooling schemes in Hamburg and Hanover, and Kinto has plans to add more than 30 countries to its network[9].

Driven, not driving

The second trend to be observed is the rise of 21st Century versions of the taxi, where consumers opt to be driven rather than drive and – perhaps – avoid altogether the hassle of actually owning a vehicle.

The most straightforward form of this is e-hailing, where you hail a vehicle to take you to your destination but, instead of waving it down as you would a taxi, you use an app on your mobile – like Careem, for instance, with whom Abdul Latif Jameel Finance Saudi Arabia signed a collaboration partnership in March 2023. Another form of this is pooled e-hailing, where you order the vehicle but share it with other passengers going in a similar direction to reduce the fare, picking them up and dropping them off on the way.

Here again, motor manufacturers have also been quick to spot a possible change to their market and have invested. In 2016, for instance, GM invested US$ 500 million in US ride-sharing platform Lyft and Volkswagen put US$ 300 million in Gett, a European taxi-hailing app[10]. Meanwhile Toyota, a long-term Abdul Latif Jameel partner, has invested in Uber, Didi and Grab, a Singaporean ride-hailing company that was also backed by Japan’s Honda and South Korea’s Hyundai[11].

According to the experts at McKinsey[12], consumers racked up more than 15 billion hailed-mobility trips in 2022, with revenues reaching US$ 165 billion. By 2028, total revenues from hailed mobility could increase to US$ 273 billion.[13]

Another form of e-hailing on the horizon is the introduction of flying taxis, powered by either electricity or new energy, moving people by air between dedicated stations, either piloted or semi-autonomous. Abdul Lateef Jameel is already in this market, having invested in California-based Joby Aviation’s revolutionary electric air taxis, which can fly at 200mph and cover 150 miles on a single charge, through the Jameel Investment Management Company (JIMCO)[14]. JIMCO invested alongside Toyota, in line with Abdul Latif Jameel’s strategy of investing in a more sustainable mobility future.

Bonny Simi, head of air operations and people at Joby Aviation, predicts the company will be the world’s largest airline by departures by 2030[15]. She envisions a future where aerial ride sharing will replace long commutes and allow for quick and easy travel for both personal and emergency purposes. Initially, she believes the adoption of advanced air mobility (AAM) will be in large, dense urban centers where congestion is a real problem. As cities become denser and roads become more congested, AAM will be able to support transportation needs and connect large metropolitan areas. Eventually, AAM will bring people from rural areas into cities.

Motoring towards micromobility

As discussed in our previous Abdul Latif Jameel Perspectives article, shared micromobility, which includes very light vehicles such as kick scooters, bicycles, e-scooters and e-bikes, has already grown swiftly, with nearly 70% of consumers willing to use micromobility vehicles for commuting[16].

Small wonder. Urban journeys are often quite short and well suited to the convenience of micromobility options. Research by INRIX, a traffic data specialist, found that one-fifth of car journeys in large British and American cities were of less than a mile. Half of urban car trips in America, and two-thirds in Britain, were shorter than three miles[17]. According to the INRIX the 2022 Global Traffic Scorecard[18], London remained the most-congested urban area in 2022, with 156 hours of delay per driver, up 5% over 2021. Big movers on the INRIX congestion scorecard include second ranked Chicago (155 hours, up 49%), Boston (134 hours, up 72%) and Toronto (118 hours, up 59%).

Against this background, the rapid move towards shared micromobility should be no surprise. Whilst e-scooter sharing did not play a major role before 2017, it accelerated from fewer than 1 million trips 2017 to more than 160 million trips in 2019, when looking at the largest players. McKinsey predicts that total consumer – shared and private combined – spending on micromobility could be up to US$ 300 billion to US $500 billion globally by 2030.[19]

Initially, many industry commentators assumed the boost in micromobility users over recent years was prompted by the COVID-19 pandemic, as e-scooters and bicycles provided a way of getting around cities that did not require you to risk infection on crowded public transport. But the increase in popularity has continued long after the pandemic, suggesting that users increasingly see the value in shared mobility. No upfront costs, no worrying that your vehicle would be stolen and having to cart around various locks and chains that weigh and cost almost as much as the vehicle itself.

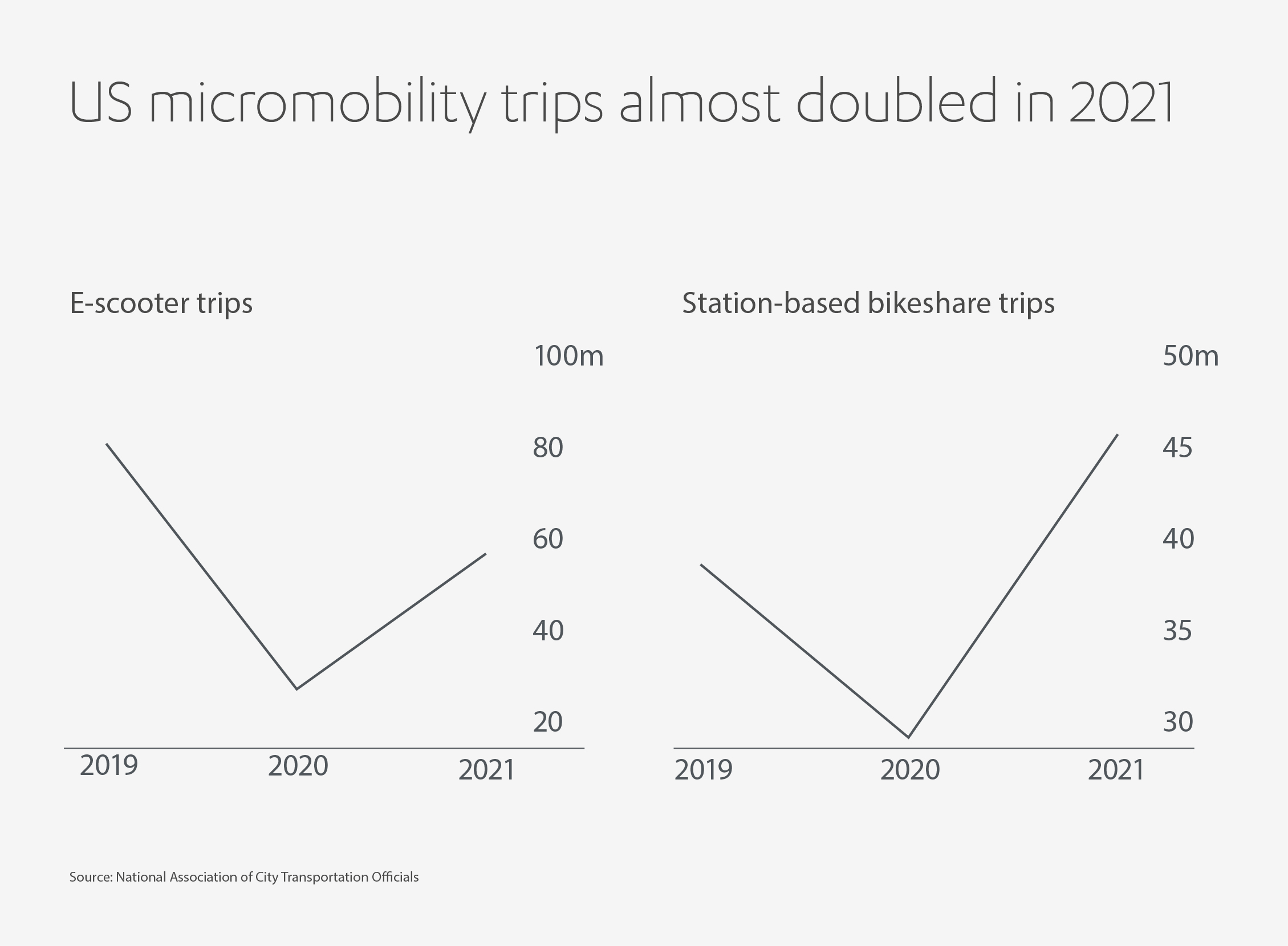

In the US, for example, the latest figures show a strong demand for docked bikes, where you collect a bicycle from a docking station and leave it at another nearer your destination. An analysis of usage trends in 2020 and 2021 from the National Association of City Transportation Officials[20] shows the number of micromobility trips in the US nearly doubled in 2021, to 112 million.

In 2021, bikeshare systems in Chicago, New York, and Philadelphia saw record levels of riders, while across the country ridership was up 18% compared to 2019. The limit on growth in this market is safety. The president of the North American Bikeshare and Scootershare Association (NABSA), Samantha Herr, argues that the biggest thing that cities can do to encourage shared micromobility is to create the infrastructure to support it: “Building out safe, connected places to ride that get people where they need to go, like protected bike lane networks, is important to facilitating shared micromobility ridership.”[21]

Downsides of personal transport

The long link between wealth and car ownership is under threat from the increasingly apparent drawbacks of owning personal transport. In the past, as a society gets wealthier, people have more cars. Greater numbers of cars mean more traffic, more accidents and more emissions. In an age of growing health and environmental awareness, this is a massive downside for cities, their residents, and their administrators.

According to the World Health Organization[22], car accidents are the eighth highest cause of death for people of all ages, and the leading cause among young people aged 5-29 worldwide. At least 1.3 million people die in car accidents every year, with a further 20 to 50 million people sustaining injuries. Poor air quality resulting from traffic is cited as increasing the risk of angina[23]. In the UK alone, up to 36,000 deaths a year in the UK are linked to air pollution.[24]

It is not just the residents and drivers who suffer. The environment takes a pounding too. Tailpipe emissions from cars, trucks and other road vehicles account for around 75% of emissions from mobility, roughly six gigatons of CO2 per year – close to 15% of total global emissions[25]. Cutting these would go a long way to meeting the United Nations target for net zero carbon emissions by 2050.

The world originally fell in love with the car because it promised us – the consumer – convenience, status and freedom. But for city dwellers at least, that promise looks increasingly broken. In London, for example, even a fairly average cyclist could beat the average rush hour of just 9 mph[26]. Yet the global trend is towards living in cities. At present 56% of the world’s population – 4.4 billion inhabitants – live in cities and the urban population more than doubling its current size by 2050, at which point nearly seven of 10 people will live in cities[27].

These inconveniences and penalties for urban motoring are beginning to feed through into car sales. In the UK, for example, car ownership has declined for the second consecutive year – for the first time in more than a century[28].

The idea of car ownership being an essential element of individual liberty now seems dated. It is Ballard’s baleful view of the automobile, considered maverick at the time, that is in tune with modern thinking.

Back in the 1970s he confected a world in which, “now and then, as part of a festival or centenary, they will hold veteran car rallies in the traffic-free pedestrian zones of major cities. And on these occasions, everyone will thoroughly enjoy three rare sensations: the smell of exhaust fumes, the noise and the congestion.”

Shared mobility is one of the tools that could make Ballard’s traffic-free vision into a tangible daily reality. It has the potential to reshape our understanding of mobility, reduce its impact on the environment and transform our cities. It is as yet unclear how the shared mobility market will play out over the next few years. But with a spirit of collaboration, partnership and commitment, governments, automotive OEMs, mobility providers and – perhaps above all – consumers, can help steer us all to a greener, more sustainable future.

[1] https://www.jgballard.ca/deep_ends/drive_mag_article.html

[2] https://www.jgballard.ca/deep_ends/drive_mag_article.html

[3] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/shared-mobility-sustainable-cities-shared-destinies

[4] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/shared-mobility-sustainable-cities-shared-destinies

[5] https://www.tomtom.com/newsroom/press-releases/general/260960154/the-cost-of-driving-has-reached-new-highs-around-the-world/

[6] https://www.automotiveworld.com/articles/peer-to-peer-car-sharing-is-here-to-stay/

[7] https://www.accenture.com/us-en/insights/automotive/mobility-x

[8] https://www.ft.com/content/f19214e0-33bc-11ea-9703-eea0cae3f0de

[9] https://www.kinto-mobility.eu/eu/en

[10] https://www.economist.com/business/2021/04/15/new-means-of-getting-from-a-to-b-are-disrupting-carmaking

[11] https://www.reuters.com/article/us-grab-toyota-investment-idINKBN1J907E

[12] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/shared-mobility-sustainable-cities-shared-destinies

[13] https://www.mordorintelligence.com/industry-reports/ride-hailing-market

[14] https://alj.com/en/news/abdul-latif-jameel-invests-in-joby-aviation/

[15] https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/Rideshares-in-the-sky-by-2024-Joby-Aviation-bets-big-on-air-taxis

[16] Mobility Ownership Consumer Survey, McKinsey Center for Future Mobility, July 2021.

[17] https://www.economist.com/the-world-ahead/2020/11/17/the-pandemic-is-changing-urban-transport-patterns

[18] https://inrix.com/blog/2022-traffic-scorecard/

[19] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/shared-mobility-where-it-stands-where-its-headed

[20] https://www.bloomberg.com/news/articles/2022-12-01/as-pandemic-wanes-bikeshare-and-e-scooter-rides-keep-rising?sref=YMVUXTCK

[21] https://www.bloomberg.com/news/articles/2022-10-04/when-public-transit-stumbles-bikesharing-can-step-up

[22] https://www.who.int/news-room/fact-sheets/detail/road-traffic-injuries

[23] https://www.bhf.org.uk/informationsupport/risk-factors/air-pollution

[24] https://www.newscientist.com/article/2263165-landmark-ruling-says-air-pollution-contributed-to-death-of-9-year-old/

[25] h https://www.mckinsey.com/capabilities/sustainability/our-insights/spotting-green-business-opportunities-in-a-surging-net-zero-world

[26] https://www.tomtom.com/newsroom/press-releases/general/260960154/the-cost-of-driving-has-reached-new-highs-around-the-world/

[27] https://www.worldbank.org/en/topic/urbandevelopment/overview

[28] https://autovista24.autovistagroup.com/news/uk-sees-car-ownership-decline-again-as-evs-yet-to-take-significant-share/

1x

1x

Added to press kit

Added to press kit