Hydrogen back in the hotspot

Hydrogen has been touted as a key catalyst in the energy transition for decades already. We have previously discussed its potential as a source of renewable energy, it’s capacity to drive green mobility solutions and the growing interest in hydrogen-powered public transport. There is a sense, however, that despite its enormous potential, it has never quite lived up to hype. At least, not yet. But after a few years out of the spotlight, hydrogen is hot news again. Could it finally be emerging from ‘niche focus’ to ‘strong contender’ in the global green transition? If the latest developments in transport are anything to go by, there’s a lot more to like about the universe’s favorite element.

Hydrogen resurgence

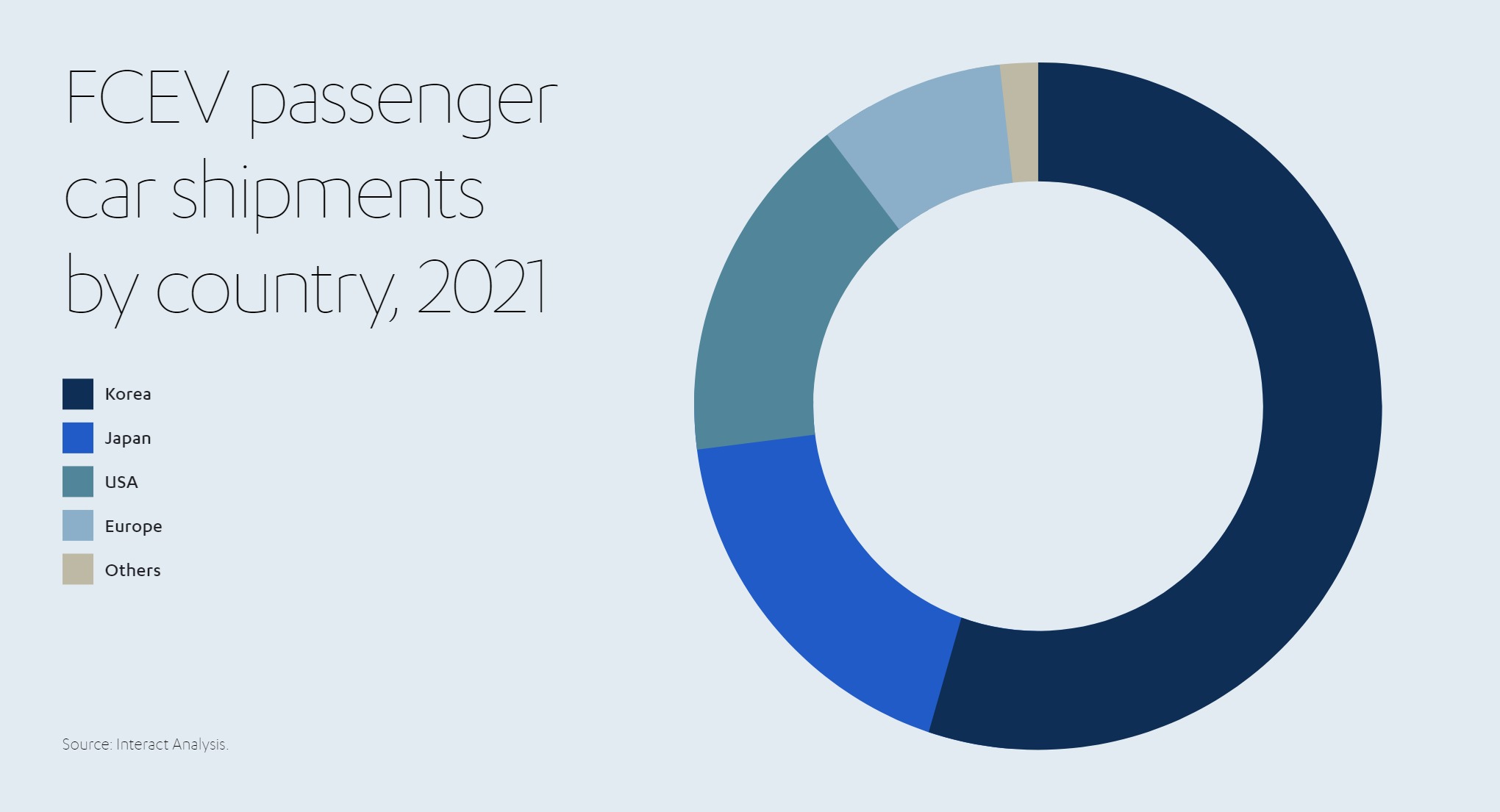

The market for hydrogen fuel cell electric vehicles (FCEVs) is experiencing significant growth. According to the International Energy Agency’s (IEA) Global EV Outlook 2023 report[1], the total number of FCEVs increased by 40% in 2022 compared to the previous year, reaching over 72,000 vehicles.

South Korea leads the pack, home to over half of the world’s passenger hydrogen vehicles and two-thirds of the additional 15,000 fuel cell cars that hit the road in 2022. The United States follows as the second-largest market for FCEVs, with over 15,000 vehicles, mostly cars, and slightly more than 200 fuel cell buses. While the FCEV stock in the US grew by more than 20% in 2022, China’s growth rate surpassed it with a remarkable 60% increase, making it the country with the third-largest FCEV stock.

China houses over 95% of the world’s hydrogen trucks and nearly 85% of the global fuel cell bus fleet. The country introduced its first 200 hydrogen cars to its FCEV fleet in 2022 after focusing primarily on buses and trucks for several years. The government aims to reach one million hydrogen vehicles by 2025[2]. Japan is not far behind, with a target of 800,000 by 2030[3]. Meanwhile, the global market for hydrogen-powered vehicles is projected to reach US$ 62.88 billion by 2032[4].

These trends indicate a growing demand for hydrogen vehicles and a strong push toward widespread adoption in various countries. As governments and industries continue to invest in hydrogen infrastructure and technological advancements, the market for hydrogen vehicles is poised for further expansion, offering promising opportunities for a sustainable and zero-emission transportation future.

Latest developments in hydrogen-powered vehicles

Hydrogen is a viable fuel source for virtually all vehicles, and several new models and deployments have been announced in the last few years.

Consumer

According to a report from Juniper Research, consumer vehicles will comprise over 60% of hydrogen vehicles in service globally by 2027[5].

Toyota, a partner of Abdul Latif Jameel since 1955, is a pioneer in hydrogen vehicle technology. It has recently announced the release of its new hydrogen car, the 2023 Toyota Crown sedan, marking the company’s first new hydrogen vehicle in a decade[6]. This addition complements Toyota’s flagship fuel cell electric vehicle (FCEV), the Mirai.

Close competitors are placing their bets on SUVs, including Hyundai’s high-performance NEXO and Honda’s forthcoming next-generation CR-V[7]. Likewise, Renault is developing the Scenic Vision, a hydrogen-powered SUV prototype that boasts a 75% smaller carbon footprint than conventional battery-electric vehicles (BEVs)[8]. And BMW is testing the waters with its proof-of-concept iX5, which includes fuel cells made by . . . yes you guessed it, Toyota[9].

Commercial

Many experts argue that heavy-duty and long-haul applications are the ideal use case for hydrogen vehicles due to their superior range, rapid refueling, and ease of maintenance. Hydrogen vehicles, powered by fuel cells or hydrogen engines, are particularly suited for journeys exceeding 180 miles and payloads exceeding 24,000 pounds. According to industry reports, there are currently no viable alternatives to hydrogen for hauling freight over 600 miles per day with zero emissions[10]. For example, the latest Hyundai Xcient trucks and the Toyota Mirai can travel more than 800 km on a single charge[11].

Hyvia, a joint venture between Renault Group and hydrogen fuel-cell maker Plug Power, has started dispatching its first hydrogen vans, which can achieve a range of up to 500 km[12]. Since last year, Hyundai’s Xcient trucks have rapidly gained market share in Germany, Switzerland, New Zealand, and South Korea, with deliveries planned for the US and Israel soon. Other major players like Toyota and Nikola are also entering the US market with commercial hydrogen vehicles[13].

Public transport

Hydrogen-powered vehicles in public transport are gaining momentum, with the Asia-Pacific region, particularly China, leading the way. According to Information Trends, the global sales of hydrogen fuel cell buses are projected to exceed 650,000 units by 2037, a substantial increase from less than 4,000 units in 2022[14].

Other countries are also making significant strides in adopting hydrogen-powered buses. In May 2023, South Korea signed a deal with industry giants Samsung, Hyundai, and others to introduce 2,000 hydrogen commuter buses by 2026[15]. According to PwC, Germany aims to have over 900 hydrogen buses by 2030, a significant increase from the current 145 buses[16].

The European Union (EU) has mandated that new city buses be battery or hydrogen-powered by 2030[17]. This directive is part of the EU’s goal to achieve a 45% reduction in emissions from heavy-duty vehicles and slash emissions from new trucks and buses by 90% by 2040.

Hydrogen-powered vehicles offer several advantages in public transport. Hydrogen combustion engines, in particular, provide a cost-effective zero-emission solution with an upfront cost that is around 50% more than their diesel counterparts, compared to more expensive BEVs[18]. This relative affordability makes hydrogen engines attractive for fleet operators transitioning to zero-emission vehicles.

In Spain, Abdul Latif Jameel Energy’s flagship renewable energy business, FRV, is partnering with the Professional Taxi Federation of Madrid to replace at least 1,000 traditional cabs with green hydrogen-powered vehicles by 2026. In collaboration with Toyota Spain, the Toyota Mirai fuel cell model, known for its impressive range of up to 600 km with zero environmental impact, will be used in this initiative.

FRV’s innovation arm, FRV-X, is also working with Vectalia to develop the first large-scale green hydrogen-powered bus transport system in Alicante, Spain.

The adoption of hydrogen-powered vehicles is not limited to buses. Fuel cell taxis are gaining popularity across Europe, with Paris already boasting a fleet of over 100 fuel cell electric vehicles (FCEVs), with plans supported by Toyota to increase that number to 10,000 by 2024[19]. Toyota is collaborating with Uber in Germany, supplying up to 200 hydrogen cars for a two-year trial[20].

Fast-tracked hydrogen innovation

Hydrogen is also challenging conventional fuels in the realm of motorsport. ROOKIE Racing, sponsored by Abdul Latif Jameel Motors Saudi Arabia, competed in the Super Taikyu (Endurance) Race at the Fuji Speedway – in a hydrogen-powered CR Corolla – and is currently racing in the “Super Taikyu Series 2023” with their hydrogen-powered engine and carbon-neutral fuel vehicles.

On May 28, a liquid hydrogen-powered car developed by Toyota completed the NAPAC Fuji SUPER TEC 24 Hours Race, the second round of the 2023 ENEOS Super Taikyu Series. Competing in a liquid hydrogen-fueled car was itself a world-first undertaking. Despite debuting in the series’ most grueling event, the 24-hour race, Toyota’s team completed 358 laps of Fuji Speedway in Oyama, Shizuoka Prefecture, a distance equaling 1,634 km.

What’s driving hydrogen-powered vehicle adoption?

While BEVs often steal the spotlight, hydrogen-powered vehicles offer numerous advantages in the pursuit of a cleaner and more sustainable future:

Growing environmental concerns

Transportation accounts for approximately 21% of global emissions[21]. Unlike traditional internal combustion engines, hydrogen vehicles emit only water vapor, making them a clean and environmentally friendly alternative. Moreover, FCEVs can achieve a range of around 60 miles per kilogram, outperforming conventional vehicles that typically cover about 25 miles per gallon of gasoline[22].

Potential to be entirely green

While BEVs theoretically rely on the energy mix where they are charged, hydrogen can be derived from various sources, including renewable energy such as wind and solar power. Additionally, electrolysis can generate hydrogen using excess electricity during off-peak hours, offering flexibility and contributing to the storage and utilization of surplus renewable energy.

Superior range and refueling time

Hydrogen-powered vehicles offer extended driving ranges compared to BEVs. They can travel hundreds of miles on a single tank of hydrogen, and refueling takes a similar amount of time as refueling a traditional gasoline or diesel vehicle, usually between 3 to 5 minutes. This alleviates one of the most persistent consumer adoption barriers to EV, ‘range anxiety’ associated with limited range and availability of rapid charging infrastructure.

Ease of scalability

Hydrogen vehicles are relatively easy to deploy for commercial applications and public transport without too much investment. Similarly, hydrogen refueling stations can be rapidly deployed, much like traditional gasoline stations, and can serve many vehicles simultaneously.

Strategic importance

The volatility in natural gas prices and the need to diversify energy sources, especially in regions reliant on traditional resources (e.g., from Russia), have sparked renewed interest in the potential of hydrogen fuel[23]. Additionally, adopting hydrogen-powered vehicles can help reduce reliance on rare earth minerals, which are essential components of BEVs and subject to supply chain challenges and concerns around ethical sourcing.

Steady innovation

Although hydrogen-powered vehicles currently use 2-4 times as much electricity as BEVs, significant efforts are being made to overcome these limitations and improve overall performance. One of the main areas of research and development is focused on increasing hydrogen fuel cell technology’s efficiency, durability, and cost-effectiveness. For instance, the US Department of Energy (DOE) is working to improve fuel efficiency to achieve nearly 100 miles on 1 kilogram of hydrogen[24].

Furthermore, the manufacturing capacity for electrolyzers, which are crucial for hydrogen production through electrolysis, has been steadily increasing – and doubled between 2021 and 2022[25]. Global investments in fuel cell and electrolyzer suppliers are also rising, reaching approximately US$ 7 billion in 2021[26]. This surge in investment demonstrates the growing interest and confidence in hydrogen as a viable alternative fuel source.

Increasing government support

Governments worldwide are taking proactive steps to support and encourage the adoption of hydrogen-powered vehicles, including a range of policies, incentives, and regulations to promote research and development, reduce emissions, and facilitate the establishment of hydrogen infrastructure[27].

In the US, the DOE has allocated US$ 47 million for research and development in hydrogen storage, delivery, and vehicular fueling technologies and recently announced US$ 750 million in funding to improve the efficiency, durability, and cost-effectiveness of clean hydrogen production and fuel cell technologies[28]. The Inflation Reduction Act 2022 introduces a 10-year production tax credit (PTC) for clean hydrogen production facilities and extends tax credits to hydrogen fuel vehicles. The legislation also provides up to US$ 40,000 in credits for qualified commercial clean vehicles, including fuel cell vehicles, and offers incentives of up to US$ 100,000 for hydrogen vehicles in low-income and rural areas[29].

China has included hydrogen as one of the critical factors in its 14th Five-Year Plan (2021-2025)[30]. The plan sets targets for developing a comprehensive hydrogen energy industry, focusing on independent innovation, manufacturing capabilities, and annual hydrogen production from renewable sources[31].

Japan has outlined its Strategic Roadmap, which sets ambitious targets for the mass production of low-cost fuel-cell vehicles and the establishment of a hydrogen refueling station network. The government aims to have up to 800,000 FCVs, 1,200 fuel-cell buses, and 10,000 fuel-cell forklifts on the roads by 2030[32]. Similarly, South Korea has made significant strides in deploying hydrogen vehicles, signing agreements with leading companies like Samsung and Hyundai to put thousands of hydrogen commuter buses on the roads[33].

Meanwhile in Europe, as mentioned above, the European Union (EU) has set the goal of having new city buses powered by batteries or hydrogen by 2030[34]. This commitment aligns with the EU’s targets to reduce emissions from heavy-duty vehicles and promote the adoption of zero-emission technologies.

Similarly, the UK Hydrogen Strategy intends to reach 10 GW of low-carbon hydrogen production capacity by 2030[35]. The UK has already introduced hydrogen-powered buses in London and is rolling them out to other regions while actively supporting the development of hydrogen-fueled vehicles, such as the hydrogen-fuel cell version of the Toyota Hilux pickup truck[36].

Expansion of refueling infrastructure

Currently, there aren’t enough refueling stations to meet the demands of hydrogen-powered vehicles – the classic ‘chicken and egg’ conundrum. However, governments and industry stakeholders are collaborating to establish new refueling stations and create networks across countries and continents.

For example, regions like California, Germany, Japan, South Korea, and China have made significant progress in building hydrogen refueling infrastructure. In 2022, there were already 1,020 hydrogen refueling stations in operation worldwide, with China leading the way, followed by South Korea, Japan, Germany, and the United States[37].

In Japan, the establishment of the Japan Hydrogen Station Network Joint Company (JHyM) is driving the acceleration of hydrogen refueling station development to support the expansion of fuel cell vehicles (FCVs)[38]. In the European Union (EU), a commitment has been made to install hydrogen refueling stations in all major cities and along core routes every 200 kilometers[39].

As the number of refueling stations increases, it will become ever more convenient and accessible for drivers to refuel their hydrogen vehicles, promoting the growth and acceptance of this clean and sustainable transportation option.

Collaborations and partnerships

Collaborations and partnerships between automakers, energy companies, and other stakeholders are driving the advancement of hydrogen-powered road vehicles.

The Hydrogen Council brings together leading energy, transport, industry, and investment companies with a shared vision to develop the hydrogen economy[40].

Honda and General Motors have partnered to deliver a ‘next-generation’ hydrogen fuel cell system for personal vehicles and freight trucks. With manufacturing set to commence in 2023, Honda aims to sell 60,000 units annually by 2030[41]. Similarly, BMW and Toyota have joined forces to produce hydrogen fuel cell vehicles. The two automakers will start producing and selling jointly developed hydrogen fuel cell vehicles from 2025 onwards[42]. This collaboration builds upon their previous successful ventures, including developing the iX5 Hydrogen based on BMW’s X5 SUV[43].

Increasing focus on green hydrogen

The current primary source of hydrogen production is natural gas, resulting in significant carbon dioxide emissions. To address this challenge, there is a growing push for increased investment in renewable energy generation and government subsidies to support the production of ‘green hydrogen’. With a strong emphasis on securing domestic energy sources and reducing dependence on imported fossil fuels, Japan has made significant strides in renewable energy production and hydrogen technology[44]. The International Energy Agency (IEA) predicts a potential 30% reduction in the cost of producing hydrogen from renewable energy by 2030, thanks to the scaling up of hydrogen production and declining prices of renewable technologies[45].

The road ahead

The future is bright for hydrogen-powered transportation – not least because the only way is up. Currently, there are only around 72,000 hydrogen vehicles on the roads, which is just a minuscule fraction of the 1.5 billion cars globally.

In contrast, 14 million battery electric vehicles (BEVs) will be sold this year alone[46].

However, analysts foresee a convergence of factors that will propel the widespread adoption of hydrogen vehicles in the next decade. Increased government support, expansion of refueling infrastructure, ongoing innovation, pressure to transition to greener fuels while diversifying from unreliable supply chains. As economies of scale come into play, the stage will be set for a dramatic surge in the use of hydrogen vehicles.

Don’t ditch your BEV just yet. But look in the rearview mirror; hydrogen is gaining ground.

[1] https://www.iea.org/reports/global-ev-outlook-2023

[2] https://www.euronews.com/next/2022/10/08/at-a-fork-in-the-road-do-hydrogen-cars-offer-a-better-future-than-electric

[3] https://www.euronews.com/next/2022/10/08/at-a-fork-in-the-road-do-hydrogen-cars-offer-a-better-future-than-electric

[4] https://www.polarismarketresearch.com/industry-analysis/hydrogen-fuel-cell-vehicle-market

[5] https://www.juniperresearch.com/whitepapers/why-hydrogen-vehicles-are-ready-for-the-mainstream

[6] https://www.hydrogeninsight.com/transport/toyota-unveils-its-first-new-hydrogen-car-in-a-decade-to-go-on-sale-this-autumn/2-1-1433307

[7] https://www.caranddriver.com/news/a42796089/2024-honda-cr-v-powered-by-hydrogen-details/

[8] https://autovista24.autovistagroup.com/news/hydrogen-vehicles-in-europe/

[9] https://www.autocar.co.uk/car-review/bmw/ix5-hydrogen

[10] https://nacfe.org/research/electric-trucks/hydrogen/

[11] https://www.ft.com/content/64806305-cbc1-43b4-83da-87c98c81cf07

[12] https://autovista24.autovistagroup.com/news/hydrogen-vehicles-in-europe/

[13] https://www.hydrogenfuelnews.com/big-hydrogen-truck-industry/8558375/

[14] https://www.prnewswire.com/news-releases/over-650-thousand-hydrogen-fuel-cell-buses-to-be-sold-by-2037-says-information-trends-301760555.html

[15] https://www.hydrogeninsight.com/transport/south-korea-signs-deal-with-samsung-hyundai-and-others-to-put-2-000-hydrogen-commuter-buses-on-its-roads-by-2026/2-1-1445858

[16] https://www.pwc.de/de/branchen-und-markte/oeffentlicher-sektor/e-bus-radar.html

[17] https://www.hydrogeninsight.com/transport/new-city-buses-in-eu-must-be-battery-or-hydrogen-powered-by-2030-as-bloc-targets-45-emissions-cut-for-heavy-duty-vehicles/2-1-1404389

[18] https://www.hydrogeninsight.com/transport/new-city-buses-in-eu-must-be-battery-or-hydrogen-powered-by-2030-as-bloc-targets-45-emissions-cut-for-heavy-duty-vehicles/2-1-1404389

[19] https://www.euractiv.com/section/energy/news/hydrogen-taxis-could-be-the-next-big-thing/

[20] https://www.hydrogeninsight.com/transport/special-advantage-toyota-providing-up-to-200-hydrogen-cars-to-uber-in-germany-as-part-of-two-year-trial/2-1-1438797

[21] https://www.iea.org/reports/net-zero-by-2050

[22] https://www.energy.gov/eere/vehicles/articles/hydrogens-role-transportation

[23] https://www.bbc.co.uk/news/business-60066015

[24] https://www.energy.gov/eere/vehicles/articles/hydrogens-role-transportation

[25] https://www.iea.org/reports/hydrogen

[26] https://hydrogencouncil.com/wp-content/uploads/2022/09/Hydrogen-Insights-2022-2.pdf

[27] https://think.ing.com/articles/hold-3of4-governments-are-shaping-their-hydrogen-ambitions

[28] https://www.energy.gov/articles/biden-harris-administration-announces-47-million-develop-affordable-clean-hydrogen

[29] https://www.electronicdesign.com/markets/automotive/article/21249381/electronic-design-automakers-forge-ahead-with-hydrogenfuelcell-vehicle-development

[30] https://cset.georgetown.edu/wp-content/uploads/t0284_14th_Five_Year_Plan_EN.pdf

[31] https://www.reuters.com/world/china/china-produce-100000-200000-t-green-hydrogen-annually-by-2025-2022-03-23/

[32] https://www.cliffordchance.com/content/dam/cliffordchance/briefings/2022/08/focus-on-hydrogen-in-japan.pdf

[33] https://www.hydrogeninsight.com/transport/south-korea-signs-deal-with-samsung-hyundai-and-others-to-put-2-000-hydrogen-commuter-buses-on-its-roads-by-2026/2-1-1445858

[34] https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_763

[35] https://www.gov.uk/government/publications/uk-hydrogen-strategy

[36] https://www.gov.uk/government/news/more-than-70-million-to-turbocharge-the-future-of-clean-transport

[37] https://www.iea.org/reports/global-ev-outlook-2023

[38] https://www.cliffordchance.com/content/dam/cliffordchance/briefings/2022/08/focus-on-hydrogen-in-japan.pdf

[39] https://www.hydrogeninsight.com/policy/eu-nations-agree-to-install-hydrogen-fuelling-stations-in-all-major-cities-and-every-200km-along-core-routes/2-1-1426859

[40] https://hydrogencouncil.com/en/hydrogen-insights-2022/

[41] https://www.cbtnews.com/honda-and-gm-partner-to-create-next-generation-hydrogen-fuel-cell-system

[42] https://asia.nikkei.com/Editor-s-Picks/Interview/BMW-fuel-cell-SUV-to-enter-mass-production-as-soon-as-2025-executive

[43] https://techcrunch.com/2022/08/12/ev-laggards-bmw-and-toyota-to-partner-on-hydrogen-fuel-cell-vehicles

[44] https://www.sciencedirect.com/science/article/abs/pii/S0360319921032444

[45] https://www.iea.org/reports/the-future-of-hydrogen

[46] https://iea.blob.core.windows.net/assets/dacf14d2-eabc-498a-8263-9f97fd5dc327/GEVO2023.pdf

1x

1x

Added to press kit

Added to press kit